How to Pay Your Rent with a Credit Card

Explore using a credit card to pay rent, discussing its pros and cons. From earning rewards on your preferred card, to setting up automated rent payments, discover why this method is becoming more popular among renters.

Rent Payments through Sniip

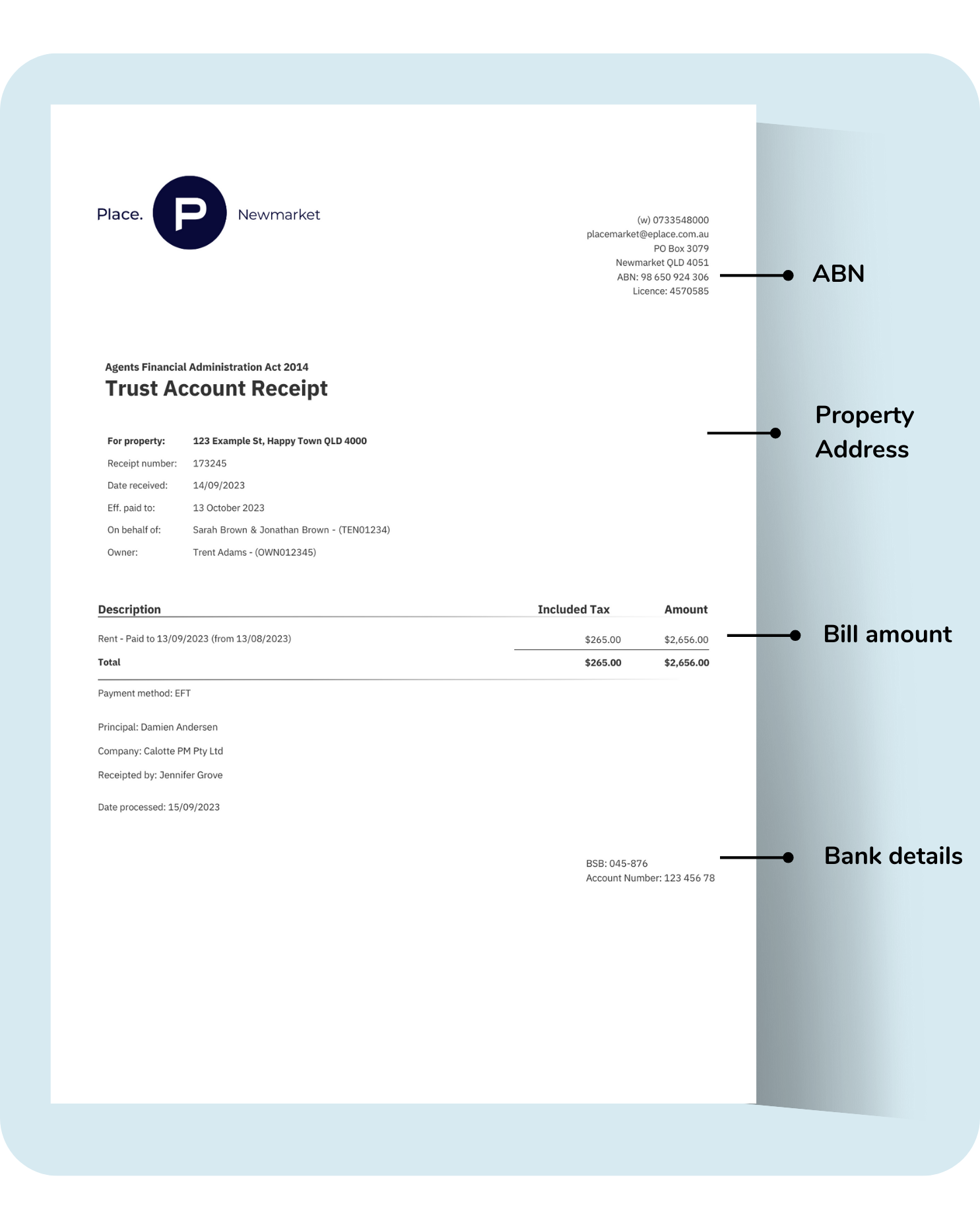

Upload/share a receipt of your previous rent payment to Sniip. This is a great option as it contains the key information we need:

- ABN of the biller you’re paying

- Total bill amount

- BSB & Account Number Details of who you’re paying

Alternatively, please email a copy of your lease/rental agreement containing the below details to rent@sniip.com.

