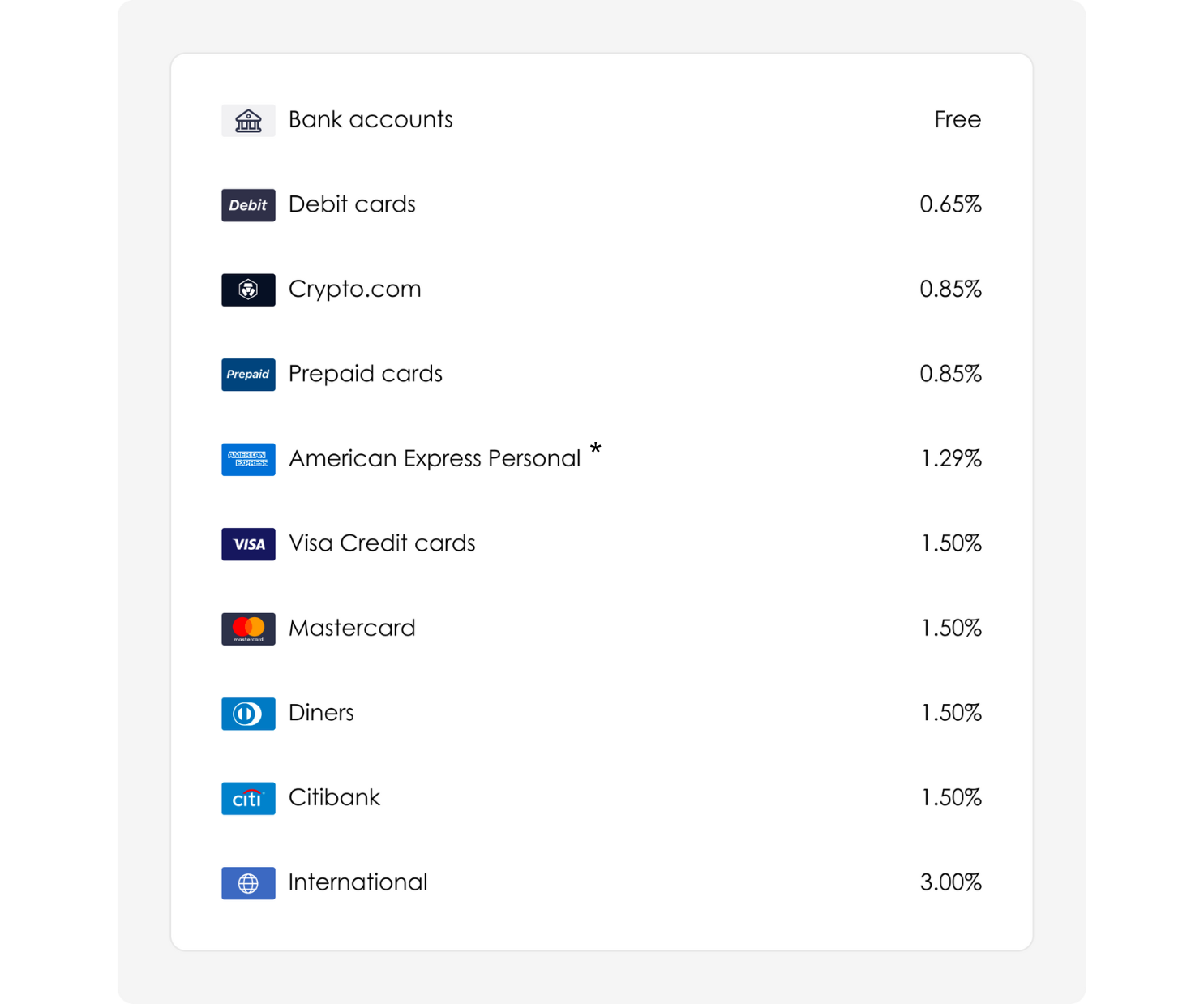

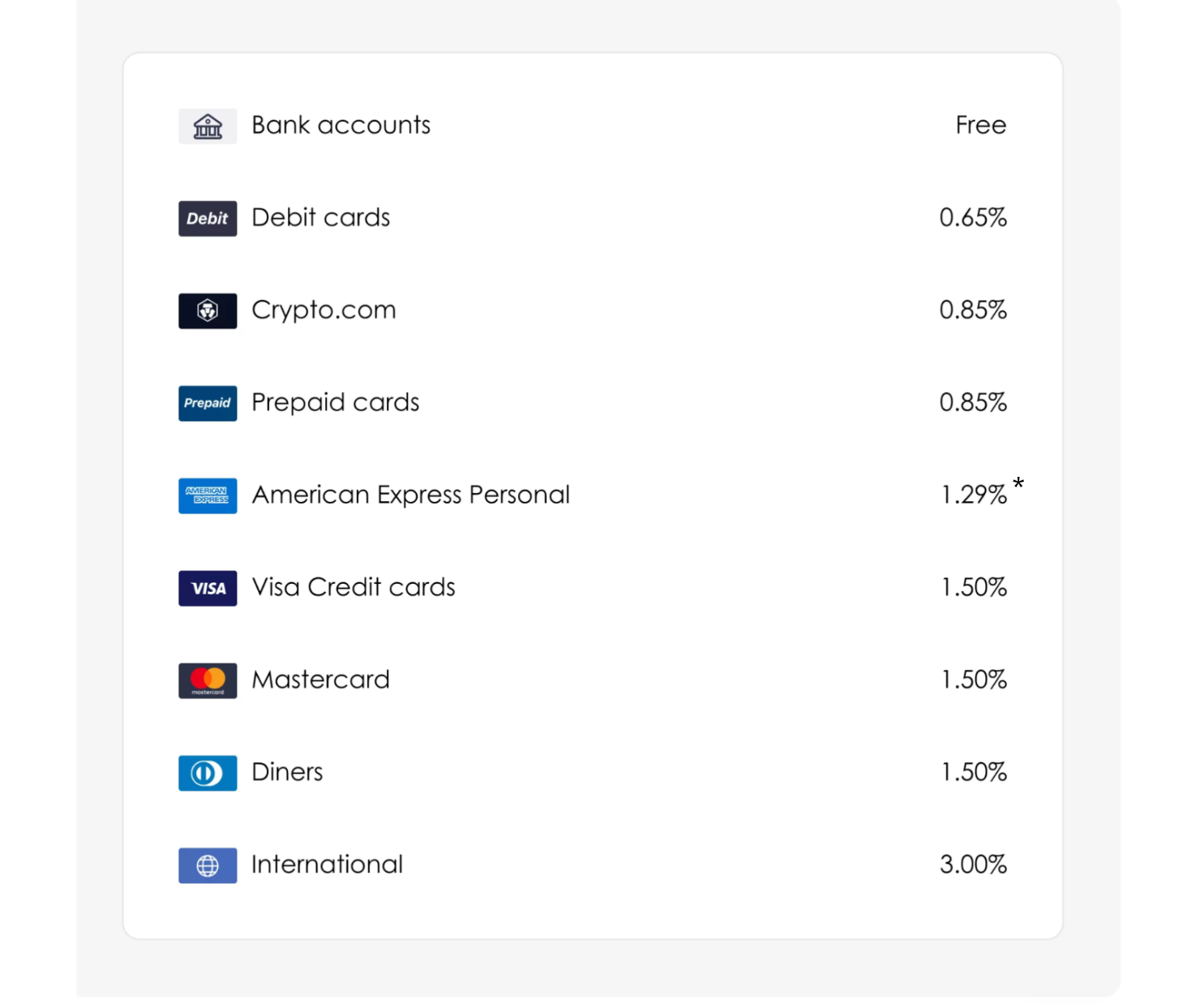

Sniip allows you to pay your personal expenses* with your preferred payment method, even if your supplier doesn’t normally accept it.

*Please note: All American Express payments to the ATO (personal/business/corporate) are required to be processed at our business rates – the best in market. Learn more, here.

*Please note: All American Express payments to the ATO (personal/business/corporate) are required to be processed at our business rates – the best in market. Learn more, here.

Trusted partner of

Points Calculator

Calculate how many points you'll earn on payments through Sniip*

*All ATO/superannuation/business payments (personal/business/corporate) are required to be processed at our business rates (tiered from 1.75%) on Personal Amex cards. Please select ‘ATO’ as the payment type for ATO payments.

