ATO Credit Card Payment

Learn how to earn your full point allocation, receive full points on the processing fee, and pay your tax bills off in partial instalments.

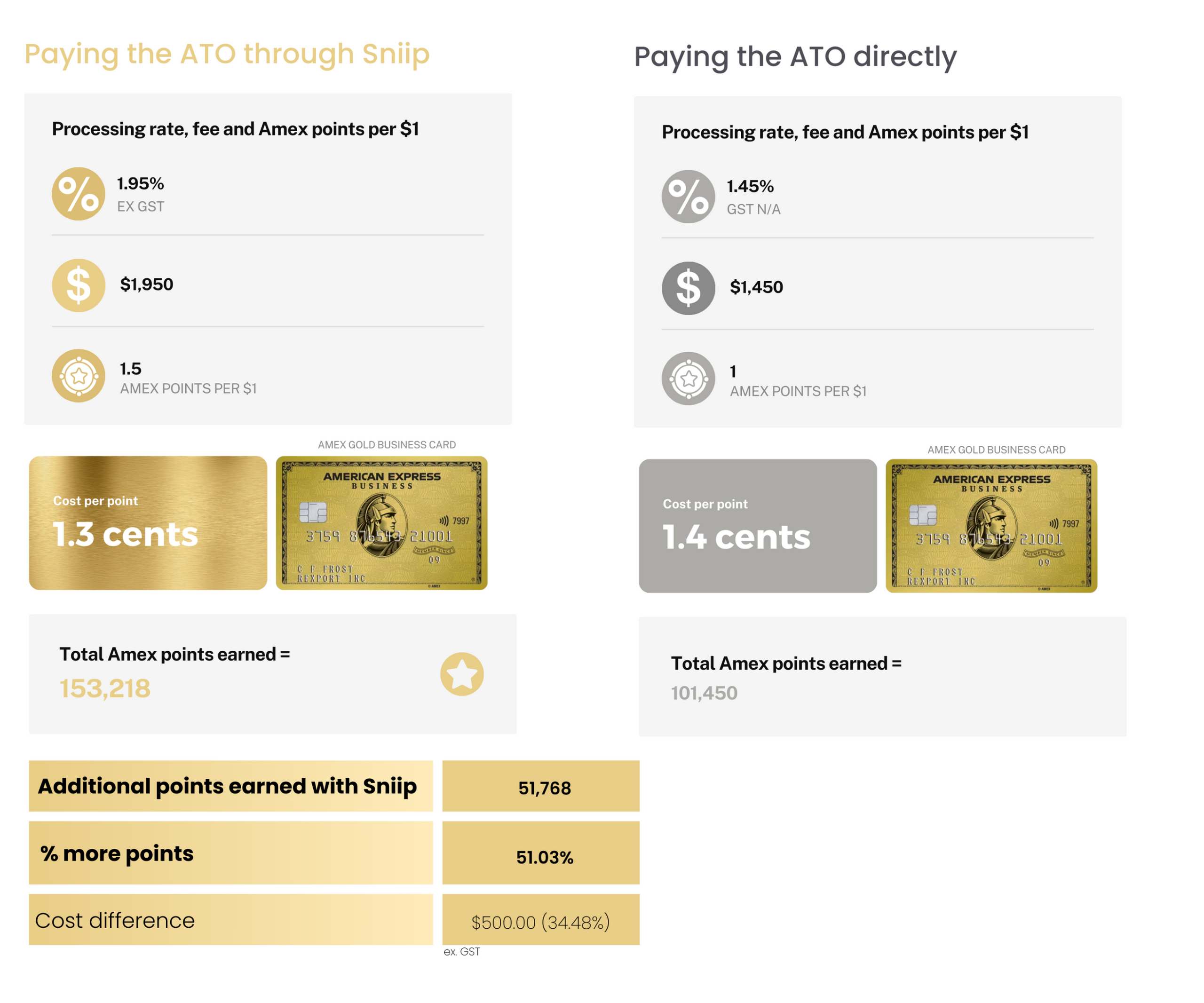

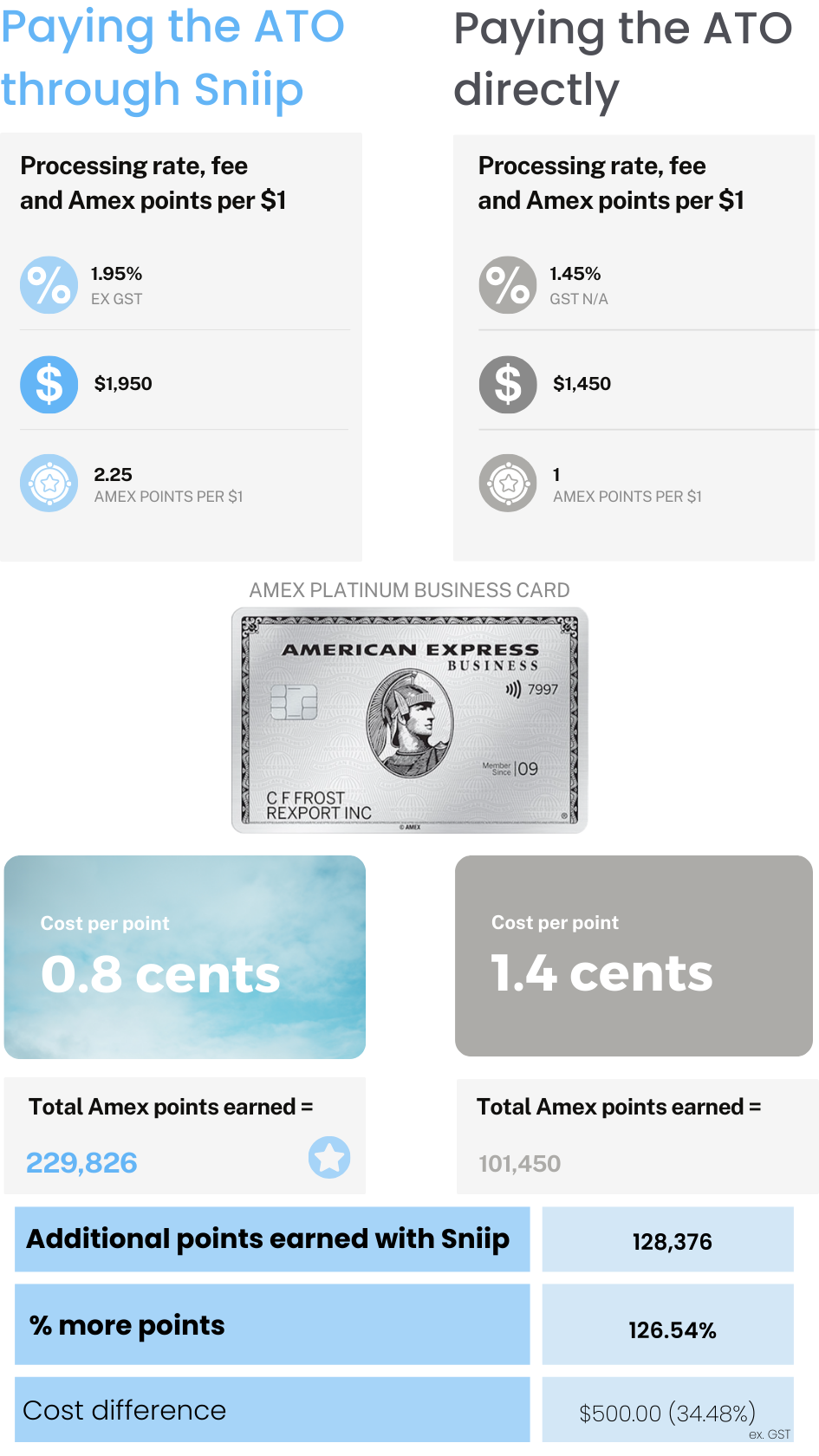

