Terms and Conditions

Key Terms

- Fees apply to your use of the App. This includes the following processing fees for each payment made using the App:

Personal payments

Type of card Processing fee Bank Accounts 0.00% Debit cards 0.65% Amex 1.29% Diners 1.50% Visa/Mastercard 1.50% Visa/Mastercard International* 3.00% Prepaid cards 0.85% Crypto.com cards 0.85%

All processing fees are inclusive of GST.

*All international cards are recognised as credit cards and incur a 3% processing fee.American Express Business payments

Transaction amount Processing fee $0 – $99,999 2.19% (1.99% + GST) $100,000 – $299,999 2.15% (1.95% + GST) $300,000 – $499,999 2.09% (1.90% + GST) $500,000 – $999,999 2.04% (1.85% + GST) +$1,000,000 1.93% (1.75% + GST) -

If you pay a direct biller utilising the Sniip QR code on a bill or using the AusPost Barcode, you may incur fees and / or charges imposed by your Biller at the time of making Payment, or on your next bill, for payment processing costs.

See clause 22 of these Terms for more information on other fees that we may receive.

- Sniip is not responsible for any services or products of a Biller or any errors in a Bill provided by a Biller to you. You indemnify Sniip in connection with your use of the App.

- When you pay a bill via Sniip, you authorise Sniip to receive funds from your nominated payment method. The bill amount will be held by us on trust for the specific purpose of paying your bill. Sniip will then process your bill payment to your biller on the day those funds are received.

-

Both you and Sniip acknowledge and agree that any and all funds which Sniip may receive for the purpose of making payments of your bills are held by Sniip on trust for you for that purpose and no other. Sniip agrees that these funds are not available to it for its general business purposes, payment of its own creditors, or any purpose other than payment of your bills.

-

You must only register a Sniip account on behalf of yourself and not on behalf of another person. Where multiple accounts are created, Sniip may suspend or terminate your access to the App.

- You must register within Sniip, with your legal name, that matches your government issued photographic identification.

- You must register with a valid Australian mobile number and must be able to be contacted by Sniip on that number in the case of verification, refunds from billers or errors with payments. If you do not register with a legitimate phone number, Sniip has the right to withhold or quarantine your bill payments, until you have verified your mobile number.

- You must be over 18 years of age and an Australian resident or residing in Australia to use the App.

- You need to ensure that the payment method details that you provide are correct and that you are authorised to use the payment method that you connect to the App.

- You must maintain the security of your account and Device and confidentiality of your PIN/password. You acknowledge and agree that you are solely responsible for all transactions via the App. You must notify Sniip immediately of any unauthorised transactions through the App or loss or theft of your Device. Failure to do so may incur additional liability.

- Unless your payment is a mistake, unauthorised or fraudulent, payments via the App are irrevocable. Any dispute must be resolved with Sniip or the Biller. However, you may have “chargeback” rights against Sniip under applicable rules of the Card issuer.

- You must not use Sniip to make a Prohibited Payment, or to pay yourself or any associated party (including relatives, friends or related businesses). If you are making a payment on behalf of a company, you must not use the Sniip to pay a subsidiary or related entity, or related shareholders or directors.

N.B. If a payment may be contrary to the above, please request guidance from our compliance team (risk@sniip.com.au), prior to making the payment. Sniip at it’s sole discretion, may reject a payee (even after payment is made) and funds will be returned (net of any Sniip fees).

- You need to provide Sniip with information we may ask for, including for the purposes of Anti-Money Laundering (AML) laws and Know Your Customer (KYC) requirements, any other applicable law or regulation and the requirements of our service providers. Sniip may suspend or terminate your access to the App in line with the Terms below.

- You may be required to provide government issued photo identification to verify your account prior to us processing a payment or, before you can make or continue to make payments on the App. This includes using Sniip Rewards (such as Refer a Friend bonuses).

- If you use a prepaid card to make a payment via Sniip, you will be required to complete the KYC verification process. If Sniip receives a refund from your biller, we can only refund back to the prepaid card the payment was made on. If you are no longer in possession of the card, you will be issued with a credit in the Sniip App, that is valid for 12 months, to use towards future bill payments in the App.

- Sniip is not liable for any late fees or interest fees incurred through late payments made via the Sniip app.

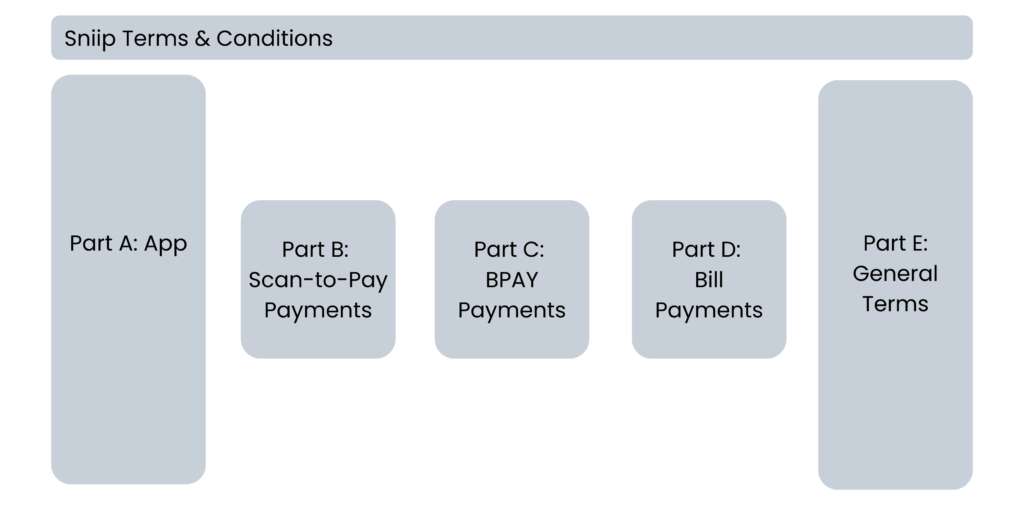

- Sniip Terms & Conditions

Part A: App

1. Overview and User Acceptance

1.1 Our Responsibilities

This Terms and Conditions document is a contract between you and Sniip Ltd ACN 161 862 068 (Sniip, we, us or our) and applies to your use of the Sniip Application (App).