- ABN

- Lessor and lessee details

- Payable amount

- Reference Number (so your biller can locate your payments)

- BSB + Account details

We’ll create you a rental bill and add it to your ‘To pay’ tab within the ‘Bills’ section of the Sniip app. You’ll get a handy push notification and an email when it arrives.

Please note that this process can take up to 1 business day. If there’s an urgency to your request, please call (07) 3268 7710.

Paying a biller's BSB and Account Number with a credit card

Pay your rental agent’s BSB and Account Number with American Express, VISA, Mastercard, debit, or bank account (even if they don’t directly accept these payment methods).

Creating a Recurring Payment

To make life easier, you are able to pay rent, utilities and other ongoing payments by setting up recurring payments in the Sniip app. You can create a recurring payment by doing the following:

- Import your bill into the Sniip app.

- Once reviewing your bill details, tap ‘Schedule’ in the bottom right of the screen.

- Select ‘Create Recurring Payment’.

- Choose the amount you’d like to pay and how often you would like the payments to be made (weekly, fortnightly).

- Choose the end date or select no end date.

- Tap confirm.

Paying your rent with a credit card

In today’s fast-paced world, convenience is key. We are always on the lookout for ways to simplify our daily tasks and make our lives easier.

One area where convenience is often sought after is in the realm of paying rent. Gone are the days of writing checks or rushing to the bank to withdraw cash and pay the landlord/real estate in person. Technology has transformed rent payment with credit cards.

In this article, we will delve into the ins and outs of paying your rent with a credit card, exploring the benefits and potential pitfalls of this method. From earning serious reward points on your favourite credit card to having the ability to schedule automatic payments or create recurring payments, you’ll discover why this option is gaining popularity among renters.

But before we dive in, it's important to understand how credit card payments for rent work and what you need to consider before using this method.

We’ll walk you through the process and provide you with helpful tips to ensure a smooth and seamless experience.

Get ready to unlock the convenience of paying your rent with a credit card and revolutionise the way you manage your monthly expenses. Ready? Let’s go!

Benefits of Paying Rent with a Credit Card

Paying your rent with a credit card comes with several benefits that can make your life easier and even more rewarding. Here are some of the key advantages:

1. Earn reward points

One of the most enticing benefits of paying rent with a credit card is the opportunity to earn reward points. Many credit card companies offer generous rewards programs, allowing you to accumulate points that can be redeemed for travel, cashback, or other valuable perks (the best value of your points is always travel). Using a credit card for rent boosts rewards from expenses.

2. Convenience and Flexibility

Paying rent with a credit card offers unparalleled convenience and flexibility. You no longer have to worry about writing checks, visiting the bank, or dealing with cash. Instead, you can simply make your rent payment online or set up automatic payments (scheduled or recurring), saving you time and effort. Additionally, credit cards often come with grace periods, giving you more flexibility in managing your cash flow. Win, win!

3. Build Credit History

Consistently paying your rent with a credit card can help you build a positive credit history. Timely payments and responsible credit card usage can improve your credit score, making it easier for you to secure loans, mortgages, and other financial products in the future. Paying rent with a credit card is a great way to establish a strong credit profile while covering your monthly housing expenses.

Now that we’ve explored the benefits, let’s take a closer look at the factors you should consider before paying rent with a credit card.

