Ready to pay home and business rent?

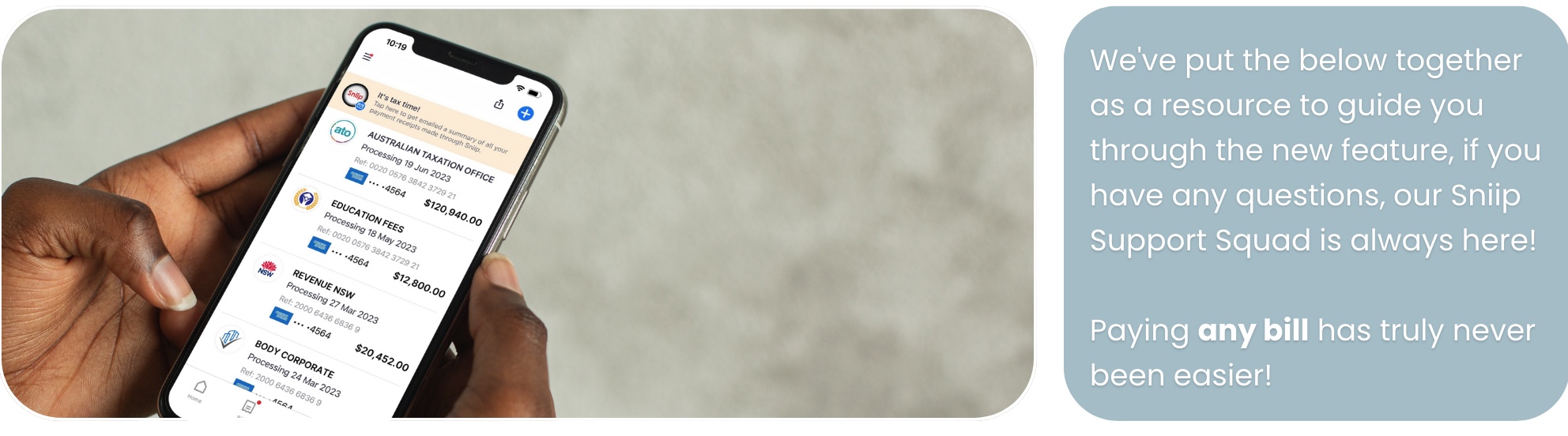

NOW LIVE: Pay Any Bill to a Biller's BSB & Account Number

You can now pay bills that don’t offer BPAY with Sniip – it’s been our #1 requested feature and it’s now live!

If your biller doesn’t accept your credit card directly, you can now pay to their BSB & Account Number, even if BPAY is not available.

*restricted/blocked industries apply

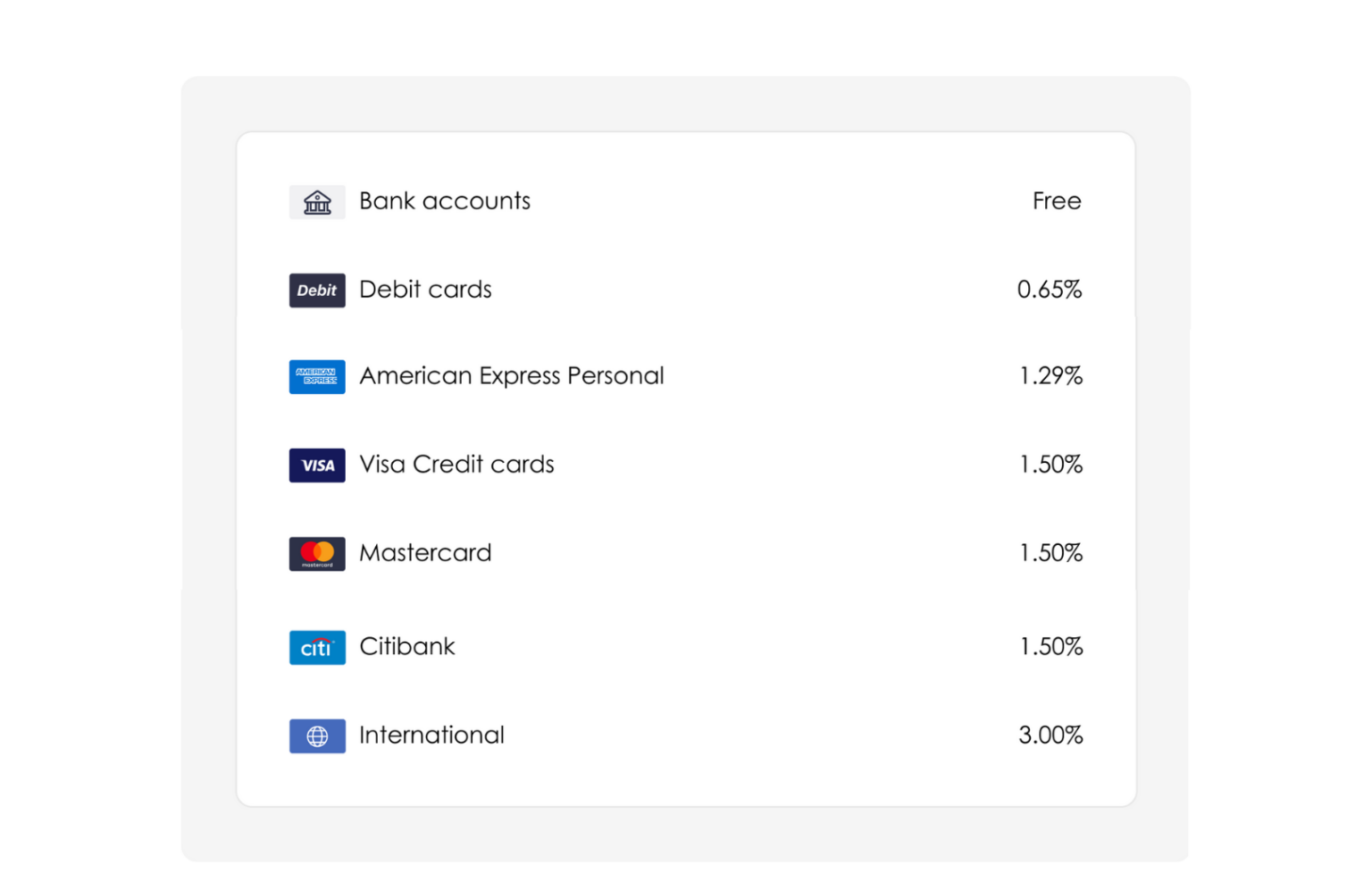

We accept

$0 download or subscription costs. No hidden costs. Pay one processing fee only.

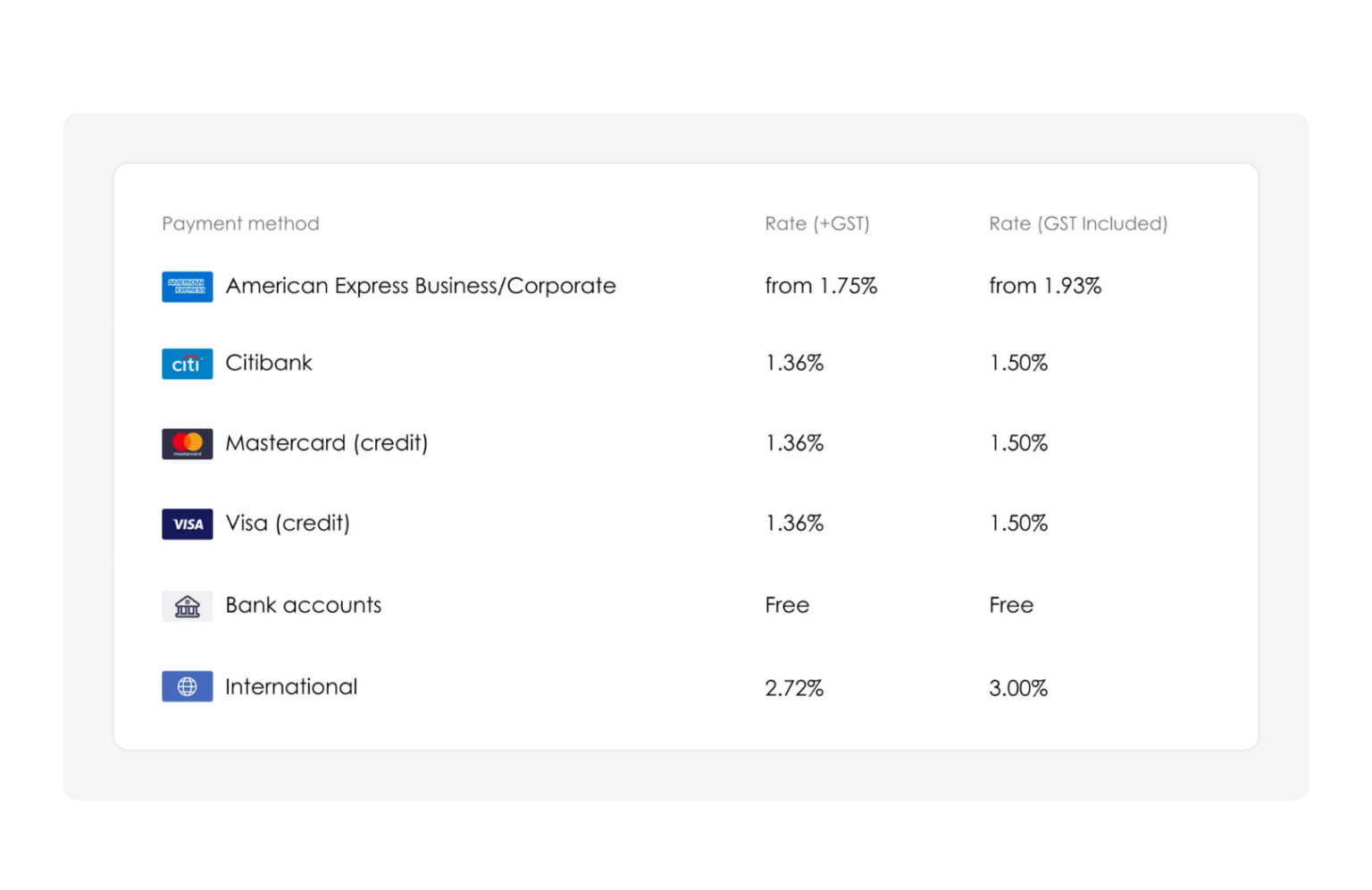

Personal Payment Methods and Fees

Business Payment Methods and Fees

Rent to pay? You can pay it with Sniip!

Paying rent with the payment method of your choice has never been easier! To get started, email your lease agreement and/or receipt to rent@sniip.com.