You must be an Australian resident and/or reside in Australia and be at least 18-years-old to open a Sniip account and use the Sniip services.

Use of the App is at your own risk and the terms under which you access the App are set out in this document (Terms of Use or Terms). Your access to, and use of, the App is conditional upon compliance with, and acceptance of, the Terms, so please read these carefully. By downloading or using the App you acknowledge that you have read and fully understood, agree with, and accept all of the terms and conditions in these Terms.

1.2 ePayments Code

Sniip is a subscriber to the ePayments Code found at https://asic.gov.au/regulatory-resources/financial-services/epayments-code/. Sniip warrants that it will comply with the ePayments Code. If you feel that we have breached the ePayments Code in any way, you are entitled to make a complaint to us in accordance with the dispute resolution provision of these Terms.

1.3 Amendments

We may update these Terms from time to time and your use of the App will be governed by the most recent Terms available at https://sniip.com/terms-and-conditions/. We will notify you if we make any change to the Terms before those changes take effect. We will give you at least 20 days’ advance written notice through the App or to your nominated email address if we make any of the following changes to the Terms:

(i) imposing or increasing fees or charges for issuing or replacing a device or passcode;

(ii) imposing or increasing fees and charges for performing transactions;

(iii) increasing your liability for losses relating to transactions; or

(iv) imposing, removing, or changing a daily or other periodic limit on:

(A) transactions;

(B) a facility; or

(C) electronic equipment.

Your continued use of the App following any changes to these Terms indicates your acceptance of any changes to these Terms. The App is currently made available to you free of charge, but there are fees payable if you use our BPAY Payments Service. We reserve the right to amend or withdraw the App, cease support or charge for the App or service provided to you at any time and for any reason.

1.4 Changes to Terms and Conditions

(a) We reserve the right at our sole discretion to restrict, terminate or suspend these Terms and your access to all or any part of the App at any time and for any reason without prior notice or liability. All provisions of the Terms which by their nature should survive termination shall survive termination, including intellectual property provisions, liability provisions, warranty and indemnity provisions.

We may, in our sole and absolute discretion, delay, block or refuse to process or settle any transaction without incurring any liability if we suspect, for any reason, that you have not complied with these Terms, applicable law or our policies (including in relation to the fair use of our services). Where we do so, we may, at our sole and absolute discretion, refund any monies received by us in connection with the transaction or hold and quarantine such monies while we determine whether to process the transaction, refund the monies or take other action.

If we limit or close your account or terminate use of the App for any reason, you may contact us and request restoration of access, if appropriate. However, if we deem you violated these Terms, applicable law or our policies in relation to the fair use of the App or the Sniip Services, restoration of access is at our sole discretion.

Any reward, promotion, offer, discount or other benefit in connection with the use of the App is provided at our sole and absolute discretion and subject to these Terms, as well as any other terms and conditions which are communicated to you. We may, at our sole and absolute discretion, suspend or terminate (or reverse, where necessary), your participation in any such promotion, offer, discount or benefit where we deem you violated these Terms, applicable law or our policies in relation to the fair use of the App or the Sniip Services.

1.5 Financial Advice

Sniip does not provide any financial advice in connection with the App or its use.

2. Responsibilities

2.1 Registration

When registered on the App, you represent and warrant that you are able to form a binding contract with Sniip and that you have the authority to enter into, and the capacity to be bound by, these Terms, and that all information you have provided is true, accurate and complete.

You must ensure that your registration details on the App are true and correct at all times. Upon installation of the App, you are responsible for ensuring that the App is used in accordance with the Terms of Use and any instructions we provide in relation to the App. We are not liable to install the App or to provide any services or support in respect of the installation of the App, except as expressly stated in the Terms. You must ensure that your access to, and use of the App is not prohibited by laws that apply to you.

2.2 Identity Verification

You must sign up to the Sniip app with the legal name as detailed on your government-issued identification. You hereby authorise us, directly or through third parties, to make any inquiries we consider necessary to validate your identity and/or authenticate your identity and account information. This may include asking you for further information and/or documentation about your account usage or identity, or requiring you to take steps to confirm ownership of your email address, wireless/mobile telephone number or third-party bank accounts or Cards or Apple Pay (or other digital wallets) used, and verifying your information against third party databases or through other sources. You must provide us with all information which we request from you and must provide full cooperation to our attempts to confirm and verify your identity. Please refer to our Privacy Policy which sets out how we use and store your personal information. Any of your information we provide to one of our partners may be held and used in accordance with that relevant partner’s privacy policy.

2.3 Eligibility

In order to use the App, you will need an eligible Device and Sniip recommends that you keep your Device updated with the latest operating system and security software as released by the Device or system operator. Sniip will not be liable if the App cannot function, or cannot function properly, due to an out-of-date operating system or security features.

2.4 Spend Limits

You will be responsible for all costs (if any) associated with charges related to exceeding any daily or other spend limit imposed by your financial institution, or as set by a Biller. You should also note that your payment may be rejected and thus not processed if you exceed any daily or other spend limit as determined by your banking institution.

2.5 Use

You agree that you may not use the App in any way that is, or for purposes that are prohibited under the Terms or any law in force in your jurisdiction. You also agree not to engage in any activity that interferes with, or disrupts the servers and networks relating to the App. You must not work around any technical limitations in the App, or attempt to run the App on an unsupported platform.

2.6 Protecting against unauthorised use

You are responsible for maintaining the confidentiality of your PIN and password for all accounts used by you to access the App. You acknowledge and agree that you are solely responsible for all activities that occur under all such accounts and for the security of your PIN, passwords and Device.

3. Payment Connectivity

3.1 Payment Details

It is your responsibility to ensure that the Card or Apple Pay/ Google Pay (or other digital wallets) details that you provide are correct and you warrant that you are authorised to use Cards or digital wallets that you connect to the App.

