3 Top Tips for

Non-BPAY Bills!

As the demand for non-BPAY biller requests continues to soar, we’re now receiving hundreds of new additions daily. In response, we’re sharing three top tips to help you streamline payments to billers that only offer BSB and account numbers (i.e. non-BPAY billers).

land tax NSW, qld land tax, land tax calculator, land tax victoria, land tax qld, nsw land tax, queensland land tax, sto land tax, land tax calculation nsw, land tax queensland, land tax threshold nsw, victoria land tax, nsw land tax calculator, victorian land tax, qld land tax changes

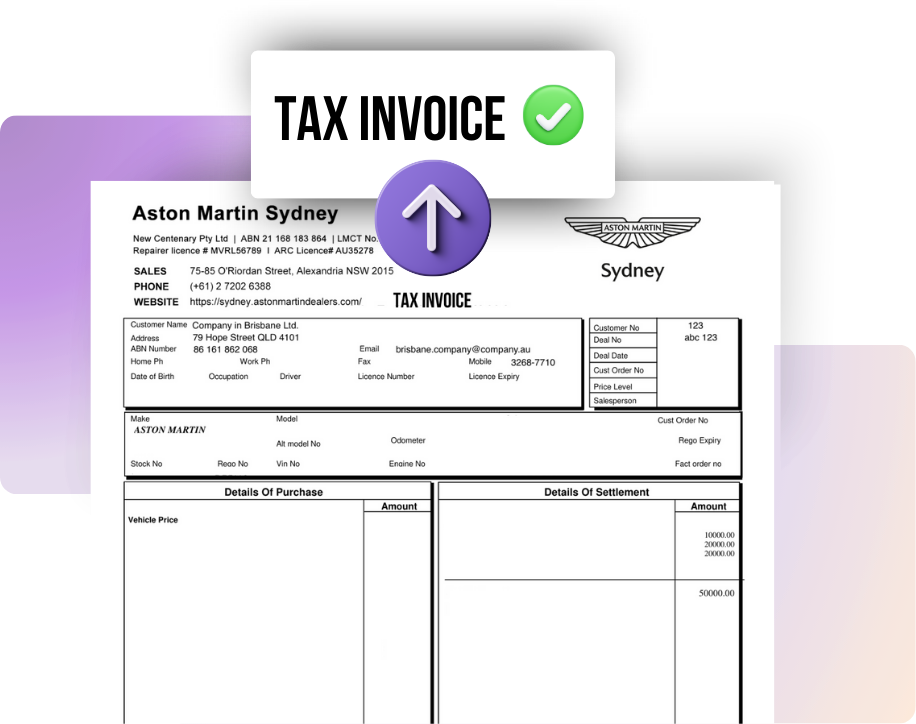

TIP ONE

No Statements please

When you’re uploading a new biller for the first time, ensure you’re uploading a Tax Invoice or a Receipt, not a Statement.

Unfortunately a statement doesn’t enable us to see what specifically is being paid for to ensure it’s a permitted industry.

Once the biller is approved, you’re able to upload a statement moving forward, or … utilise TIP TWO.

