Rent, Rates and Running Costs

Rent, Rates and Running Costs

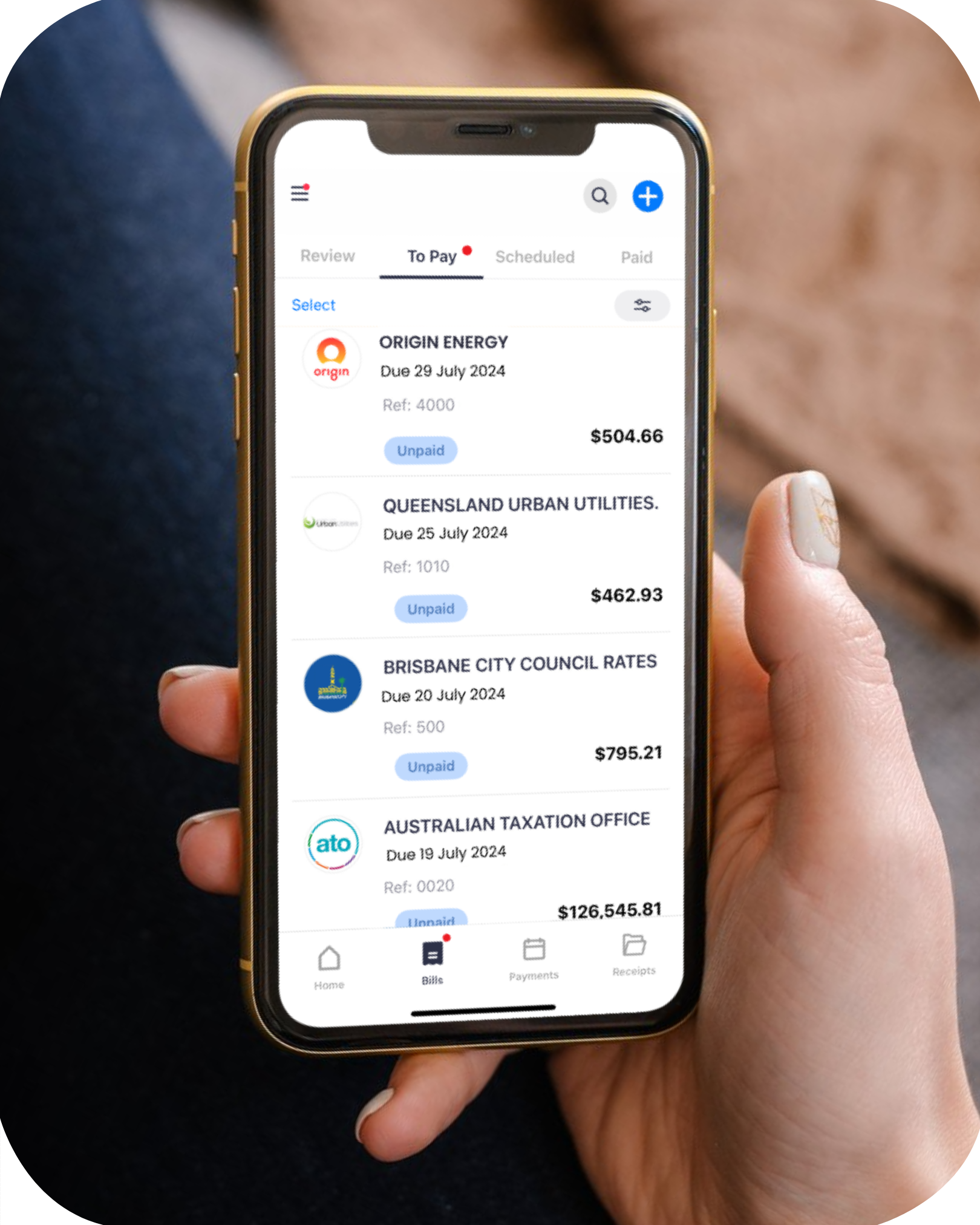

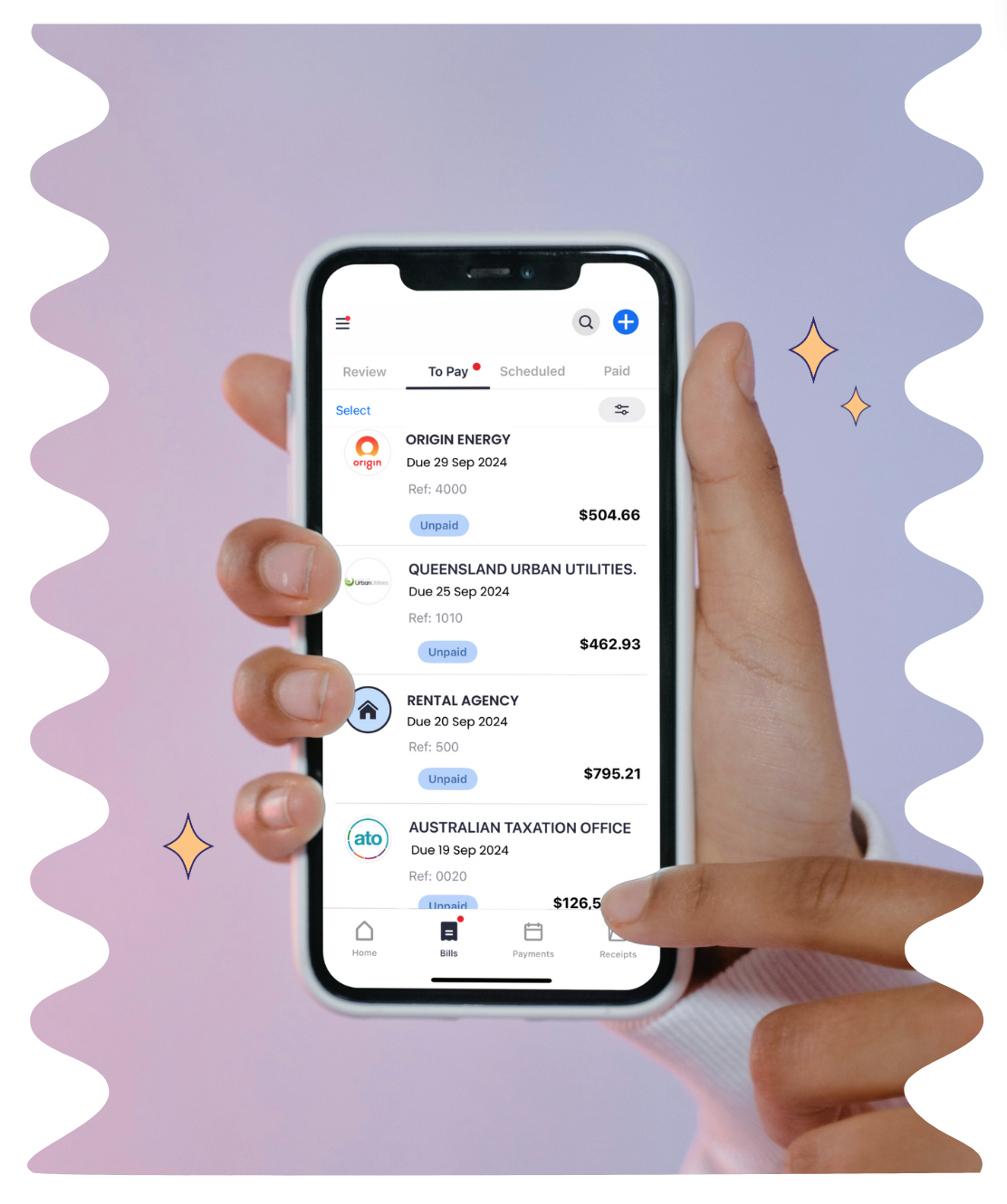

Paying bills is a necessary but often tedious part of managing your finances. Sniip is here to simplify this process – offering a seamless way to pay rent, rates, and various running costs directly from the one app.