Payment amount

1

1

1

Select your payment method

Velocity Platinum Amex Card

Velocity Platinum Amex Card

Explorer Amex Card

Platinum Amex Card

Qantas Amex Ultimate Card

Qantas Amex Premium Card

Qantas Amex Discovery Card

CommBank Ultimate Qantas Card*

Macquarie Bank Black Card

Velocity Escape Amex Card

Essential Amex Card

Centurion Amex Card

Diners Club International Card

Citi Premier Qantas Credit Card

ANZ Frequent Flyer Black Credit Card

Nab Rewards Visa

Citi Prestige Mastercard

Velocity Platinum Amex Card

Velocity Platinum Amex Card

Explorer Amex Card

Platinum Amex Card

Qantas Amex Ultimate Card

Qantas Amex Premium Card

Qantas Amex Discovery Card

CommBank Ultimate Qantas Card*

Macquarie Bank Black Card

Velocity Escape Amex Card

Essential Amex Card

Centurion Amex Card

Diners Club International Card

Citi Premier Qantas Credit Card

ANZ Frequent Flyer Black Credit Card

Nab Rewards Visa

Citi Prestige Mastercard

Total points earned#

12,661

Velocity Points

Payment amount

$10,000

Processing fee (incl GST)

$129.00

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

Velocity Points

Payment amount

$10,000

Processing fee (incl GST)

$129.00

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

$10,000

Processing fee (incl GST)

$129.00

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

$129.00

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

Assumes points earn based on 1.25 point/s per dollar spent.

This calculator is provided as a guide only, please refer to your credit card provider for the most up-to-date information. Please note: The above calculator is not an exhaustive list of the credit cards available to use with Sniip. Sniip accepts all payment methods and credit cards, including American Express, Visa, Mastercard, Citibank and Diner’s Club cards. Please email customercare@sniip.com if you would like to add a card to the calculator. *Assumes no previous spend for the statement period.

The benefits of Sniip

No monthly fees

The Sniip app is free to download. There are no monthly account keeping fees or any other hidden fees.

Secure payments

Sniip is proud to have achieved Tier 1 PCI DSS compliance. Rest assured that your payments are protected by the highest safety and encryption standards.