TIP TWO

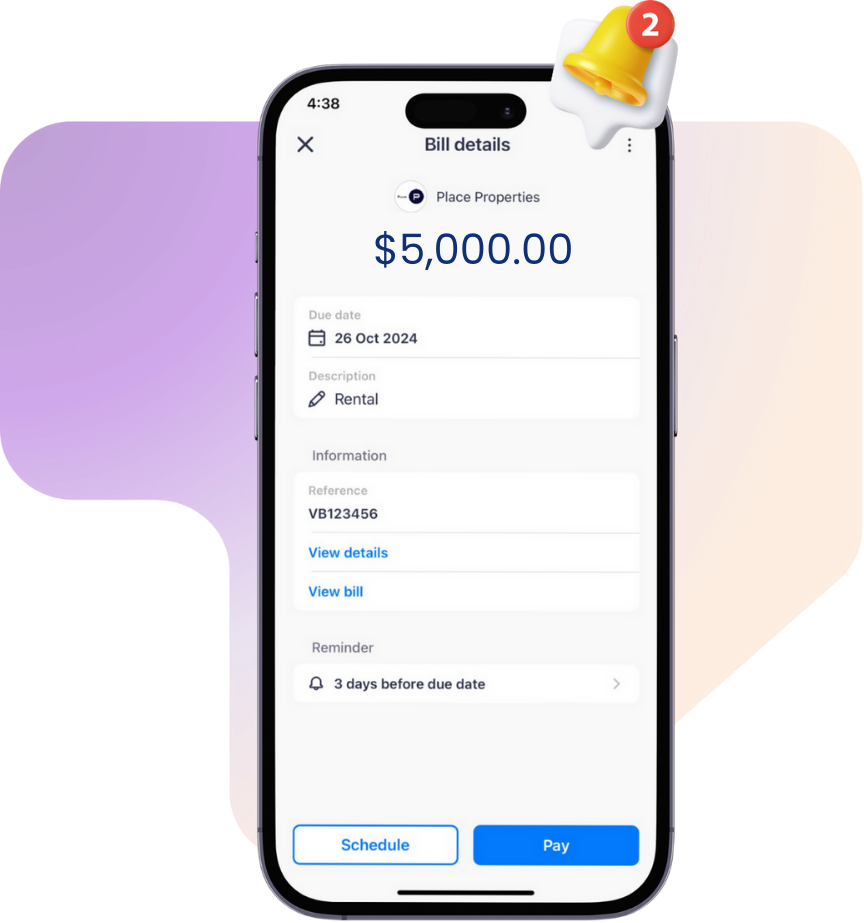

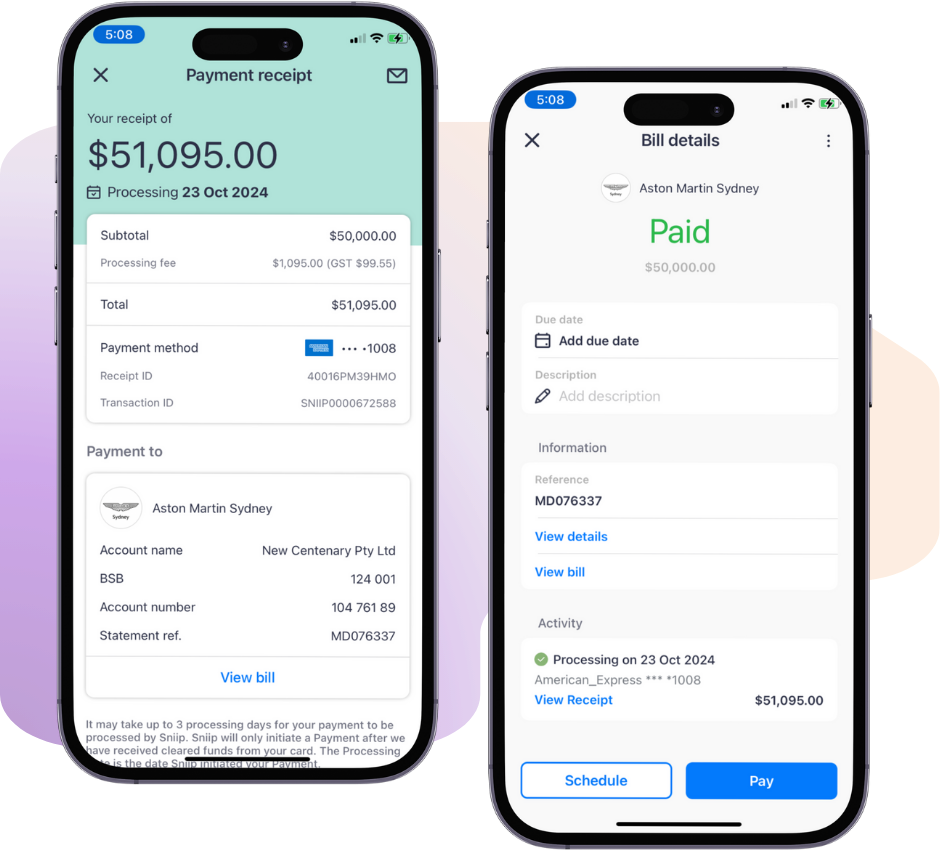

Repay a biller using ‘Receipts’

Once a biller has been approved, you don’t need to keep uploading the invoice – of course you’re welcome to do this for convenience or reconciliation purposes.

However, if you’d like to simply pay the bill for the amount you wish, tap on ‘Receips’. Locate the biller you wish to pay and tap to open the ‘Payment receipt’ – scroll down and tap ‘View bill’ then select, ‘Pay’.

Once you have tapped ‘Pay’, you can edit the bill amount beside the pencil ✏️ icon to be what you wish to pay. Then tap your payment method.

A ‘Warning’ will pop up to advise, ‘You are about to pay more than the amount owed. Would you like to continue?’. As you’re looking to pay the biller again, select, ‘OK’ and continue with the payment process.