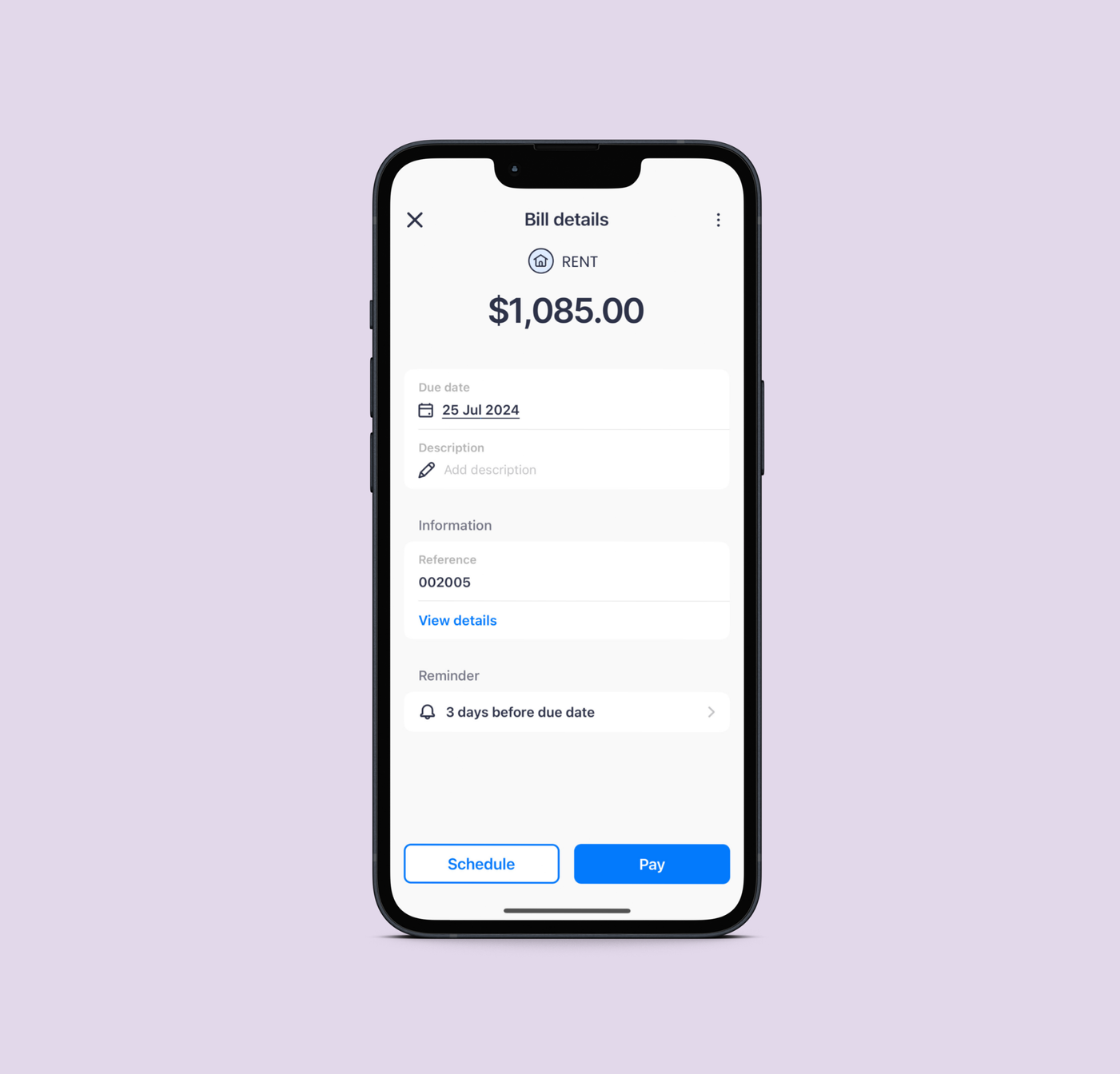

Rent payments

Paying rent is now easier than ever with Sniip. To get started, email your lease agreement and/or receipt to rent@sniip.com.