You may be required to verify any accounts, Apple Pay/ Google Pay (or other digital wallets) or Cards which you attempt to link to the App. Failure to complete such verification, as we reasonably require, entitles us to terminate or suspend your access to the App.

3.2 Biller Terms and Conditions

When you instruct us to pay a Biller via the App, all payments to that Biller are done pursuant to the contract or commercial arrangements between yourself and the Biller. Sniip has not approved or screened any products, services or Bills provided by any Biller and is not responsible for any services, products, or errors in a Bill provided by a Biller to you.

3.3 Processing

All due dates are set for the end of the day in the Biller’s time zone (eg DD MM YYYY, 23:59).

3.4 Statements and Receipts

We will provide you with an electronic receipt for each payment you instruct us to make to a Biller via the App. We will provide you with an electronic statement of all transactions made via the App every six months (unless you request to receive statements more frequently). Paper copies of receipts or statements will not be available.

4. The App

4.1 Links and Advertisements

The App may contain links to other websites which are not covered by these Terms and may have their own terms and conditions and privacy policies.

We have not reviewed all of the third party websites linked on the App and are not responsible for and will not be liable in respect of their content or accuracy (including websites linked through advertisements). Sniip does not endorse, support or sponsor those websites, their operators, the goods, services or content that they describe.

If you choose to access these third party linked websites, you do so at your own risk. Sniip is not responsible for, and will not be liable in respect of the content or operation of those websites or any of the goods, services or content that they describe. Sniip is not responsible for, and will not be liable in respect to any incorrect link to an external website.

4.2 No Warranty

Sniip has made efforts to ensure that information provided in the App by Sniip is free from error, however, Sniip does not warrant the accuracy or completeness of any information provided in the App. Furthermore, Sniip does not warrant that the App will always be available or free from defects.

4.3 Multiple Devices

The App is available for you to use on more than one Device. The Terms apply to each Device that you may use.

4.4 Apple App Store and Google Play Market

If you download the App through the Apple App Store and/or the Google Play Market, in addition to these Terms, your use of the App is also subject to Apple’s End User License Agreement available at https://www.apple.com/legal/internet-services/itunes/or Google Play’s Terms of Service available at https://play.google.com/intl/en_au/about/play-terms.html, as applicable.

If you have obtained the App via Apple’s App Store, then you acknowledge and agree that:

(i) these Terms are concluded between you and Sniip, and not Apple, Inc. (Apple);

(ii) Sniip, and not Apple, is solely responsible for the App

(iii) the Licence granted to you is subject to Apple’s Usage Rules set out in the App Store Terms and Conditions available at http://www.apple.com/legal/internet-services/itunes/au/terms.html#APPS

(iv) Apple has no responsibility whatsoever to furnish any maintenance and support services with respect to the App

(v) in the event of any failure of the App to conform to any applicable warranty, you may notify Sniip and we will investigate the transaction;

(vi) to the maximum extent permitted by applicable law, Apple will have no other warranty obligation whatsoever with respect to the App

(vii) Apple is not responsible for any claims that you have arising out of your use of the App;

(viii) Apple will have no responsibility whatsoever for the investigation, defence, settlement or discharge of any third-party claim that the App infringes that third party’s intellectual property rights; and

(ix) Apple and its subsidiaries are third party beneficiaries of these Terms and, upon your acceptance of these Terms, Apple will have the right (and will be deemed to have accepted the right) to enforce these against you as a third party beneficiary.

You acknowledge that the App may be subject to the export control laws of various countries, including without limitation the laws of the US. You represent and warrant that:

(x) you are not located in a country that is subject to a government embargo, or that has been designated by a government as a “terrorist supporting” country; and

(xi) you will not export the App to countries, persons or entities that are subject to a government embargo, or that have been designated by a government as a “terrorist supporting” country; and

(xii) you are not listed on any government list of prohibited or restricted parties.

If you connect an Apple Pay account to the App, then you acknowledge and agree that:

(xiii) Apple Pay is provided by Apple; and

(xiv) Sniip is not liable for any loss associated with the use, functionality or availability of Apple Pay or for any disruption arising from its availability.

5. Liability and Indemnity

5.1 When are you not liable for a loss?

You will not be liable for loss arising from an unauthorised transaction if the cause of the loss is any of the following:

(i) fraud or negligence by a Sniip employee or agent, a third party involved in networking arrangements, or a merchant or their employee or agent;

(ii) a PIN or password which is forged, faulty, expired or cancelled;

(iii) a transaction requiring the use of a PIN or password that occurs before you receive the PIN or password (including in the case of a re-issued PIN or password)

(iv) a transaction being incorrectly debited more than once; or

(v) an unauthorised transaction performed after Sniip has been made aware that a Device has been misused, lost or stolen, or the security of a PIN or password has been breached.

You will not be liable for loss caused by the failure of a system or equipment provided by us or a third party which we rely upon to complete a transaction in accordance with your instructions.

Sniip is responsible for the security of cardholder data received from you through the Sniip App. Sniip is responsible for securely storing, processing, and transmitting cardholder data on your behalf.

5.2 When are you liable for a loss

Where we can prove on the balance of probability that you contributed to a loss arising from an unauthorised transaction through fraud, or breaching the passcode security requirements set out in clause 12 of the ePayments Code, you will be liable in full for the actual losses that occur before you report the loss, theft or misuse of your Device or security breach of your PIN or password to us.

Where we can prove on the balance of probability that you contributed to a loss arising from an unauthorised transaction by unreasonably delaying reporting the misuse, loss or theft of your Device or a security breach of your PIN or password to us, you will be liable in full for the actual losses that occur between:

(i) when you became aware of the security compromise, or should have reasonably become aware in the case of a lost or stolen Device; an

(ii) when you report the security compromise to us.

In both cases described above, you will not be liable for the portion of losses:

(iii) incurred on any one day that exceeds any applicable daily transaction limit; or

(iv) incurred in any period that exceeds any applicable periodic transaction limit.

