Should I get the American Express® Platinum Business Card?

Earn 350,000 Membership Rewards® Bonus Points when you apply by 25 June 2024, are approved and spend $12,000 on eligible purchases on your new American Express® Platinum Business Card within 3 months of your approval date. T&Cs apply. Available for new American Express Card Members only.

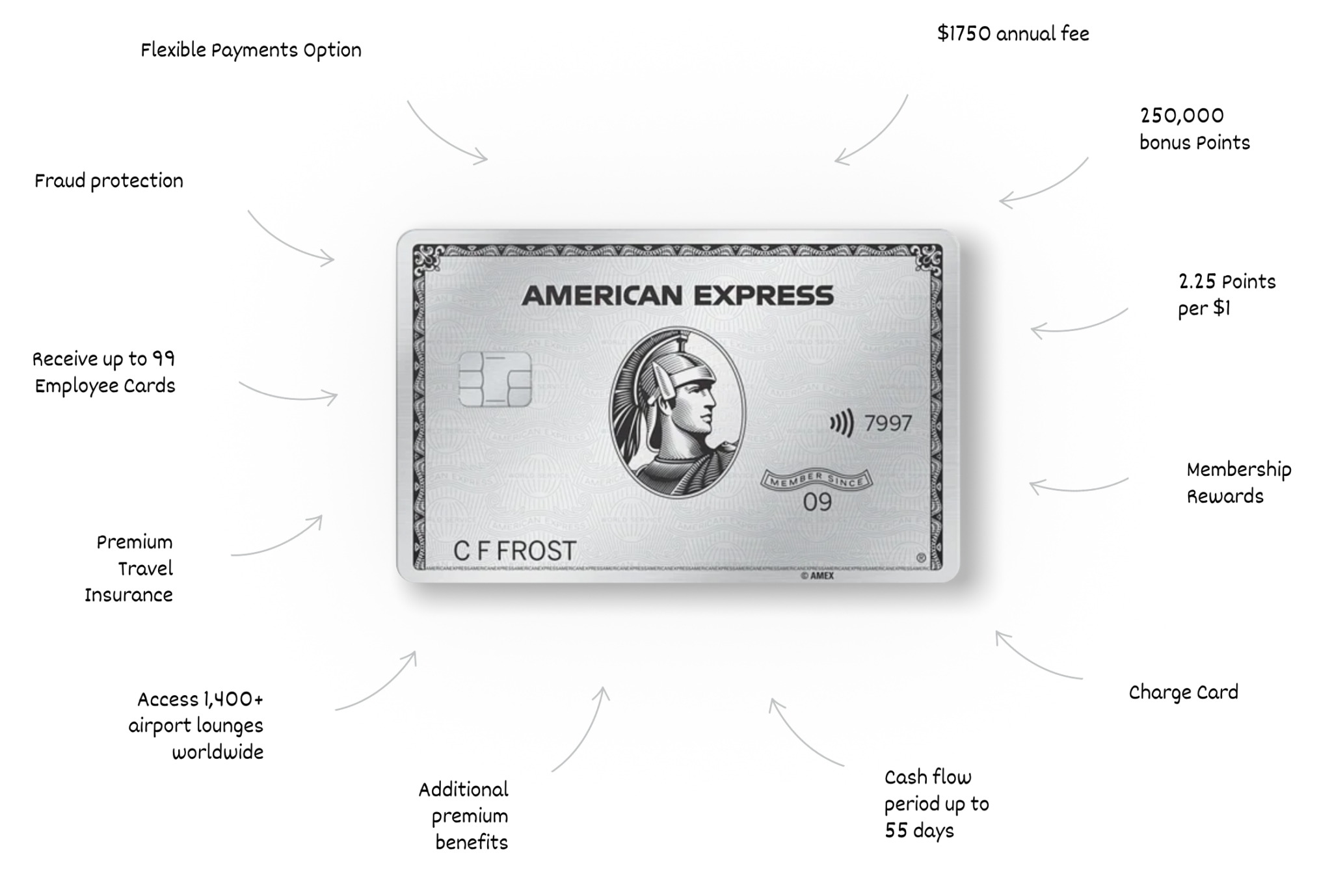

American Express® Platinum Business Card Overview

Annual Fee

$1750

Bonus Points

Earn 350,000 Membership Rewards® Bonus Points when you apply by 25 June 2024, are approved and spend $12,000 on eligible purchases on your new American Express® Platinum Business Card within 3 months of your approval date. T&Cs apply. Available for new American Express Card Members only.