Things to Consider before paying rent with a credit card

1. Credit Card Fees

Some landlords or property management companies may charge a convenience fee for credit card payments. This fee is typically a percentage of the rent amount and can add up over time. Before opting to pay with a credit card, make sure to understand the fees involved and calculate whether the rewards you earn outweigh the additional costs.

To get the best rates on credit card fees, we’d recommend using Sniip (as seen on Sunrise, the Today Show, etc) to pay your rent with your credit card. Sniip offers the best rates in the market for credit card payments at 1.5% or 1.29% for personal American Express card payments. The processing fee for American Express business cards is tiered and from 1.75% (+GST).

2. Credit Card Interest Rates

If you choose to carry a balance on your credit card, the interest rates can quickly accumulate and negate any rewards you earn. It’s crucial to pay off your credit card balance in full each month to avoid interest charges. If you struggle with credit card debt or have a history of carrying balances, paying rent with a credit card may not be the best option for you and it’s important to make the right choice based on your personal circumstances.

3. Landlord Acceptance

Not all landlords or property management companies accept credit card payments. To bypass this antiquated offering, a service like Sniip (used by over 100,000 Australians) will enable you to pay your rent and earn points on your credit card, even though the biller doesn’t accept credit card directly.

Sniip offers the best rates in the market for credit card payments at 1.5% or 1.29% for personal American Express card payments. The processing fee for American Express business cards is tiered and from 1.75% (+GST).

Now that you have considered these factors, let’s explore how you can find landlords that accept credit card payments.

The secret to having any landlord accept credit cards for rent

Finding a landlord that accepts credit card payments may require some effort, and that’s where a service like Sniip (as seen on Sunrise, the Today Show, etc) really shines.

Sniip allows anyone to pay rent with a credit card, even if the landlord does not accept credit cards as a payment method.

Downloading the app and setting up a Sniip account can be well worth it for the convenience and rewards it offers – unlike other services Sniip has no app download fees, monthly recurring fees or other hidden fees. The Sniip app has just the one processing fee and no other costs.

To use the Sniip service to pay your rent with your credit card, you’ll need either a BPAY Biller Code and Reference Number, DEFT or BSB and Account Number for your rent payment.

How to find landlords that accept credit card payments:

Here are a few strategies to help you find landlords who are open to credit card payments:

Online Rental Listings: Start your search by looking for rental listings on popular websites or platforms. Websites like Realestate.com.au or Domain.com are the biggest players in Australia and will allow you to review which real estate is listing the property for rent.

Biggest companies such as Ray White, Harcourts or Belle are more likely to have a BPAY Biller Code for rental payments or a DEFT code. Alternatively, you can ask your real estate for a BSB and Account Number to pay the payment using the Sniip service and use your credit card.

Even if the real estate agent advises that they don’t accept credit card directly, you can still use your credit card to pay the bill with Sniip and earn full points.

Local Property Management Companies: Contact local property management companies and inquire about their payment options. Ask for one of the following:

- BPAY Biller Code and Reference Number

- DEFT code (cannot be used with American Express)

- BSB and Account Number

Then, download the Sniip app and use your available option from the above to pay your rent with your credit card.

Once you have found a landlord or property management company that offers a BPAY Biller Code, DEFT code or BSB and Account Number for payments, you’re good to pay your rent with a credit card via the Sniip app.

Next, it’s time to learn how to pay your rent with a credit card. Let’s dive into a step-by-step guide on how to do just that.

A step-by-step guide to pay rent with a credit card

Making a rent payment with a credit card

Paying your rent with a credit card is a straightforward process, but it’s essential to follow the correct steps to ensure a smooth transaction. Here’s a step-by-step guide to help you pay your rent with a credit card:

1. Confirm their details

Ensure your landlord provides BPAY, DEFT, or BSB and Account details for payments.

You do not need to confirm if they accept credit card payments, because using the Sniip service bypasses biller acceptance, allowing you to use any card (including credit card) to pay the bill.

