It’s Official: Pay the ATO and earn full points

How To Earn Full Credit Card Points on Bills

Plus, earn full points even when your biller doesn’t accept credit cards at all!

Earning credit card reward points at the Australian Tax Office and other government agencies has long been a challenge for savvy frequent flyers, with the banks gradually reducing the points earned on those transactions.

Add to that the credit card surcharges that many institutions charge, and you’ll quickly see why it’s just often not worth pursuing the points when paying off those type of bills.

But one new solution to this problem is going through a third-party payment provider. These platforms usually settle your bills via BPAY, offering full reward points when you pay them for the service via credit card in exchange for a small fee.

That’s where Sniip comes in! Sniip is a Brisbane-based fintech company that offers stellar rates when paying bills with an American Express card, which are often the highest points-earning cards on the market.

What is Sniip?

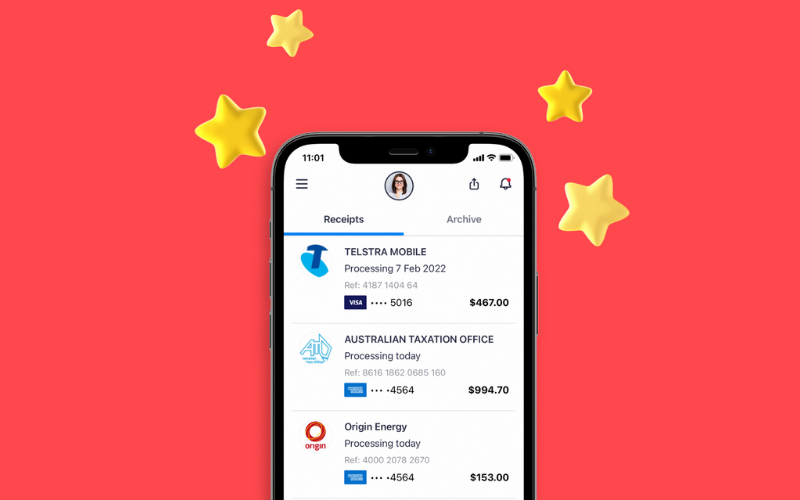

Sniip is a payment platform that allows you to pay personal and business expenses with any type of credit card, all through one easy app. In 2021, the fintech partnered with Amex to offer a flat 1.5% fee for its services, (now 1.29% as of 1 March, 2023).

You’ll always earn full American Express Points when using Sniip to pay bills!

There are other similar payment processors on the market such as pay.com.au, B2BPay and RewardPay. However, those are tailored to small businesses – Sniip the best and most competitive option for both individuals and businesses.

Being transparent, and ensuring individuals and businesses understand how Sniip would benefit them is a top priority. If you’d like to learn more about how Sniip could benefit you or your business, email customercare@sniippay.com.au to chat with us!

How does Sniip work?

Sniip processes your transaction as a two-legged transaction:

- You pay money in the Sniip Trust Account

- Sniip pays your bill on your behalf

When you use a rewards credit card you’ll earn points on the first leg of the transaction – even if your payment method isn’t accepted by your biller directly, and even if you’d earn reduced points / no points if you pay the biller directly (for example, government billers).

Sniip will make payments via BPAY on the second leg of the transaction and this utilises the BPAY Scheme.

This process allows you to earn full points on all of your bills which is a big reason why people love Sniip so much!

In summary: You pay Sniip with your credit card to earn full points, and Sniip then pays your biller via BPay to settle your amount owing.

How do I use Sniip?

Here are the steps to start using Sniip.

- Download the Sniip App from Google Play or the Apple App Store

- Register for an account or login

- Under ‘Wallet’, ensure you have a valid payment method set up

- Tap on the blue ‘+’ icon to add a new bill. You can scan it, add the details manually or sync your email account

- Enter the payment amount and the due date, then tap ‘Add Bill’

- Confirm all details are correct. If needed, you can set up a payment reminder through the app and add attachments.

- Tap ‘Pay’ to pay now or ‘Schedule’ to schedule the payment for later, either as a one-off sum or broken into instalments.

- Once the funds are cleared from your credit card, Sniip will make the BPay payment to your biller, which takes 1-2 business days for credit cards.

Sniip is a mobile app you can use to import from email or scan your paper bills to make payments in under one minute.

- Scan and pay any bill with a BPAY Code, and earn FULL POINTS.

- Pay bills and other expenses with any payment method (even when credit cards aren’t usually accepted by the biller).

Why would Sniip benefit me?

Sniip is the best way to earn even more reward points on transactions where you wouldn’t normally earn anything!

Typically, American Express reduces its points earn on ATO and other government-related transactions down to a low 0.5 or 1 point per A$1 — that’s a big drop when some cards usually earn up to 2.25 points per dollar!

Rather than pay the ATO’s 1.45% Amex fee and earn a reduced number of points, Sniip’s proposition is to pay them at a rate starting at 1.93% instead and earn the full potential of your American Express card.

Comparison of Sniip’s fees to other payment providers

Let’s say you’re an individual that owes a tax bill of $5,000 to the ATO, and you want to maximise the points on your American Express Platinum Charge card or your Qantas Premier Platinum Mastercard.

Here are some of the scenarios that could occur, taking into account payment fees and the value of points earned according to our proprietary points calculator.

Analysis of the results: Sniip vs ATO

Qantas Premier Platinum

With the Qantas Premier Platinum, you’d earn 0 points directly at the ATO (since the card doesn’t award points on those transactions), and 5,109 Qantas Points through Sniip in exchange for a 1.75% (+GST) fee.

That’s just okay, it’s certainly nothing to write home about since the points earn rate on that card is not exceptionally high.

American Express Platinum Card

With the American Express Platinum Card, you could earn a reduced 5,000 points if paying the ATO directly, for a 1.45% fee. But pay just a bit more at Sniip, and you’ll unlock your card’s full earning potential.

That’s 2.25 Membership Rewards points per dollar spent, which more than doubles your haul to 11,496 points for a A$5,000 transaction.

Summing up

The true value of Sniip lies in its new 2021 partnership with American Express that sees it offer a reduced 1.5%* fee for Amex transactions. While equal to the Visa/Mastercard fee, using the right American Express card could really open up your points-earning options.

Add to that most credit cards offer up to 55 days interest-free on regular payments, it makes sense to funnel some of your bigger bills through a service like Sniip to maximise rewards and boost your cashflow.

To get started, visit the Sniip website and be prepared to download the app to Android or iPhone. If you’d like to learn more about how Sniip is the best option for your business and personal payments, email customercare@sniippay.com.au and we’d be happy to chat!

Visit article: https://www.pointhacks.com.au/earning-points-with-sniip/

*As of March 1, 2023, the rate for personal Amex cards is 1.29%, and all ATO payments with an Amex are charged at the business tiered rates.

Join the Sniip Community!

Discover convenience, connection and community as you navigate bill payments effortlessly with Sniip – join us today and be a part of something that’ll make you wonder why you ever paid bills differently!

Check out some of our reviews here.

sniippay.com.au