GET THE GREEN TICK: Why we're getting to know you better

What is user verification?

User Verification is the the green tick of security verification on your account.

It’s an important part of our Know Your Customer (KYC) process. KYC is a widely used term referring to the verification of a customer’s identity. As a regulated Bill Payment Provider (BPSP), Sniip is not dissimilar to a bank or financial institution and sometimes, we need to get to know you better.

Sniip is an authorised Payment Institution Member (PIM) of BPAY and undertakes significant compliance assessments in order to provide and maintain our service. As part of this commitment, Sniip is required to identify our customers for the purpose of addressing Anti Money-Laundering/Counter-Terrorism Funding risk, fraud and misappropriation risk, as well as requirements imposed by our banking and regulatory partners.

Why am I being requested to verify?

There a numerous flags in our systems that will automatically request User Verification. A few examples include:

- Paying a non-BPAY bill (payment to a biller’s BBS & Account Number)

Adding a payment method to your account that’s different to the legal name on your account

Using a prepaid card

Setting up pay from a BSB and Account Number (Bank Account)

Adding numerous blocked bills

Requesting User Verification

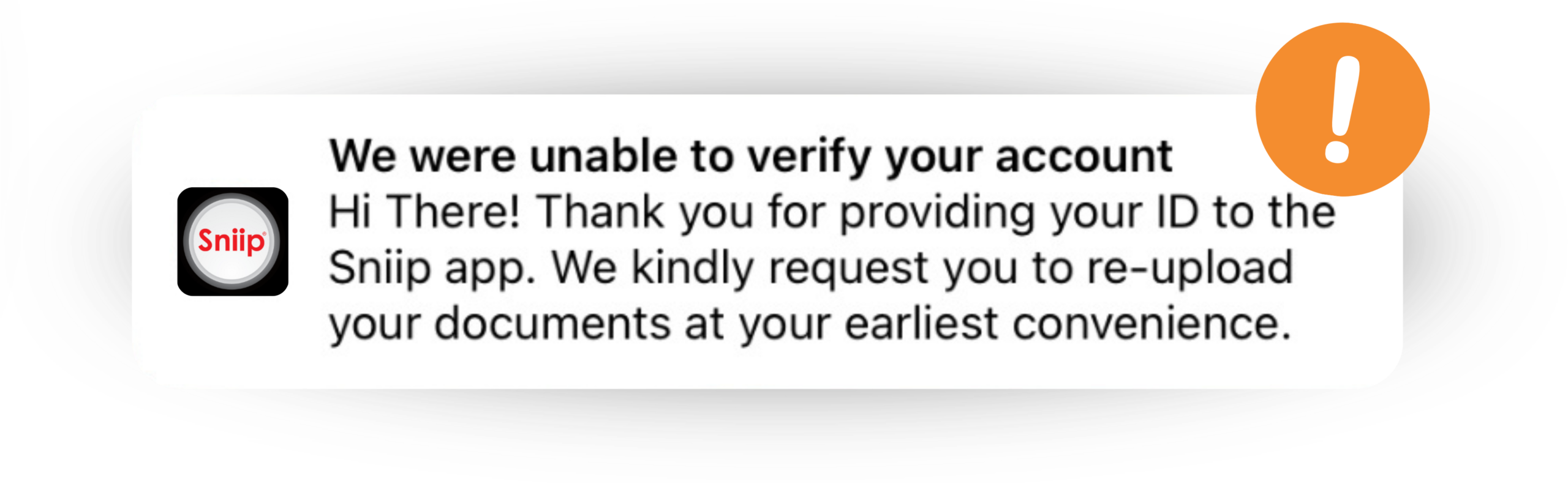

Right now, User Verification is required at sign-up. If you have been requested to verify, you receive a notification from Sniip.

If you are requested to verify your account, we need to collect and check your information. This means we need to verify your identity before we can facilitate payments and provide our service to you, such as paying from a BSB & Account Number (non-BPAY).

What involves getting the green tick?