2. Choose the right credit card

Select a credit card that offers attractive rewards, such as cashback or travel points (Amex Membership Points, Qantas/Virgin points, etc), to maximise the benefits of paying your rent with a credit card. Consider any annual fees, interest rates, and credit limits when making your decision.

3. Set up automatic payments

Using the Sniip service, you can set up automatic payments to avoid missing due dates and ensure timely rent payment. This feature available through the Sniip app when setting up the payment, allowing you to schedule payments in advance or create a recurring payment.

4. No need to share your credit card information

Sharing your credit card information to your landlord or property management company previously involved filling out an online form, providing your credit card details over the phone, or submitting a physical payment form.

Not only is this inconvenient, it’s not secure.

Using a service like Sniip, you can utilise your Apple Pay or Google Pay wallet, or set-up your payment methods securely in the app which is PCI DSS Tier 1 secure – which is the same level as banks.

5. Review transaction details

Double-check the biller details, payment amount and due dates before finalising the transaction in the Sniip app. Ensure the information is accurate to avoid any payment issues or discrepancies. Using a service like Sniip assists with accuracy as it will check the details of your bill prior to payment.

6. Keep your receipts

A service like Sniip offers confirmation emails and in-app receipts as proof of payment. This will come in handy if any disputes or questions arise in the future with your property agent or real estate.

When paying rent through Sniip, the real estate must acknowledge the payment date as the BPAY Receipt ID date.

Even if the real estate takes a while to reconcile their transactions, the Sniip receipt showing the BPAY Receipt ID proves your payment has been made by the date provided.

By following these steps, you can successfully pay your rent with a credit card and enjoy the convenience it offers using the Sniip app. But why stop there? Let’s explore some tips for maximising credit card rewards when paying your rent.

Frequently asked questions

How to pay rent?

You can pay your rent conveniently using Sniip. Sniip was developed to offer you multiple payment options to suit your preferences. With the Sniip app, you can:

Pay with a Credit Card: Paying your rent with any credit card is now hassle-free. Not only can you pay your rent conveniently, but you can also earn full reward points for every transaction (including full points on the processing fee amount too!).

Free Bank Transfer: If you prefer not to use a credit card, we also offer the option to pay your rent for free via bank transfer. This ensures that you can make payments without incurring any additional fees.

Set Up Recurring Payments: To make your life even easier, Sniip allows you to set up recurring payments with your chosen payment method. You can schedule automatic rent payments, ensuring that you never miss a due date!

Our goal at Sniip is to provide you with flexibility, and convenience when it comes to paying your rent. Download the Sniip app today to simplify your rent payment process and enjoy the benefits of earning reward points or making free bank transfers.

Is Sniip a cheaper alternative to Rental Rewards?

Sniip provides an affordable bill payment solution compared to Rental Rewards. Sniip offers unbeatable processing fees for American Express, Mastercard and VISA cards. The processing fees (the only fee you pay) are as follows:

- American Express Personal - 1.29%

- American Express Business - from 1.93%

- VISA Personal / Business - 1.5%

- Mastercard Personal/ Business - 1.5%

All prices are inclusive of GST.

Can I pay rent with a credit card?

Certainly! You can pay your rent with a credit card using Sniip. Sniip is a user-friendly app that allows you to conveniently make rent payments with your credit card.

Plus, when you use Sniip to pay your rent, you earn full reward points not only on the rental amount, but also on the processing fee! Additionally, if you use a business credit card, you can enjoy the benefit of earning bonus Velocity Points on top of your credit card reward points.

Sniip simplifies the process of paying your rent while offering you valuable rewards.

I have a rent payment and want to use my Amex, will I earn full reward points?

Yes, when you make a rent payment using your personal or business American Express (Amex) through Sniip, you will earn full reward points on the rent amount.

Sniip is designed to provide you with the convenience of paying rent with your Amex card while allowing you to maximise your rewards by earning full reward points on the transaction.

It's a great way to make your rent payments more rewarding!