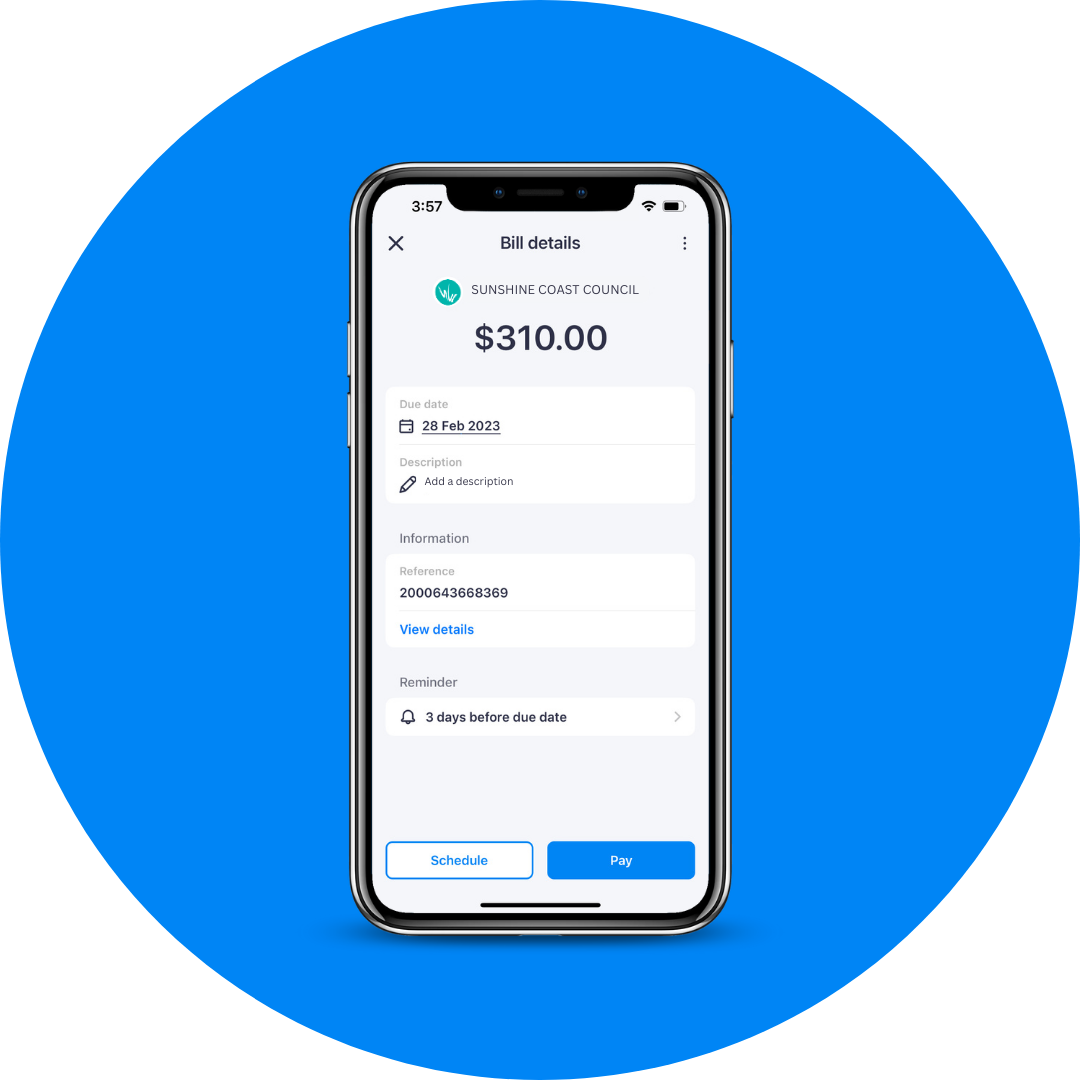

Set and forget

Schedule your payments in the app, and have the peace of mind knowing they'll get paid on time. Set and forget!

Earn full points

When you pay your bills with Sniip, you are eligible to earn full reward points on your credit card to government bodies, where you would normally earn reduced points.

FAQ

What bills can I pay with my personal Amex at the personal rate of 1.29%?

As part of our contract with American Express, we are required to determine business vs personal based on the purpose of the payment and the type of industry your biller falls under.

American Express restricts the personal rate to the following industry categories:

- Tax payments (excluding ATO payments)

- Telecommunications services

- Cable and other pay television services

- Utilities

- Electric, gas, water, and sanitary

- Insurance sales, underwriting, and premiums

- Real estate agents and managers

- Rentals

- Parking lots and garages

- Dance halls, studios, and schools

- Membership clubs (sports, recreation, athletic), country clubs, and private golf courses

- Doctors and physicians – not elsewhere classified

- Hospitals

- Medical services and health practitioners – not elsewhere classified

- Elementary and secondary schools

- Colleges, universities, professional schools, and junior colleges

- Correspondence schools

- Business and secretarial schools

- Trade and vocational schools

- Schools and educational services – not elsewhere classified

- Child care services

- Court costs, including alimony and child support

- Fines

- Government Services – not elsewhere classified

If your bill/invoice falls outside of these categories, we can still process your bill, however, we are required by American Express to process the payment at our tiered business rates.

We appreciate the payment may be a personal payment to you, however we are bound by the category list for personal payments as defined by American Express.

We are actively working with American Express to broaden these categories.

Do I earn points on the processing fee?

Absolutely! You earn full points (even at the ATO) on the transaction amount and the processing fee.

What if you determine my payment to be business, but it’s personal?

All rates are clearly displayed before you make a payment and you can always clarify with us before you process the payment.

The processing fee for personal payments using a personal card is 1.5%, excluding American Express personal cards. The rate for personal American Express cards is 1.29%.

Please note that payments to the ATO (including superannuation) are charged at our business rates for all Amex cards.

If I use my business card to make personal payments, will that be charged at 1.29%?

If it is a business card, American Express deems it to be used for business purposes and that would be charged at the business rate. Payments to the ATO, including superannuation, are charged at the business rate when using any American Express card.

However, we’d strongly recommend you apply for the same card in the consumer/ personal version when making personal payments which will earn full points at the 1.29% rate with Sniip.

Can I pay make SME payments now, pay to BSB + Account Number?

You can now pay bills that don’t offer BPAY with Sniip – it’s been our #1 requested feature and it’s now live!

If your biller doesn’t accept your credit card directly, you can now pay to their BSB & Account Number, even if BPAY is not available.

You can learn how to pay BSB and Account Numbers here.

If I’m a sole trader, will I be charged the business, or the personal rate if I pay the ATO?

Payments to the ATO, including superannuation, are charged at the business rate when using any American Express card. If you’re making a personal payment to the ATO on a personal card (other than Amex), you’ll be charged at the personal rate.

If you have an ABN, you may be classified as a business. If you’re making a business payment with a personal American Express card, you may be charged at the business rate.

The good news is, all rates are clearly shown before you make the payment and you can always clarify with us before you process the payment.

What is Sniip's criteria for determining what is business and personal payments?

Great question! It comes down to the payment you’re making and the card you’re using.

If you’re making a personal payment, on a personal card, you’ll be charged the personal rate. Please note, payments to the ATO, including superannuation, are charged at the business rate when using any American Express card.