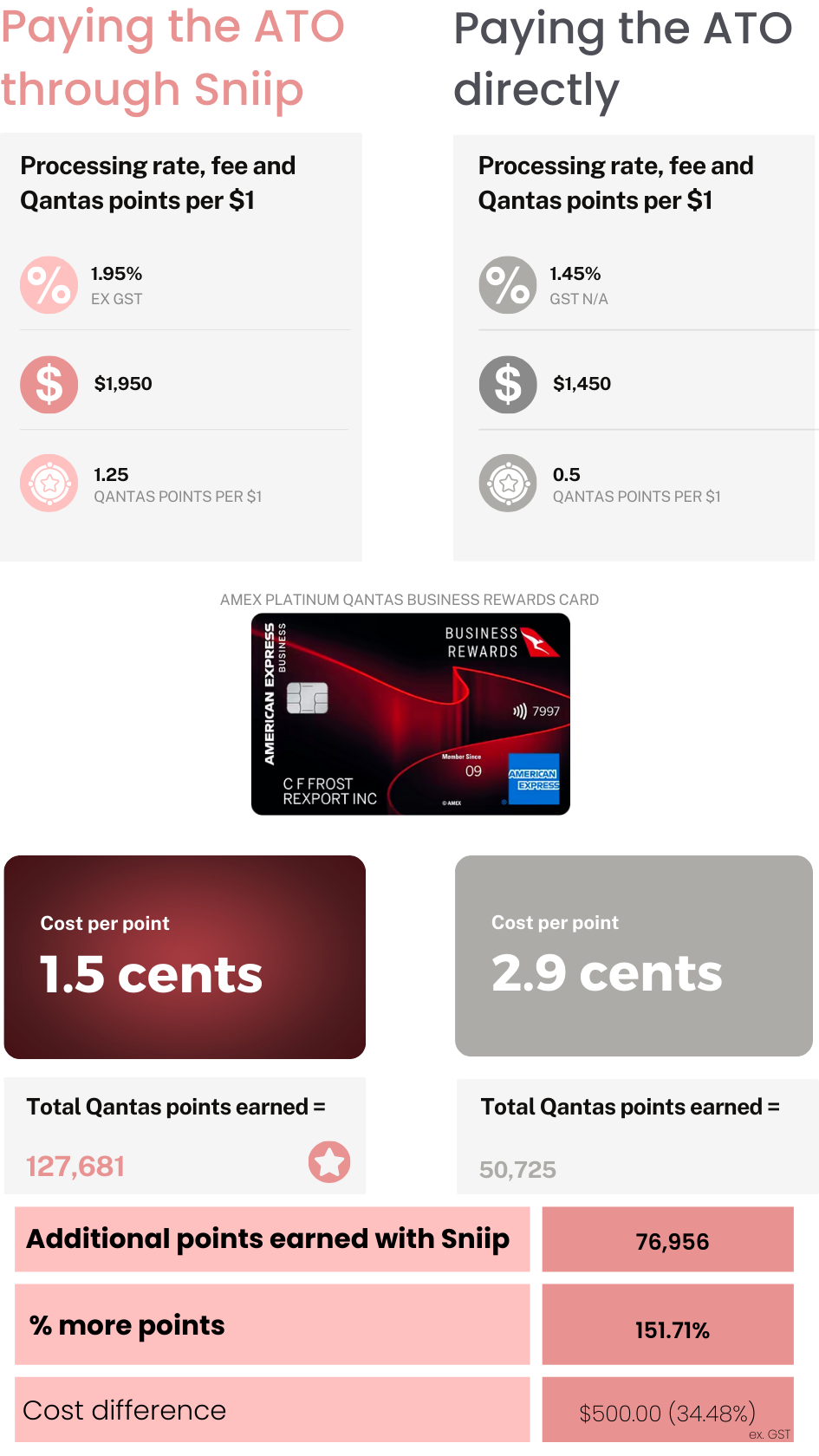

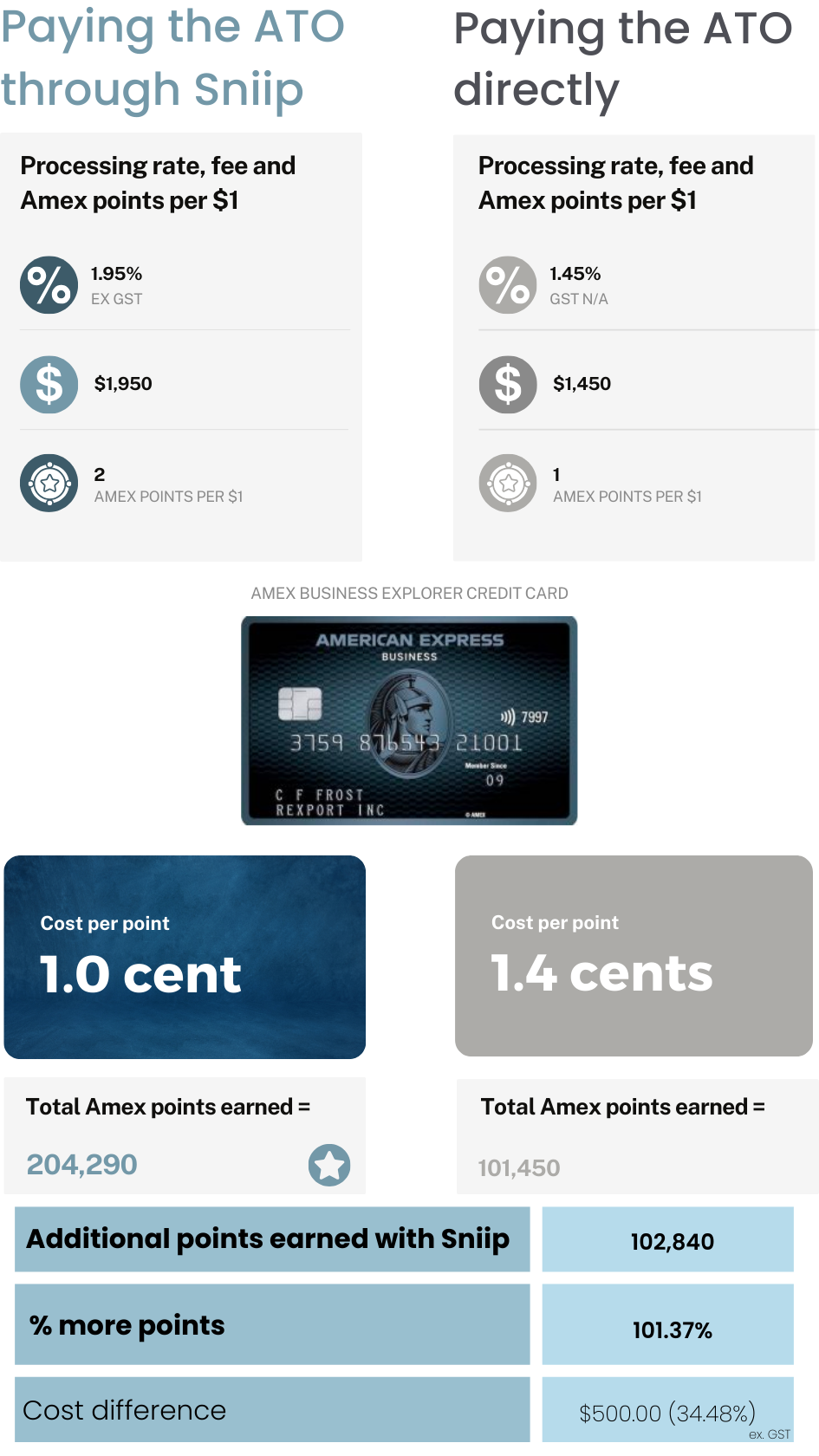

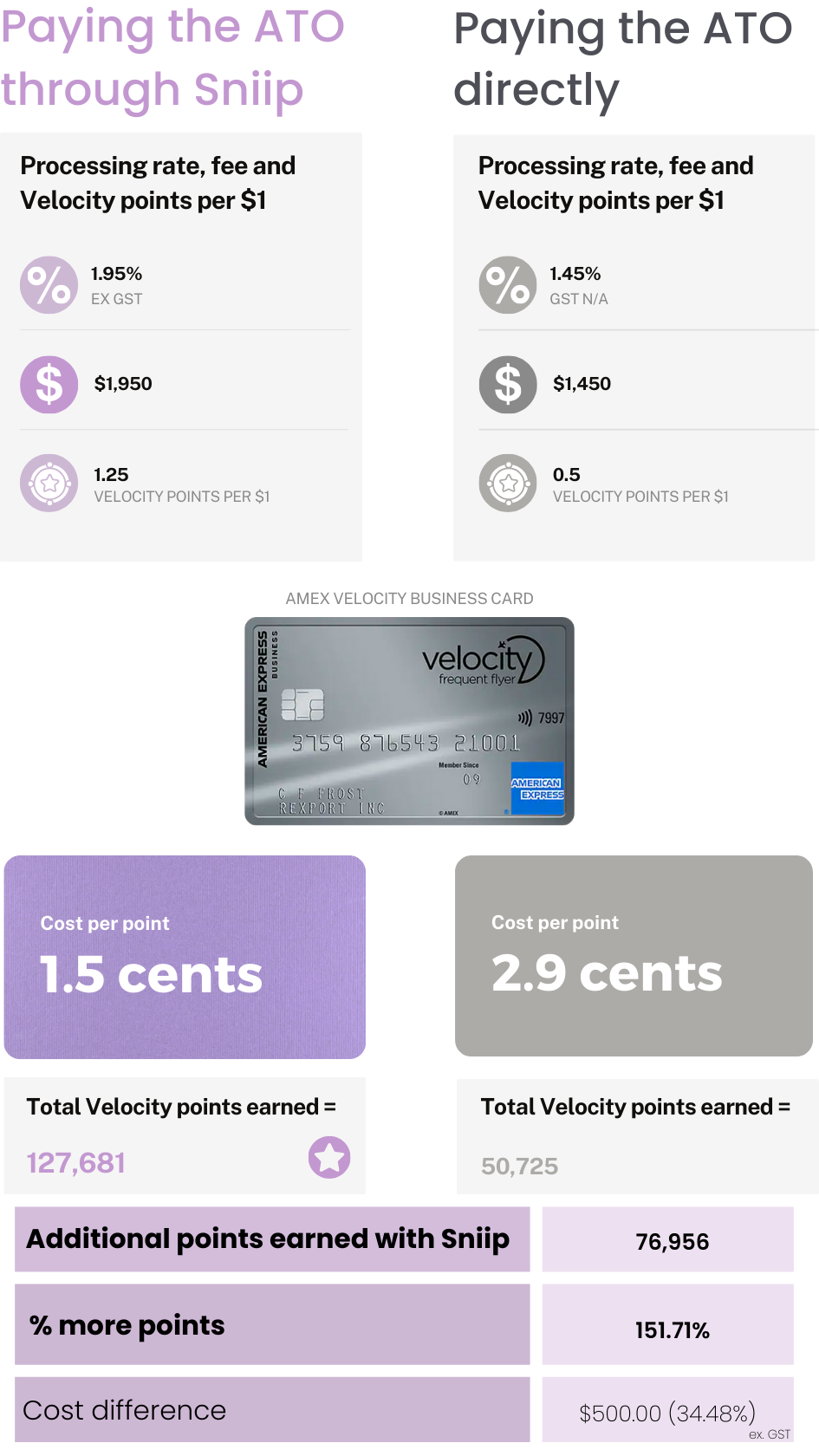

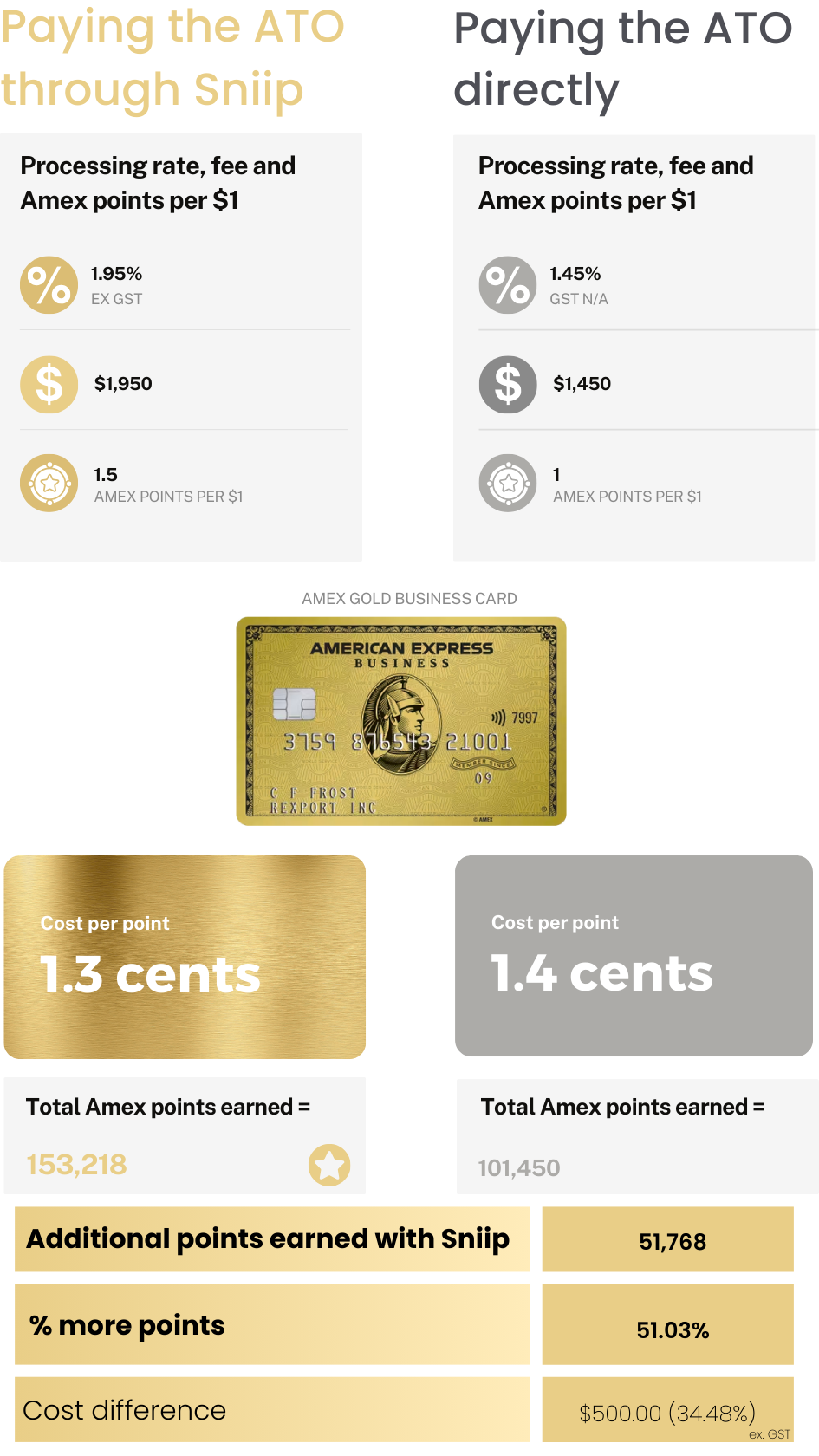

Sniip vs ATO Direct Payment

In the realm of tax payments, efficiency and value are paramount. In this comparison, we delve into the intricacies of processing rates, fees, cost per point, and total points earned when making payments to the Australian Taxation Office (ATO) through Sniip versus opting for direct ATO payments.

Normally, when you pay the ATO with a rewards credit card, you earn capped or zero credit card reward points. However with the Sniip app, you earn full, uncapped reward points on every single transaction.