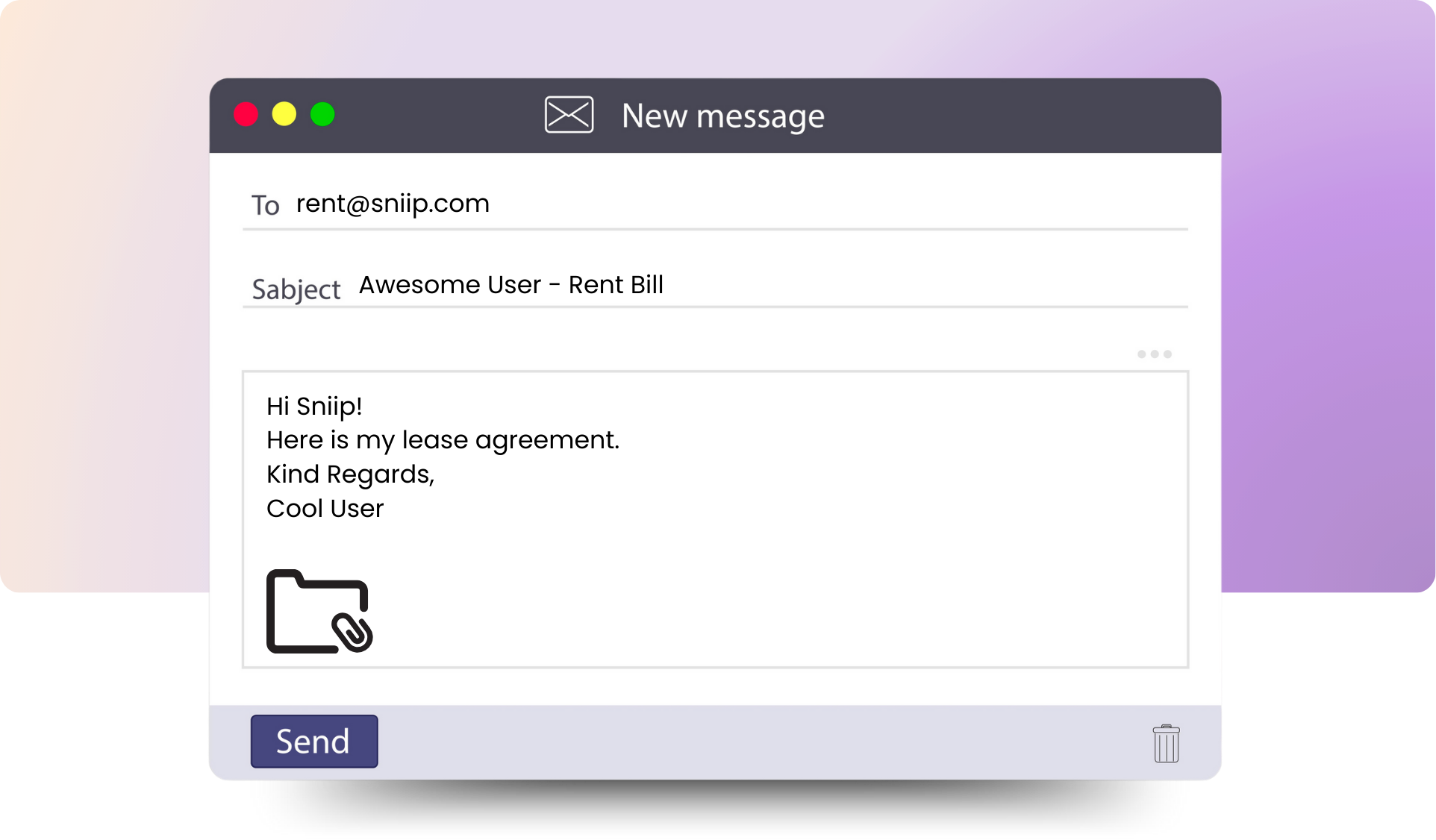

TIP THREE - Rent goes to rent@sniip.com

Rent continues to be one of the most popular billers paid via non-BPAY, but it’s unlikely you’ll be able to add it into the Sniip app directly. This is often because the details are across multiple documents.

Of course, if you’re lucky and your rental receipt contains:

– The ABN of your rental agency;

– The BSB and account details for payment;

– The total rent amount; and

– The words ‘Receipt’,

You’ll be able to upload it directly into the app.

If you’re paying a new rental agency or don’t have a rental receipt, simply email your lease agreement through to rent@sniip.com.

Please confirm that your lease agreement contains:

The ABN of your rental agency (we cannot accept an ACN, and the ABN must be written on the lease agreement)

The BSB and Account details for payment. (If these are not contained on your lease agreement, please forward a copy of the email containing the details from your rental agency with their email signature on the bottom of the email.)

The total rent amount. (You can edit this in the app later.)

Your unique reference number/identifier for payment, e.g 11HOPECRT or SMITH231 etc.