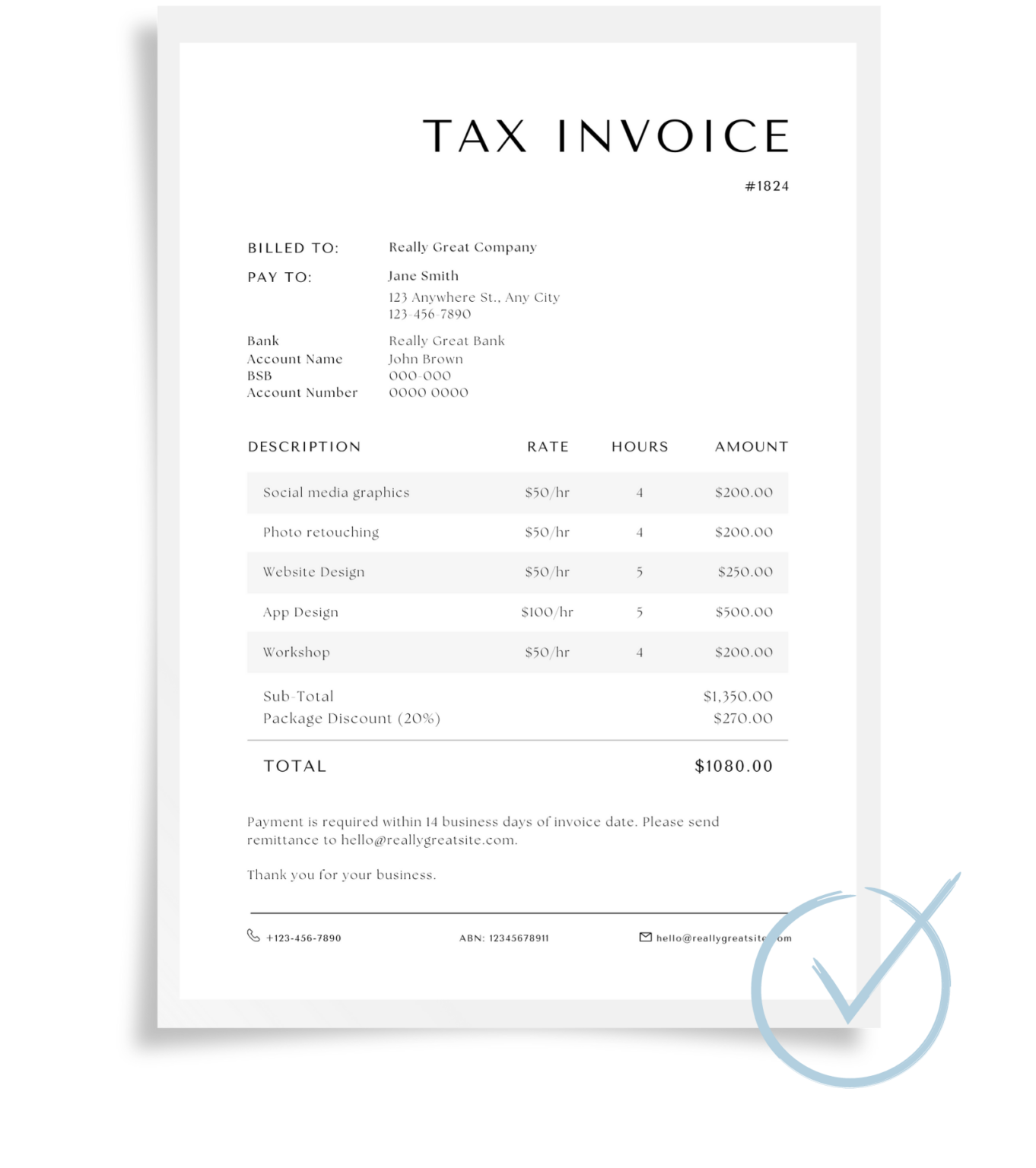

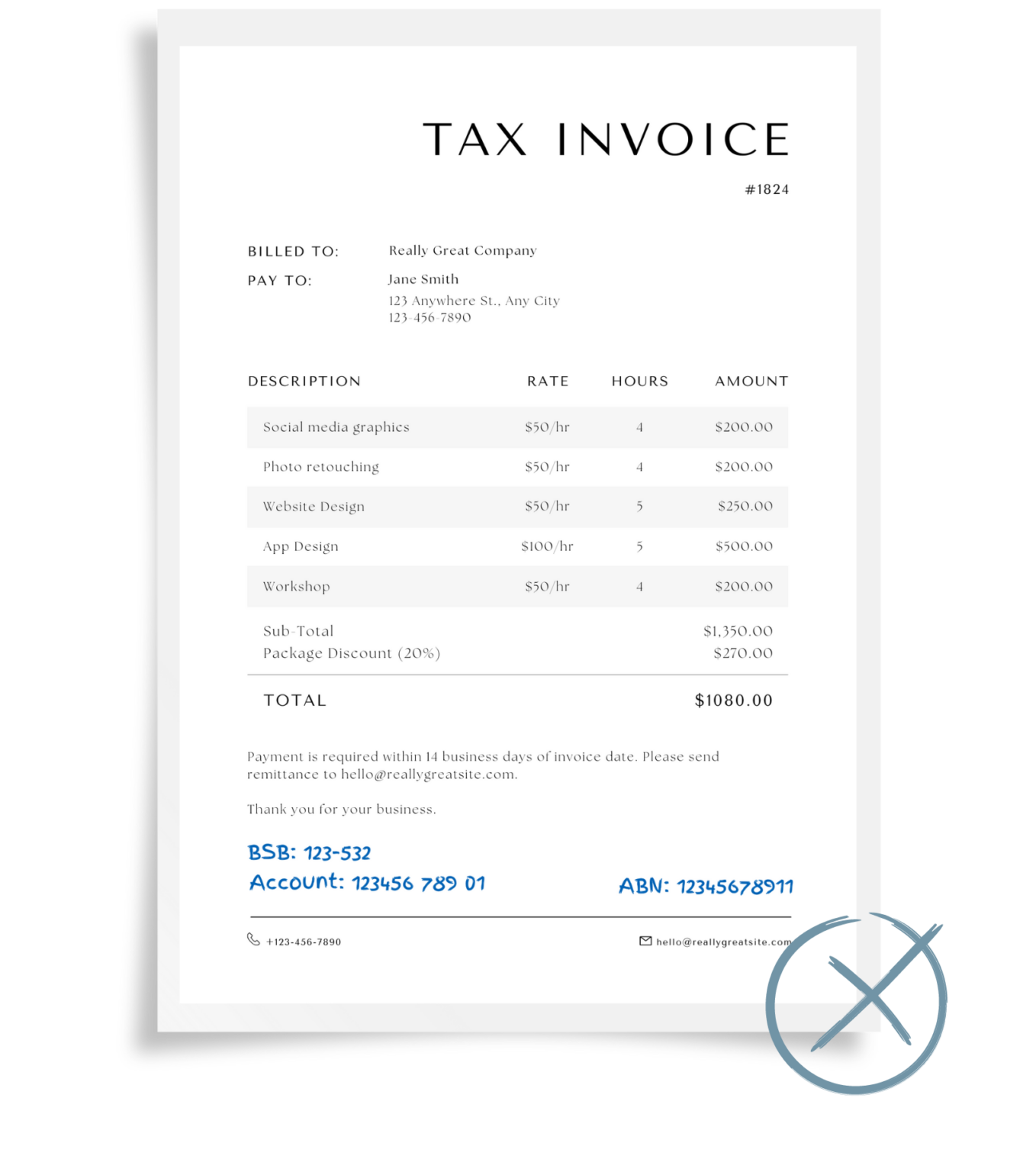

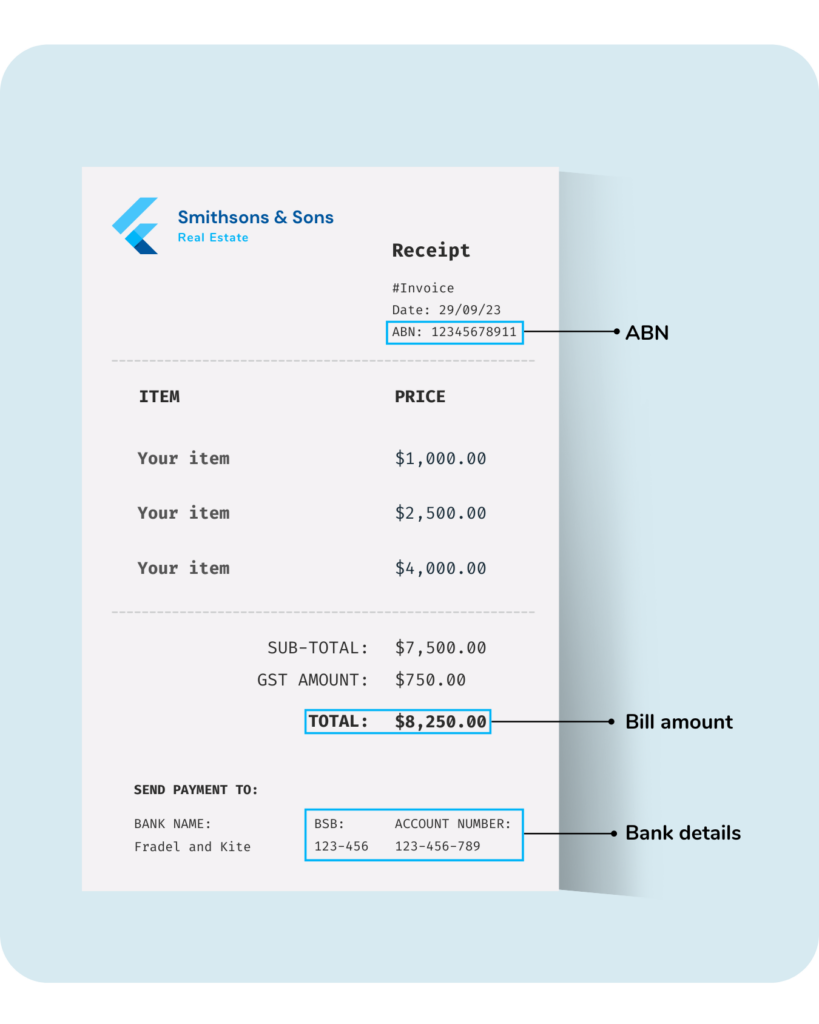

Ensure your lease/receipt includes the following:

- Your rental agency’s ABN

- The BSB and Account Number for the biller

- Payment reference number (i.e 173TerraceSmith)

- Property address for the rental

- Rent amount (you can edit this later)

Paying your rent