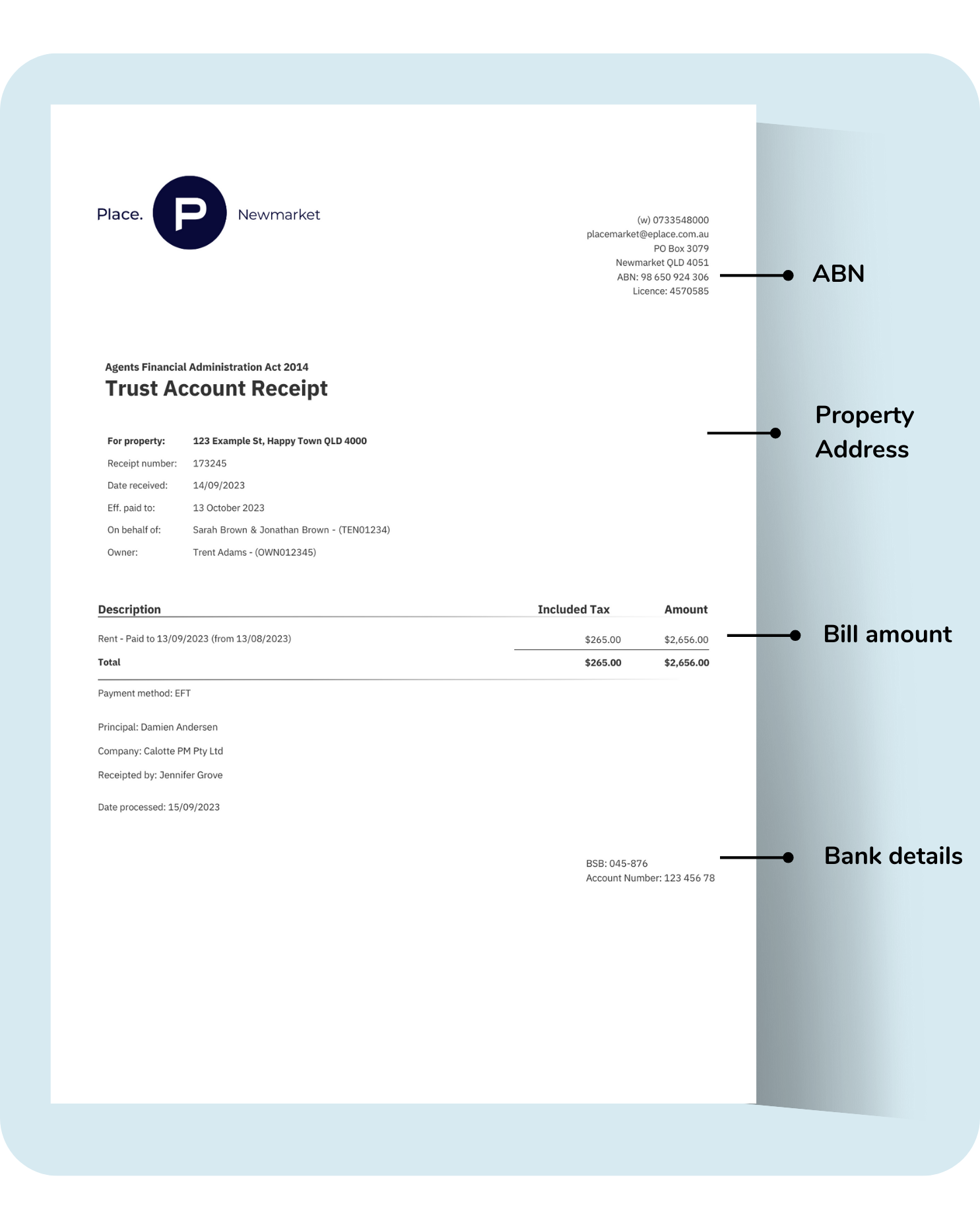

Please confirm your lease includes the following:

- Your rental agency’s ABN

- The BSB and Account Number for the biller

- Payment reference number (i.e 173TerraceSmith)

- Property address for the rental

- Rent amount (you can edit this later)

Maximise rewards, pay any rent with Sniip

You can pay your home rent, PLUS your business rent with Sniip and start earning full reward points with your points earning card!

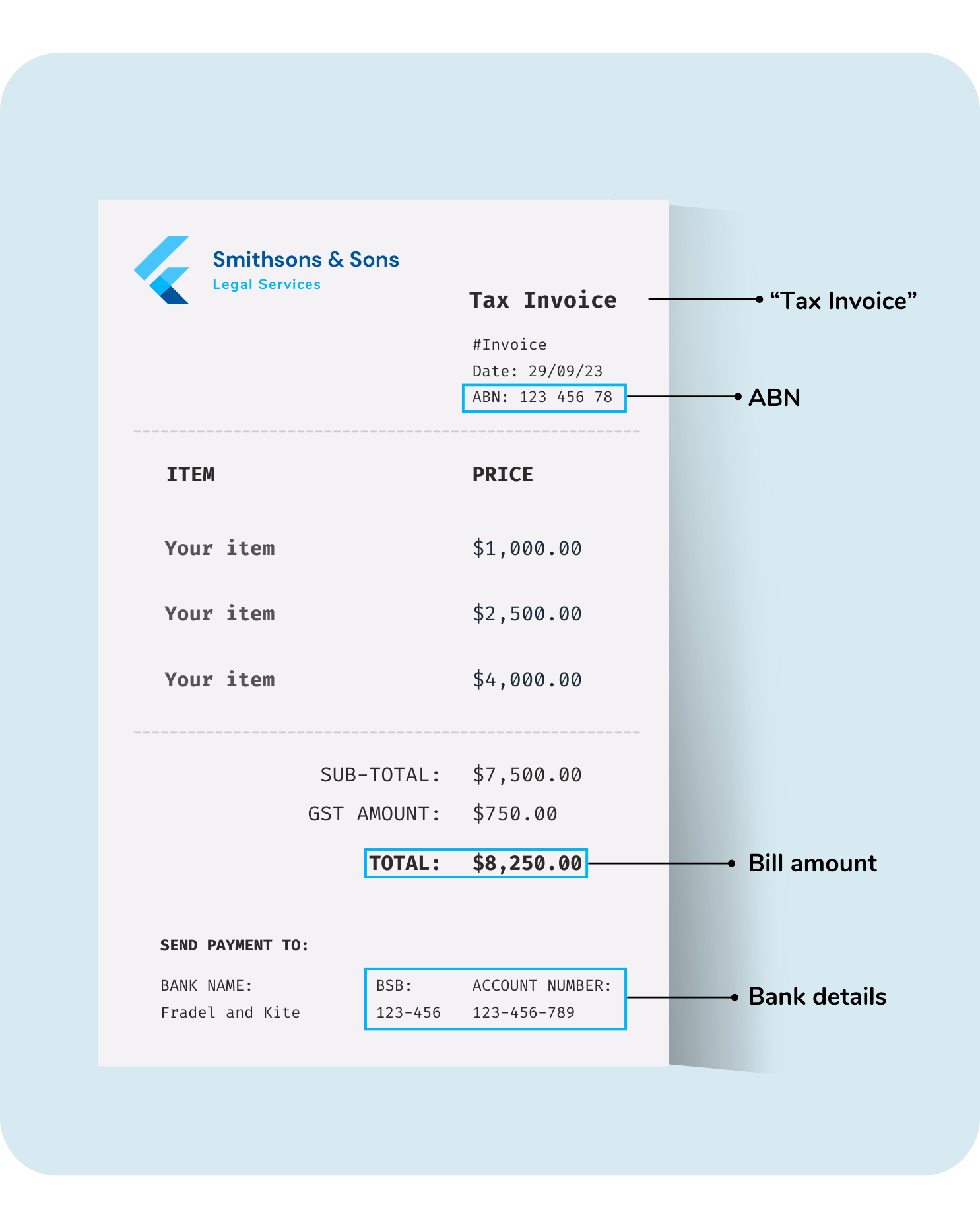

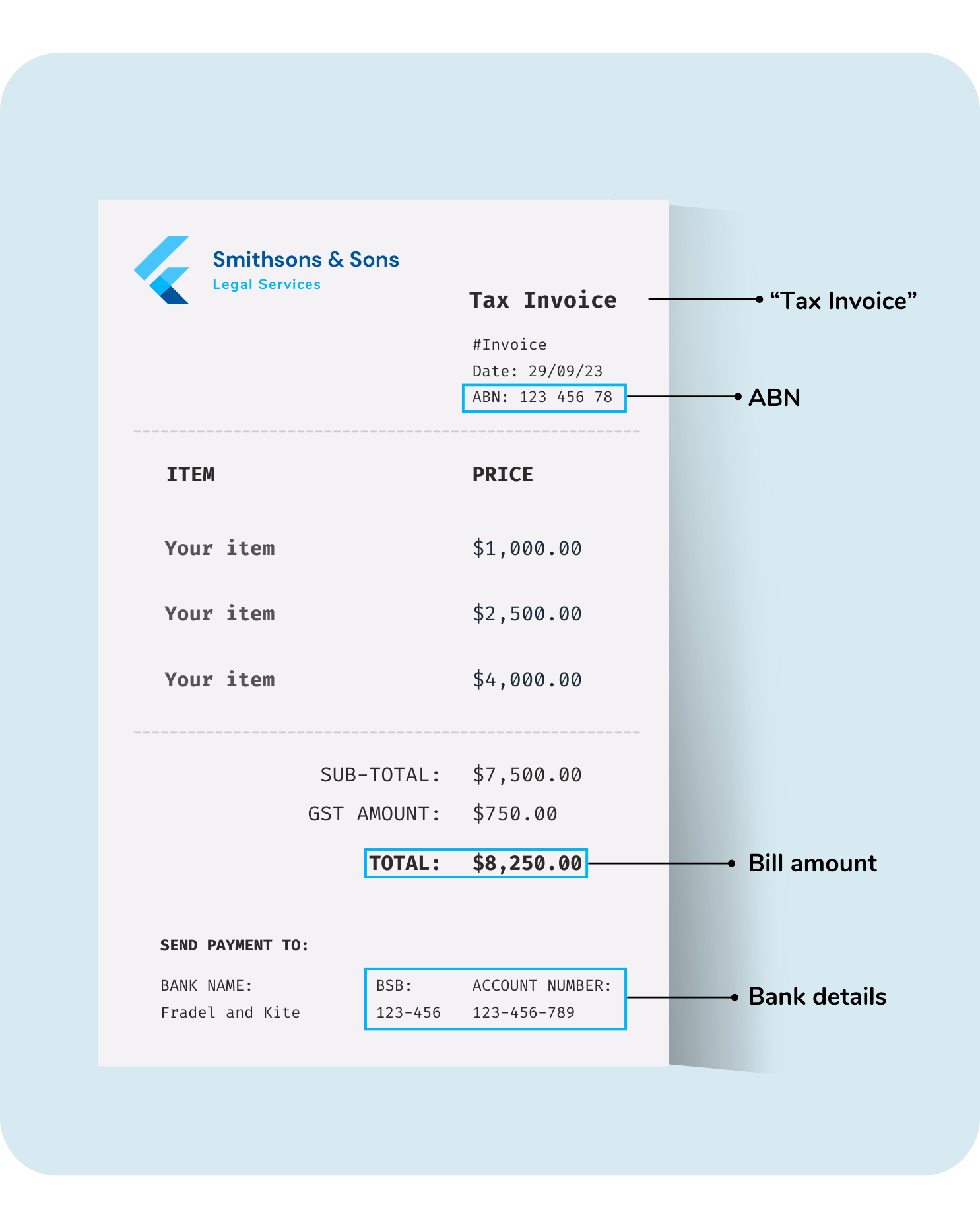

Plus, most business rent already comes with an invoice, making the process seamless.

Simply tap the ‘+’ to upload a copy of your invoice for payment. Pay now, or create a recurring payment.

Upload your rent here 👇

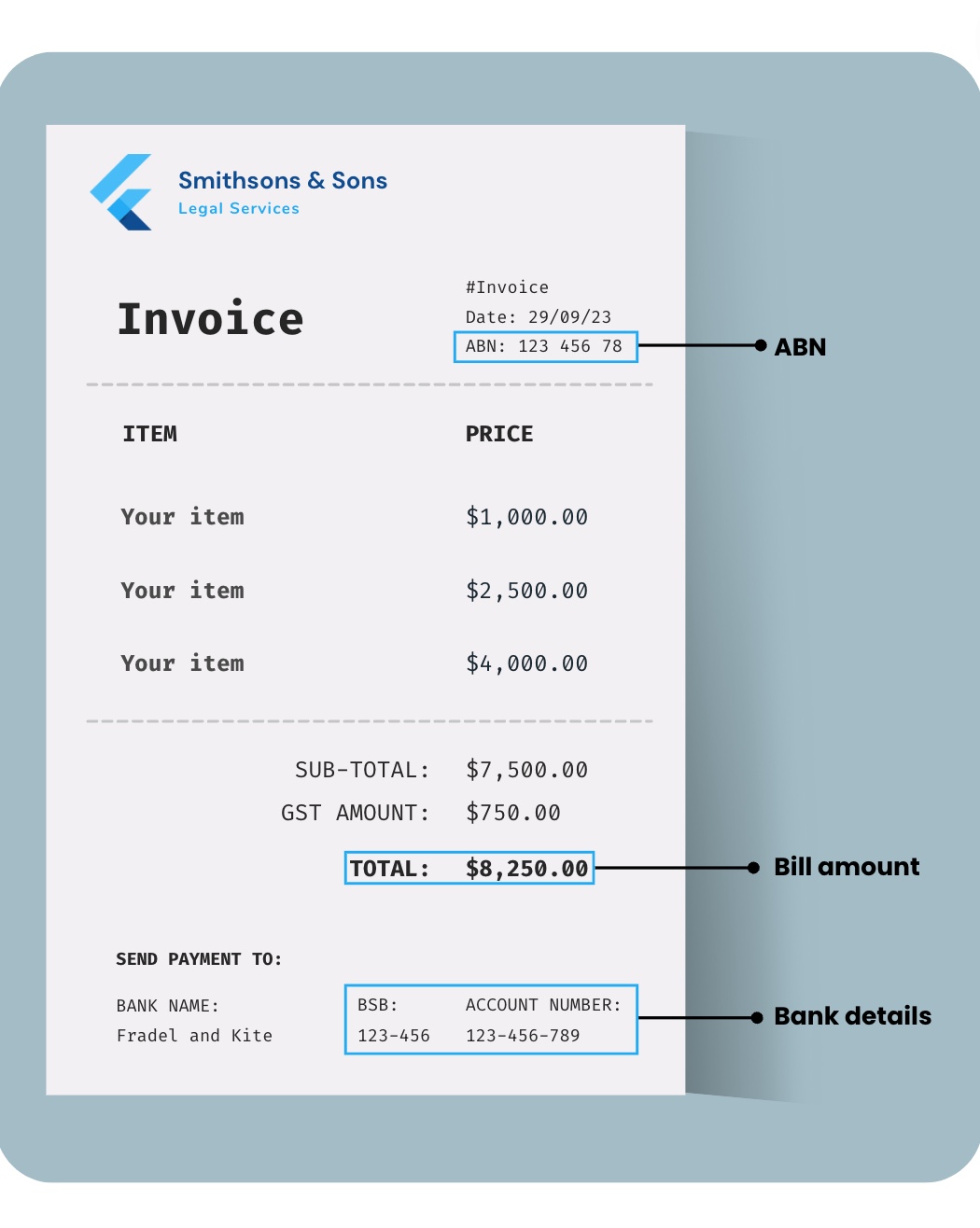

- The phrase ‘Tax Invoice’ (Statements are not accepted)

