#1 Trusted bill payment solution. Pay bills now, pay later today.

Buy now. Pay later.

Got bills? That’s a problem for another day.

Experience the pinnacle of Buy Now, Pay Later (BNPL), where you call the shots with your preferred payment methods. Navigate a user-friendly platform with a plethora of features and payment options.

Enter your mobile number and we’ll text you a link to download the app.

100,000+

Total active users

$1B+

Transaction volume

Time and flexibility are on your side. Download Sniip and BNPL all your bills with your chosen payment method.

- Trusted by

Your options are endless!

See below to discover how to pay bills in 4 payments through Sniip

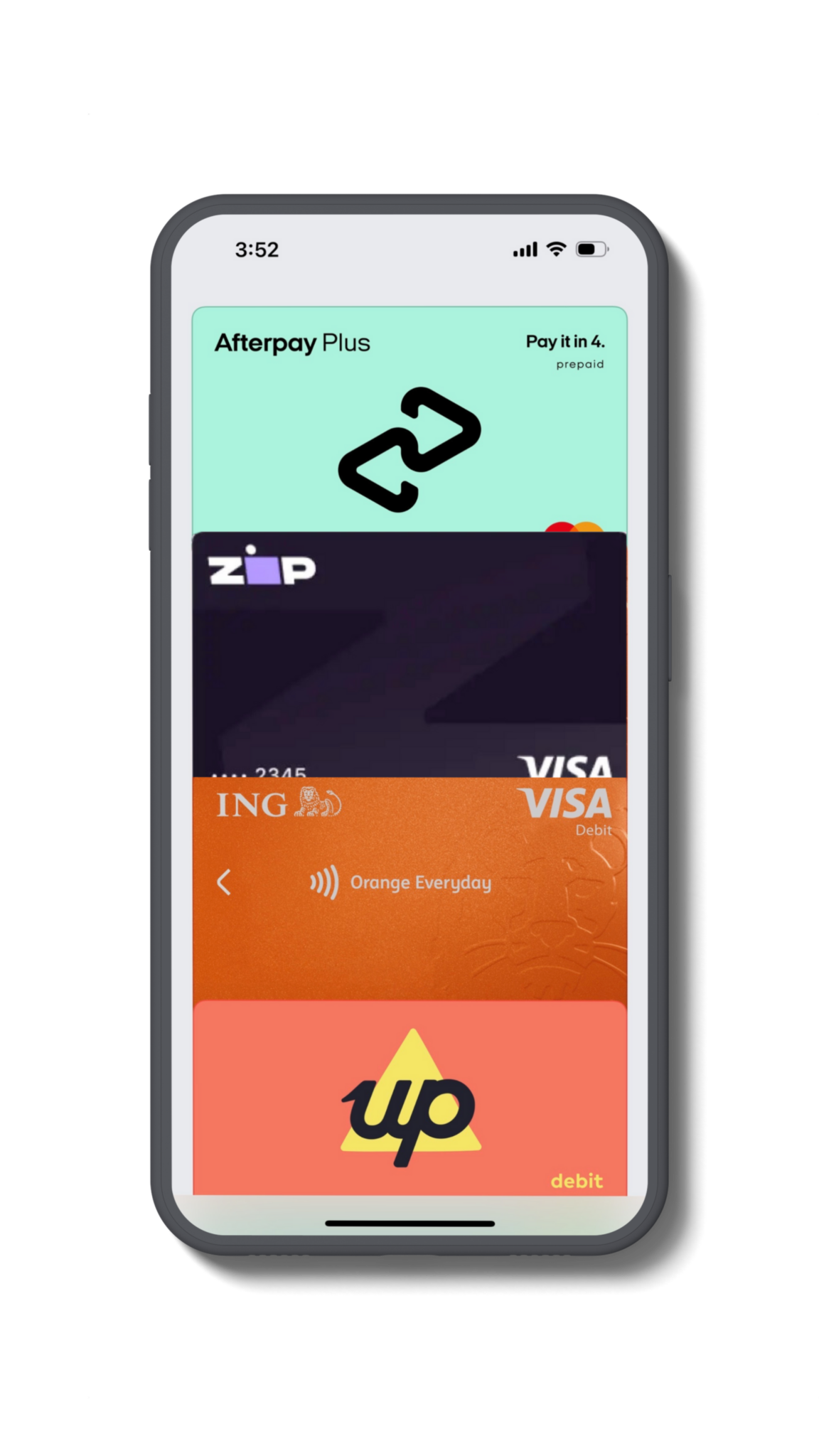

Afterpay Plus

You can conveniently use Afterpay Plus to manage a wide array of bills, including insurance, ATO, school fees, car registration, and countless other expenses.

Zip

Zip brings greater affordability to your life, not only for purchases but also for managing your bills through Sniip. With Zip, you can spread the costs of your expenses over time.