I’m looking for houses to rent/ rental properties and am wondering the best way to make rent payments?

One of the convenient options for making rent payments is using Sniip. Sniip is a user-friendly mobile payment app that allows you to pay your rent using various payment methods, including credit cards, debit cards, and bank transfers. It offers the advantage of earning full reward points on the rent amount and processing fees when using a credit card, and allows you to create recurring payment plans.

Additionally, if you have a business credit card, Sniip provides the bonus benefit of earning Velocity points. Sniip simplifies the rent payment process, making it an excellent choice for those looking for a modern and rewarding way to pay rent.

What is the processing fee percentage with Sniip?

Sniip offers low processing fees for American Express, Mastercard and VISA cards. The prices are as follows:

- American Express Personal - 1.29%

- American Express Business - from 1.93%

- VISA Personal / Business - 1.5%

- Mastercard Personal / Business - 1.5%

All prices are inclusive of GST. You can learn more about Sniip’s pricing here.

Maximise credit card rewards when paying rent

If you’re going to pay your rent with a credit card, why not make the most of it? Here are some tips to help you maximise your credit card rewards:

1. Choose the Right Credit Card

Select a credit card that offers the best rewards for your specific needs. Consider the type of rewards, redemption options, and any bonus categories that align with your spending habits.

2. Utilise Sign-Up Bonuses

Take advantage of sign-up bonuses when applying for a new credit card. These bonuses often require you to spend a certain amount within a specified time frame to earn extra rewards or points, making them an excellent opportunity to boost your rewards.

A service like Sniip is a trusted partner of American Express and Virgin and offers sign-up bonuses to users. At present, a promotion offers 20,000 Velocity Points to your business for transacting $20,000 within the first 30 days of service. Terms and conditions, of course apply.

3. Pay Attention to Bonus Categories

Some credit cards provide higher rewards for specific categories, such as groceries, dining, or travel. If your credit card offers bonus rewards for rent payments or recurring bills, make sure to use it for these transactions to earn more points.

Using Sniip for rent payments ensures full credit card points, even if your landlord doesn’t accept credit cards directly.

By implementing these tips, you can make the most of paying your rent with a credit card and unlock even more rewards. However, it’s essential to be aware of potential drawbacks that come with this payment method. Let’s explore them next.

Potential drawbacks of paying rent with a credit card

As mentioned earlier, some landlords or property management companies may charge convenience fees for credit card payments. These fees can add up over time and may outweigh the rewards you earn, making credit card payments less attractive.

1. Credit card fees

As mentioned earlier, some landlords or property management companies may charge convenience fees for credit card payments. These fees can add up over time and may outweigh the rewards you earn, making credit card payments less attractive.

That’s where a service like Sniip really shines, offering credit card processing fees that are the best in the market ensuring you earn full points at a fee that makes sense for the points you receive.

2. Interest charges

If you carry a balance on your credit card and accrue interest charges, the cost of paying rent with a credit card can quickly outweigh the benefits. It’s crucial to pay off your credit card balance in full each month to avoid interest charges.

3. Reward exclusions

Some credit cards exclude certain types of transactions, such as cash advances or balance transfers, from earning rewards. If you pay the real estate directly (if they accept credit card, you make be excluded from rewards).

By using a service like Sniip, you guarantee your rewards on your credit card in paying your rent. Payments with Sniip are not treated as a cash advance and are not excluded from rewards.

In short, there’s big benefits in using the Sniip service.

It’s important to consider these drawbacks when deciding whether to pay rent with a credit card. If you decide it’s not the best option, don’t worry—there are alternatives available.

Alternatives to paying rent with a credit card

Alternatives exist if credit card rent payment doesn’t match your goals. Here are a few options:

Debit card: If credit cards are too tempting for you, a service like Sniip offers debit card payment at 0.65%. Just grab the BPAY Biller Code, DEFT code, or BSB and Account Number details for the payment from your property manage/landlord and you’re good to go.