- Description of the goods

- ABN (Australian Business Number)

- Total bill amount

- Bank Account Details (incl BSB and Account Number)

These details will be imported by Sniip, ready for your review. You do not need to enter these details manually.

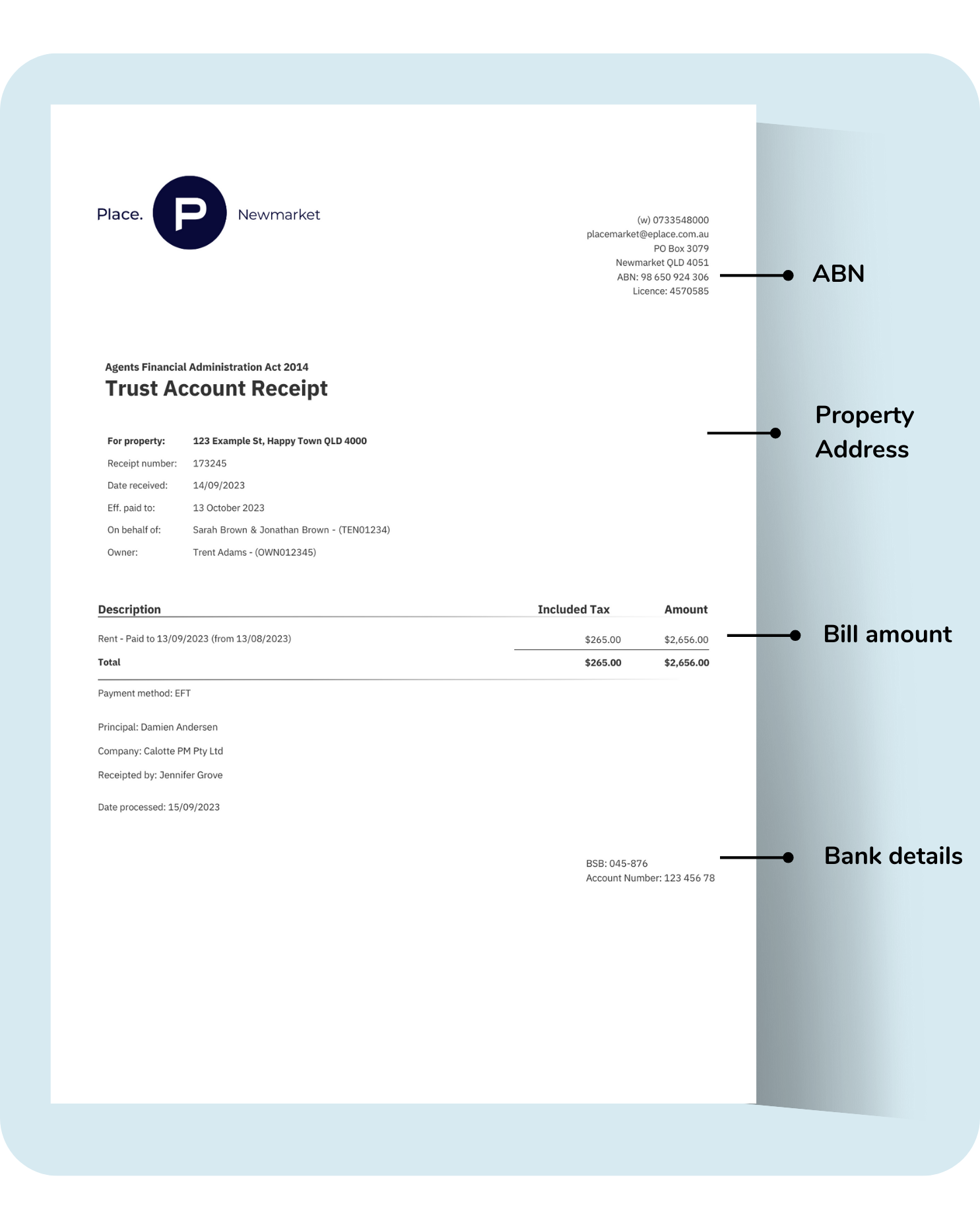

Rent Payments

Upload/share a receipt of your previous rent payment to Sniip. This is a great option as it contains the key information we need:

- ABN (this is required, we cannot facilitate private rentals)

- Total bill amount

- BSB & Account Number Details of who you’re paying

Alternatively, please email a copy of your lease/rental agreement containing the below details to rent@sniip.com.

- ABN (this is required, we cannot facilitate private rentals)

- Lessor and lessee details

- Payable amount

- Reference Number (so your biller can locate your payments)

- BSB + Account details

We’ll create you a rental bill and add it to your ‘To pay’ tab within the ‘Bills’ section of the Sniip app. You’ll get a handy push notification and an email when it arrives.

Please note that this process can take up to 1 business day. If there’s an urgency to your request, please call (07) 3268 7710.

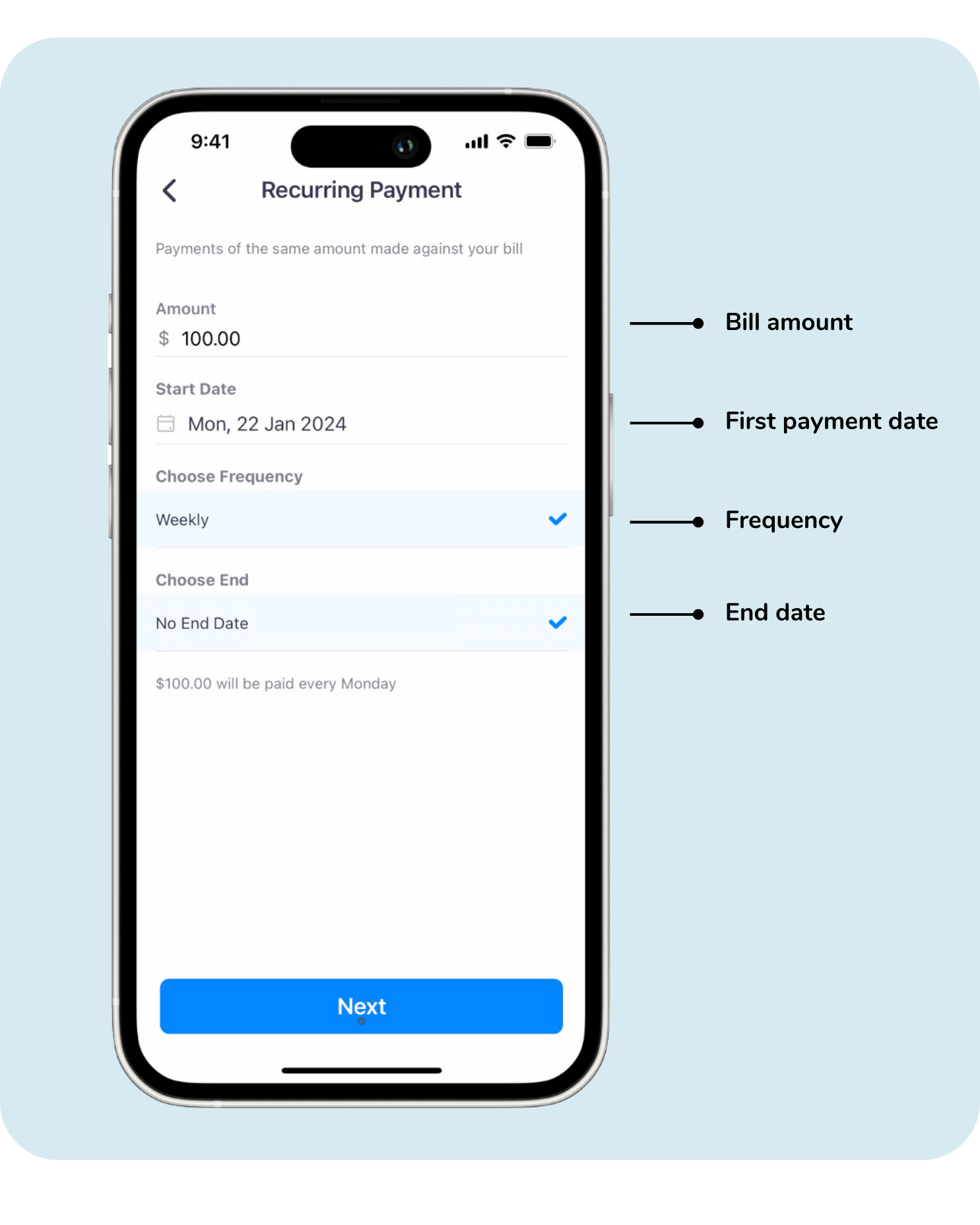

To make life easier, you are able to pay rent, utilities, and other ongoing payments by creating Recurring Payments in the Sniip app!