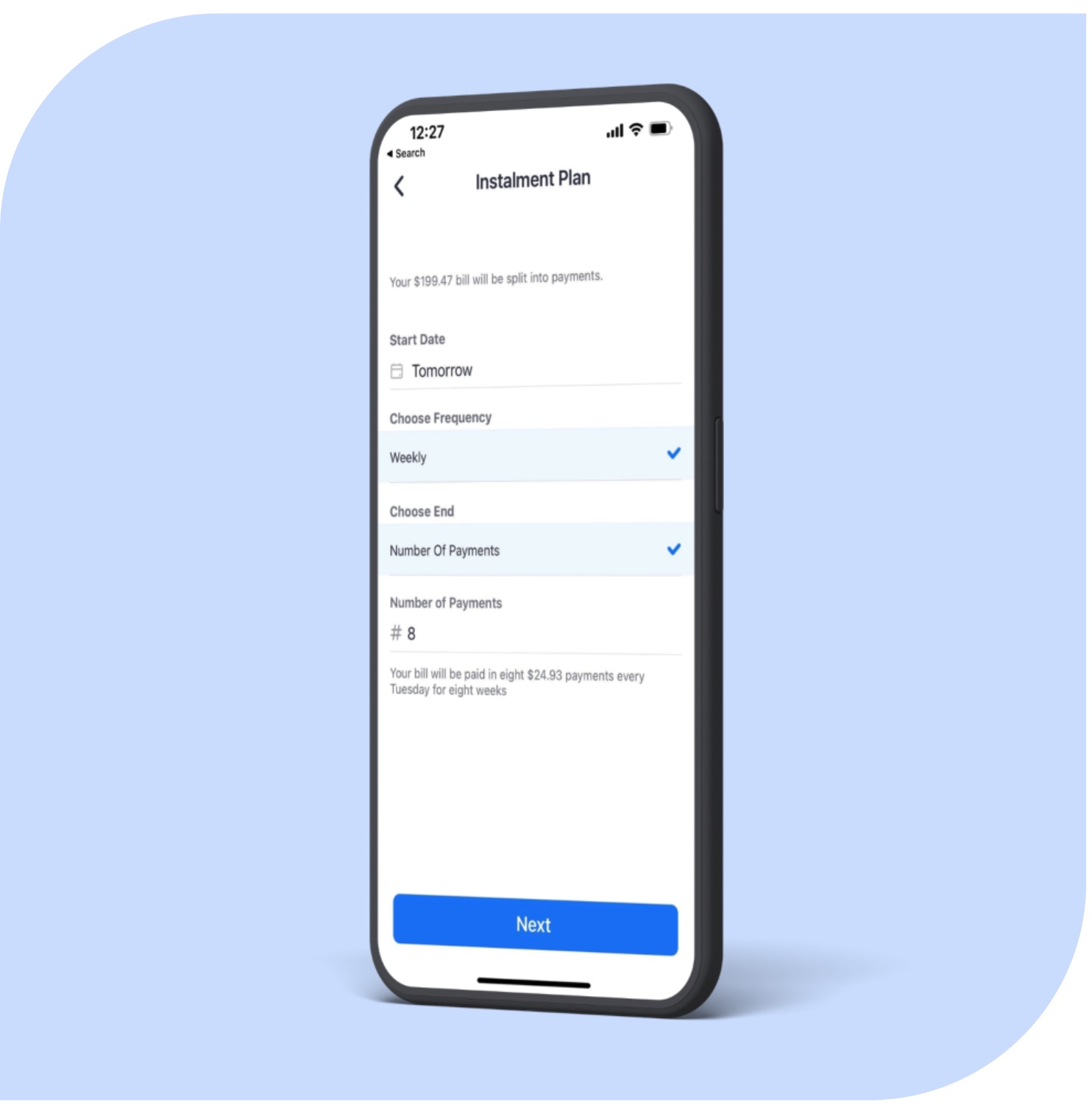

Instalments

In the Sniip app, you have the flexibility to set up an instalment plan, enabling you to proactively chip away at your bill before the due date by making partial payments.

Manage bills easily

Get to know the Sniip interface, created by a Brisbane-based development and design team