Where a PIN or password was required to perform an unauthorised transaction and we are unable to prove any of the matters described above, you will be liable for the least of:

(v) the amount of $150; or

(vi) the actual loss at the time you report the misuse, loss or theft of your Device or security breach of your PIN or password to us.

5.3 Limitation of our Liability

To the maximum extent permissible at law, we accept no responsibility or risk for the content provided, printed, sent or received in relation to the App, including by a Biller. You, by accessing or using the App, accept all responsibility, risk and liability for the content chosen, added, edited, provided, uploaded and modified. You indemnify us against any loss or damage we may suffer due to any claim, demand or action of any kind brought against us arising directly or indirectly because you acted negligently or fraudulently in connection with this agreement.

We do not, and we are under no obligation to, monitor or review any ratings, comments, communications, forums, discussions, postings, transmissions and other messages communicated by users of the App. Sniip assumes no liability or responsibility arising from the contents of any such communications or for any defamation, error, inaccuracy, libel, obscenity or profanity contained in any such communication. You hereby irrevocably and unconditionally waive any claim against us for defamation, libel or whatsoever arising out of any such communication.

We are not liable for any consequential loss or damage you suffer as a result of using the App, other than due to any loss or damage you suffer due to our negligence or in relation to any breach of a condition or warranty implied by law in contracts for the supply of goods and services and which may not be excluded, restricted or modified at all or only to a limited extent.

We are not liable for any disruption or impairment of the App or for disruptions or impairments of intermediary services on which Sniip relies for the performance of its obligations, provided that such disruption or impairment is not due to our negligence or in relation to any breach by us of a condition or warranty implied by law in contracts for the supply of goods and services, which may not be excluded, restricted or modified at all or only to a limited extent.

We are not responsible for any event or matter beyond reasonable control, such as acts of God, actions or omissions of financial institutions, card schemes or payment gateway providers or processors, legal or regulatory compliance reasons, power failures and the like.

You acknowledge that Sniip will provide the App using facilities provided by banks, payment service providers, clearing networks and other third party payment processing services (Service Providers). No commercial agreement exists between the Service Providers and yourself and each of the Service Providers will accordingly have no direct liability to you.

Before making a payment Sniip will debit your card through the card scheme as a merchant for the bill amount plus any relevant surcharges and fees. You agree that the Bank has no responsibility for your funds before they are received into the account and that the Bank is not liable or responsible for any loss of funds that you may incur as a result of using the App.

Nothing in this Terms of Use excludes, restricts or modifies any consumer guarantee, right or remedy conferred on you by the Australian Consumer Law being Schedule 2 to the Competition and Consumer Act 2010 (Cth) (“ACL”) or any other applicable law that cannot be excluded, restricted or modified by the agreement.

To the fullest extent permitted by law, the liability of Sniip for a breach of a non-excludable guarantee under the ACL is limited, at Sniip’s option, to:

(i) in the case of goods supplied or offered by us, any one or more of the following: the replacement of the goods or the supply of equivalent goods; the repair of the goods; the payment of the cost of replacing the goods or of acquiring equivalent goods; or the payment of the cost of having the goods repaired; or

(ii) in the case of services supplied or offered by us: the supplying of the services again; or the payment of the cost of having the services supplied again.

5.4 Sniip Rewards

You are eligible to receive ten (10) dollars in Sniip credit for each friend you refer to the Sniip app. This credit can be applied to all eligible bill payments made using the Sniip app and is non-transferrable.

For each eligible person you refer, you are eligible for a ten (10) reward to use on your next bill.

To be eligible for Sniip Rewards:

- The referee is required to have made a payment of $50 or more in the Sniip App

- The referred user must be making their first payment of $50 or more in the Sniip app

- Sniip Rewards or Credits cannot be redeemed when Scheduling payments, or if using the Sniip QR code or AusPost when making payments.

- Sniip offers the Sniip Rewards program for the benefit of eligible users who enjoy using our app, so that they may be rewarded in recommending their family, friends, colleagues or other eligible parties. Sniip reserves the right to void rewards if a user is found to have created a phantom account/s to earn rewards or is in breach of the terms.

Earned Refer a Friend credits or other issued Credit expires after twelve months.

If you use Sniip Rewards when making a payment you will be ineligible for any other Sniip promotional offer.

You may be required to provide government issued photo identification to verify your account prior to Sniip processing a payment or, before you can make or continue to make payments in the App. This includes Sniip Rewards (such as Refer a Friend bonuses).

5.5 Sniip KYC Requirements

In order for Sniip to verify your identity, we require a copy of your physical and valid Australian Government issued identity document or overseas Passport. This must clearly show your full name, date of birth and government-issued photo identity.

We may also require a copy of the payment method that you have added to your Sniip E-wallet. You are asked to ensure the middle numbers of your card/s and CVV are blanked out before you send a copy to us. We require the first 6 and last 4 numbers to be visible, as well as your full name and the expiry date of your card.

Credit Card verification is an important part of our anti-credit card fraud security measures and is our only method of ensuring that you are in possession of the credit card used to make payments within the Sniip App.

5.6 Fair‑Use of Promotional Codes and Sniip Discretion

1. Single‑Use Only

a. Each promotional or bonus code is issued for use by a single, bona fide customer. You agree not to:

i. Create multiple accounts linked to the same device, payment method or customer;

ii. Collude with any other person or account to redeem codes more than once; or

iii. Exploit any technical or procedural loophole to obtain additional bonuses.

2. Prohibited Conduct

Sniip may investigate any suspected abuse, including but not limited to:

i. Duplicate, fraudulent or “farm” accounts;

ii. Use of VPNs, emulators or device‑spoofing tools to mask multiple redemptions; or

iii. Any other scheme or arrangement intended to gain more than the single‑customer benefit.

3. Sniip Discretion & Fair‑Use

a. Sniip reserves the right, in its sole and absolute discretion, to:

i. Determine eligibility for any bonus, incentive or promotion;

ii. Refuse, withhold or revoke any bonus or incentive, in whole or in part; and

iii. Declare an account ineligible if it believes fair‑use limits have been exceeded.

b. Where Sniip detects or reasonably suspects misuse under sections 5.1 or 5.2, Sniip may:

i. Remove the bonus/incentive from all implicated account(s);

ii. Recover any value already applied; and

iii. Suspend or terminate the account(s) without notice.