STEP 1

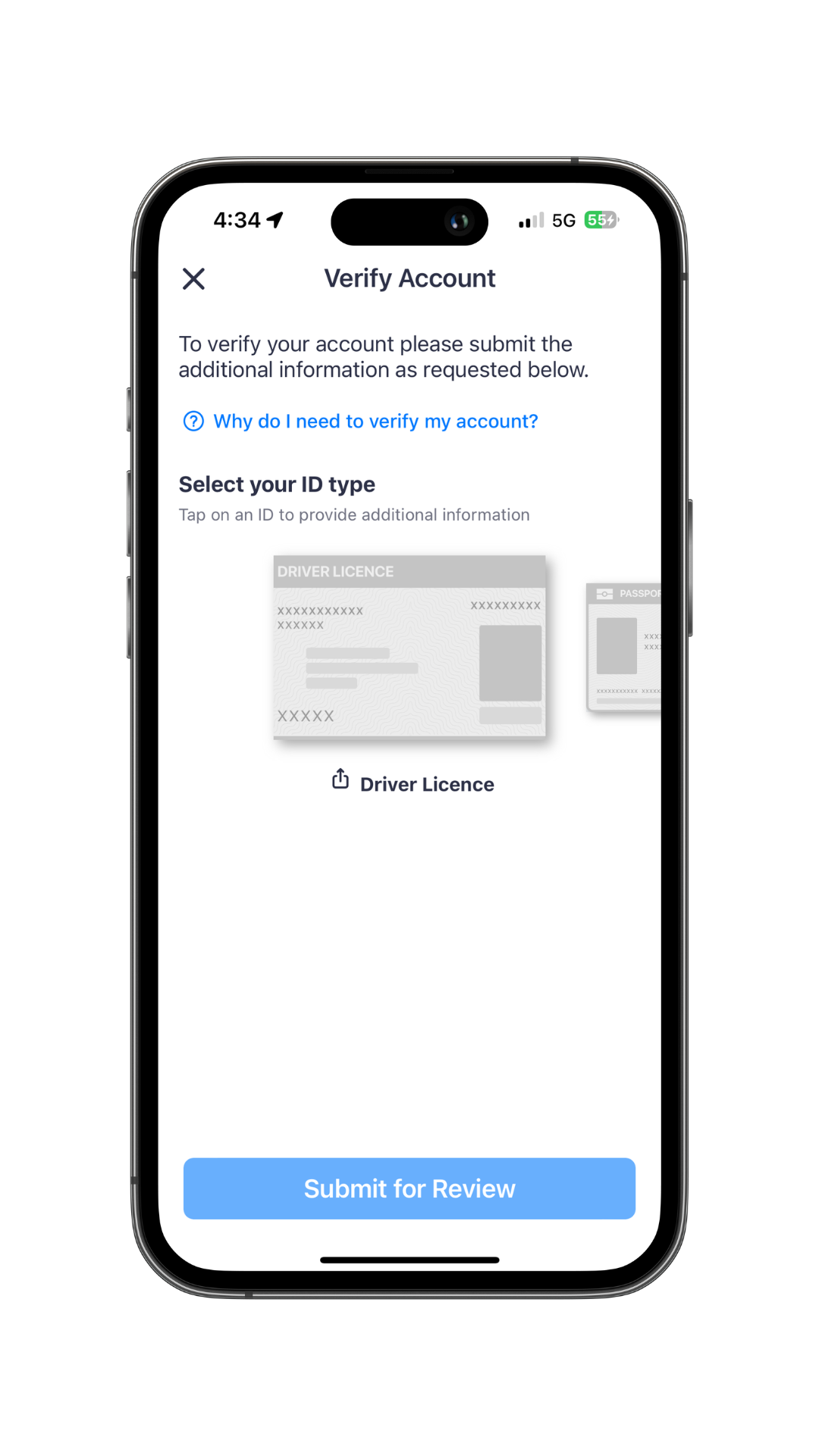

NOTE: If your Sniip account is already verified, please proceed to step 2.

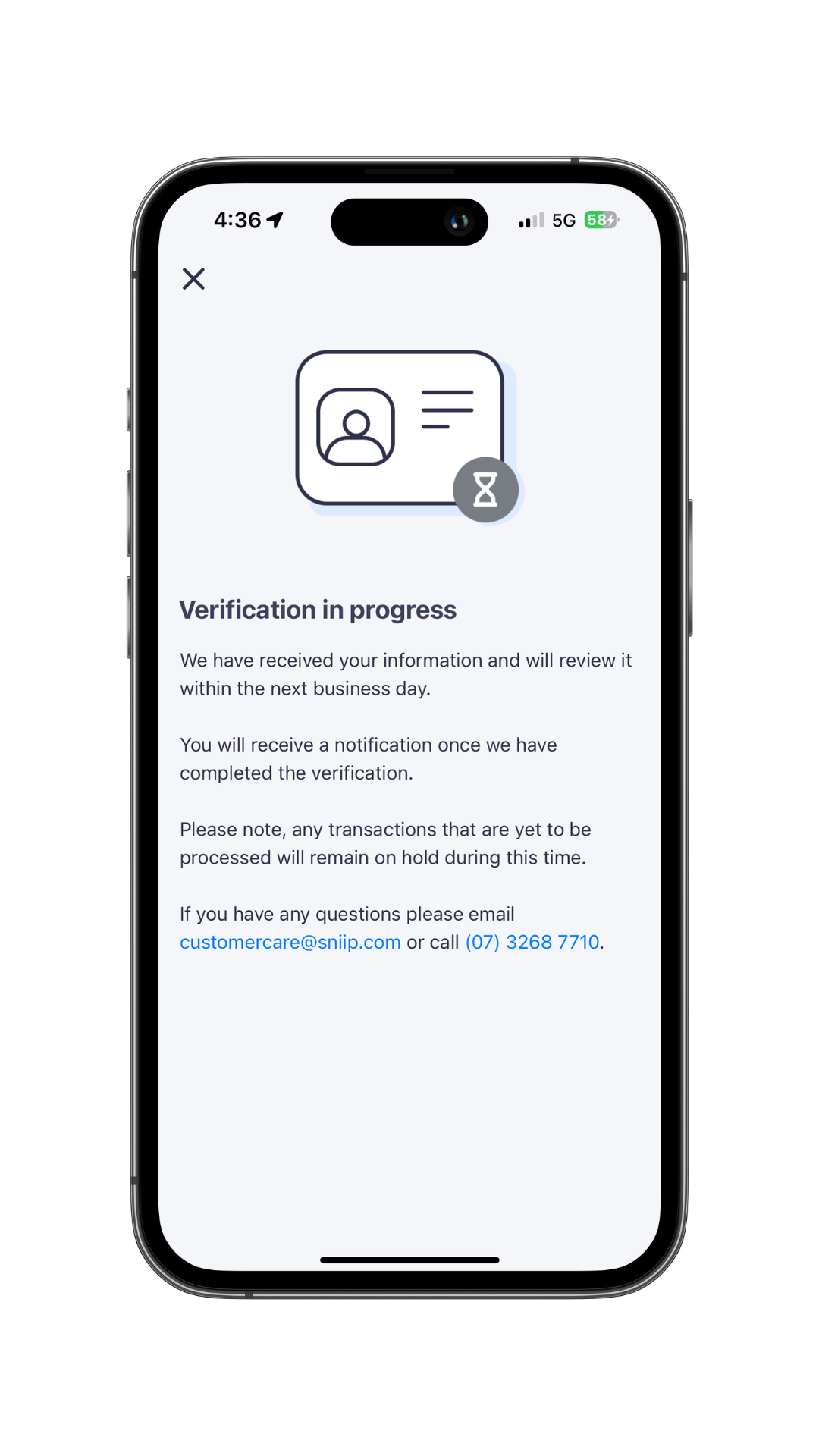

To pay bills to a biller’s BSB and Account Number with Sniip, please complete User Verification in the app.

In doing so, you’ll get the green tick of

User Verification is a crucial step in the process of making bill payments to a BSB & Account Number is required to be undertaken by all users who wish to access functionality. It serves several important purposes:

1. Security & Fraud Prevention: Verifying user information adds an extra layer of security and protection for your account and all parties involved in the payment process.

2. Regulatory Compliance: Sniip is a regulated Bill Payment Service Provider (BSPS). We are committed to maintaining compliance with all relevant industry standards and regulations. As part of these requirements, we’re required to request user verification for certain types of transactions, including payments to a BSB & Account Number.

You can learn more about our User Verification process, here.

User Verification involves uploading a form of photo identification (Driver Licence/Passport) securely to the Sniip app.

To ensure compliance within these regulations, User Verification is required is assist in the prevention of fraud and money laundering – this includes when making bills payments to BSB & Account Number/Bank Transfer/SME payments.

You can learn more about our account User Verification process, here.

We ensure all data entered into Sniip is managed with the highest level of security. At Sniip, we’re proud to have achieved full Tier 1, Payment Card Industry Data Security Standard (PCI DSS) compliance — the same standard that Australian banks comply with.

Sniip is an authorised Payment Institution Member (PIM) of BPAY and adheres to strict compliance standards to offer our service.

To learn more about how our Compliance Team manages security at Sniip, contact the Sniip Support Squad or call (07) 3268 7710.

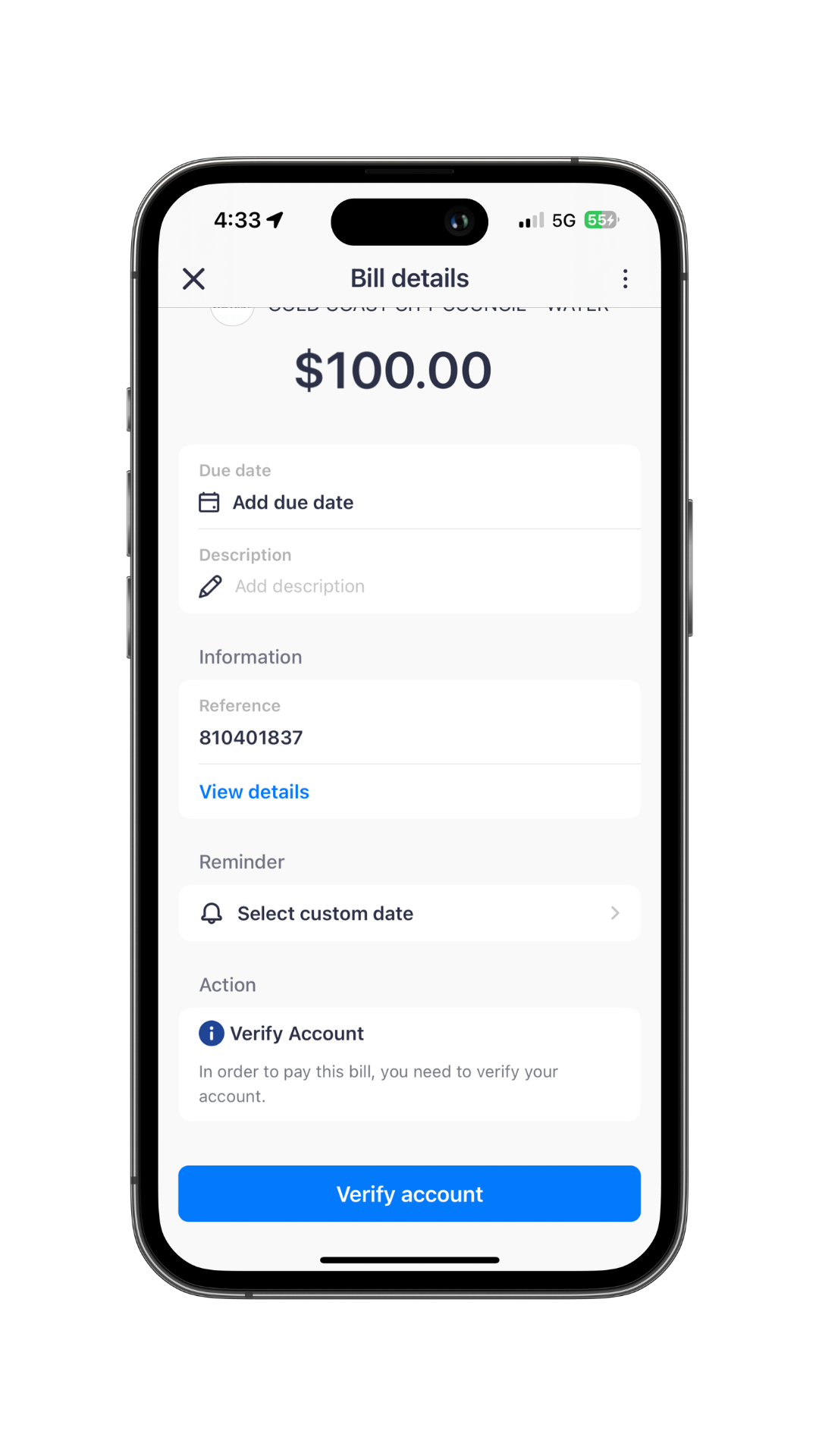

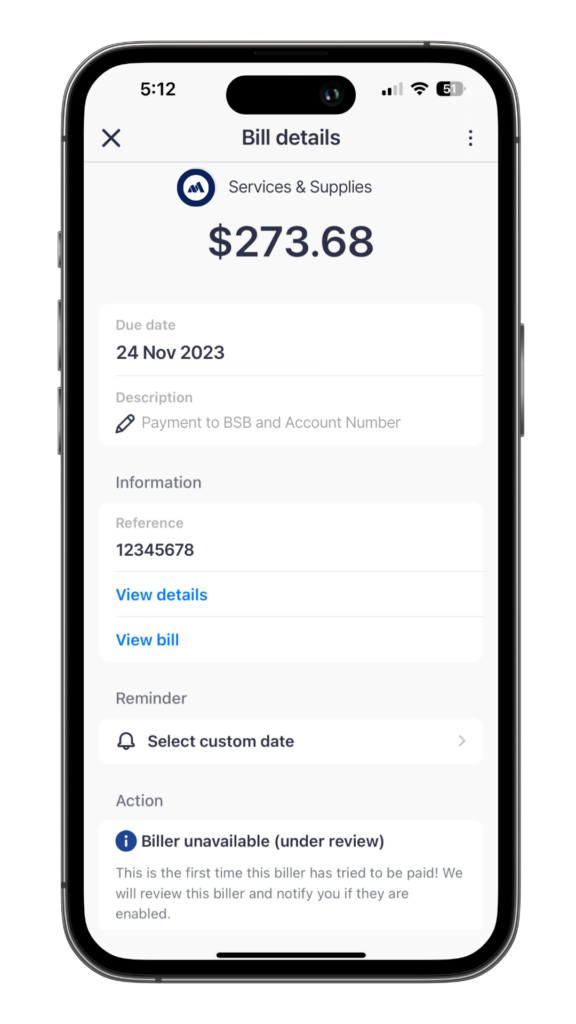

What you will see when…

Your bill has been approved, and your verification documents are being reviewed.

