FAQ: FAQ: FAQ: American Express Tiered Processing Fees

Processing Fees Tiers

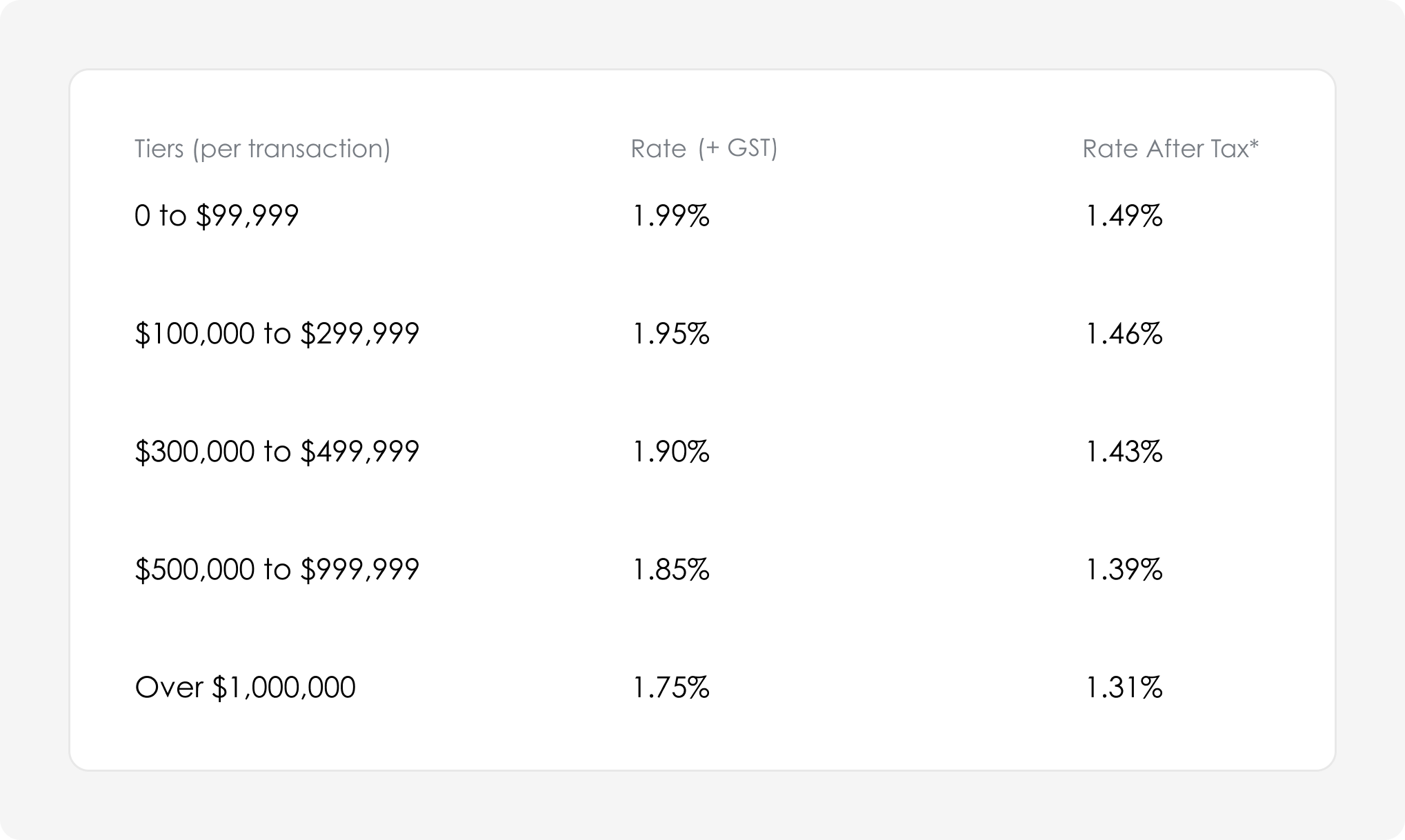

All processing fees are exclusive of GST.

*Assumes corporate tax rate of 25% and GST is claimed

How do tiered processing fees work?

Sniip’s tiered pricing structure for American Express is broken into five payment brackets.

Checking tiered processing fees before your payment

You can always check what tier your payment will fall within before making your payment. Simply navigate to the ‘Help’ menu in the app.

Viewing tiered processing fees during your payment

If you need clarity on the processing fee applying to your payment, you can always check. Tap on the ‘i’ next to the processing fee amount to view your tier.

FAQ

Why would I use Sniip to pay my business bill?

Sniip users benefit from the best processing fees in market, you can read more about our American Express – Business tiered pricing, here.

Plus, it’s the easiest and quickest way to pay your bill (and earn full points).

You can explore our Amex x Sniip hub, here or speak with our Amex x Sniip representative Jennifer by calling (07) 3268 7710.

How do I know how many points I’ll earn on my transaction and what my processing fee (tier) will be?

Great question! We’ve built a points calculator just for you, superstar! You can explore the points calculator, here.

Points are provided by your credit card provider and your points earn per $1 spend (i.e. 1.25 points) can differ from card to card. Please review your card providers terms and conditions for points earning eligibility.