4. No Waiver

Exercise of any right or remedy under this Section 5 does not constitute a waiver of Sniip’s right to enforce any other provision of these Terms & Conditions.

Part B: Scan-To-Pay Payments

6. Payment Scheduling

We can accept an order to stop a Payment being processed prior to the BPAY file being sent. A user must confirm this via email for our records. Sniip will not accept an order to stop a Payment once the BPAY file has been sent.

You should notify us immediately if you become aware that you may have made a mistake (except when you make an underpayment – for those errors see clause 6(f) below) when instructing us to make a Payment, or if you did not authorise a Payment that has been made from your account. Clause 7 describes when and how we will arrange for such a Payment (other than in relation to an underpayment) to be refunded to you.

Subject to clause 19 (Cut-off Times) Billers who participate in BPAY Payments have agreed that a Payment we make on your behalf will be treated as received by the Biller to whom it is directed:

(i) on the date we make that Payment, if we make the Payment before our Payment Cut-Off Time on a Banking Business Day; or

(ii) on the next Banking Business Day, if we make a Payment after our Payment Cut-Off Time on a Banking Business Day, or on a non-Banking Business Day.

A delay may occur in processing a Payment where:

(iii) there is a public or bank holiday on the day after you tell us to make a Payment

(iv) we make a Payment either on a day which is not a Banking Business Day or after the Payment Cut-Off Time on a Banking Business Day;

(v) another financial institution participating in BPAY Payments does not comply with any applicable obligations relating to BPAY Payments; or

(vi) a Biller fails to comply with any applicable obligations relating to BPAY Payments.

While it is expected that any delay in processing under this agreement for any reason set out in clause 6(d) will not continue for more than one Banking Business Day, any such delay may continue for a longer period.

You must be careful to ensure that you tell Sniip the correct amount you wish to pay. If you instruct Sniip to make a Payment and you later discover that the amount you told Sniip to pay was less than the amount you needed to pay, you can make another Payment for the difference between the amount actually paid to a Biller and the amount you needed to pay.

7. Mistaken payments, unauthorised transactions and fraud

Pursuant to the EFT Code / ePayments Code, if under this clause 7 you are liable for an unauthorised or fraudulent payment and the ePayments Code applies, then your liability is limited to the lesser of:

(i) the amount of that unauthorised or fraudulent payment; and

(ii) the limit (if any) of your liability set out in our Terms of Use.

If (ii) applies, we will be liable to you for the difference between the amount for which you are liable and the amount of the unauthorised or fraudulent payment.

We will attempt to make sure that your payments are processed promptly by the participants in BPAY Payments, including those Billers to whom your payments are to be made. You must promptly tell us:

(iii) if you become aware of any delays or mistakes in processing your payments;

(iv) if you did not authorise a Payment that has been made from your account; or

(v) if you think that you have been fraudulently induced to make a Payment.

We will attempt to rectify any such matters in relation to your payments in the way described in this clause. However, except as set out in this clause 7 and clause 5.3(c), we will not be liable for any loss or damage you suffer as a result of using BPAY Payments.

The longer the delay between when you tell us of the error and the date of your payment, the more difficult it may be to perform the error correction. For example, we or your Biller may not have sufficient records or information available to us to investigate the error. If this is the case, you may need to demonstrate that an error has occurred, based on your own records, or liaise directly with the Biller to correct the error.

8. Mistaken Payments

If a Payment is made to a person or for an amount, which is not in accordance with your instructions (if any), and your account was debited for the amount of that payment, we will credit that amount to your account. However, if you were responsible for a mistake resulting in that payment and we cannot recover the amount of that payment from the person who received it within 20 Banking Business Days of us attempting to do so, you must pay us that amount.

9. Fraudulent Payments

If a Payment is induced by the fraud of a person involved in the Scheme, then that person should refund you the amount of the fraud-induced payment. However, if that person does not refund you the whole amount of the fraud-induced payment, you must bear the loss unless some other person involved in the Scheme knew of the fraud or would have detected it with reasonable diligence, in which case that person must refund you the amount of the fraud-induced payment that is not refunded to you by the person that induced the fraud.

10. Resolution Principles

(a) If a payment you have made falls within the type described in clause 9 and also clause 8 or 10, then we will apply the principles stated in clause 9.

(b) If a payment you have made falls within both the types described in clauses 8 and 10, then we will apply the principles stated in clause 10.

11. No 'chargebacks'

Even where your Payment to us has been made using a credit card account, charge card account, Apple Pay (or other digital wallets), no ‘chargeback’ rights will be available for BPAY Payments by us through the Scheme. However, you may have ‘chargeback’ rights against us in respect of your payment to us.

12. Biller Consent

If you tell us that a payment made from your account is unauthorised, you must first give us your written consent addressed to the Biller who received that payment, consenting to us obtaining from the Biller information about your account with that Biller or the payment, including your Customer Reference Number (CRN) and such information as we reasonably require to investigate the payment. If you do not give us that consent, the Biller may not be permitted under law to disclose to us the information we need to investigate or rectify that payment.

Part C: BPAY Payments

13. Paying via BPAY

We are a member of the Scheme and we subscribe to BPAY Payments. BPAY Payments is an electronic payments service through which you can ask us to make payments on your behalf to organisations (Billers) who tell you that you can make payments to them through the “BPAY Payments” payment service (BPAY Payments).

We will tell you if we are no longer a member of the Scheme, or if our subscription to BPAY Payments is cancelled. For the purposes of BPAY Payments, we may also be a Biller.

When you tell us to make a payment, you must give us the information specified in clause 6 below. We will then debit your Card, Apple Pay (or other digital wallet) with the amount of that payment.

Due to the risk profile of certain billers, Sniip has initially restricted certain sectors.