Verifying your account.

Your bill has been approved, but you haven’t verified your account.

STEP 2

Add your bill to the Sniip app in one of three ways:

1. Import from Photo (in the Sniip app)

Take a photo/ Import from camera roll.

2. Share PDF bill from email (via your chosen email app)

Open the email containing your bill/invoice, tap the ‘Share’ button and select Sniip.

3. Have bills automatically import from your email

The next time you have a bill land in your inbox, it’ll automatically upload into the Sniip app.

Import from camera roll / take a photo

Import from camera roll/take a photo

Step 1

Open the Sniip app and tap the blue + icon in the top right corner.

Step 2

Select ‘Import from photo’

Step 3

Choose to ‘Take a photo’ of the bill or ‘Select from photos’ to import from your camera roll

Step 4

When importing from camera roll, tap on the image of your bill and select ‘Import’

Step 5

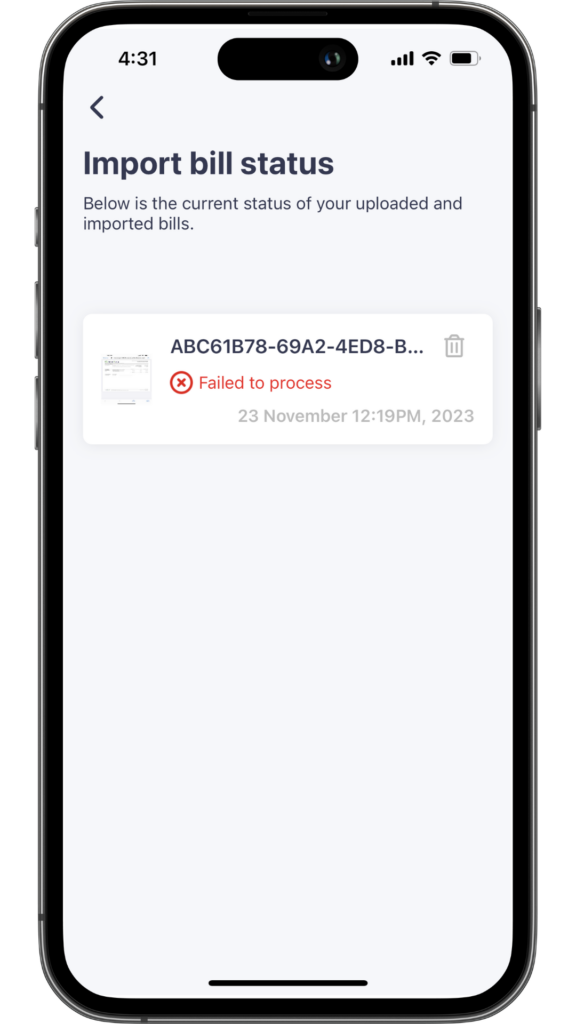

You will see ‘We’re processing your bill’, select, ‘Dismiss’ and your bill will automatically begin processing. To locate your processing bill, select, ‘Bills’, then the ‘Review’ tab.

You’ll be notified when the bill details are digitised and you are able to pay!

NOTE: If your bill ‘Failed to process’, please ensure it contains 1) an ABN, 2) BSB & Account details 3) The bill amount. Alternatively, please email a copy of your bill to customercare@sniip.com for our team to assist you.

Share bill PDF from email

Share bill PDF from your email

Step 1

Open your email and tap on the bill attachment.

Step 2

Tap the share icon (in the bottom left of the screen) and select, ‘Sniip’. If you don’t see the app as an option, scroll across to the ‘More’ button.

Step 3

Select the Sniip app and tap ‘Import Bill’.

Step 4

You bill will automatically begin processing in the ‘Review’ tab in the bills section.

You’ll be notified when the bill details are digitised and you are able to pay!

NOTE: If your bill ‘Failed to process’, please ensure it contains 1) an ABN, 2) BSB & Account details 3) The bill amount. Alternatively, please email a copy of your bill to customercare@sniip.com for our team to assist you.

Automatically import from email

Auto import from email

Step 1

Open the Sniip app.

Step 2

Tap the menu in the top left corner.

Step 3

Select ‘Import from email’.

Step 4

From here, choose your email provider and enter the email address you’d like your bills imported from.

Step 5

Tap ‘Continue’ and follow the prompts to connect your email address.

All done! The next time you receive a bill attachment in your emails, it’ll be automatically uploaded to the Sniip app, ready for you to pay or schedule. You’ll receive a notification when a new bill arrives.

NOTE: If your bill ‘Failed to process’, please ensure it contains 1) an ABN, 2) BSB & Account details 3) The bill amount. Alternatively, please email a copy of your bill to customercare@sniip.com for our team to assist you.

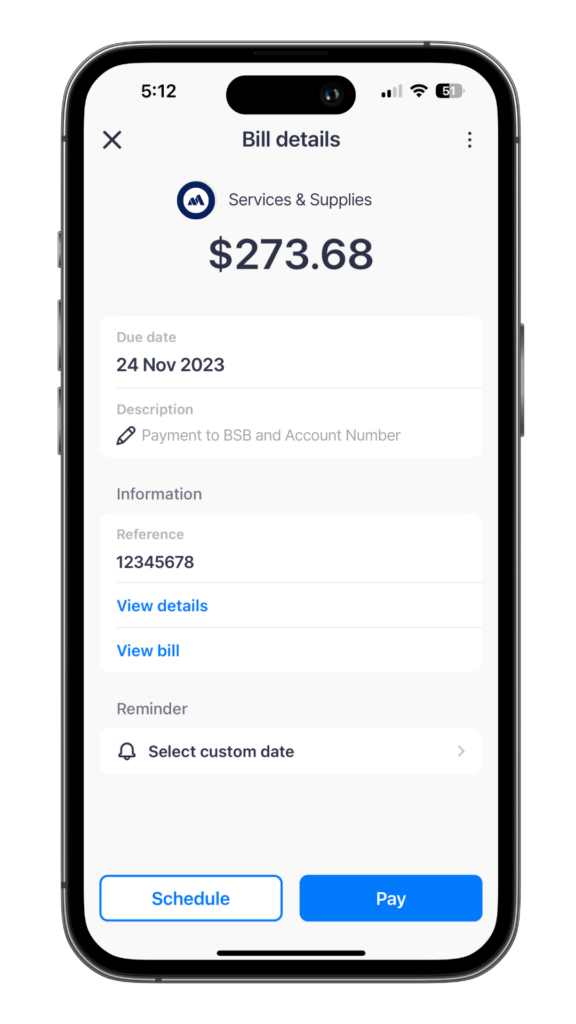

STEP 3

If the BSB & Account Number combination you’re looking pay has approved already, you’re ready to pay!

As this is a brand new feature for Sniip (and much like when we launched BPAY in 2019), we’re required to review every biller that’s added to the app.

If you’re the first person to pay the BSB & Account Number combination, your bill will be reviewed by our team within two business days.

If there’s any urgency to your bill, please email customercare@sniip.com or phone (07) 3268 7710 and we’ll ensure your request is prioritised.

READY TO PAY

If your bill has been approved, you’re all good to pay your bill!

UNDER REVIEW

If your bill was required to be reviewed and has been approved, you’ll receive a push-notification and be ready to pay. If your bill was required to be reviewed and has been declined, you will not be able to pay this bill.

AUTOMATICALLY DECLINED

If your bill falls within a blocked industry, it will be automatically declined.

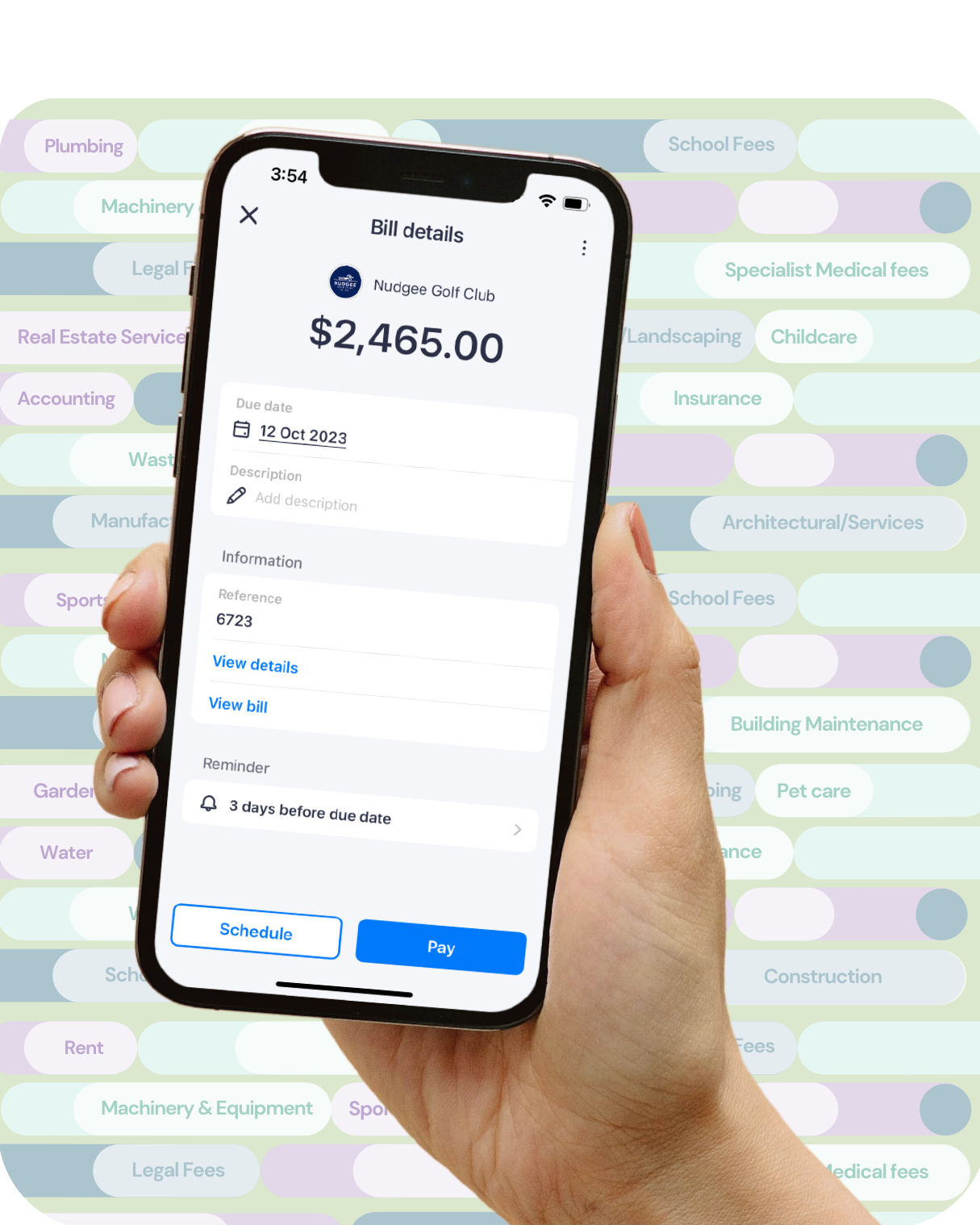

STEP 4

BSB & Account Number

Once your bill has been automatically/manually approved, you’re all set to pay the bill!

You can find your bill in the ‘Review’ or ‘To Pay’ tabs in the ‘Bills’ section, which is located at the bottom of the Sniip dashboard in the app.