- Send your lease agreement or rent receipt to rent@sniip.com. Once approved, your rent bill will be added to the ‘To Pay’ tab in the ‘Bills’ section of the Sniip app.

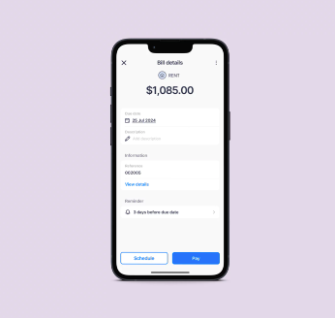

- Select your bill, and tap ‘Schedule’ in the bottom right of the screen.

- Select ‘Create Recurring Payment’.

- Choose the amount you’d like to pay and how often you would like the payments to be made (weekly, fortnightly).

- Choose the end date or select no end date.

- Tap confirm.

- Follow the prompts to complete your payment!

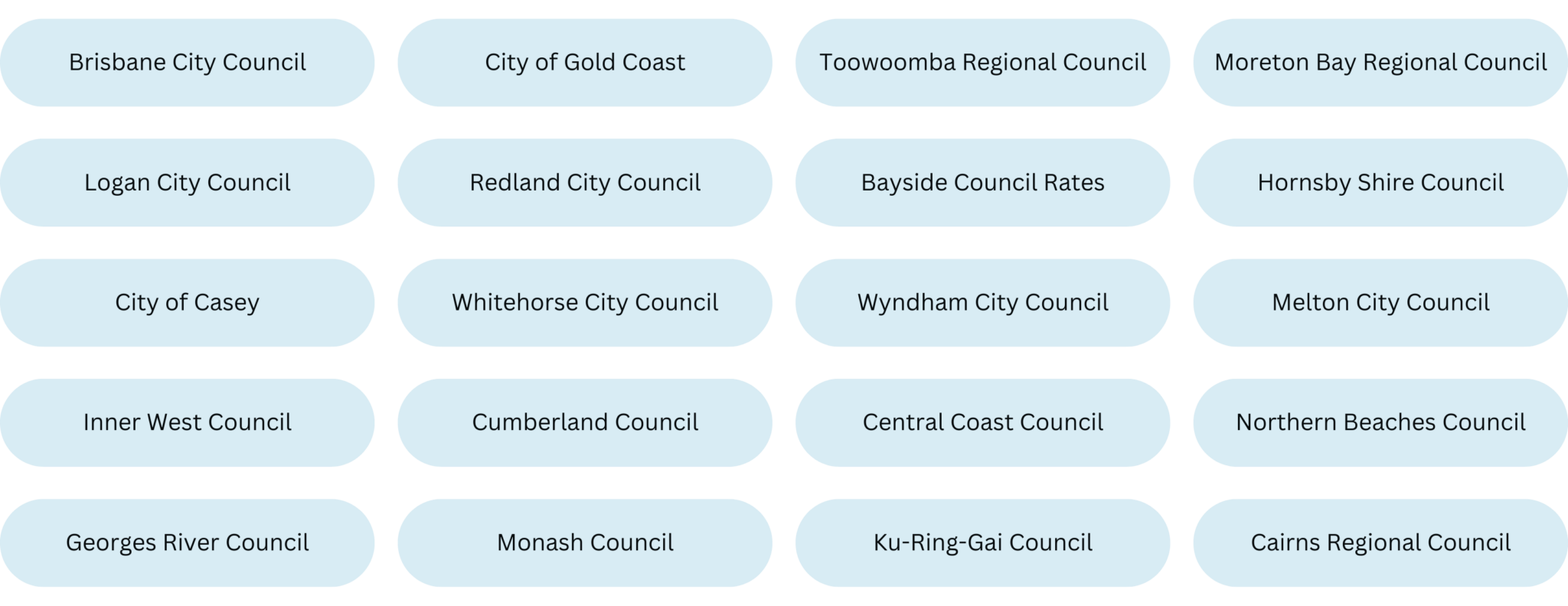

Rates payments

With Sniip, you can pay any Australian rates bill using your preferred payment method. Whether it’s council rates, water (for example Urban Utilities), or any other local government bills – Sniip has got you covered!