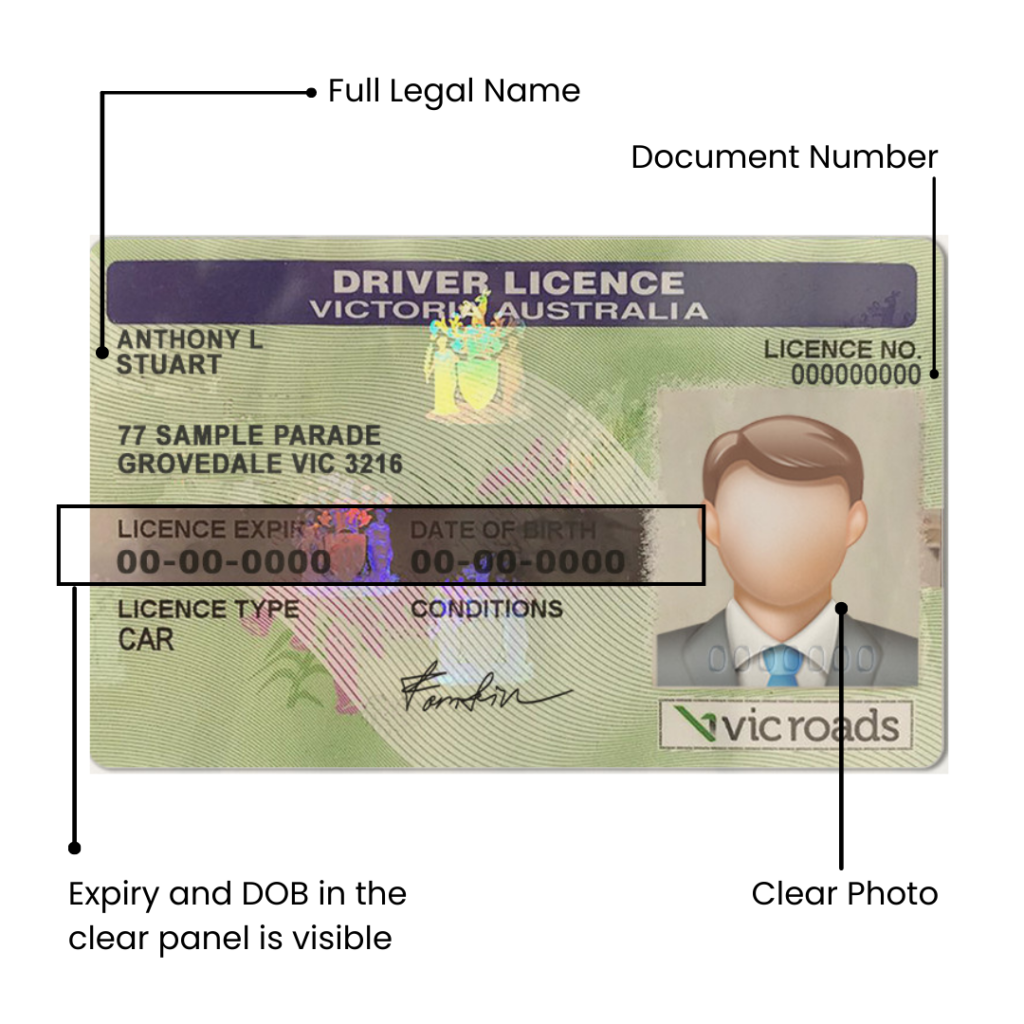

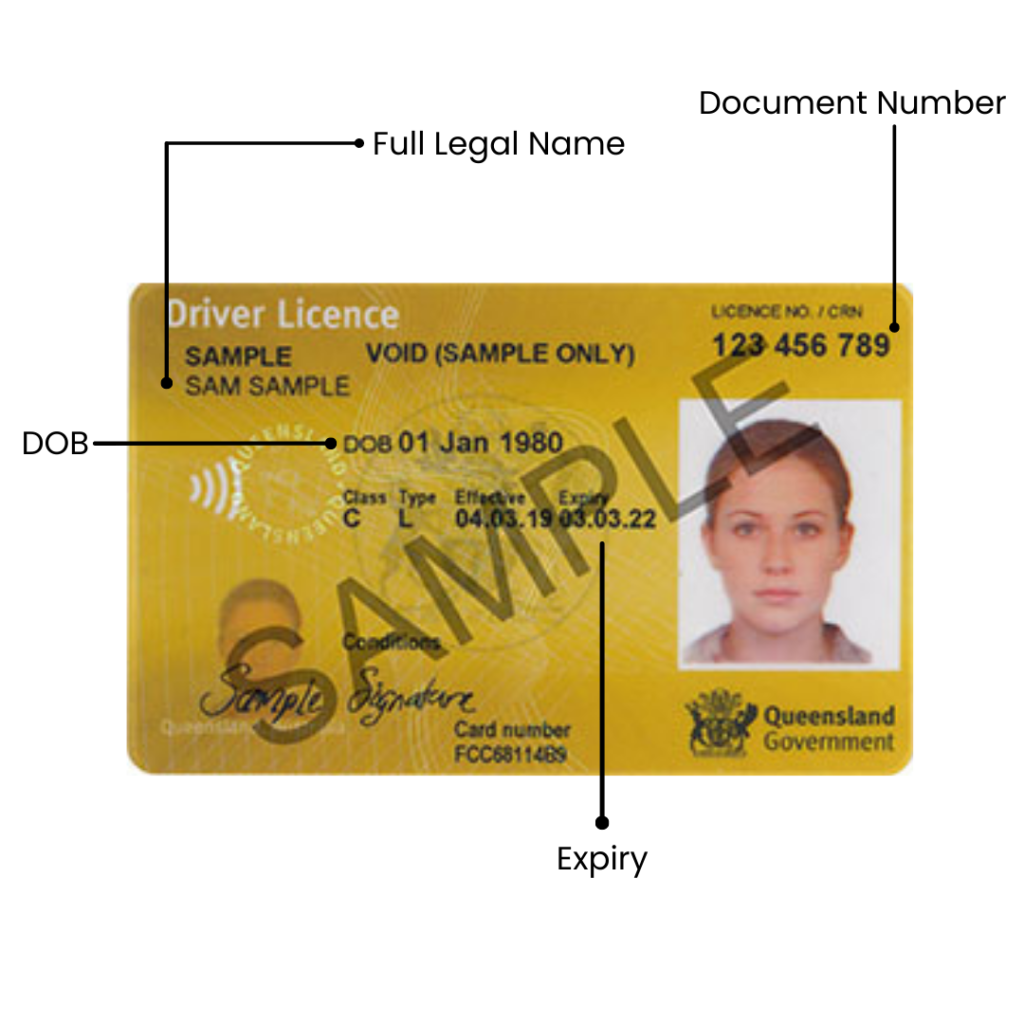

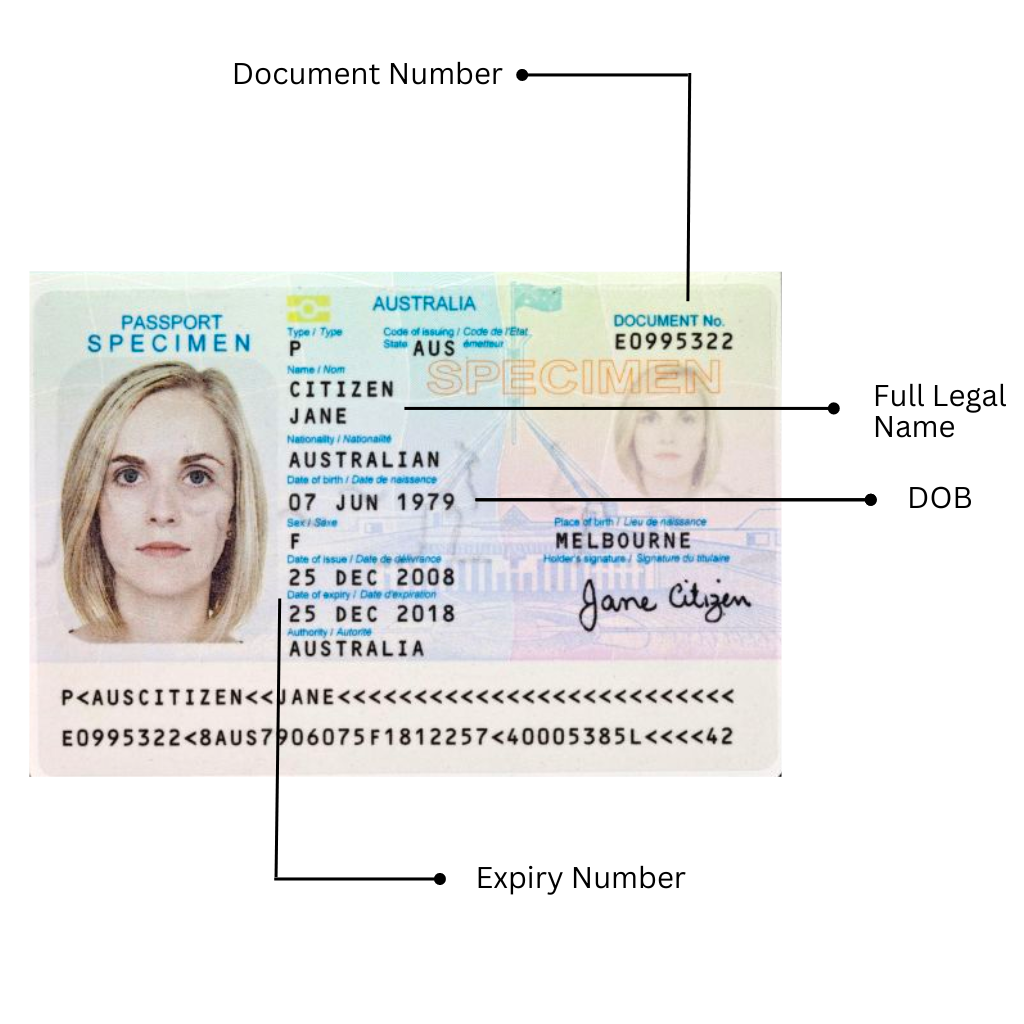

If we ask you to verify your account, we require a copy of your valid government issued photo identification document (e.g. Australian Driver Licence or Passport) which clearly shows your:

- Full name (Legal First Name & Legal Last Name that matches the ID and name on your Sniip account)

- Date of birth

- Photograph

- Document Number

Just a quick heads-up: when entering your name in the app, make sure to use standard casing (avoid using all caps). Providing your details in the correct format helps us speed things along and ensures there won’t be any delays in verifying your account.

On some occasions, we may also require you to upload a copy of your bank card. Firstly, card verification is an important part of our anti-fraud card security measures. Secondly, it is our only method of ensuring that you are in possession of the card used to make payments within the Sniip app.