Step 1

Find your bill in the ‘To Pay’ tab within the ‘Bills’ section located at the bottom of the dashboard in the Sniip app.

Step 2

Choose ‘Pay’ it now to or ‘Schedule’ your bill for a later date.

Step 3

To pay now, tap ‘Pay’, and choose the payment method you wish to pay the bill.

Please note: Google Pay, Diner’s Club and prepaid cards are not currently enabled with non-BPAY payments.

Step 4

Confirm the payment date and bill about, and tap ‘Next’.

Step 5

Enter your PIN to complete the payment. Done!

PAYEE: What the recipient receives

━━━━━━━━━━━━━━━━━━

As your payment is processed in a two-legged transaction, your funds will land in the biller’s accounts with the reference that you entered when adding the bill to Sniip. This is the same as adding a reference number when previously paying your biller.

Your bill will include your unique reference, this will help the biller identify your payment.

PAYER: What receipt you receive

━━━━━━━━━━━━━━━━━━

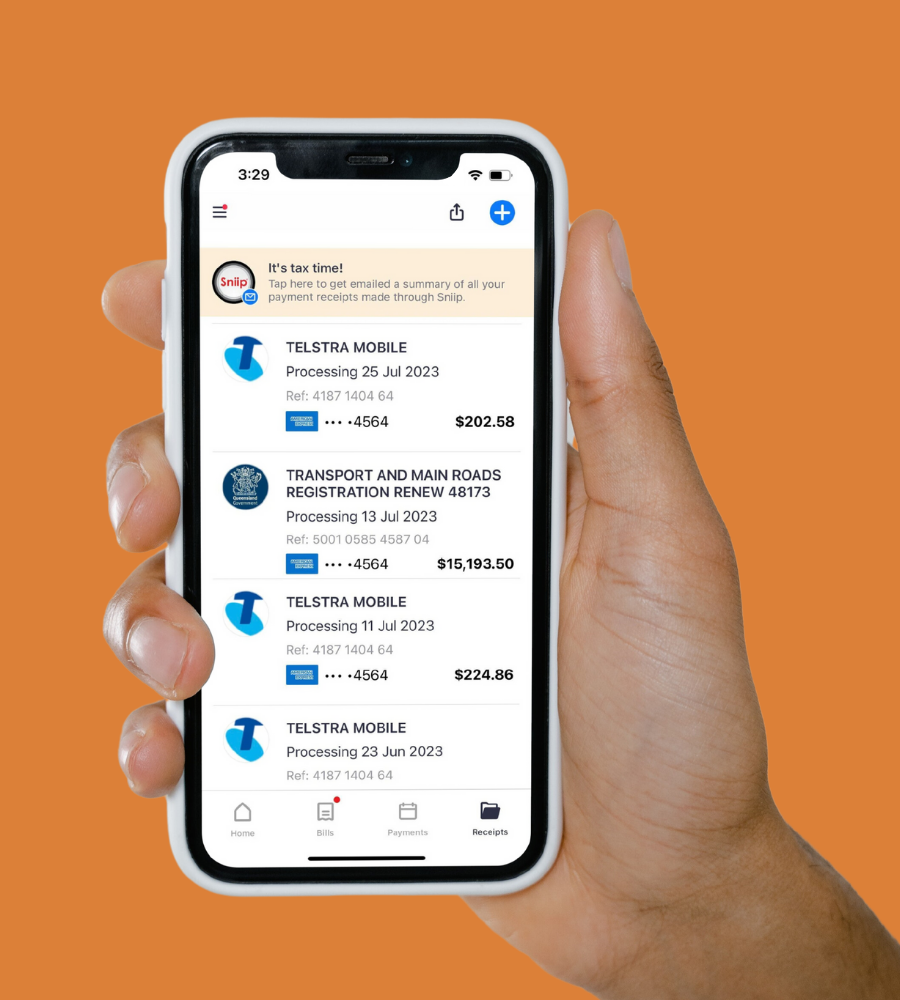

You will get a transaction receipt after a successful payment. This is stored in the ‘Receipt’ section of the app. The receipt contains the following:

- Payment amount

- Processing fee

- GST (if applicable)

- Payment date + more

How do I add my bill?

Great question! When it comes to BSB & Account Number payments, we need a copy of the bill. That gives you two simple ways to import (with no manual entry required).

Option 1: Import the bill/invoice from a photo:

Open the Sniip app, tap the blue '+' button in the top right corner and select the second option, 'Import from photo'.

You can opt to take a photo of your bill or import it from your camera roll. If the bill is on your computer, take a photo or it, or use Option 2.

Option 2: Import PDF attachment from your email:

On your phone, open your preferred mail app with the email containing your bill. Open the bill PDF attachment or link, then tap the share icon and select, 'Sniip'. Your bill will then be sent to the 'Bills' section of the Sniip app, within the 'Review' tab. Double check that your bill has successfully imported and doesn't say, 'Failed to process'.

Please ensure your invoice contains the following details in order to upload your bill:

- ABN (Australian Business Number)

- Total bill amount

- Bank Account Details (including BSB and Account Number)

- An 'Invoice' heading

My bill failed on upload, why?

This may be due to a number of reasons, which are listed below with solutions for each.

Missing details:

To successfully upload your non-BPAY bill into the Sniip app, you will need to ensure your invoice contains the following information:

1. The ABN of your biller (we're unable to accept ACN)

2. The BSB & Account Number for payment

3. Your total bill amount

4. The words 'Tax Invoice' or 'Invoice' on your bill

Please confirm your bill contains these four key elements. If your bill contains each of these elements but won't upload to Sniip, please email a copy of your bill to customercare@sniip.com.

Layout issue:

If there is limited (or no spacing) between the wording of 'ABN' and the following numbers, please reach out to your biller to amend this and add more spacing between. After this, you will be able to successfully add your bill into your Sniip app.

Incorrect ABN/ACN:

The ABN on your invoice must have 11 digits. Our systems may have picked up that the ABN displayed on your invoice contains more or less digits that required, and therefore could not be imported onto your Sniip app. Please reach out to your biller to amend this.

Note: We're unable to accept an ACN, please reach out to your bill to have their ABN added to your bill.

Missing heading 'Tax Invoice' on your document:

In addition to the ABN, BSB & Account Number details and total bill amount, please ensure that the wording 'Tax invoice' is visible on the bill as well for a successful import.

Please reach out to your biller to amend this. Once the phrase 'Tax Invoice' is included on your bill, you'll be able to import it to the Sniip app.

My account is now verified, but I can't pay my non-BPAY bill? Is it getting reviewed?

Nice work on verifying your account! And not to worry, this likely means the bill you've added is 'Under Review' (being reviewed by our team). The review process can take up to two business days.

We're currently experiencing a very high volume of biller reviews due to the high uptake of this new feature. Our team are working through this backlog as quickly as possible and you'll receive a push notification when your bill has been approved.

If there's urgency to your bill, please email customercare@sniip.com or phone (07) 3268 7710 and we'll assist you.

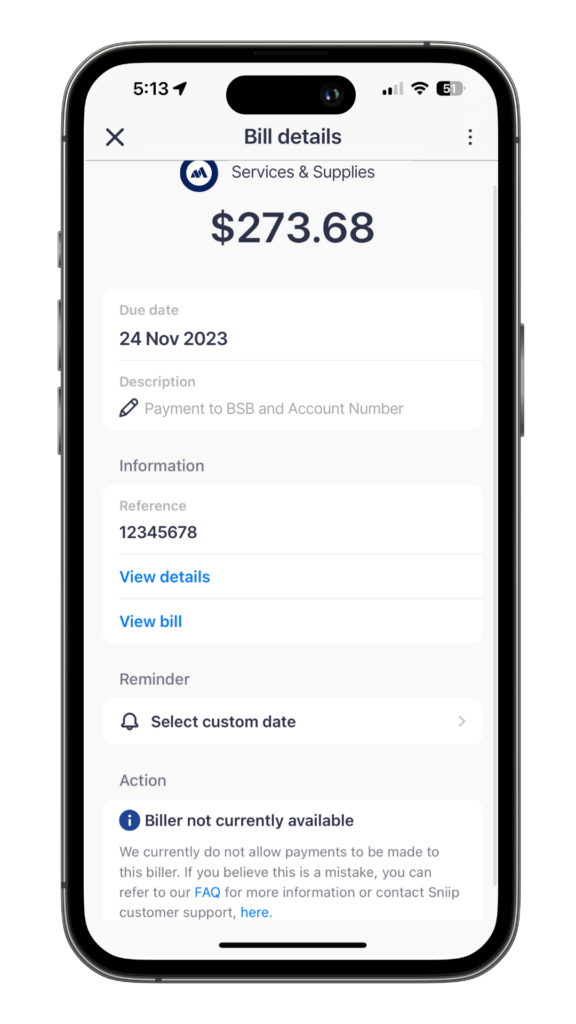

Please note: If your bill is displaying the message, 'Blocked Biller', it means that we are unable to facilitate this payment. It likely falls within a restricted/blocked industry.

My bill is approved but I can't pay it? Why?

This is likely one of two reasons:

1) You need to complete User Verification

2) You've submitted your User Verification, but it's currently under review

We aim to review User Verification requests within one (1) business day. If there's an urgency to your review or you have any questions, please email customercare@sniip.com or phone (07) 3268 7710.

Can I pay my home/commercial rent?

Absolutely! If your rental receipt contains all of the following:

- The ABN of your biller (we cannot accept ACN and cannot facilitate private rentals)

- The BSB & Account Number for payment

- The total bill amount

- The words 'Tax Invoice'

You can import/screenshot this and add it to Sniip for payment.

If your rent receipt doesn't contain these details, please email a copy of your lease/rental agreement, along with the BSB and Account Number for payment to customercare@sniip.com.

We'll review your bill, then provide you with a custom PDF bill to upload to Sniip. You can then share this PDF file from your email to your Sniip app, and it will be ready to pay!

My bill failed on upload, why?

This may be due to a number of reasons, which are listed below with solutions attached.

Missing details:

To successfully upload your non-BPAY bill into the Sniip app, you will need to ensure your invoice contains the following information:

1. The full, 11 digit ABN of your biller (we're unable to accept ACN)

2. The BSB & Account Number for payment

3. Your total bill amount

4. The words 'Tax Invoice'

Please confirm your bill contains these four key elements. If your bill contains these key elements but won't upload to Sniip, please email a copy of your bill to customercare@sniip.com.

Layout issue:

If there is limited or no spacing between the wording of 'ABN' and the following numbers, please reach out to your biller to amend this and add more spacing between. After this, you will be able to successfully add your bill into your Sniip app.

Incorrect ABN/ACN:

Our systems may have picked up that the ABN displayed on your invoice contains more digits and therefore could not be imported onto your Sniip app.

Missing heading 'Tax Invoice' on your document:

In addition to the ABN, company name, BSB and Acc No details, please ensure that the wording 'Tax invoice' is visible on the bill as well for a successful import.

Please reach out to your biller to amend this. Once the phrase 'Tax Invoice' is included on your bill, you'll be able to import it to the Sniip app.

My bill contains all the required info, but it still won't upload.

Sorry to hear that you're having trouble uploading your invoice. The information required to upload your invoice successfully includes:

- The full, 11 digit ABN of your biller (we're unable to accept ACN)

- The BSB & Account Number for payment

- Your total bill amount

- The words 'Tax Invoice'

If your bill contains this information and still won't upload, it may be because the ABN included on your invoice is associated with a BPAY Biller. As such, we're required to process this invoice as a BPAY bill.

Please reach out to your biller to ask for your BPAY Reference Number and we can assist you to make the payment.

My account is now verified, but I can't pay my non-BPAY bill?

Nice work on verifying your account! And not to worry, this likely means the bill you've added is 'Under Review' (being reviewed by our team). The review process can take up to two business days.

We're currently experiencing a very high volume of biller reviews due to the high uptake of this new feature. Our team are working through this backlog as quickly as possible and you'll receive a push notification when your bill has been approved.

If there's urgency to your bill, please email customercare@sniip.com or phone (07) 3268 7710 and we'll assist you.

Please note: If your bill is displaying the message, 'Blocked Biller', it means that we are unable to facilitate this payment. It likely falls within a restricted and blocked industry.