Top 20 rates payments processed through Sniip

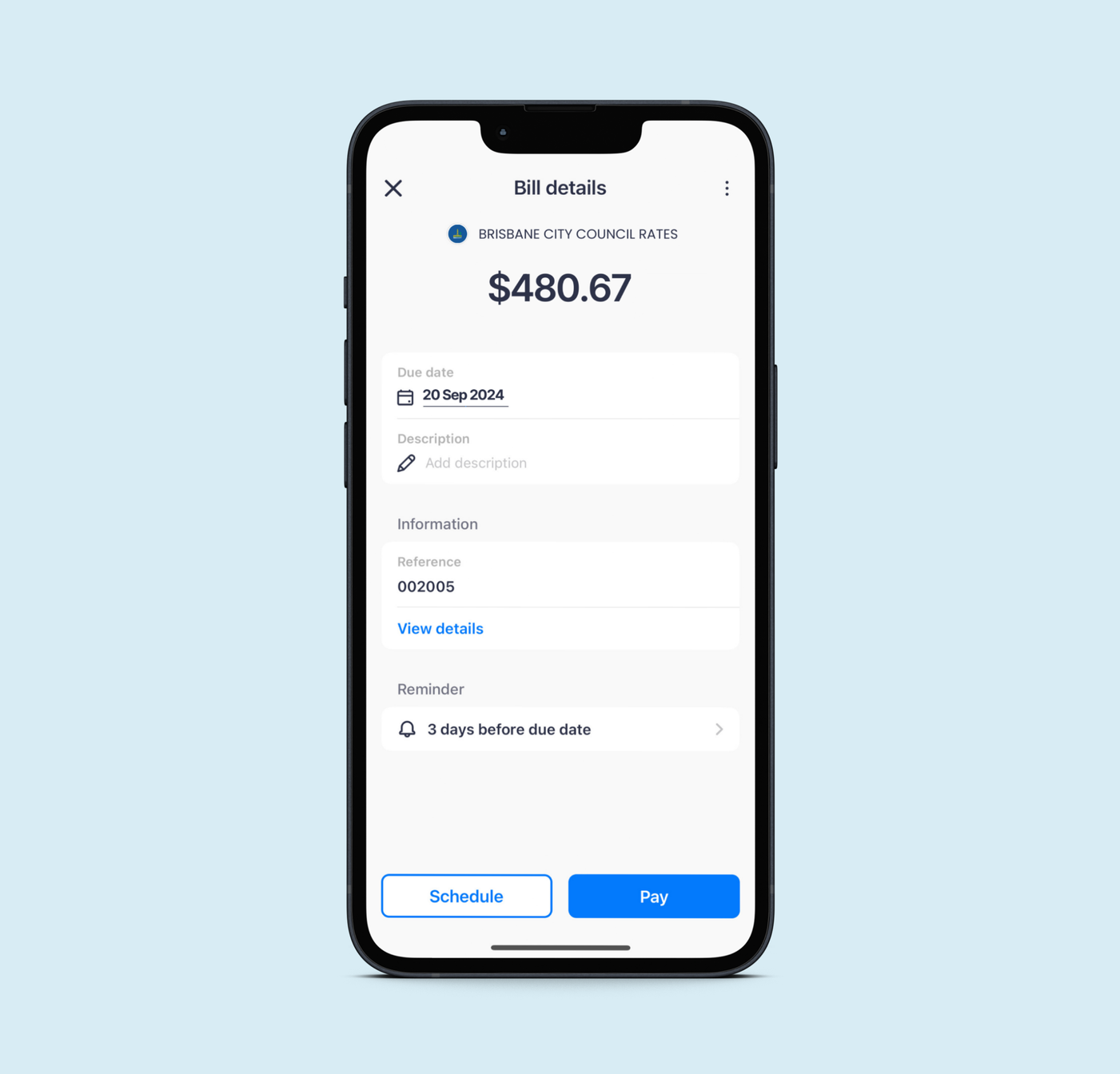

Paying your rates

- Open the Sniip app and tap the ‘+’ button in the top right corner

- Tap ‘Scan any bill’

- Scan the BPAY Code and Reference Number on your bill

- Tap the ‘Add bill’ button

- Choose to pay your bill now, or schedule it to be paid at a future date

- Select your payment method and confirm the payment

- All done!