If you’re making a business payment, on a business/corporate card, you’ll be charged the applicable business rate.

If you’re flagged as making a business payment on a personal card, you may be asked to supply a copy of your invoice and your transaction will be reviewed.

The good news is, all rates are clearly shown before you make the payment and you can always clarify with us before you process the payment.

If you have any questions, please call (07) 3268 7710 or email customercare@sniip.com.

Looking for business payments?

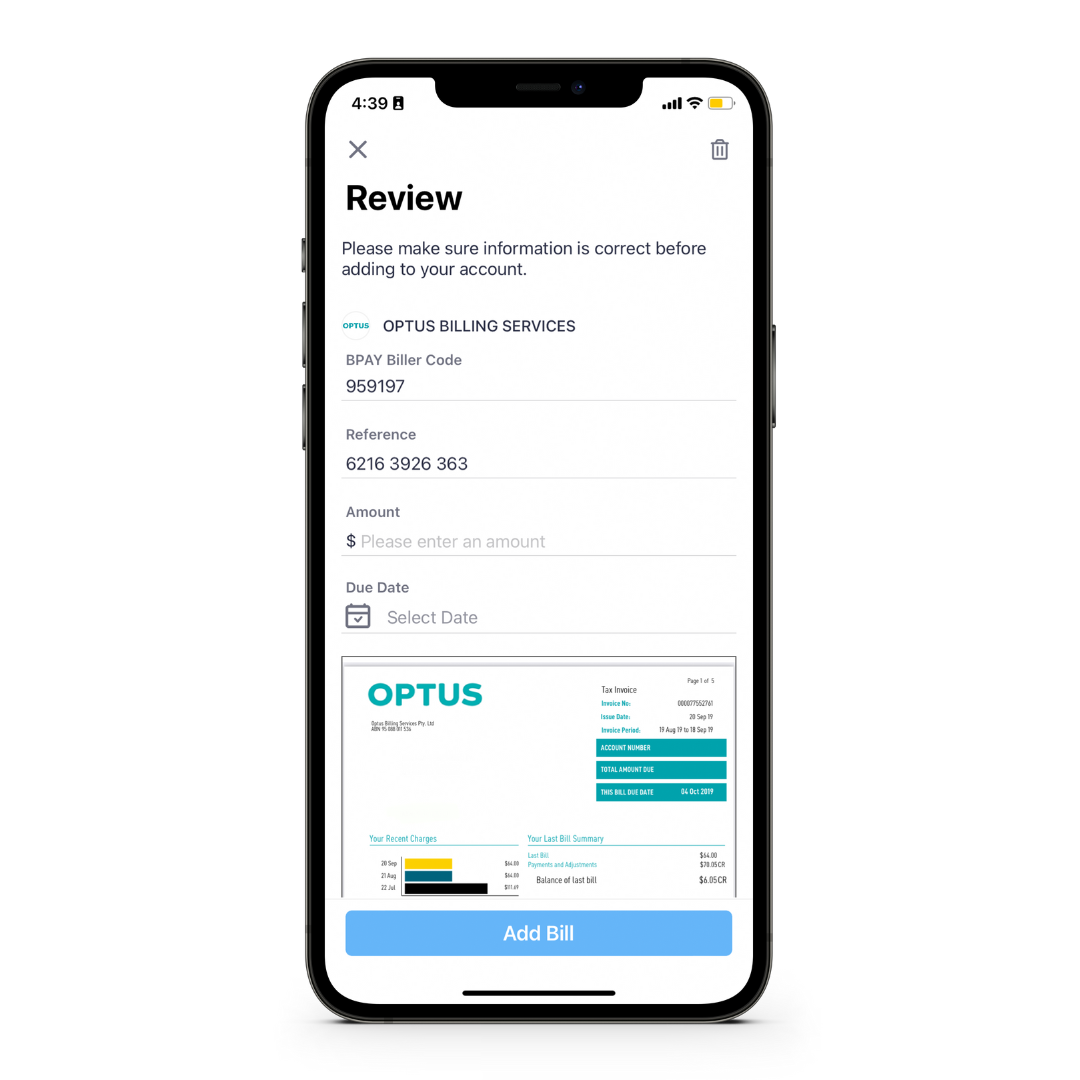

Payments from your phone

Download the Sniip app, your new go-to for all bill payments, right from your phone. It’s the simplest way to make payments and manage your bills.

Get started today 🚀

Get started today 🚀

Enter your mobile number and we’ll send you a link to download the app.