These categories include:

- Remittance service provider

- Charities and Not-for-Profit

- Intermediaries

- Pay-day lenders

- Internet gambling

- Casinos

- Goods dealers

- Foreign exchange currencies

- Securities and derivatives

- Managed investment schemes

- International business operations

- International students or travel products

- Hiring and leasing

- Banking and financial institutions

14. How to use BPAY Payments

You can make payments through your registered account on the App.

Transactions through the BPAY Product will be processed in accordance with the following:

(i) The App will enable a user to scan a paper or email bill, to digitise and store the BPAY Payment details.

(ii) The App will verify the validity of the BPAY Payment details.

(iii) Sniip will debit a user’s card, Apple Pay/Google Pay (or other digital wallet) as merchant for the bill amount, plus any relevant transaction fees. Those funds will be held in an account with an Australian Authorised Deposit Taking Institution (the Bank) in its own name, on the user’s behalf. This leg of the transaction does not involve the BPAY Scheme.

(iv) After cleared funds are received in Sniip’s account with the Bank (which may take up to three (3) business days (or longer in exceptional circumstances), Sniip will make payment/s from the funds held on trust for the specific purpose of paying your bill in the Sniip Account via BPAY. This leg of the transaction utilises the BPAY Scheme and is subject to these Terms. You will need to consider these time frames when instructing Sniip to make BPAY Payments on your behalf to ensure that you pay your Bill on time.

When you use a credit card or a credit card via Apple Pay/ Google Pay (or other digital wallets) to pay a bill through the BPAY Product, we treat that payment as a credit card purchase transaction.

You acknowledge that the receipt by a Biller of a mistaken or erroneous payment does not, or will not constitute under any circumstances part or whole satisfaction of any underlying debt owed between you and that Biller.

15. Valid payment direction

We will treat your instruction to make a payment as valid if, when you give it to us you comply with the security procedures specified in our Terms of Use.

16. Information you must provide to Sniip

The information you must provide Sniip to instruct us to make a payment includes:

the Biller’s BPAY Biller Code;

your Customer Reference Number (CRN); and

the payment amount.

You acknowledge that we are not obliged to effect a payment if you do not provide Sniip all of the above information, or if any of the information you provide Sniip is inaccurate.

17. Payment queries

If you have any queries or complaints in respect of a payment, please contact us using the details listed in our Terms of Use (refer to clause 24). We will attempt to resolve your complaint or query in accordance with those procedures.

18. Cut-off times

The cut off time for Sniip to receive and process payments the following business day are as follows:

- 11.59pm AEDT Sydney time Visa/ Mastercard

- 6pm AEDT Sydney time AMEX

For BPAY payments, Sniip will let the user know prior to confirming the payment when the bill will be processed via BPAY to the biller.

This is generally the next business day (unless using a Diners card which may take one (1) further business day). Sniip will let you know the date of payment to the biller, prior to payment.

The Biller must recognise the BPAY payment as the date that the bill was paid.

For payments utilising the Sniip QR code, Sniip uses the same payment gateway as the relevant biller.

However, each biller may have different transfer timeframes and there may be delays in the funds being received into your billers account.

19. When a Biller cannot process a payment

If Sniip is advised that your payment cannot be processed by a Biller, we will:

advise you of this;

credit your account with the amount of the payment; and

take all reasonable steps to assist you in making the payment as quickly as possible.

20. Account records

You should check your account records carefully and promptly report to us as soon as you become aware of any payments that you think are errors, or are payments that you did not authorise, or you think were made by someone else without your permission.

21. Fees

You agree to pay the following processing fees for each payment made using the App:

Personal payments

| Type of card | Processing fee |

|---|---|

| Bank Accounts | 0.00% |

| Debit cards | 0.65% |

| Amex | 1.29% |

| Diners | 1.50% |

| Visa/Mastercard | 1.50% |

| Visa/Mastercard International* | 3.00% |

| Prepaid cards | 0.85% |

| Crypto.com cards | 0.85% |

All processing fees are inclusive of GST.

*All international cards are recognised as credit cards and incur a 3% processing fee.

American Express Business payments

| Transaction amount | Processing fee |

|---|---|

| $0 – $99,999 | 2.19% (1.99% + GST) |

| $100,000 – $299,999 | 2.15% (1.95% + GST) |

| $300,000 – $499,999 | 2.09% (1.90% + GST) |

| $500,000 – $999,999 | 2.04% (1.85% + GST) |

| +$1,000,000 | 1.93% (1.75% + GST) |

You agree to pay the surcharges as notified to you from time to time and calculated and displayed to you prior to instructing Sniip to make a payment and authorise us to debit your nominated Card, Apple Pay (or other digital wallet) for all fees payable by you.

The surcharge displayed may not be the same as the surcharge at time of processing, due to a fee change falling between the two dates. In this instance, although a user may have scheduled the payment with the lower fee displayed, Sniip reserves the right to process payments at a higher surcharge on the date of payment.

If you request a refund of a payment (where possible), you will be subject to a fee of $25 and Sniip will retain any surcharges paid by you in respect of that payment. Sniip may also receive any interest paid in respect of user funds held in its account with the Bank before a payment is made by Sniip to a biller via BPAY.

Sniip may also receive fees from the Bank and/or its processing partners for processing a BPAY payment

22. Approval of payments

Sniip is entitled to determine whether or not to approve an instruction to make a payment at its sole discretion pursuant to its Know Your Customer (KYC) and fraud screening procedures and policies, any applicable law or regulation, for anti-money laundering purposes and for other legal and regulatory related reasons. When rejecting a transaction, Sniip is under no obligation to disclose the reason for the rejection. You are solely responsible for any fees, costs and expenses associated with rejected transactions.

Part D: Bill Payments

23. Paying non-BPAY Bills

We offer a Bill Payment Service through which you can ask us to make payments on your behalf to Billers who provide you with their Details, including BSB and bank account number.

When you tell us to make a Payment, you must give us the information specified in clause 27 below. We will then debit your Card, Apple Pay (or other digital wallet) with the amount of that Payment.

24. How to pay non-BPAY bills

You can make payments through your registered account on the App.

Payments in which you give us the required Details will be processed in accordance with the following:

- The App will enable a user to scan a paper or email bill, to digitise and store the Biller’s Details.