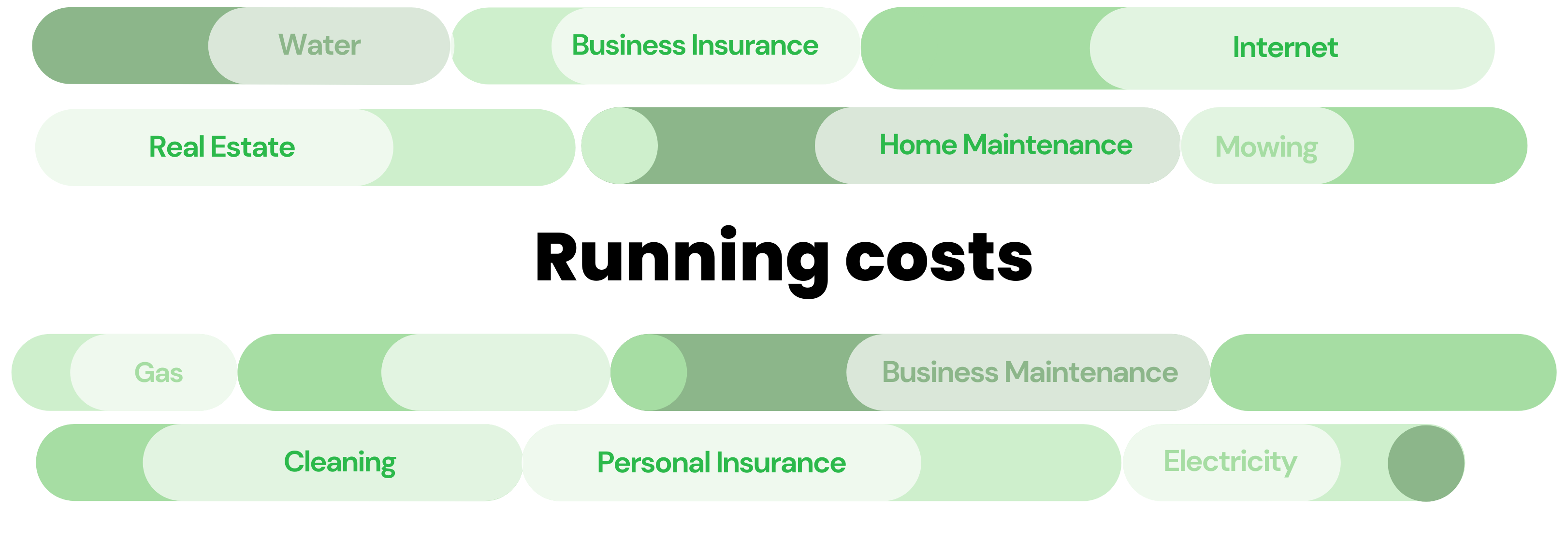

Sniip supports payments for any household/business running costs via BPAY or non-BPAY (payment to a biller’s BSB & Account Number). Here’s a list of bills you can pay through the Sniip app:

- Internet: Keep your connection uninterrupted by setting up automatic payments.

- Electricity: Ensure your lights stay on without the hassle of manual payments.

- Gas: Never miss a gas bill with Sniip’s convenient payment scheduling and reminder options.

- Water: Manage your water bills effortlessly.

- Home/Business Insurance: Protect your property by ensuring timely insurance payments.

- Mowing/Cleaning: Pay for regular services like mowing and cleaning easily.

- Home/Business Maintenance: Cover costs for maintenance and repairs using your preferred payment methods.

Sniip is designed to streamline your bill payments, giving you more time to focus on what matters most. Simplify your financial management today by downloading the Sniip app and taking control of your bill payments.

Verification on your account and unlock your access to pay bills with a BSB & Account Number using Sniip.

Verification on your account and unlock your access to pay bills with a BSB & Account Number using Sniip.