Terms & Conditions Summary

The points below are a summary of key points in the Sniip Terms & Conditions. These points are designed to make it easier to understand what you are agreeing to. The full Terms & Conditions, Product Disclosure Statement and Financial Services Guide are linked below.

1. Fees apply to your use of the App. This includes the following processing fees for each payment made using the App:

Personal payments

| Type of card | Processing fee |

|---|---|

| Bank Accounts | 0.00% |

| Debit cards | 0.65% |

| Amex | 1.29% |

| Diners | 1.50% |

| Visa/Mastercard | 1.50% |

| Visa/Mastercard International* | 3.00% |

| Prepaid cards | 0.85% |

| Crypto.com cards | 0.85% |

All processing fees are inclusive of GST.

*All international cards are recognised as credit cards and incur a 3% processing fee.

American Express Business payments

| Transaction amount | Processing fee |

|---|---|

| $0 – $99,999 | 2.19% (1.99% + GST) |

| $100,000 – $299,999 | 2.15% (1.95% + GST) |

| $300,000 – $499,999 | 2.09% (1.90% + GST) |

| $500,000 – $999,999 | 2.04% (1.85% + GST) |

| +$1,000,000 | 1.93% (1.75% + GST) |

2. If you pay a direct biller utilising the Sniip QR code on a bill or using the AusPost Barcode, you may incur fees and / or charges imposed by your Biller at the time of making Payment, or on your next bill, for payment processing costs.

See clause 22 of these Terms for more information on other fees that we may receive.

3. Sniip is not responsible for any services or products of a Biller or any errors in a Bill provided by a Biller to you. You indemnify Sniip in connection with your use of the App.

4. When you pay a bill via Sniip, you authorise Sniip to receive funds from your nominated payment method. Sniip will then process your bill payment to your biller on the day those funds are received.

5. Both you and Sniip acknowledge and agree that any and all funds which Sniip may receive for the purpose of making payments of your bills are held by Sniip on trust for you for that purpose and no other. Sniip agrees that these funds are not available to it for its general business purposes, payment of its own creditors, or any purpose other than payment of your bills.

6. You must only register a Sniip account on behalf of yourself and not on behalf of another person. Where multiple accounts are created, Sniip may suspend or terminate your access to the App.

7. You must register using your legal name, that matches your government issued photographic identification.

8. You must register with a valid Australian mobile number and must be able to be contacted by Sniip on that number in the case of verification, refunds from billers or errors with payments. If you do not register with a legitimate phone number, Sniip has the right to withhold or quarantine your bill payments, until you have verified your mobile number. By providing your phone number to Sniip, you consent to receiving service-related text messages.

9. You must be over 18 years of age and an Australian resident, or residing in Australia, to use the App.

10. You need to ensure that the payment method details that you provide are correct and that you are authorised to use the payment method that you have added to the Sniip App.

11. You must maintain the security of your account and Device and confidentiality of your PIN/password. You acknowledge and agree that you are solely responsible for all transactions via the App. You must notify Sniip immediately of any unauthorised transactions through the App or loss or theft of your Device. Failure to do so may incur additional liability.

12. Unless your payment is a mistake, unauthorised or fraudulent, payments via the App are irrevocable. Any dispute must be resolved with Sniip or the Biller. You agree not to do a Chargeback against your Sniip transaction with your card provider, if you are disputing a transaction with the end supplier.

13. You need to provide Sniip with information we may ask for, including for the purposes of Anti-Money Laundering (AML) laws and Know Your Customer (KYC) requirements, any other applicable law or regulation and the requirements of our service providers. Sniip may suspend or terminate your access to the App in line with the Terms below.

14. You must not use Sniip to make a Prohibited Payment, or to pay yourself or any associated party (including relatives, friends or related businesses). If you are making a payment on behalf of a company, you must not use the Sniip to pay a subsidiary or related entity, or related shareholders or directors.

N.B. If a payment may be contrary to the above, please request guidance from our compliance team (risk@sniip.com.au), prior to making the payment. Sniip at it’s sole discretion, may reject a payee (even after payment is made) and funds will be returned (net of any Sniip fees).

15. You may be required to provide government issued photo identification to verify your account prior to us processing a payment or, before you can make or continue to make payments on the App. This includes using Sniip Rewards (such as ‘Refer a Friend’ bonuses).

16. If you use a prepaid card to make a payment via Sniip, you will be required to complete the KYC verification process. If Sniip receives a refund from your biller, we can only refund back to the prepaid card the payment was made using. If you are no longer in possession of the card, you will be issued with a credit in the Sniip App, which is valid for 12 months, to use towards future bill payments in the App.

17. Sniip is not liable for any late fees or interest fees incurred through late payments made via the Sniip app.

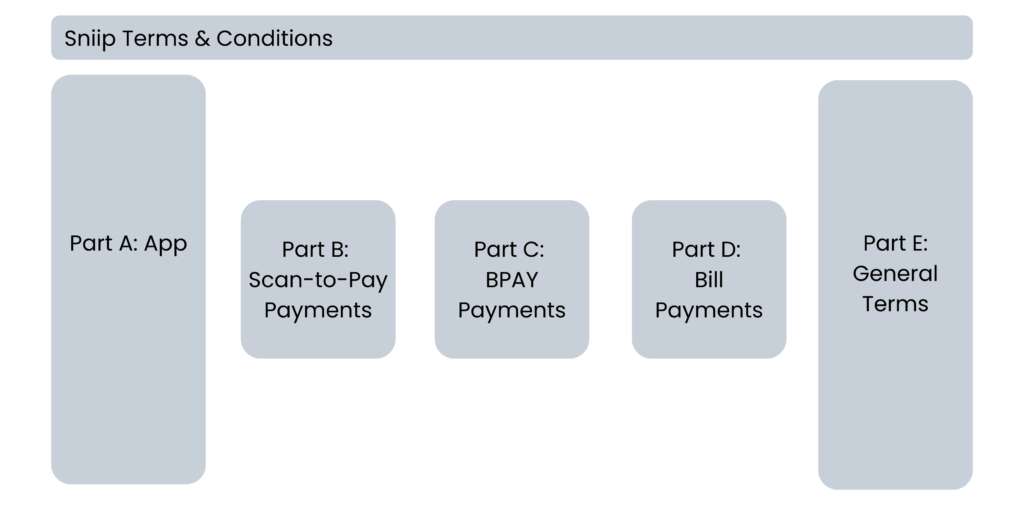

18. Sniip Terms & Conditions