Points Earn Rate

Earn 2.25 points per $1 spent with Sniip*

Rewards Program

American Express Membership Rewards

Cash Flow

Get more flexibility for your business with up to 55 days to pay for spendings

Designed for SMEs

Boost reward points and access greater business and travel perks

*Use your American Express Credit Card to pay bills through Sniip, and earn full points for ‘everyday purchases’ on all payments (including payments to government bodies such as the ATO). The Sniip MCC code for Amex is 7399, which should not be excluded from your Credit Card reward programs. This means, when you pay with Sniip you can earn full reward points.

Benefits of the American Express® Platinum Business Card

Get peace of mind with Complimentary Travel Insurance:

Enjoy Complimentary Travel Insurance for both domestic and international trips, covering you, your spouse, and Employee Card Members. Your insurance covers the following:

– Medical Emergency Expenses Cover

– Business Trip Completion Cover

– Personal Liability Cover

– Trip Cancellation and Amendment Cover

Terms, conditions and exclusions apply (such as maximum age limits, pre-existing medical conditions and cover limits).

Amplify your business travel perks with exclusive offers:

Treat yourself on your next business trip with an AccorPlus membership (valued at $399). Get a free night’s stay annually, and up to 50% off dining at partner restaurants. Additionally, relish VIP perks at over 1,600 luxury hotels worldwide through Fine Hotel + Resorts and The Hotel Collection.

Platinum advantages also encompass remarkable savings and benefits on rental cars worldwide from Hertz and Avis.

American Express Cards support Apple Pay, Google Pay, and Samsung Pay. Easily add your American Express Business Platinum Card to your digital wallet so you can use your Amex from your mobile phone.

Your American Express® Platinum Business Card unlocks priority access to over 1,400 airport lounges across 140 countries, including The Centurion® Lounge, Priority Pass Lounges, and Virgin Australia domestic lounges when flying Virgin Australia.

Expand your cashflow up to 55 days:

Provide your business with financial flexibility, offering up to 55 days for payment on purchases.

Experience more freedom with a Flexible Payment Option:

Free up cash flow, manage revenue fluctuations, and pursue new business endeavours by paying off a portion of your balance (up to your FPO limit) overtime. Interest charges apply.

Grow your business with no pre-set spending limit:

The Platinum Business Card empowers businesses with no pre-set spending limit (however, this does not mean unlimited spending). This feature is dependent on multiple factors including business income and spending, and your businesses credit rating.

Monitor and manage your employee spendings:

With up to 99 complimentary employee cards, optimise your business’ cash flow by accessing all key employee spending in one place (displayed in real-time). Plus, share some perks of your Platinum Business Card with them.

Efficient Financial Reporting

Bring efficiency to your business’s financial reporting process instantly by effortlessly consolidating and streamlining data from your Card Accounts into Quicken™, Microsoft® Excel, and MYOB®.

Greater control with the Amex App

Keep a close eye on your business and personal expenses, manage benefits and rewards, redeem points, and access live support on-the-go with the intuitive Amex App.

Emergency Card Replacement within 48 Hours

Rest easy knowing that if your Card goes missing, regardless of your location worldwide, replacement Cards are typically issued within 48 hours.

Comprehensive Fraud Protection

Safeguard your company’s finances with robust protection against unauthorised transactions made with your Card.

Seamless tap-and-pay

Utilise your linked Platinum Business Card on your smartphone or wearable device for effortless, rapid, and secure payments via Apple Pay®, Samsung Pay®, and Google Pay®.

Maximise and accelerate your points earn by paying all your bills through the Sniip mobile app. Earn 2.25 points on everyday purchases, and on all your bill payments (including ATO, land tax, insurance, superannuation, and more) when you pay through Sniip with your Business Platinum Card.

EARN 35,000 MEMBERSHIP REWARDS® BONUS POINTS

Earn 350,000 Membership Rewards® Bonus Points when you apply by 25 June 2024, are approved and spend $12,000 on eligible purchases on your new American Express® Platinum Business Card within 3 months of your approval date. T&Cs apply. Available for new American Express Card Members only.

Is this Card right for me?