1

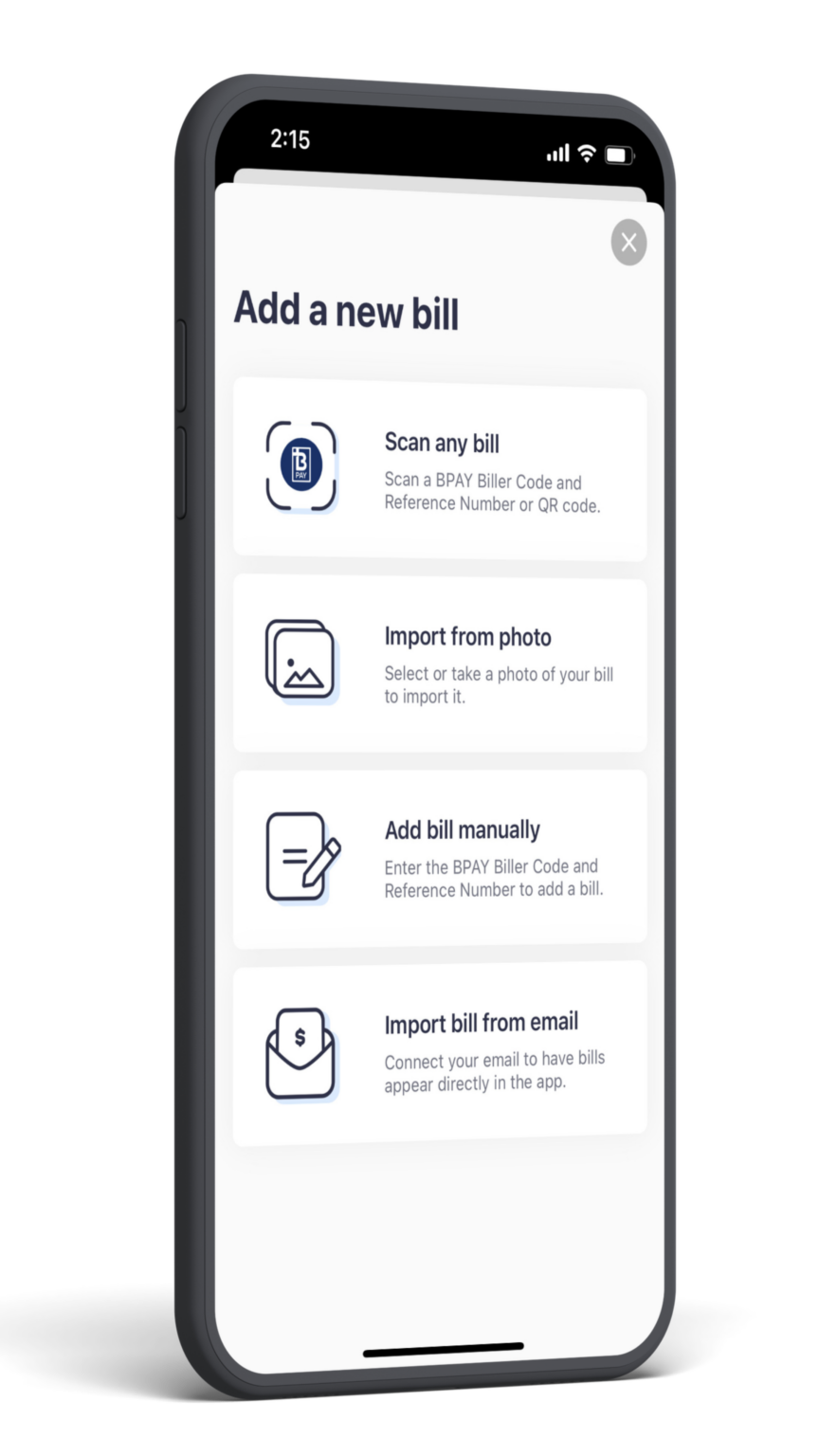

Add your bill to the Sniip app

2

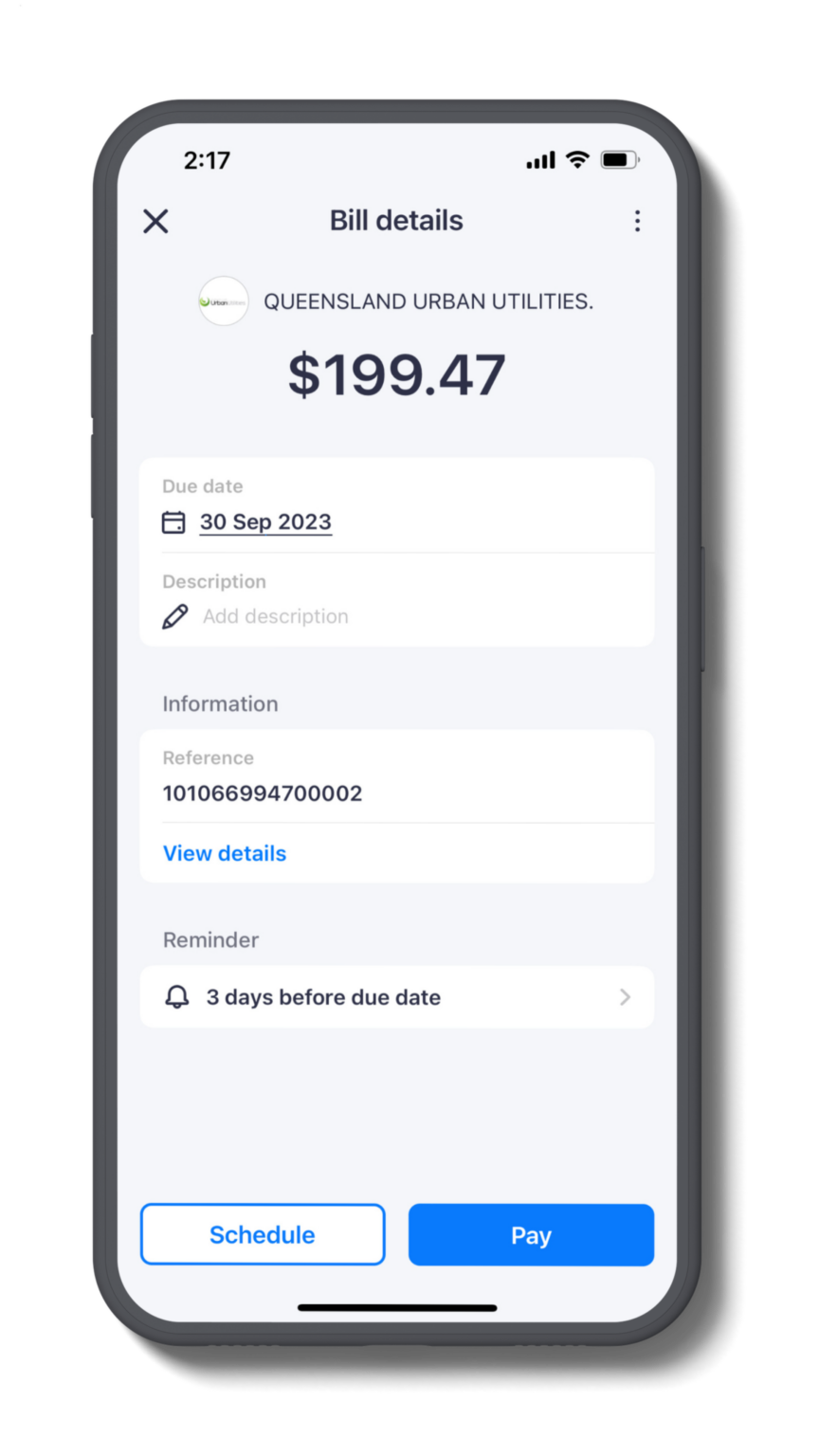

Pay your bill now, or schedule for a future date

3

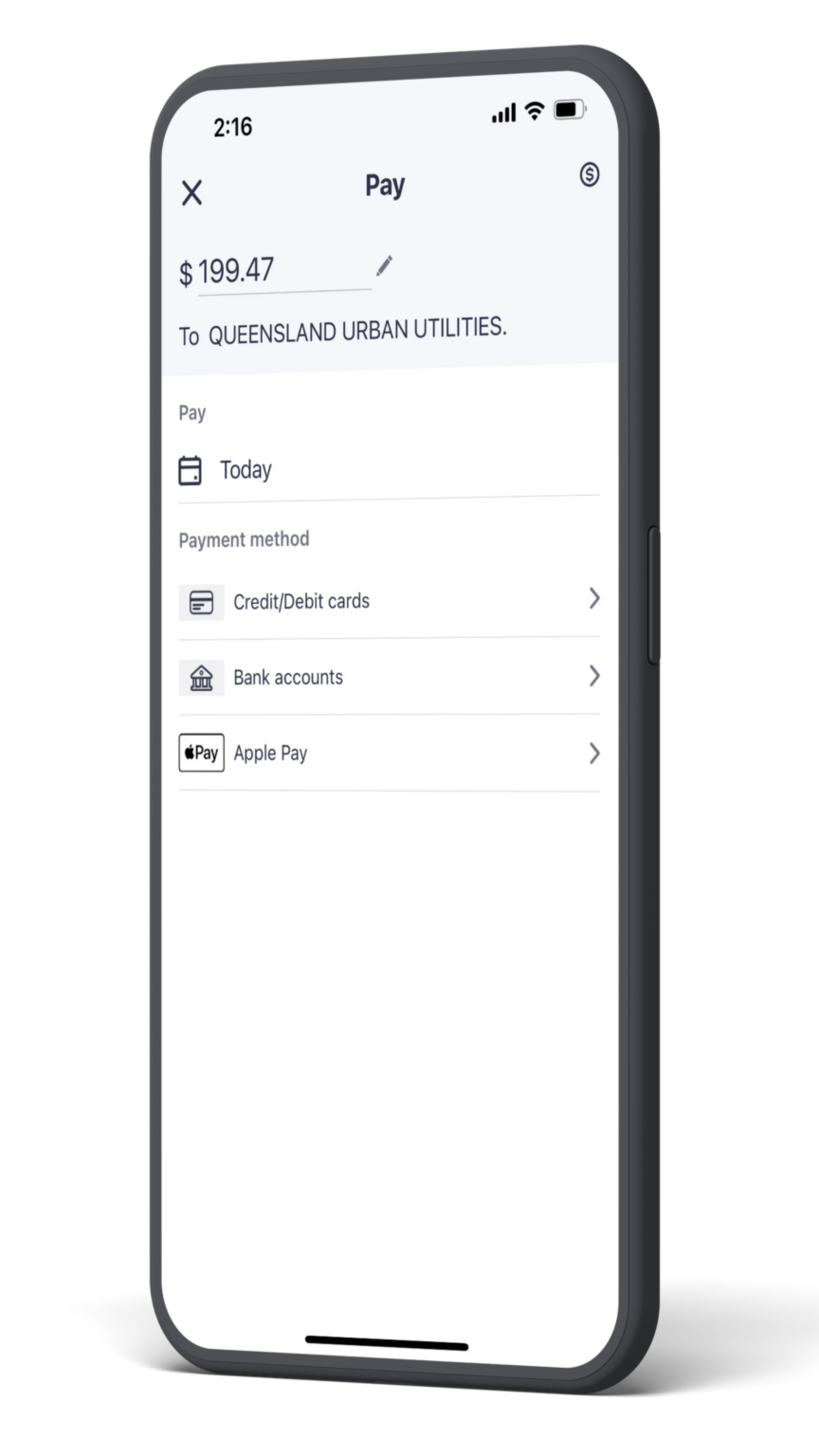

Pay your way – including Apple Pay or Google Pay

What are the benefits?

Paying your bills with Sniip’s Buy Now, Pay Later (BNPL) option offers a host of benefits that redefine bill management:

- No Upfront Costs: Say goodbye to immediate financial strain; with Sniip, you can start your bill payments with $0 upfront or monthly fees.

- Flexibility: Sniip allows you to break down your bills into manageable instalments, so you can align your payments with your financial schedule.

- Improved Budgeting: Sniip’s BNPL feature enhances your budgeting capabilities, making it easier to stay on top of your financial commitments.