My invoice is approved but I can't pay it? Why?

This is likely one of two reasons:

1) You need to complete User Verification

2) You've submitted your User Verification, but it's currently under review

We aim to review User Verification requests within one (1) business day. If there's an urgency to your review or you have any questions, please email customercare@sniip.com or phone (07) 3268 7710.

Why does it say "Biller not currently available (Under Review)"?

Great question! You're likely just the first person to pay that bill! As non-BPAY payments (payments to a billers BSB & Account Number) are a new feature for Sniip, we're required to review every new biller that's added to the Sniip app to ensure it's a permitted industry.

It was the same process when we introduced BPAY payments in 2019, we've just had almost four years of approving payments now, so most billers someone has already paid before.

The good news for non-BPAY payments is, a) we're working as quickly as possible to approve your bill and, b) once your bill is reviewed, it doesn't need to be reviewed again for future payments.

Once our team has reviewed your bill, you'll receive a push notification to let you know that it's ready to pay. If your bill is deemed to fall within an industry that's blocked/restricted, unfortunately we'll be unable to facilitate the payment.

As we are currently experiencing a high volume of invoice submissions, the biller review process can take up to 2 business days. If there's an urgency to your review or you have any questions, please email customercare@sniip.com or phone (07) 3268 7710.

Blocked Billers: Why does it say "Biller not currently available"?

When you upload a bill to the Sniip app, it will let you know whether you are able to pay that specific bill. If you are unable to pay that bill it will either show 'Biller unavailable (under review) or 'Biller not currently available'. We have both restricted and blocked industries that we're unable to enable payments to, these include:

- Travel or holiday accommodation products

- Banking and financial institutions (incl personal car and home loans)

- Hiring and leasing

- Remittance service provider (i.e overseas payments)

- Charities and not-for-profit

- Intermediaries

- Pay-day lenders

- Gaming (incl Internet gambling and casinos)

- Goods dealers and foreign exchange currencies

- Securities and derivatives

- Managed investment schemes

- International business operations

If you receive the alert, 'Biller not currently available' when you add your bill, this bill falls within a blocked/restricted industry. If you believe this has been categorised incorrectly, please send a copy of your invoice to customercare@sniip.com.

I'm paying with my personal American Express and my bill is being charged business rates when it's a personal payment, why?

As part of our contract with American Express, we are required to determine business vs personal based on the purpose of the payment and the type of industry your biller falls under. If your biller is not listed under the Consumer Payment list (below), we are required by American Express to process it at our tiered business rates.

Billers that fall within the following industries will be considered as consumer payments (for American Express payments):

- Telecommunications Services

- Cable and Other Pay Television Services

- Utilities

- Electric, Gas, Water, and Sanitary

- Insurance Sales, Underwriting, and Premiums

- Body Corporate (not including sales)

- Residential Real Estate Agents and Managers (excluding Commercial Rent)

- Parking Lots and Garages

- Dance Halls, Studios, and Schools

- Membership Clubs (Sports, Recreation, Athletic), Country Clubs, and Private Golf Courses

- Doctors and Physicians

- Not Elsewhere Classified

- Hospitals

- Medical Services and Health Practitioners - Not Elsewhere Classified

- Elementary and Secondary Schools

- Colleges, Universities, Professional Schools, and Junior Colleges

- Correspondence Schools

- Business and Secretarial Schools

- Trade and Vocational Schools

- Schools and Educational Services – Not Elsewhere Classified

- Child Care Services

- Court Costs, including Alimony and Child Support

- Fines

- Government Services – Not Elsewhere Classified

If your biller does not fall within these industries, you may be charged the business rate on your personal American Express card.

Additionally, if you pay a biller on the Consumer Payments list with a Business American Express card, you will be charged the business rates.

If you think your bill has been incorrectly categorised, please send a copy of your invoice to customercare@sniip.com to have it reviewed.

Are the fees the same as BPAY payments?

Can I pay to a BSB and Account Number that does not have an ABN? I wish to transfer funds to my friend.

Unfortunately we are unable to facilitate personal bank transfers, as determined by our banking partners. An ABN is one of the four key information pieces required for your invoice to be uploaded successfully onto your Sniip app.

- ABN (Australian Business Number) - we cannot accept ACN

- Total bill amount

- Bank Account Details (including BSB and Account Number)

- A 'Tax Invoice'/'Invoice' heading

Do you offer any Loyalty Programs for businesses?

Yes. If you currently have an active ABN/ACN, you can earn Velocity Points for your business on your payments with Sniip.

Sniip is an official partner of Virgin Australia Business Flyer, allowing you to earn 1 point per $10 on your business payments (or payments that are charged at the business rates).

A step-by-step guide on setting up a new Virgin Business Flyer account and linking it to Sniip can be found, here.

These Velocity Points for your business are at no extra cost and are in addition to the uncapped points you earn on your business American Express, Visa, Master or Diners Card on your Sniip payments.

You are welcome to read further on our Velocity Points Loyalty Program for business and eligible payments, here.

How do I complete my verification?

You can submit your user verification documents securely through the Sniip app. If you've been requested to verify your account, tap on the push notification you received and you'll be taken to the ‘User Verification’ section in the app.

If you haven’t been requested to submit verification, you can still choose to verify your account. Simply tap on the top left hand menu and select ‘Account’ from the available options. You will be prompted to enter your Sniip PIN. In this screen, tap ‘Security & Privacy’ and then select ‘Verify account’.

You can then choose to submit either a valid License or Passport (simply swipe left to see the upload Passport option).

We usually review your verification submission within one (1) business day. You will be notified when your verification has been approved.

To ensure your account is approved as seamlessly as possible, please ensure you upload a copy of your current Drivers Licence or Passport that clearly shows your full name, date of birth and photograph.

If there is an urgency to your payment, please contact (07) 3268 7710 or email customercare@sniip.com and we will assist in any way possible.

What is account verification?

User Verification involves uploading a form of photo identification (Driver Licence/Passport) securely to the Sniip app.

To ensure compliance within these regulations, User Verification is required is assist in the prevention of fraud and money laundering - this includes when making bills payments to BSB & Account Number/Bank Transfer/SME payments.

You can learn more about our account User Verification process, here.

Will my details be secure?

We ensure all data entered into Sniip is managed with the highest level of security. At Sniip, we’re proud to have achieved full Tier 1, Payment Card Industry Data Security Standard (PCI DSS) compliance — the same standard that Australian banks comply with.

Sniip is an authorised Payment Institution Member (PIM) of BPAY and adheres to strict compliance standards to offer our service.

To learn more about how our Compliance Team manages security at Sniip, contact the Sniip Support Squad or call (07) 3268 7710.

Why is verification required?

User Verification is a crucial step in the process of making bill payments to a BSB & Account Number is required to be undertaken by all users who wish to access functionality. It serves several important purposes:

1. Security & Fraud Prevention: Verifying user information adds an extra layer of security and protection for your account and all parties involved in the payment process.

2. Regulatory Compliance: Sniip is a regulated Bill Payment Service Provider (BSPS). We are committed to maintaining compliance with all relevant industry standards and regulations. As part of these requirements, we're required to request user verification for certain types of transactions, including payments to a BSB & Account Number.

You can learn more about our User Verification process, here.

My account is now verified, but I can't pay my non-BPAY bill?

Nice work on verifying your account! And not to worry, this likely means the bill you've added is 'Under Review' (being reviewed by our Payments Team). The review process can take up to two business days.

We're currently experiencing a very high volume of biller reviews and our team are working through this backlog as quickly as possible. You'll receive a push notification when your bill has been approved.

If there's urgency to your bill, please email customercare@sniip.com or phone (07) 3268 7710 and we'll assist you.

Please note: If your bill is displaying the message, 'Blocked Biller', it means that we are unable to facilitate this payment. It likely falls within a restricted and blocked industry.

Can I pay my home/commercial rent?

Absolutely! If your rental receipt contains all of the following:

- The ABN of your biller (we cannot accept ACN)

- The BSB & Account Number for payment

- The total bill amount

- The headline 'Tax Invoice' or 'Invoice'

You can import/screenshot this and add it to Sniip for payment.

If your rent receipt doesn't contain these details, please email a copy of your lease/rental agreement, along with the BSB and Account Number for payment to customercare@sniip.com.

We'll review your bill, then provide you with a custom PDF bill to upload to Sniip. You can then share this PDF file from your email to your Sniip app, and it will be ready to pay!

I don't have an invoice for my rent, how can I upload it?

Not a problem! Please email a copy of your lease/rental agreement containing the ABN, lessor and lessee details, payable amount and BSB + Account details to rent@sniip.com.

We’ll create you a rental bill and add it to your ‘To pay’ tab within the ‘Bills’ section of the Sniip app. You’ll get a handy push notification and an email when it arrives.

Please note that this process can take up to 1 business day. If there’s an urgency to your request, please call (07) 3268 7710.

Can I set up direct-debit transfers in Sniip?

Sniip’s Recurring Payments feature is a great way to manage recurring payments such as rent, phone bills, internet, and insurance.

To set up recurring payments, simply:

- Open the Sniip app

- Upload a copy of your invoice to the Sniip app

- Once your bill has been approved and you have reviewed the bill details, tap ‘Schedule’

- Tap ‘Create Recurring Payment’

- Enter the bill amount

- Select the start date of the recurring payments

- Select the frequency you would like this bill to be paid (i.e. weekly, fortnightly, monthly or quarterly)

- Choose when you would like the recurring payment plan to end (i.e. a specific date or after a number of payments)

How do I add my bill?

Great question! When it comes to BSB & Account Number payments, we need a copy of the bill. This gives you two simple ways to import (and no manual entry required).

Option 1: Import the bill/invoice from a photo:

Open the Sniip app, tap the blue '+' button in the top right corner and select the second option, 'Import from photo'.

You can opt to take a photo of your bill or import it from your camera roll. If the bill is on your computer, take a photo of it, or use Option 2.

Option 2: Import PDF attachment from your email:

On your phone, open your preferred mail app with the email containing your bill. Open the bill PDF attachment or link, then tap the share icon and select, 'Sniip'. Your bill will then be sent to the 'Bills' section of the Sniip app, within the 'Review' tab. Please confirm that your bill has successfully imported and hasn't '(x) Failed to process'.

Please ensure your invoice contains the following details in order to upload your bill:

- ABN (Australian Business Number) - we cannot acccept ACN

- Total bill amount

- Bank Account Details (including BSB and Account Number)

- A 'Tax Invoice'/'Invoice' heading

When will the biller receive my payment? And how can they identify my payment?

Similar to your BPAY payments, the cut-off times for Sniip to receive your payment for processing the following business day are as follow:

1. American Express: 5pm AEST

2. Visa/Mastercard debit: 5pm AEST

3. Visa/Mastercard credit: 5pm AEST

As your payment is processed in a two-legged transaction, your funds will land in the biller’s accounts with the reference that you entered when adding the bill to Sniip.

This is the same as adding a reference number when previously paying your biller. Because your transaction will include your unique reference, the biller will be able to identify your payment.

How long does it take to review my invoice?

I want to pay to a BSB and Account No, why was BPAY Code and Reference Number selected instead?

If your invoice includes both BPAY details and BSB and account number details, our systems are configured to read the BPAY details from you bill.

As such, you will only be able to pay this biller via the Sniip app to the billers BPAY Biller Code & Reference Number.

I can locate the BSB and Account Number payment option, but how do I verify my account?

To verify your Sniip account, simply tap on the top left hand menu and select ‘Account’ from the available options.

You will be prompted to enter your Sniip PIN. In this screen, tap ‘Security & Privacy' and then ‘Verify account’. Here, submit either a valid License or Passport (simply swipe left to see the upload Passport option).

We usually review your verification submission within one (1) business day. You will be notified when your verification has been approved.

To ensure your account is approved as seamlessly as possible, please ensure you upload a copy of your current Driver Licence or passport that clearly shows your full name, date of birth and photograph, we have some great tips to ensure a seamless upload, here.

If there is an urgency to your payment, please contact (07) 3268 7710 or email customercare@sniip.com and we will assist in any way possible.

Can I use a prepaid or Crypto.com card for non-BPAY bill payment? If not, can you enable it?

Unfortunately you cannot use a prepaid card or a Crypto.com card for non-BPAY bill payments.