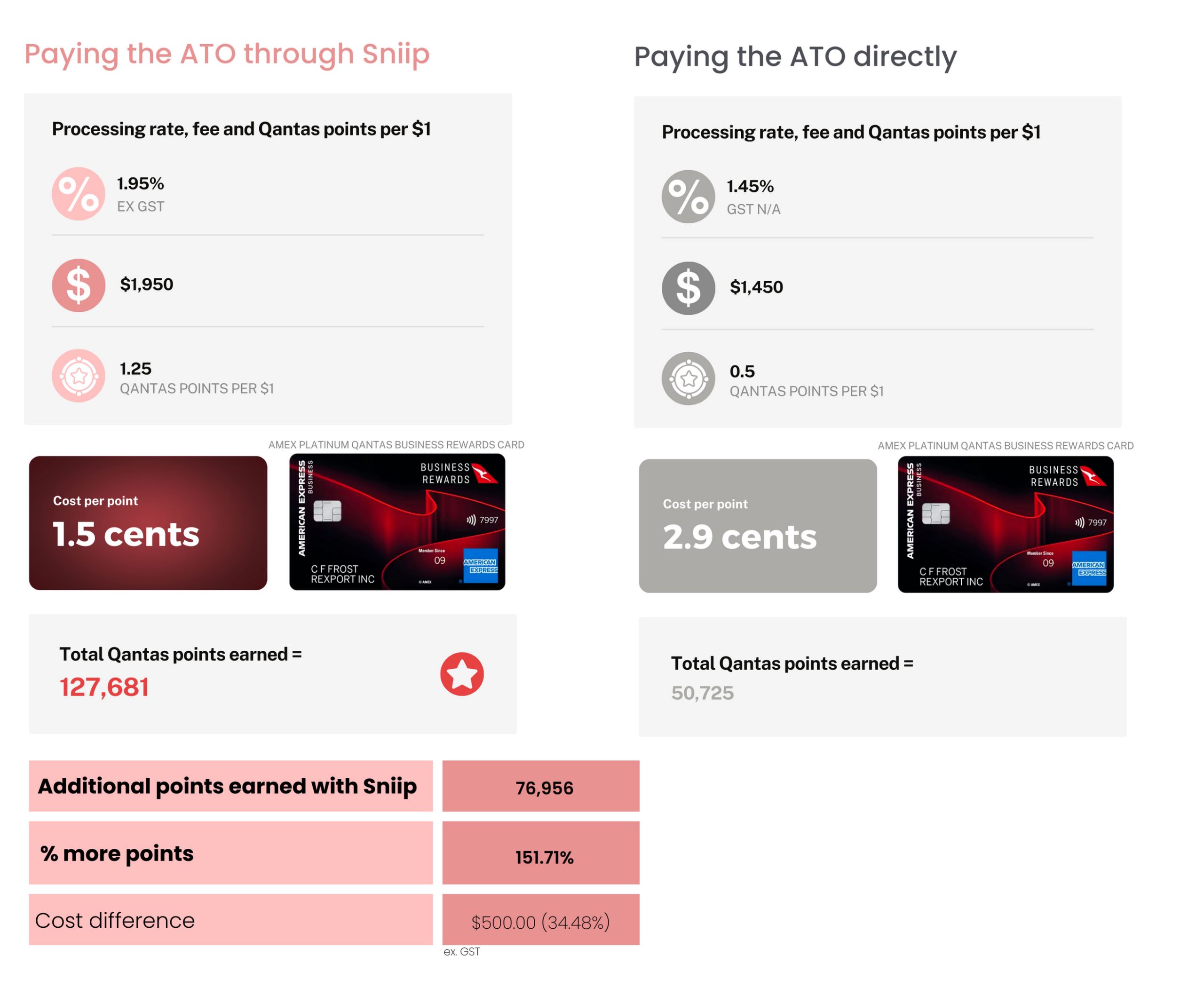

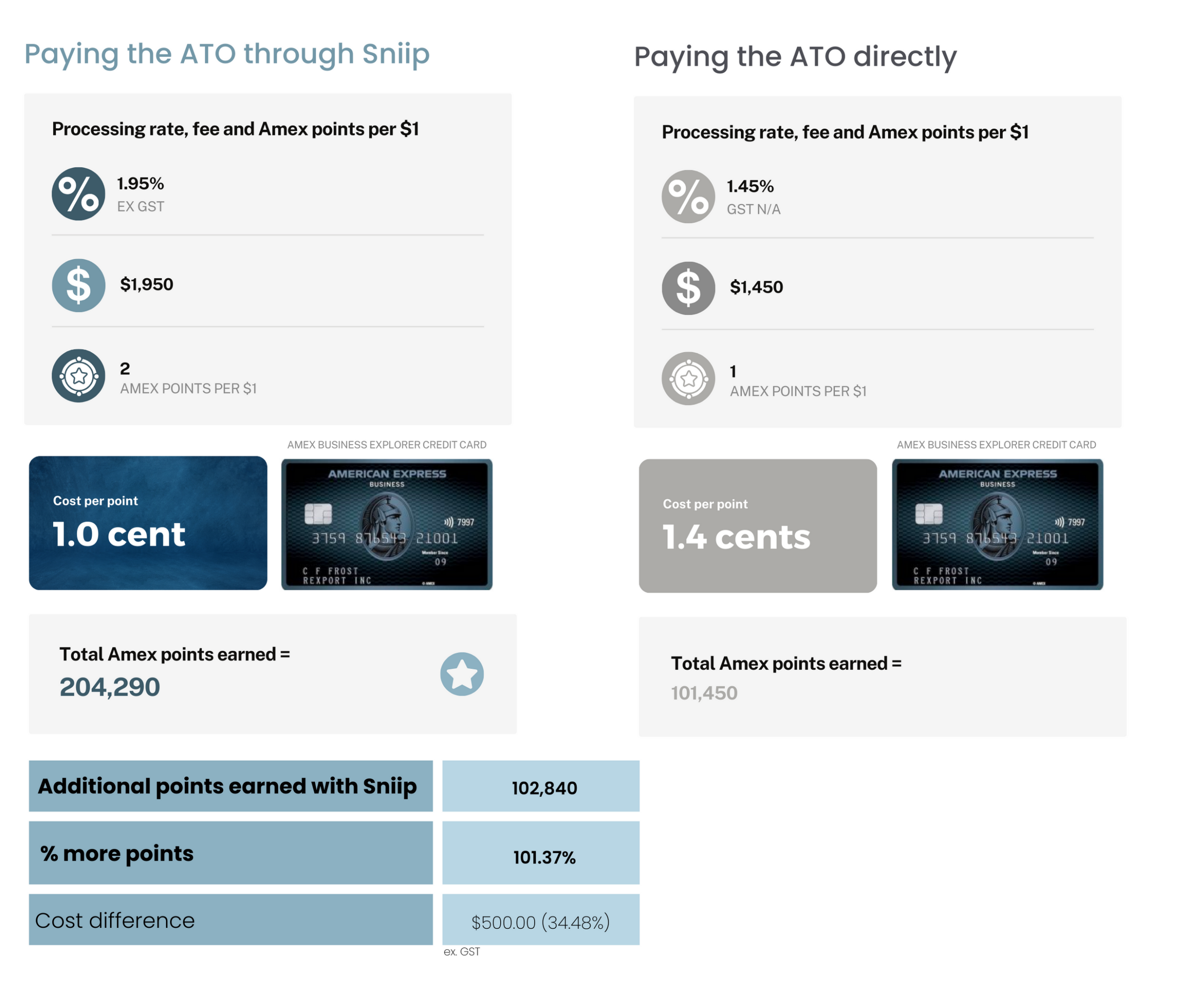

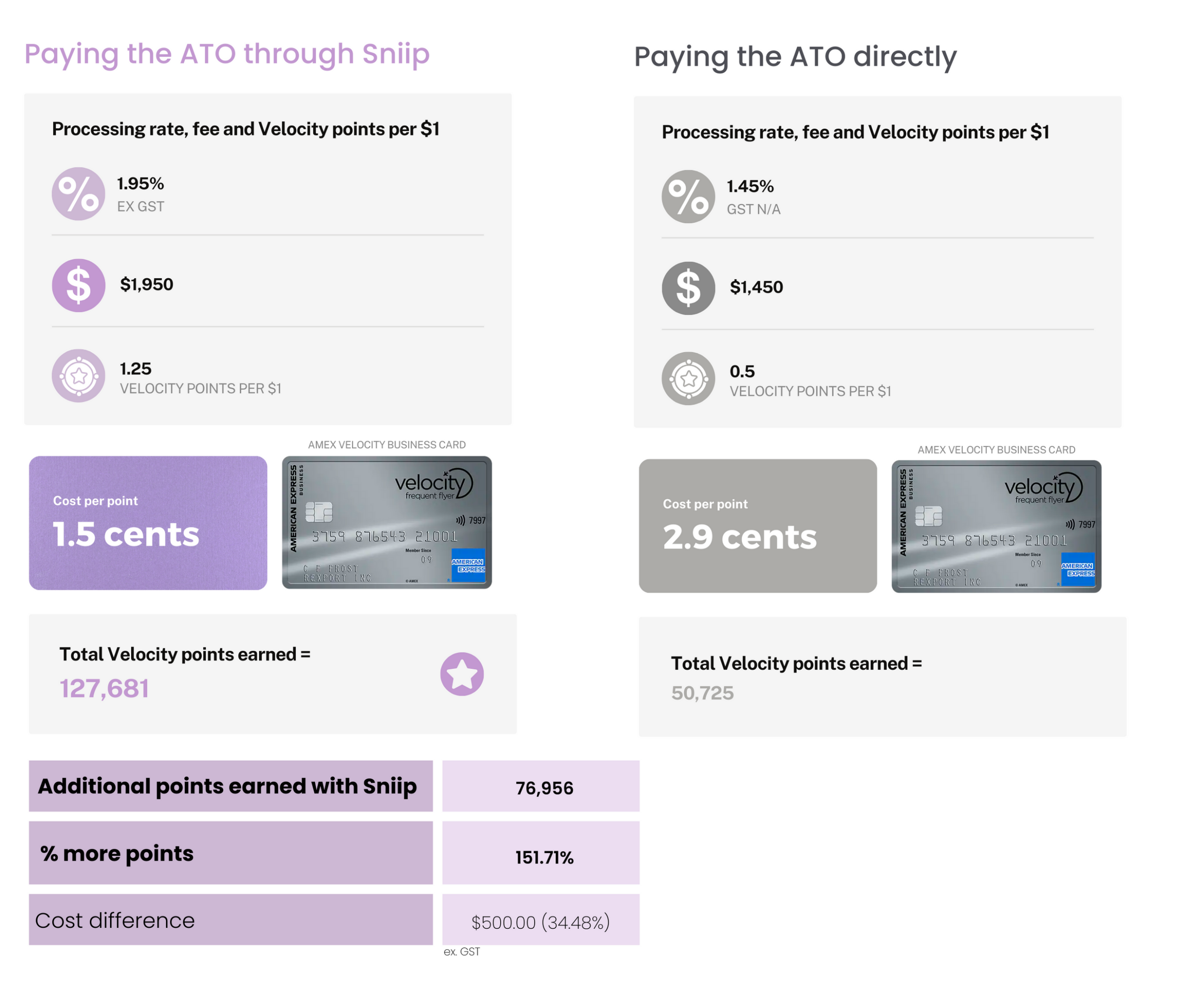

Sniip stands as the frontrunner for making payments to the Australian Taxation Office (ATO), regardless of the type of American Express (AMEX) card you possess. Sniip consistently outshines direct