- Late Fee Avoidance: By utilising Sniip’s BNPL, you can avoid those pesky late fees.

- Convenient Mobile App: Manage your payments effortlessly through Sniip’s user-friendly mobile app, giving you full control at your fingertips.

- Secure Transactions: Rest assured that your financial information is kept secure with Sniip’s thorough security measures.

Important Info: Sniip Instalment Plans

Pay bills in instalments

If you have the funds ready to pay your bill, this option is perfect for you! In summary, through Sniip’s instalment plan feature, you can pay bills in 4 payments (or more).

The instalment plan must be paid before the bill’s due date. Specifically, Sniip does not offer a financing option to pay your bills.

To create a Sniip instalment plan, simply tap on the bill you wish to pay and tap ‘Schedule’, then tap ‘Create Instalment Plan’. Then, you can then set-up a bill due date and the number of instalments you wish to pay!

Brisbane-based customer support

Have a question or want to get in touch? You can search our extensive Frequently Asked Questions Hub to find your answer. Also, you can chat to our friendly, Brisbane-based customer support team!

Frequently Asked Questions

Pay bills in 4 Australia

Absolutely! You can enjoy the flexibility to pay bills in 4 Australia by using popular services like Afterpay and Zip pay. With the Sniip app, which is tailored to make pay bills in 4 instalments simple, you have the power to manage your bill payments with ease.

Sniip simplifies the entire process, allowing you to spread your bills into smaller instalments, aligning perfectly with the idea to pay bills in 4 payments.

Whether you're dealing with utility bills, rent, or any other payments, Sniip empowers you to take control of your finances by offering this convenient payment method.

Can I pay later bills with Sniip?

Absolutely! With Sniip, you have the convenience to pay later bills. Using Afterpay or Zip pay in conjunction with Sniip, you can split your bills into smaller, interest-free instalments, giving you the flexibility to pay later bills on your terms.

Is there a processing fee?

Paying with the Sniip app is completely free when paying from a bank account.

When using a credit card (Mastercard/Visa) you’ll pay just 1.5% (incl GST) and earn FULL POINTS on your rewards-based card. The rate for personal American Express cards is 1.29% (incl GST).

Buy now pay later bills Australia?