The available payment methods for non-BPAY (payments to BSB & Account Number) include American Express, Visa, Mastercard, Debit Card and Bank Accounts.

Why can't I pay this invoice? I am seeing a "Biller not currently available" message.

When you upload a bill to the Sniip app, it will let you know whether you are able to pay that specific bill. If you are unable to pay that bill it will either show 'Biller unavailable (under review) or 'Biller not currently available'. We have both restricted and blocked industries that we're unable to enable payments to, these include:

- Travel or holiday accommodation products

- Banking and financial institutions (incl personal car and home loans)

- Hiring and leasing

- Remittance service provider (i.e overseas payments)

- Charities and not-for-profit

- Intermediaries

- Pay-day lenders

- Gaming (incl Internet gambling and casinos)

- Goods dealers and foreign exchange currencies

- Securities and derivatives

- Managed investment schemes

- International business operations

If you receive the alert, 'Biller not currently available' when you add your bill, this bill falls within a blocked/restricted industry. If you believe this has been categorised incorrectly, please send a copy of your invoice to customercare@sniip.com.

Use any* payment method

VISA, Mastercard, Amex, Debit

As with BPAY payments, even if your biller doesn’t accept your payment method directly, you can use it to pay BSB & Account Number bills with Sniip! Plus, you can use Apple Pay too.

*Google Pay/Diner’s Club and prepaid cards are not enabled with non-BPAY payments

Pay Bills using BSB and Account Number

Paying non-BPAY Bills is now unlocked

You have the flexibility to pay any* bill featuring a BSB and Account Number, all while choosing the payment method that suits you best.

*As usual, blocked/restricted industries apply as required by our banking partners.

Earn full points

Always earn full credit card points on payments

With Sniip, every bill you pay becomes an opportunity to maximise your credit card points. Enjoy the benefit of earning full credit card rewards on all your payments.

Please note: Pay from Bank Account requires one additional day processing time.

Bank Accounts:

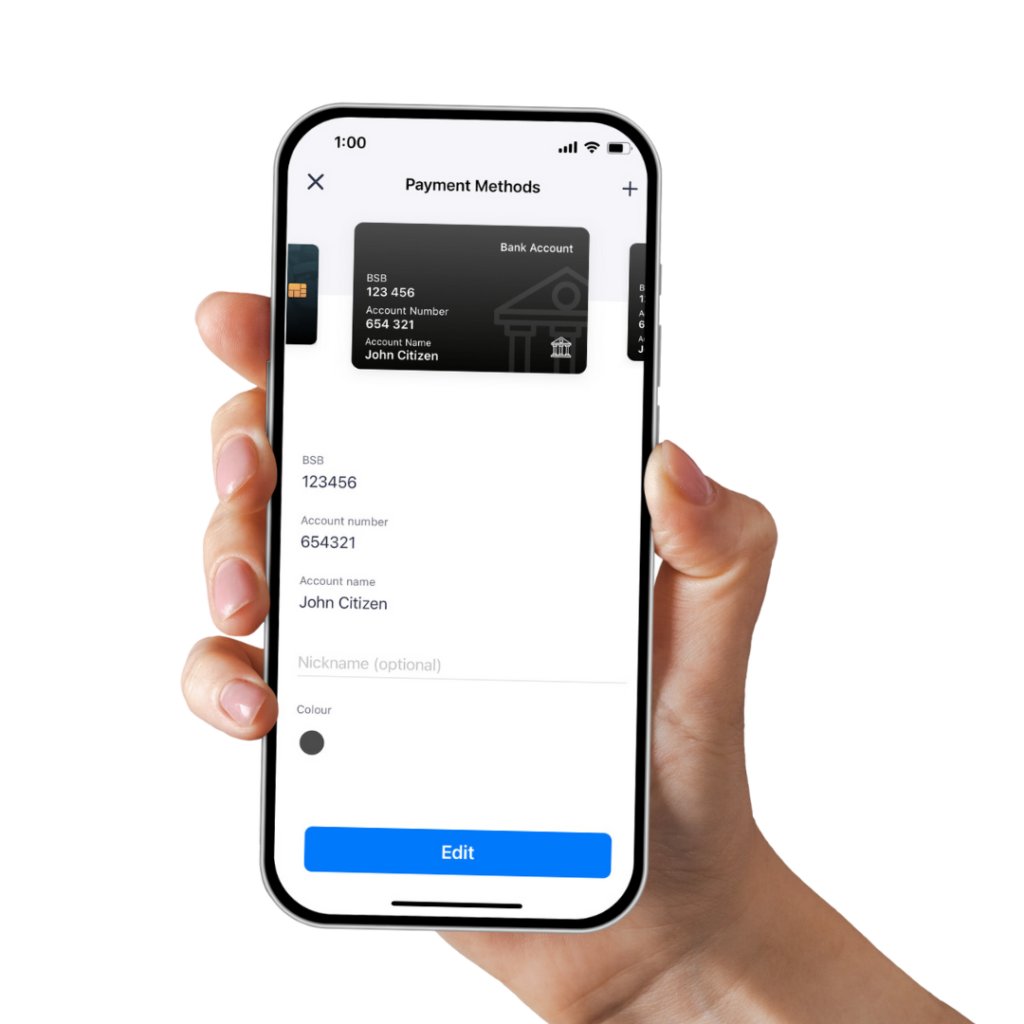

Paying from a BSB & Account Number

How to pay using a BSB and Account number.

Adding and verifying your BSB & Account Number

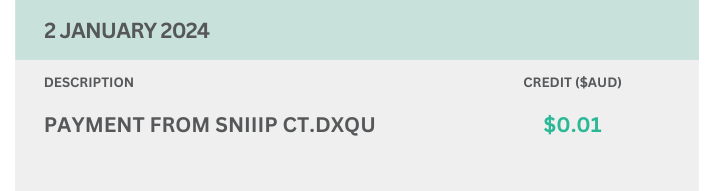

Example of desktop application not displaying full description, including the SN.

Example of mobile application displaying full description, including the SN.

What is the SN Code?

When adding your bank account, we will deposit a small amount into your nominated account to verify the information you have provided.

After adding your bank account details, check your bank account to find a deposit from Sniip, containing “SN”. This SN code must be entered into the Sniip app in order to verify your bank details.

Issue locating the SN

If you’re unable to find ‘SN’ and a series of numbers, it is likely being cut-off by the desktop application. Please open your banking app where you were see the ‘SN’ displayed in the statement reference/description.

Zero processing fees

Use the Sniip app without any processing fees by connecting your Bank Account. Get set-up now with two simple steps:

1. Verify your identity

2. Add your BSB & Account Number

Verification for Bank Accounts

Your payment security is our top priority! Therefore, before adding your BSB & Account Number, you need to verify your identity in the Sniip app.

User verification is a quick and painless process and is an important part of our card security and fraud prevention measures. We conduct this process to protect your account, ensuring you can pay with comfort and certainty.

Please note, in order to successfully verify your identity, your legal name must match the name on your Driver License/Passport. Check-out further information on how to update your legal first name.

What is a BSB & Account Number?

BSB

A BSB number stands for Bank State Branch, and is a six digit number that identifies the bank, state and branch of your bank account.

Bank Identification: The first two digits of the BSB number identify the specific bank or financial institution. Each bank in Australia is assigned a unique two-digit code. For example, Westpac might have the code “03,” while Commonwealth Bank could have “06.”

State Location: The following two digits of the BSB number indicate the state in which the bank branch is located. This is crucial because many banks have branches in multiple states. For instance, the code “12” might refer to a branch in New South Wales, while “24” could point to a branch in Queensland.

Branch Identification: The last two digits of the BSB number distinguish individual branches within the same bank and state. This ensures that the funds are directed to the correct branch, even if multiple branches exist in the same state.

Account number

An account number is a unique number used to identify your bank account.

Uniqueness: Each account within a branch of a bank has a distinct account number. This number ensures that the money is directed to the correct individual or business account.

Varied Length: Account numbers can vary in length and format between different banks. They may consist of digits only or a combination of letters and digits. The length and format of account numbers are determined by the bank’s internal systems.

Security: Account numbers are sensitive and should be kept confidential to prevent unauthorised access to the associated bank account.

When you provide both the BSB and account number for a recipient, you enable the banking system to accurately direct funds to the intended account. It’s essential to double-check these numbers when making transfers to avoid any errors that could lead to misdirected funds.

Bank BSB Lookup

NAB

NAB’s bank branch identifying numbers can be found with the bank BSB search here.

Westpac

Westpac’s bank branch identifying numbers can be found with the bank BSB search here.

Commbank

Commbank’s branch identifying numbers can be found with the bank BSB search here.

ANZ

ANZ’s bank branch identifying numbers can be found with the bank BSB search here.

ING

ING’s bank BSB number is BSB: 923-100. Learn more about ING bank here.

Bank of Queensland

BOQ has two BSB numbers:

- 124-899: for accounts managed in the myBOQ App use

- 124-001: for all other accounts

Learn more about Bank of Queensland BSB numbers here.

Macquarie Bank

Learn how to locate your Macquarie Bank BSB number here.

Bendigo Bank

Bendigo Bank’s BSB number is: 633-000. Learn more about Bendigo Bank here.

Suncorp Bank

Suncorp Bank’s BSB number is: 484-799. Learn more about Suncorp Bank here.

Bankwest

Learn how to locate your Bankwest BSB number here.

*Disclaimer: This information is provided as a guide only. Please refer to your bank for the most up to date and accurate information.

Paying from a BSB & Account Number

General FAQ

Short answer: Two to three days.

When you make a bank account payment through Sniip, Sniip will move it to the processing stage within two business days. Accordingly, this component of the transaction utilises the BPAY scheme and is subject to the BPAY terms.

The cut-off times for Sniip to receive your payment for processing within two business days is as follows:

- 6pm AEDT/5pm AEST

Please allow sufficient time for your payment to be processed. Generally, funds take roughly 24 hours to finalise and be deposited into the billers account. Therefore, we suggest always paying your bills three days in advance.

Additionally, you can find a time stamped receipt under the ‘History’ in the Sniip app. Here, you’ll see the exact time your payment was made to your biller via BPAY. To clarify, the biller must recognise the BPAY payment as the date that the bill was paid.

Great question! You can update the payment method for any scheduled or recurring payment by going into the ‘Payments’ tab in the Sniip app.

Tap on the payment you want to update, then tap ‘Edit Payment’ and ‘Edit Recurring Payment’ if you’re amending the payment method on a recurring payment.

Tap the ‘Next’ button. Swipe through your Payment Methods to find the correct one and tap ‘Next’. Review the details for this payment, select ‘Confirm’ and then enter your PIN/Face ID.

Please note: You need to repeat this process for each of the scheduled bills you want to update.

You will see this error message if incorrect details have been entered. We’d recommend checking to ensure the details you provided are correct.

If you’re still experiencing this issue, please contact our Sniip Support Squad on (07) 3268 7710 or email customercare@sniip.com.

Verification FAQs

When you add your bank account, Sniip will deposit a small amount to verify the information you provided.

Once you’ve added your account details, check your bank account and look for a deposit called SN. Copy the five characters after ‘SN’.

Go back to the Sniip app, enter the five numbers and enter ‘Verify now’. If successful, you should see the ‘Bank account verified’ screen!

When adding a bank account to your Sniip wallet, we will need to verify your identity.

Sniip is a regulated Bill Payment Service provider and we are a member of BPAY. This requires us to undertake significant compliance assessments in order to provide our service.

As part of this commitment, Sniip must identify our customers and verify that their information is correct for the purpose of addressing Anti Money-Laundering/Counter-Terrorism Funding risk, fraud and misappropriation risk, as well as requirements imposed by our banking and regulatory partners.

We usually review your verification submission within one (1) business day.

You will be notified when your verification has been approved.

To ensure your account gets approved as soon as possible, please ensure you upload a copy of your current Driver Licence or passport that clearly shows your full name, date of birth and photograph.

Our team is working hard to verify each Sniip account as quickly as possible.

Customer protection, card security and fraud prevention are the highest priorities at Sniip.

In the meantime, please check if you have received an email from our customer service team requesting any further information or clarification.

We will notify you when we verify your account. For any urgent payments, please contact us on (07) 3268 7710 and we will assist in any way possible.

More questions?

Check out our FAQ Page