- The App will not verify the validity of the Biller’s Details.

- Sniip will debit a user’s Card, Apple Pay (or other digital wallet) as merchant for the bill amount plus any relevant surcharges and fees and place funds into an account held with an Australian Authorised Deposit Taking Institution (the Bank) in its own name on the User’s behalf.

- After cleared funds are received in Sniip’s account with the Bank (which may take up to three business days (or longer in exceptional circumstances)), Sniip will make payments from the funds held on trust for the specific purpose of paying your bill in the Sniip Account to the Biller. It may take up to three (3) business days (or more in exceptional circumstances) from the time a payment is made by the User to Sniip through the Product until Sniip pays the Biller. During this period, Sniip will hold funds in an account with the Bank in its own name on the User’s behalf.

When you use a credit card or a credit card via Apple Pay/ Google Pay (or other digital wallets) to pay a bill through the App, we treat that payment as a credit card purchase transaction.

You acknowledge that the receipt by a Biller of a mistaken or erroneous payment does not, or will not constitute under any circumstances part or whole satisfaction of any underlying debt owed between you and that Biller.

25. Valid payment direction

We will treat your instruction to make a payment as valid if, when you give it to us you comply with the security procedures specified in our Terms of Use.

26. Information you must provide Sniip

The information you must provide Sniip to instruct us to make a payment includes:

the Biller’s Details;

your payment reference or invoice number; and

the payment amount.

You acknowledge that we are not obliged to effect a payment if you do not provide Sniip all of the above information, or if any of the information you provide Sniip is inaccurate.

27. Payment queries

If you have any queries or complaints in respect of a payment, please contact us using the details listed in our Terms of Use (refer to clause 34). We will attempt to resolve your complaint or query in accordance with those procedures.

28. Cut-off times

If you make a payment prior to 5:00pm AEST / AEDT it will be paid to the biller the next available business day. Payments made on a weekend (Saturday, Sunday) or public holiday will take two business days to appear on your biller account.

29. When a Biller cannot process a payment

If Sniip is advised that your payment cannot be processed by a Biller, we will:

advise you of this;

credit your account with the amount of the payment; and

take all reasonable steps to assist you in making the payment as quickly as possible.

30. Account records

You should check your account records carefully and promptly report to us as soon as you become aware of any payments that you think are errors or are payments that you did not authorise or you think were made by someone else without your permission.

31. Approval of Payments

Sniip is entitled to determine whether or not to approve an instruction to make a payment at its sole discretion pursuant to its Know Your Customer (KYC) and fraud screening procedures and policies, any applicable law or regulation, for anti-money laundering purposes and for other legal and regulatory related reasons. When rejecting a transaction, Sniip is under no obligation to disclose the reason for the rejection. You are solely responsible for any fees, costs and expenses associated with rejected transactions.

You must not use Sniip to make a Prohibited Payment, or to pay yourself or any associated party (including relatives, friends or related businesses*). If you are making a payment on behalf of a company, you must not use the Sniip to pay a subsidiary or related entity, or related shareholders or directors.

*If there is any doubt as to whether a payment may be impacted by the above restrictions, please request guidance from our compliance team (risk@sniip.com.au), prior to making the payment. Sniip at it’s sole discretion, may reject a payee (even after payment is made) and funds will be returned (net of any Sniip fees).

Part E: General items

32. Helpdesk/Queries, Reports and Complaints

Contact Sniip at customercare@sniip.com. You may also write to us at Sniip Ltd, Level 1/79 Hope St, South Brisbane QLD 4101. If you request information from us, we are required to respond to you within 15 days unless exceptional circumstances apply.

If you make a complaint to us, we are required to complete an investigation and advise you of the outcome in writing or advise you of the need for more time to complete our investigation in writing within 21 days. We are required to complete our investigation within 45 days of your complaint unless exceptional circumstances apply.

If your complaint relates to our BPAY Payments Service and we are unable to resolve your complaint within 45 days or you are dissatisfied with how your complaint was handled or its outcome, you can refer your complaint to the Australian Financial Complaints Authority (AFCA), an independent external dispute resolution scheme covering applicable Australian customers.

AFCA can be contacted at:

Online: www.afca.org.au

Email: info@afca.org.au

Phone: 1800 931 678

Mail: Australian Financial Complaints Authority, GPO Box 3, Melbourne VIC 3001

33. Privacy

If you register to use the App and the Product, you agree to our disclosing to Billers nominated by you and if necessary the entity operating BPAY Payments (BPAY) or any other participant in BPAY Payments and any agent appointed by any of them from time to time, including BPAY Group Pty Ltd, that provides the electronic systems needed to implement BPAY Payments:

(i) such of your personal information (for example your name, email address and the fact that you are our customer) as is necessary to facilitate your registration for or use of BPAY Payments; and

(ii) such of your transactional information as is necessary to process your payments. Your payments information will be disclosed by BPAY, through its agent, to the Biller’s financial institution.

If you agree to provide us with access to your email in order for us to notify you of any upcoming Bills, you acknowledge that we may use the data from the Bill to:

(iii) analyse our services and customer needs with a view to developing new or improved products or services; or

(iv) subject to Applicable Laws, notify you of promotions, special offers or deals from other service providers, which might interest you.

You must notify us, if any of your personal information changes and you consent to us disclosing your updated personal information to all other participants in BPAY Payments referred to in clause 25(a)(i), as necessary.

You can request access to your information held by us, BPAY or its agent, BPAY Group Pty Ltd at their contact details listed in the Definitions, or by referring to the procedures set out in the privacy policy of the relevant entity.

Our Privacy Policy, along with the privacy policies of BPAY and BPAY Group Pty Ltd, contain information about how you may complain about a breach of the Privacy Act 1988 (Cth), and the process by which your complaint will be handled.

If your personal information detailed above is not disclosed to BPAY or its agent, it will not be possible to process your requested payment.

Sniip’s Privacy Policy can be found at https://sniip.com/privacy-policy/.