Certainly, in Australia, you have the convenience of managing your bills with popular "buy now, pay later" services like Afterpay and Zip pay. With the Sniip app, which is designed to streamline "buy now, pay later" bills in Australia, you have a powerful tool to handle your financial obligations.

Sniip simplifies the entire process, allowing you to split your bills into smaller, interest-free instalments, perfectly aligning with the "buy now, pay later" bills concept in Australia. Whether you're dealing with utility bills, rent, or any other payments, Sniip empowers you to take control of your finances by offering this convenient payment method.

Is the Sniip processing fee on top of the existing biller fees?

Short answer, no!

Why? You are essentially making a BPAY payment through Sniip.

Your biller receives the funds via BPAY. If there are no additional fees from the biller for making a BPAY payment, the only fee you’ll pay is the Sniip processing fee of 1.29% for Amex Personal and 1.5% for Visa, Mastercard and Diners. Please see our full list of processing fees, here.

Paying from your bank account is 100% free in the Sniip app.

There are no app download fees, subscription fees or other hidden fees in the Sniip app.

If you pay a direct biller utilising the Sniip QR code or the AusPost Barcode, you may incur fees and/or charges imposed by the biller. These payment processing costs may be reflected at the time of making payment, or on your next bill from that biller.

Why does my bill say Biller Under Review/Unavailable?

Each BPAY biller is reviewed by Sniip to ensure it is in a permitted industry. This process is completed within one business day of you adding that biller for the first time into Sniip.

Due to the risk profile of certain billers, Sniip has initially restricted certain sectors.

These categories include:

- Remittance service provider

- Charities and Not-for-Profit

- Intermediaries

- Pay-day lenders

- Internet gambling

- Casinos

- Goods dealers

- Foreign exchange currencies

- Securities and derivatives

- Managed investment schemes

- International business operations

- International students or travel products

- Hiring and leasing

- Banking and financial institutions

If you believe you should be able to pay any of these billers, please contact the Sniip Support Squad or call (07) 3268 7710 and we will evaluate your biller on a case-by-case basis.

Please note: If a biller has been restricted by us, you will receive a ‘blocked biller’ message when you try to process the bill payment.

Will I get a receipt?

Absolutely! After a successful payment you will get a transaction receipt which is stored under the Receipt tab of the Sniip app. This receipt can be emailed to you from the app ready for tax time/account reconciliation. This receipt will show you the processing fee, GST, total amount paid and has our ABN number.

Is there a transaction limit for payments?

Sniip has no transaction limit. There are however, minimum and maximum payment amounts determined by each biller.

If you are making a large payment and are getting a declined message even though you believe you have the funds available to make the payment, we would suggest contacting your financial institution.

If your financial institution identifies a large transaction that seems out of the ordinary, it may be stopped or flagged as fraudulent. Once you contact your bank and explain that you are making a transaction via Sniip they should enable the transaction. If you have any questions or wish to discuss your transaction, please contact the Sniip Support Squad or call (07) 3268 7710.

Can I pay bills in instalments through Sniip?

Sniip provides you with the flexibility to pay your bills with your own money, in instalments, before your bill is due.

The instalment plan must be paid before the bill's due date. Specifically, Sniip does not offer a financing option to pay your bills.

To create a Sniip instalment plan, simply tap on the bill you wish to pay and tap ‘Schedule’, then tap ‘Create Instalment Plan’. You can then set-up a bill due date and the number of instalments you wish to pay.

Also, feel free to contact our friendly customer support team on 07 3268 7710 if you have any questions!

What is Sniip?

Sniip is the easy way to pay!

Sniip is a free mobile app for iOS and Android that allows you to pay your bills, all in the one place. The app supports all payment methods and bank networks, allowing you to pay your bills from one central app. We are a bank and card agnostic, meaning you can pay with whichever card or bank you like, for whichever bill you like, in less than 20 seconds.*

With Sniip you can pay a bill now, schedule a payment for a later date, create recurring payment or connect your email to have all your bills automatically imported into the app for payment.

