January’s Top Bills 2025

January’s Top Bills 2025 Explore the top bills Sniip users are paying this month! We’ve sorted them by payment method, so you can easily find

January’s Top Bills 2025 Explore the top bills Sniip users are paying this month! We’ve sorted them by payment method, so you can easily find

Best Christmas Gifts 2024 This is your ultimate guide for the best Christmas Gifts list 2024 Explore our handpicked collection of affordable, high-quality gifts crafted

December’s Top Bills 2024 Discover the most popular bills Sniip users are paying this month! We’ve organized the list by payment method, making it easy

Best Christmas Gifts 2024 This is your ultimate guide for the best Christmas Gifts list 2024 Discover a carefully curated selection of affordable, high-quality gifts

Christmas is coming and here’s 10 surprising bills you can pay with Sniip Plus, use your credit card and you’ll earn points in the process,

November’s Top Bills 2024 Explore the most popular bills Aussies are paying with Sniip this November! We’ve organised the list by payment method, making it

3 Top Tips for Non-BPAY Bills! As the demand for non-BPAY biller requests continues to soar, we’re now receiving hundreds of new additions daily. In

Results Are In: October’s Top Bills Revealed! Check out the top bills users are paying with Sniip this month! We’ve segmented the list by payment

Your easy guide to Sniip’s Fast Five for this month. 1. Can you use Sniip to pay to a bank account? Absolutely! This is one

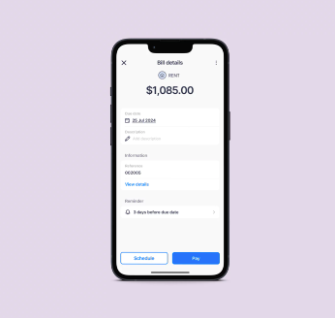

Rent, Rates and Running Costs Paying bills is a necessary but often tedious part of managing your finances. Sniip is here to simplify this process