The below conditions are required to apply for the American Express® Platinum Business Card.

- Age 18 years or over

- Australian citizen or permanent resident

- Director or controller of a business

- Good credit history and no payment defaults

- Annual business revenue of $75,000 or more

- Valid ABN registered for GST

You’ll need the following information when applying for the American Express® Platinum Business Card:

- Your personal income or business revenue

- Your drivers license (if you own one)

- The details of your business' ownership as it appears on ASIC (for the Director and/or Beneficial Owner)

How to earn and redeem your Membership Rewards

Unlock a fool-proof method to earning full, uncapped (2.25 points) on every bill payment (including government transactions like ATO and superannuation) when you pay through the Sniip mobile app. Learn how today.

Redeem points directly on flights, accommodation, and car rental with American Express Travel online booking service, as well as Webjet and helloworld. Or transfer points to your choice of 12 world-class airline partners including Qantas, Virgin Australia, and Air New Zealand where you can use them for flights and upgrades.

More perks from the American Express Platinum Business card

Dine better and savour your rewards

Gain access to premium dining, travel, and leisure benefits worldwide with your valuable Platinum membership.

Turn Points to platinum travel

Exchange your points for flights, accommodation, and car rentals through American Express Travel Online booking service, Webjet, and helloworld.

Alternatively, choose between 12 esteemed airline partners such as Qantas, Virgin Australia, and Air New Zealand, and redeem your points for flights and upgrades.

Compare American Express Business Cards

Easily compare credit cards to uncover the card that caters best to you and your business’ unique needs. We take the heavy lifting out of the research and only list the best deals that are worth your while.

Frequently Asked Questions

Most credit cards offer an interest-free period ranging from 44 to 55 days. If you settle the entire balance before this period ends, no interest is accrued. Yet, failing to clear the full balance results in interest charges. Therefore, it’s crucial to monitor statements and settle the full amount before the interest-free period expires.

Redeem points directly on flights, accommodation, and car rental with American Express Travel online booking service, as well as Webjet and helloworld. Or transfer points to your choice of 12 world-class airline partners including Qantas, Virgin Australia, and Air New Zealand where you can use them for flights and upgrades.

The minimum income required to apply for an American Express Business Card varies from card-to-card.

- American Express Platinum Business Card: $XYZ

- American Express Qantas Business Rewards Card: $XYZ

- American Express Business Explorer Card: $XYZ

- American Express Velocity Business Card: $XYZ

Please note: these amounts are an estimation and the actual requirement may vary based on the economic climate and American Express’s lending criteria.

When you’ve applied for credit or a loan, a credit report detailing your financial history is created.

You’re entitled to receive a copy of your credit report every three months for free.

Included in your credit report is your credit rating, indicating the category your credit score falls into (e.g., low, fair, good, very good, excellent).

Accessing your report online typically takes one to two days. Alternatively, you may wait up to ten days to receive it via email or mail.

To obtain your free credit report, reach out to the following credit reporting agencies:

- Experian: 1300 783 684

- illion: 132 333

- Equifax: 138 332

As the information held by different agencies may vary, you may have credit reports with more than one agency.

Maximise and accelerate your points earn by paying all your bills through the Sniip mobile app. Earn 2.25 points on everyday purchases, and on all your bill payments (including ATO, land tax, insurance, superannuation, and more) when you pay through Sniip with your American Express card.

Sniip processes your transaction as a two-legged transaction. When you use a rewards credit card, you will earn points on the first leg of the transaction (payment into the Sniip Trust account) even if Amex isn’t accepted by your biller, and even if you’d earn reduced points / no points if you pay the biller directly (for example government billers).

Sniip will make payments via BPAY on the second leg of the transaction and this utilises the BPAY Scheme.

This process allows you to earn full points on all of your bills which is a big reason why our users love Sniip so much.

Sign up for Sniip for free today, and start earning uncapped points on every single bill payment!

Disclaimer:

Please note that the information provided here is for general informational purposes only and may not always reflect the most accurate or up-to-date details. We strongly advise users to refer to the official American Express website for the latest and most precise information regarding products, services, terms, and conditions. While we strive to ensure the accuracy of the information presented, we cannot guarantee its completeness or timeliness. Any reliance you place on the information provided here is strictly at your own risk. We encourage you to verify all information directly with American Express before making any decisions or taking any actions based on the information provided.