*Restricted industries apply

How does Sniip work?

Sniip is a payment platform that you can use to pay most BPAY bills. Sniip is bank and card agnostic, meaning you can pay with whichever card or bank you like, for whichever bill you like – even if your biller doesn’t accept that payment method*.

Using Sniip’s scan-to-pay feature, you can turn your paper/ PDF bills into digital bills within the Sniip app and pay them directly from your mobile phone.

Once registered, simply scan the BPAY Biller Code/Sniip QR code and confirm your payment using Touch ID/Face ID or a 4-digit PIN.

Sniip makes paying bills quick, easy and convenient! Learn more, here.

*Restricted/ prohibited industries apply.

How do I pay with Sniip?

Sniip is an app available on the Apple App Store and Google Play Store.

When paying with Sniip, you can use your digital wallets (Apple Pay/ Google Pay) or you can use a bank account, debit, credit, Amex or Diners card.

To do this, tap the top left hand corner menu, and select ‘Payment Methods’. Tap the ‘+’ icon in the top right-hand corner of the screen, and select whether you want to add a debit/credit card or a bank account. Follow the prompts and fill out all the necessary fields.

When making a bill payment Apple Pay/Google Pay is the primary payment method.

To change to a card in your Sniip Wallet, swipe on the Apple Pay logo to select your preferred payment method.

Who can use Sniip?

Everyone! Sniip is for anyone who wants to save time by managing and paying their bills electronically.

Is the Sniip app free?

Yes! Sniip is free to download from the app store.

If you’re making a payment using the circular Sniip QR code, the surcharge (if any) is determined by the biller. These will be displayed to you prior to processing any payment.

If making a payment using the BPAY Biller Code and Reference Number, paying from a bank account is completely free! To see all our processing fees for different payment methods, click here.

Does Sniip have a web portal?

Great question! Currently, Sniip is only available as an app.

We hear you though! Our team is working to develop a web portal which will be available in the future.

In the meantime, you can download Sniip on your mobile device via the Apple App and Google Play stores.

Is the Sniip app secure?

Great question! Absolutely.

Sniip is secure to use. We encrypt and safely store all data and monitor all transactions through our in-house compliance department.

We ensure all payment data entered into a Sniip application or transmitted as part of a transaction is managed with the highest level of security. At Sniip, we’re proud to have achieved full Tier 1, Payment Card Industry Data Security Standard (PCI DSS) compliance — the same standard that Australian banks comply with.

Credit/debit card or bank account information is only sent to verified third parties at the time of payment. Once you make a payment, we require you to verify your identity with your PIN or ID login.

Sniip is trusted Payer Institution Member (PIM) of BPAY.

Is Sniip PCI compliant?

We sure are! At Sniip, we’re proud to be certified Tier 1 Payment Card Industry Data Security Standard (PCI DSS) compliant. This is the same standard that an Australian bank must comply with.

although analogous to

altogether although this may be true

another another key point

basically as a matter of fact

because as a result

before as an illustration

besides as can be seen

but as has been noted

certainly as I have noted

chiefly as I have said

comparatively as I have shown

concurrently as long as

consequently as much as

contrarily as shown above

conversely as soon as

correspondingly as well as

despite at any rate

doubtedly at first

during at last

e.g. at least

earlier at length

emphatically at the present time

equally at the same time

especially at this instant

eventually at this point

although analogous to

altogether although this may be true

another another key point

basically as a matter of fact

because as a result

before as an illustration

besides as can be seen

but as has been noted

certainly as I have noted

chiefly as I have said

comparatively as I have shown

concurrently as long as

consequently as much as

contrarily as shown above

conversely as soon as

correspondingly as well as

despite at any rate

doubtedly at first

during at last

e.g. at least

earlier at length

emphatically at the present time

equally at the same time

especially at this instant

eventually at this point

Paying bills with BNPL? It couldn’t get much easier than this!

Have a question? You can contact Brisbane-based Sniip Support on

(07) 3268 7710.