ATO payments by offering a low-cost, high-value option and allowing you to earn full credit card points.

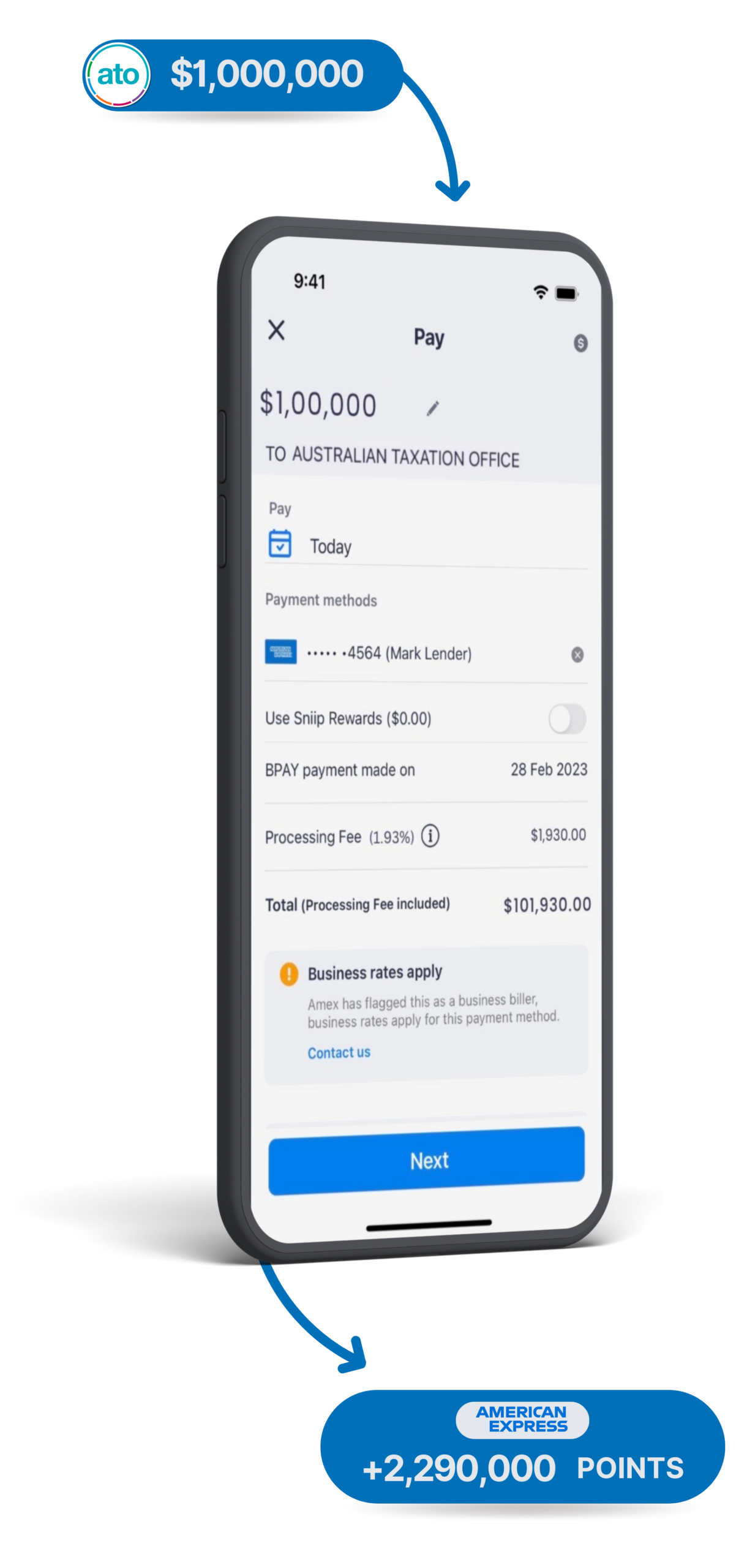

Making a $100,000 ATO Payment

Please note: These calculations are indicative only and Sniip is not providing advice. Use the information provided here as a guide only.