Prepaid card: Different providers like Coles offer prepaid cards at a discounted rate from time-to-time, recently we saw a 10% discount of prepaid cards. You can buy prepaid cards at a discounted rate to reduce the cost of your rent and with a service like Sniip processing prepaid cards for rent at 0.85% there’s definitely value in considering the option.

Bank account: Using the Sniip app for your bill payments, you can pay your zero with zero processing fees from your pant account. Just grab the BPAY Biller Code, DEFT code, or BSB and Account Number details for the payment from your property manager/landlord and you’re good to go. That means, even if your rental agency/landlord charges a fee for payments from a bank account, using the Sniip app means these payments are fee free.

Consider personal preferences, financial situation, and available options when choosing the best payment method for rent.

Some extra frequently asked questions about paying rent with a credit card using Sniip

1. Can I earn rewards on my rent payments?

Yes, paying rent with a credit card through the Sniip app earns you rewards. Based on your credit card, this might be a cashback or reward points, depending on your credit card’s rewards program.

2. Will my credit score be affected if I pay my rent with a credit card?

Paying your rent with a credit card can impact your credit score, both positively and negatively. Timely payments can help build a positive credit history, while high credit utilisation or missed payments can hurt your score. It’s always something to consider.

3. Can I set up automatic payments for my rent using a credit card with Sniip?

Yes, the Sniip service offers the option to set up automatic payments for your rent. This feature allows you to schedule payments in advance or create recurring payments (there’s no additional cost for this functionality), ensuring timely rent payments.

4. Is there a limit to how much rent I can pay with a credit card?

The credit limit on your credit card determines the maximum amount you can charge. There is no limit to the amount you can transact through Sniip.

If your rent exceeds your personal/business credit limit, you may need to explore alternative payment methods or discuss the possibility of splitting the payment across multiple credit cards.

If the rent amount you’re paying is unusual for your credit card, it may be blocked by your credit card provider. Just use the number on the back of your credit card to give your provider a heads up to ensure it isn’t deemed to be unusual/fraudulent activity by your provider.

5. Can I use a prepaid card to pay my rent?

Yes, using a service like Sniip enables you to pay your rent with a prepaid card.

Paying your rent with a credit card can offer convenience, rewards, and the opportunity to build credit history. However, it’s crucial to consider the potential drawbacks, interest charges, and credit utilisation, before making your decision.

Evaluate your financial situation, credit card rewards programs, and the options available to you. Paying your rent with a credit card using the Sniip app is our #1 recommended option of anything available on the market. There is no better way to pay your rent than using the Sniip service offer. It’s used by >100,000 Australians and growing.

Remember, it’s essential to stay informed, review your credit card statements regularly, and make timely payments to avoid any issues. With careful consideration and responsible credit card usage, paying your rent with a credit card can unlock a new level of convenience and rewards in your life.

altogether although this may be true

another another key point

basically as a matter of fact

because as a result

before as an illustration

besides as can be seen

but as has been noted

certainly as I have noted

chiefly as I have said

comparatively as I have shown

concurrently as long as

consequently as much as

contrarily as shown above

conversely as soon as

correspondingly as well as

despite at any rate

doubtedly at first

during at last

e.g. at least

earlier at length

emphatically at the present time

equally at the same time

especially at this instant

eventually at this point

evidently at this time

explicitly balanced against

finally being that

firstly by all means

following by and large

formerly by comparison

forthwith by the same token

fourthly by the time

further compared to

furthermore be that as it may

generally coupled with

hence different from

henceforth due to

however equally important

i.e. even if

identically even more

indeed even so

instead even though

last first thing to remember

lastly for example

later for fear that

lest for instance

likewise for one thing

markedly for that reason

meanwhile for the most part

moreover for the purpose of

nevertheless for the same reason

nonetheless for this purpose

nor for this reason

notwithstanding from time to time

obviously given that

occasionally given these points

otherwise important to realize

once once in a while

overall in a word