34. Security

34.1 Security Precautions

You must take the following security precautions:

Don’t select a PIN or password that:

(i) represents your birth date;

(ii) represents a recognisable part of your name; or

(iii) is the same PIN as that used for your Card.

Don’t write your PIN or password or carry a record of them:

(iv) on your Device; or

(v) on anything that is carried with or could be lost together with your Device,

(vi) unless you make a reasonable attempt to protect the security of your PIN or password including by (but not limited to):

(vii) hiding or disguising them among other records;

(viii) hiding or disguising them in a place where they would not be expected to be found; or

(ix) preventing unauthorised access to an electronically stored copy of your PIN or password.

Do not tell or show your PIN to anyone else (including family and friends).

Do not leave your Device unattended and/or left logged into the App. Exit from the App at the end of each session.

Do enable password-protection and other security features that may be made available on your Device to stop unauthorised use of the App.

Do change your PIN at regular intervals.

34.2 Notification

You should immediately tell your financial institution and us (via customercare@sniip.com) if:

you believe your Card or other account may be compromised;

your PIN, password or Device has been lost or stolen;

an electronic fund transfer has been made without your permission; or

the statement from your financial institution shows transfers that you did not make.

34.3 Device Security

You agree that you will:

not leave your Device unattended and/or logged into the App;

lock your Device or take other steps necessary to stop any unauthorised use of the App;

not act fraudulently or maliciously in relation to the App or related software. As examples, you will not copy, modify, adversely effect, reverse engineer, hack into or insert malicious code into the App or software;

not override the software lockdown on your Device (e.g. jailbreak your Device);

promptly update, and keep updated, the operating system and security software for your Device when released by the Device or system provider;

not permit any other person to store their Biometric Identifier on your Device; and

before you sell or permanently give your Device to any person, delete the App and, if you have enabled a Biometric Identifier for access to the App, disable this feature within the App (e.g. disable Touch ID or Face ID).

35. Intellectual Property

All rights, title and interest to the App and any related intellectual property are owned by Sniip. Nothing you do will transfer any intellectual property from Sniip to you. You acknowledge that any unauthorised reproduction by you of any proprietary information provided or available via the App or any portion of it may result in legal action being taken. You agree to not copy, modify, adversely effect, reverse engineer, hack into or insert malicious code into the App or any related software.

We grant to you, and you accept, a non-exclusive, royalty free, revocable and non-transferable limited licence to install and use one copy of the App on your Device in machine executable object code form solely for your own personal use. You must not re-sell, sub-license, rent, lease or otherwise distribute the App. All other rights in respect of the App are reserved to us.

3.6 Suspension and other steps Sniip can take

36.1 Notification of Suspendable Action

If we reasonably consider a Suspendable Action has occurred or may occur, we will promptly notify you in writing or via the App, by email or by phone call, including explaining the circumstances causing the Suspendable Action to arise.

36.2 Suspension

If you commit a Suspendable Action, we may immediately suspend your ability to use the App or Sniip services.

Notwithstanding paragraph (a), or any other provision of these Terms, we reserve the right to suspend your access to the App or Sniip services on notice to you if:

- directed to do so by BPAY; or

- we are required to suspend access to the App or Sniip services due to any applicable law.

When we suspend your access to use the App or Sniip services pursuant to this clause 28, you will not be able to use the App, Card or Sniip services.

Where your access to the App or Sniip services is suspended, you must:

- promptly remedy any non-compliance with these Terms; and

- comply with our reasonable directions (including directions as to timing) to remedy any non-compliance with these Terms and/or any Suspendable Action.

If your access to the App is suspended in accordance with this clause 28 for a period of 30 days or more we may, on written notice to you, terminate these Terms.

For the avoidance of doubt, we shall not be liable or responsible in any respect to you for any losses flowing directly or indirectly from any access to the App, Sniip services or Card being suspended in accordance with this clause 28.

36.3 Processing Transactions

We may, in our sole and absolute discretion delay, block or refuse to process or settle any Transaction without incurring any liability if we suspect, for any reason, that you have not complied with these Terms, applicable law or our policies (including in relation to the fair use of our services).

37 Governing Law

The Terms of Use are governed by and interpreted in accordance with the laws of the State of Queensland and the Commonwealth of Australia. Any dispute under these Terms or otherwise in connection with the App will be brought exclusively in the courts of the State of Queensland and the courts of Australia, except where prohibited by law.

38 Definitions

Application or App refers to a computer software application developed by us entitled Sniip. Reference to the “Application” or “App” includes all modifications, enhancements or updates thereto, and includes all associated printed, online or electronic documentation and instructions relating to it.

Apple Pay refers to the mobile payment and digital wallet service provided by Apple Inc. that allows users to make payments via the iOS App.

Bank means the authorised deposit-taking institution with which we maintain an account, in which funds are held in respect of payments to be made on your behalf through the App.

Bill Payment Service means the feature within the App which allows users to pay bills via electronic transfer to a bank nominated by the Biller.

Biller refers to any organisation that is eligible to receive payments via the Sniip App.

Bill or Notice refers to any Bill, including any rates and water notices issued by a city/regional/shire council, payable using the App.

BPAY refers to BPAY Pty Limited ABN 69 079 137 518.

BPAY Rules refers to the BPAY Scheme Rules and Operating Procedures in force from time to time.

BPAY Scheme refers to the electronic payments service promoted by BPAY.

BPAY Payments Service refers to the feature within the App which allows users to pay bills via BPAY.

Card refers to any bank card, credit card or stored value card capable of being used in the App.

Device refers to a mobile device with eligible software that is enabled for cellular or wireless internet connection and capable of having the App installed.

Details means a Biller’s BPAY details or a Biller’s financial account details (including Account Name, BSB and Account Number).

Payment means a payment made by you using the App by scanning a Biller’s Details.

Privacy Laws refers to the Privacy Act 1988 (Cth) and all related regulations.

You (you) / Yours (yours) refers to anyone downloading and/ or accessing the App.

We / us / ours or the Company or Sniip refers to Sniip Ltd ACN 161 862 068.

Last Updated: 15 October, 2022.