I thought the Amex rate was 1.5%, what happened?

Sniip was a consumer app, offering a consumer rate. We appreciate there was growing demand for business payments with Sniip and to continue to offer this service, we were required to offer a business rate.

We’ve worked really hard to keep our rate as low as possible to accommodate business payments and the rate is reflective of what we’re being charged to process the payment – not a margin increase for Sniip!

However, the good news is, our after tax rate on all our business tiers are below 1.5%!

Do I earn points on the processing fee?

Absolutely! You earn full points (even at the ATO) on the transaction amount and the processing fee.

How do I know what tier my payment falls under?

Good question! Our business payment tiers are below.

You can explore more about tiered pricing, here.

Tier (single payment amount) | Rate (inc GST) | Rate % (+ GST) | **After Tax Rate |

$0 – $99,999 | 2.19% | 1.99% | 1.49% |

$100,000 – $299,999 | 2.15% | 1.95% | 1.46% |

$300,000 – $499,999 | 2.09% | 1.90% | 1.43% |

$500,000 – $999,999 | 2.04% | 1.85% | 1.39% |

$1,000,000+ | 1.93% | 1.75% | 1.31% |

** After Tax Rate assumes a 25% Small Business company tax rate.

Will you offer bonus loyalty programs?

Offering tiered pricing (with the best rates in market) is our foray into the business space. Watch this space. 😉

Can I pay make SME payments now, pay to BSB + Account Number?

We’re working on it as you read this. Launch 2023! Promise.

Couldn’t I just get a personal card to pay my business expenses?

We see you, you cheeky monkey!

It comes down to the purpose of your payment and the card you’re using. A business payment on a personal card will be flagged by Amex as a business expense.

If I’m a sole trader, will I be charged the business, or the personal rate if I pay the ATO?

If you’re making a personal payment to the ATO on a personal card, you’ll be charged at the personal rate. Payments to the ATO, including superannuation, are charged at the business rate when using any American Express card.

If you have an ABN, you may be classified as a business. If you’re making a business payment with a personal American Express card, you may be charged at the business rate.

The good news is, all rates are clearly shown before you make the payment and you can always clarify with us before you process the payment.

What is Sniip's criteria for determining what is business and personal payments?

Great question! It comes down to the payment you’re making and the card you’re using.

If you’re making a personal payment, on a personal card, you’ll be charged the personal rate.

If you’re making a business payment, on a business/corporate card, you’ll be charged the applicable business rate.

If you’re flagged as making a business payment on a personal card, you may be asked to supply a copy of your invoice and your transaction will be reviewed.

The good news is, all rates are clearly shown before you make the payment and you can always clarify with us before you process the payment.

If you have any questions, please call (07) 3268 7710 or email customercare@sniip.com.

How can you tell if I’m making a business or personal payment?

We’re really proud of our partnership with American Express and being able to offer the best business rates in the market.

As part of our contract with American Express, we determine business versus personal based on the purpose of the payment.

If the purpose of the payment is for business, i.e, to pay a business bill/ invoice/ stock, you’ll be charged at the business rate.

If you have any questions, please email customercare@sniip.com or phone (07) 3268 7710.

What if you determine my payment to be business, but it’s personal?

All rates are clearly displayed before you make a payment and you can always clarify with us before you process the payment.

The processing fee for personal payments using a personal card is 1.5%, excluding American Express personal cards. The rate for personal American Express cards is 1.29%.

Why can’t I use Apple Pay with my American Express?

At the moment, we’re unable to process payments with an American Express card through enabled digital wallets (Apple Pay or Google Pay), as we need to be able to determine the type of American express card you are using for pricing and contractual purposes.

We’re working to turn this functionality back on as soon as possible.

In the interim, you can add your American Express to your Payments Methods in Sniip and process the payment using the card.

To add a payment method to your Sniip Wallet, tap on the top left hand menu and select ‘Payment Methods’.

The first time you add a payment method, you’ll see a ‘+’ in the payment methods screen.

You can explore more about adding a payment method, here.

Why has the business processing fee increased?

Up until October 15, 2022, Sniip was a consumer app with a consumer rate for American Express payments.

As you can appreciate, the rate we were charging was well below existing rates for business payments made using an American Express.

American Express identified that business payments were being made through our consumer app. We had the option of discontinuing our service for business users, or adopting the market processing rate for Amex partners facilitating business payments.

Notwithstanding that, we remain committed to being the most competitive in our pricing and will ensure we are adhering to that commitment.

We (and our users) know we have the best product and we hope you’ll continue to enjoy the many benefit of using Sniip too!

If I use my business card to make personal payments, will that be charged at 1.5%?

If it is a business card, American Express deems it to be used for business purposes and that would be charged at the business rate.

However, we’d strongly recommend you apply for the same card in the consumer/ personal version when making personal payments which will earn full points at the 1.5% rate with Sniip, excluding American Express personal cards. The rate for personal American Express cards is 1.29%.

I always use a personal Amex card for business expenses. Can I just use my business Mastercard instead now? What’s the fee?

Absolutely! The processing fee for all Visa/Mastercards is 1.5%.