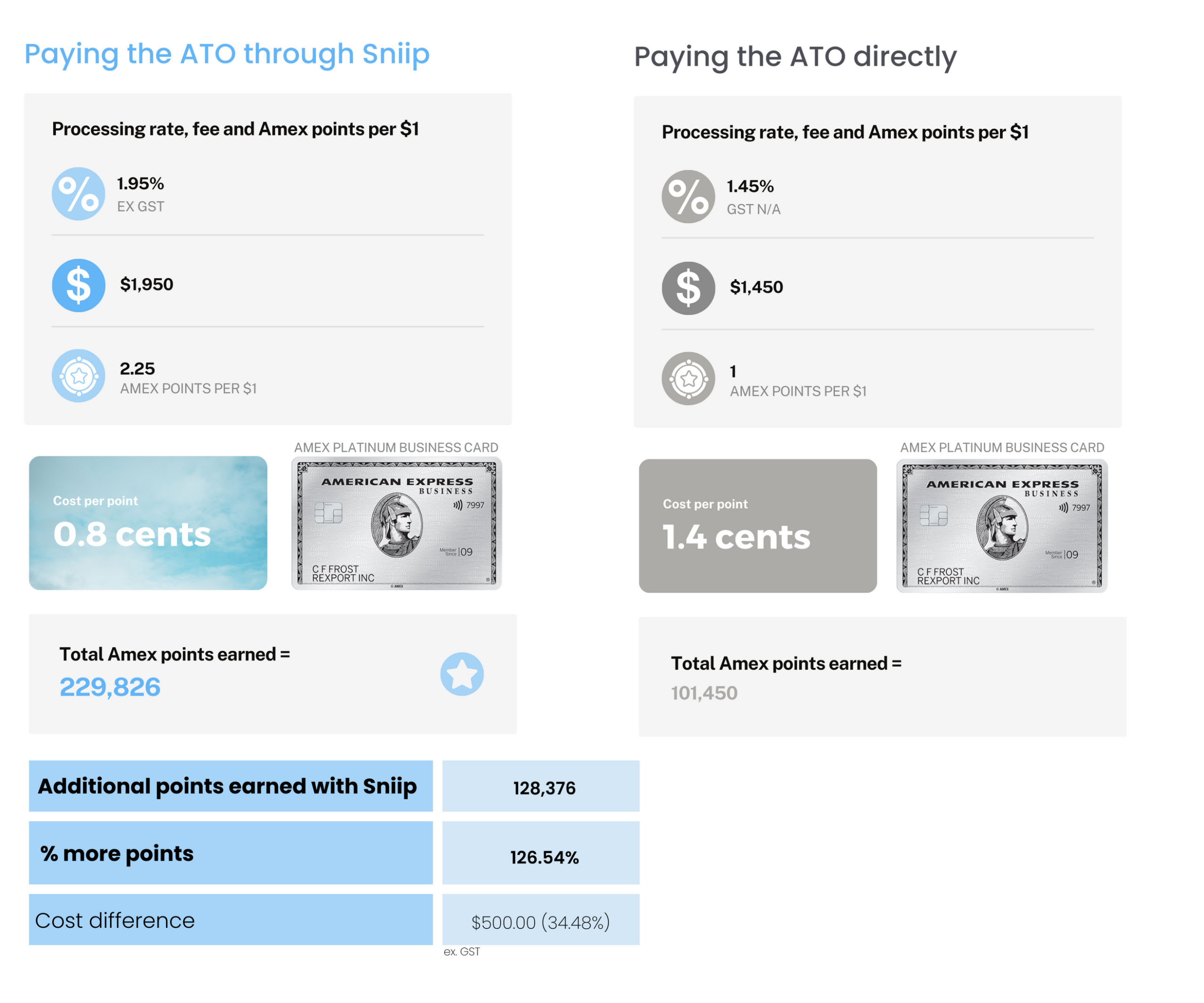

The above calculations are based on a corporate American Express card earning 2.25 points per $1 spent (1 point per $1 spent on government spend).

Please refer to the Amex website for the most accurate information or contact Amex directly.

Cost difference excludes GST.

Points Calculator

Calculate how many points you'll earn on payments through Sniip*

*All ATO/superannuation/business payments (personal/business/corporate) are required to be processed at our business rates (tiered from 1.75%) on Personal Amex cards. Please select ‘ATO’ as the payment type for ATO payments.

Payment amount

1

1

1

Select your payment method

Velocity Platinum Amex Card

Velocity Platinum Amex Card

Explorer Amex Card

Platinum Amex Card

Qantas Amex Ultimate Card

Qantas Amex Premium Card

David Jones Amex Platinum Card

David Jones Amex Card

Qantas Amex Discovery Card

Macquarie Bank Black Card

Velocity Escape Amex Card

Essential Amex Card

Centurion Amex Card

Diners Club International Card

Citi Premier Qantas Credit Card

ANZ Frequent Flyer Black Credit Card

Nab Rewards Visa

Citi Prestige Mastercard

Velocity Platinum Amex Card

Velocity Platinum Amex Card

Explorer Amex Card

Platinum Amex Card

Qantas Amex Ultimate Card

Qantas Amex Premium Card

David Jones Amex Platinum Card

David Jones Amex Card

Qantas Amex Discovery Card

Macquarie Bank Black Card

Velocity Escape Amex Card

Essential Amex Card

Centurion Amex Card

Diners Club International Card

Citi Premier Qantas Credit Card

ANZ Frequent Flyer Black Credit Card

Nab Rewards Visa

Citi Prestige Mastercard

Total points earned#

12,661

Velocity Points

Payment amount

$10,000

Processing fee (incl GST)

$129.00

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

Velocity Points

Payment amount

$10,000

Processing fee (incl GST)

$129.00

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

$10,000

Processing fee (incl GST)

$129.00

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

$129.00

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

Total

$10,129.00

Assumes points earn based on 1.25 point/s per dollar spent.

Assumes points earn based on 1.25 point/s per dollar spent.