Therefore, we might request you to upload a picture of your card which shows:

- The first 6 and last 4 numbers

- Your full name

- The expiry date of your card

How to submit

You submit your user verification documents securely through the Sniip app. If you tap on the push notification you received if you’ve been asked to verify, you will be taken to the ‘User Verification’ screen in the app.

If you haven’t been requested to submit verification, you can still opt to verify your account. Simply tap on the top left hand menu and select ‘Account’ from the available options. You will be prompted to enter your Sniip PIN. In this screen, you will see ‘Security & Privacy’. Tap on this and then select ‘Verify account’ to be taken to the submit page.

Top tips for getting the green tick

To ensure you get verified as quickly as possible, we’ve shared our tried and tested tips for submitting your user verification documentation. Most importantly, ensure we can clearly see your Full Legal Name, DOB, Document Number and photo.

Do

- Wipe over your camera lens and hold your phone steady to upload a clear, crisp image

- Make sure your lighting is good

- Ensure your ID/Passport is valid (not expired)

- Make sure your name in the Sniip app matches exactly the full name on your verification documents

- Place your documents on a flat surface

Don't

- Upload a blurry, dimly lit image

- Take a photo of a photo of your ID or Passport

- Cut off part of your ID or Passport in the photo

- Upload a credit card that doesn't match the name on your ID

My verification wasn’t approved right away, what happened?

If your verification wasn’t approved immediately, it likely means some of the details provided were incorrect or did not meet our requirements. Our compliance team carefully supervises each submission and will notify you if there’s an issue, along with clear instructions on how to fix it.

This ensures that the verification process remains secure and efficient for all users.