This calculator is provided as a guide only, please refer to your credit card provider for the most up-to-date information. Please note: The above calculator is not an exhaustive list of the credit cards available to use with Sniip. Sniip accepts all payment methods and credit cards, including American Express, Visa, Mastercard, Citibank and Diner’s Club cards. Please email customercare@sniip.com if you would like to add a card to the calculator.

pay ato with credit card

ATO payments with a credit card through Sniip

Business ATO Payments with an Amex

Paying the ATO through Sniip is the best and most rewarding way to pay the ATO.

In particular, you’ll earn full Amex points on your entire payment (including the processing fee) + 1 Velocity Point per $10 on all transactions.

Personal ATO Payments with an Amex

All American Express payments to the ATO (personal/business/corporate) are required to be processed at our business rates – the best fees in market. In detail, you can learn more here.

All things considered, with the ability to earn full Amex points on your entire transaction amount (including the processing fee) + 1 Velocity Point per $10, Sniip remains the most cost effective and rewarding way to make your personal ATO payments.

Sniip Amex Rates Breakdown

Personal - Business - Corporate

Pay one processing fee only. Zero sign up or subscription fees. No hidden costs.

1. Example with Amex Platinum Card:

Payment amount: $20 000

Processing fee: $438

Points earned: 45,985

Cost per point: $0.009

2. Example with Amex Platinum Card:

Payment amount: $100,000

Processing fee: $2,150

Points earned: 229,837

Cost per point: $0.009

3. Example with Amex Platinum Card:

Payment amount: $300,000

Processing fee: $6,270

Points earned: 689,107

Cost per point: $0.009

4. Example with Amex Platinum Card:

Amex Platinum Card

Payment amount: $500,000

Processing fee: $10,200

Points earned: 1,147,950

Cost per point: $0.009

5. Example with Amex Platinum Card:

Amex Platinum Card

Payment amount: $1,000,000

Processing fee: $19,300

Points earned: 2,293,425

Cost per point: $0.009

Earn full points... but how?

Sniip processes your payments as a two-legged transaction.

- You pay into the Sniip Trust Account

- The Sniip Trust Account pays the ATO on your behalf

PAYMENT INTO TRUST

All transactions are paid into a Sniip trust account and your bill payment is made the same day we receive your funds – we do not hold onto your funds. Thus, the payment that you make to us will appear on your statement as ‘Sniip Ltd’.

EARN FULL POINTS

When you use a rewards credit card, you will earn full points on the first leg of the transaction (payment into the Sniip Trust account). Following this, Sniip will make payments via BPAY on the second leg of the transaction and this utilises the BPAY Scheme.

This process allows you to earn full points on all of your bills.

Make your ATO payments more rewarding

American Express

- Earn up to 127,600+ Qantas Points or 229,800+ Amex Membership Points on a $100,000 ATO payment.

- In addition to full membership points, earn bonus Velocity Points on all ATO payments.

- Receive tiered processing fee rates.

Diners Club International

Do you have a Diners Club International card? Through Sniip, you can earn up to 101,000+ Membership Points on a $100 000 ATO payment.

VISA

Earn up to 101,000+ Membership Points on a $100 000 ATO payment with your VISA rewards earning credit card.

Mastercard

Want to maximise your Mastercard Membership Points? You’ll earn up to 101,000+ Membership Points on a $100 000 ATO payment through Sniip.

Pay the ATO through Sniip

Step 1

Log into your Sniip account and tap the ‘+’ button in the top right corner to import a bill. Following, there are five ways you can import your bill into the Sniip app.

Step 2

Once your bill is imported, locate your bill in the ‘To Pay’ tab and import it. At this point, you can choose to ‘Pay’ or ‘Schedule’ your ATO payment.

If you wish to schedule your payment for a later date, or pay your bill in instalments, select ‘Schedule’ and follow the prompts.

On the other hand, to pay your bill now, tap ‘Pay’, and select the day* you wish to pay your bill and the payment method.

*Please note, funds take 1 (one) business day to land in the Sniip Trust account, so we always recommend setting your payment date to 1-2 business days before your due date.

Tap ‘Next’.

Step 3

Lastly, fill in your CVV number and tap the ‘Confirm’ button.

Enter your Sniip pin code as the final security step to make your payment.

All done! Your ATO bill is on the way to getting paid.

You can also pay the ATO in partial payments!

Voluntary Student Loan Repayments

voluntary repayments hecs

for example,

voluntary hecs repayments

to calrify,

hecs voluntary repayment

above all,

hecs debt repayments

therefore,

how to pay off hecs debt early

for instance

indeed even so

instead even though

last first thing to remember

later for fear that

lest for instance

likewise for one thing

markedly for that reason

meanwhile for the most part

moreover for the purpose of

nevertheless for the same reason

nonetheless for this purpose

nor for this reason

notwithstanding from time to time

obviously given that

occasionally given these points

otherwise important to realize

once once in a while

overall in a word

particularly in addition

presently in another case

previously in any case

rather in any event

regardless in brief

secondly in case

shortly in conclusion

significantly in contrast

similarly in detail

simultaneously in due time

since in effect

so in either case

soon in essence

specifically in fact

still in general

straightaway in light of

subsequently in like fashion

surely in like manner

surprisingly in order that

thereafter in particular

thereupon in short

thirdly in similar fashion

though in spite of

thus in sum

till in summary

undeniably in that case

undoubtedly in the event that

unless in the final analysis

unlike in the first place

unquestionably in the fourth place

until in the hope that

when in the light of

whenever in the long run

in the second place

whereas in the meantime

in this case

while in the same fashion

in the same way

most compelling evidence

must be remembered

not to mention

now that

of course

on account of

only if

owing to

point often overlooked

prior to

therefore

however

above all

in this case

following

therefore

but

Voluntary Student Loan Repayments

With increasing inflation, it is ideal to make early voluntary contributions to your HECS/HELP debt if you can afford to do so. In particular, the expected increase in indexation by over 7% from 1 June 2023 will sky rocket the amount of interest students and graduates have to pay on their loans.

With this in mind, Sniip allows you to easily and conveniently pay the ATO using any payment method you wish, and credit cards earn uncapped points. For example, through Sniip, you can set up recurring payments, or complete a payment in partial payments.

Join the Sniip Community!

Discover convenience, connection and community as you navigate bill payments effortlessly with Sniip. Join us today and be a part of something that’ll make you wonder why you ever paid bills differently!

ato credit card payment

Want to chat?

Book a demo with our friendly Support Squad and get all of your questions answered!

although analogous to

altogether although this may be true

another another key point

basically as a matter of fact

because as a result

before as an illustration

besides as can be seen

but as has been noted

certainly as I have noted

chiefly as I have said

Therefore, as a result, so, consequently, but, however, on the other hand