Here are some common reasons why user verification might fail:

- Uploading a blurry or damaged image

- The DOB does not match the actual DOB of the Sniip Account

- The legal first and/or last name does not match the actual information of the user's Sniip Account

- Submitting documents in a language or format we cannot verify

- Using a nickname or shortened version of your name instead of your full legal name

- Attempting to verify an account using someone else's documents

- Expired Document

To avoid delays, please make sure your information is clear, accurate, and matches the documents you provide. Following the guidelines closely will help speed up your verification process.

Our obligation to you

Sniip is proud to have Tier 1 compliance with the Payment Card Industry Data Security Standards (PCI DSS). This standard protects all Sniip user verification information with the same level of security as payment card details.

That is why we will never email you to provide these details, and only ask you to submit them via the Sniip app. Sniip only shares the required transaction information with the service provider you make payments with for reconciliation purposes.

At Sniip, your security is our top priority. We never share your information with any other third party.

FAQ

User Verification is part of our Know Your Customer (KYC) process in place for the safety and protection of your account. KYC widely used term referring to the verification of a customer’s identity. Sniip is a regulated Bill Payment Provider (not dissimilar to a bank or financial institution). As such, we sometimes need to get to know you better.

You may also verify with your passport. To do this, simply swipe as you would through your photos until you reach the passport option.

Unfortunately we’re unable to verify accounts with other forms of identity that aren’t government issued/don’t include a photo (i.e Medicare cards or student cards.)

As part of Sniip’s User Verification requirements, you may be requested to verify your identity. Sniip is a regulated Bill Payment Service provider and an authorised BPAY Payer Institution Member (PIM). This requires us to undertake significant compliance assessments in order to provide our service.

As part of this commitment, Sniip is required to identify our customers and verify that their information is correct for the purpose of addressing Anti Money-Laundering/Counter-Terrorism Funding risk, fraud and misappropriation risk, as well as requirements imposed by our banking and regulatory partners.

Not to worry! You will be able to verify your Sniip account using any valid government issued photo identification document.

You submit your User Verification document as part of our Know Your Customer (KYC) process through the Sniip app. If you tap on the push notification you will be taken to the ‘Verify Account’ screen in the app.

If you haven’t been requested to submit verification, you can tap on the top left hand menu and tap ‘Account’. In this screen you will see ‘Verify Account’ which will take you to the submit page.

In order for us to verify your identity, we require a copy of your valid Australian Driver Licence or Passport which clearly shows your full legal name, date of birth and photograph.

If you have any questions, please contact our Sniip Support Squad or call (07) 3268 7710 and one of our friendly Sniip Support Squad members will happily walk you through the process.

You must verify your account to set up paying from a BSB + Account number.

Beyond this, unless you have been contacted by one of our Sniip Support Squad members, or received a notification from Sniip requesting verification, you do not need to verify yourself in the Sniip app.

You can view your verification status under your ‘Account’ in the Sniip app. If we require verification from you, next to ‘Verify Account’ you will see ‘Required’. If it’s blank, you’re all good to keep paying those bills!

If you are asked to verify your account, no worries! It’s a simple process for the protection of your account. You’ll be notified when your verification has been successfully verified. A little green tick will appear next to your initials or profile photo at the top of the home screen in the Sniip app – yay!

If your verification is unsuccessful, a member of the Sniip Support Squad will attempt to contact you. If you have any questions, please contact our Sniip Support Squad or call (07) 3268 7710.

User verification is automatically processed in the app if successful.

On occasion, we may need to further review your documents, this process usually takes between 24-48 hours and is reviewed during business hours.

Please ensure you have uploaded all the requested documentation, whether that is your ID, your bank card/s or both. In the meantime, please check if you have received an email from a member of our Sniip Support Squad requesting any further information or clarification.

If you have any questions or would like to check the status of your account verification, please email our Sniip Support Squad or call (07) 3268 7710.

Sniip is fully PCI compliant (Tier 1) and protects all Sniip user information and documentation with the same level of security as payment card details. That is why we will never email you to provide these details, only submit them via the Sniip app.

Yes, if you do not have a Licence or Passport, you can verify with a Government-Issued proof of age card by selecting the ‘Licence’ option and then the state the proof of age card was issued in.