Pay business bills,

earn full points.

Everytime. Uncapped.

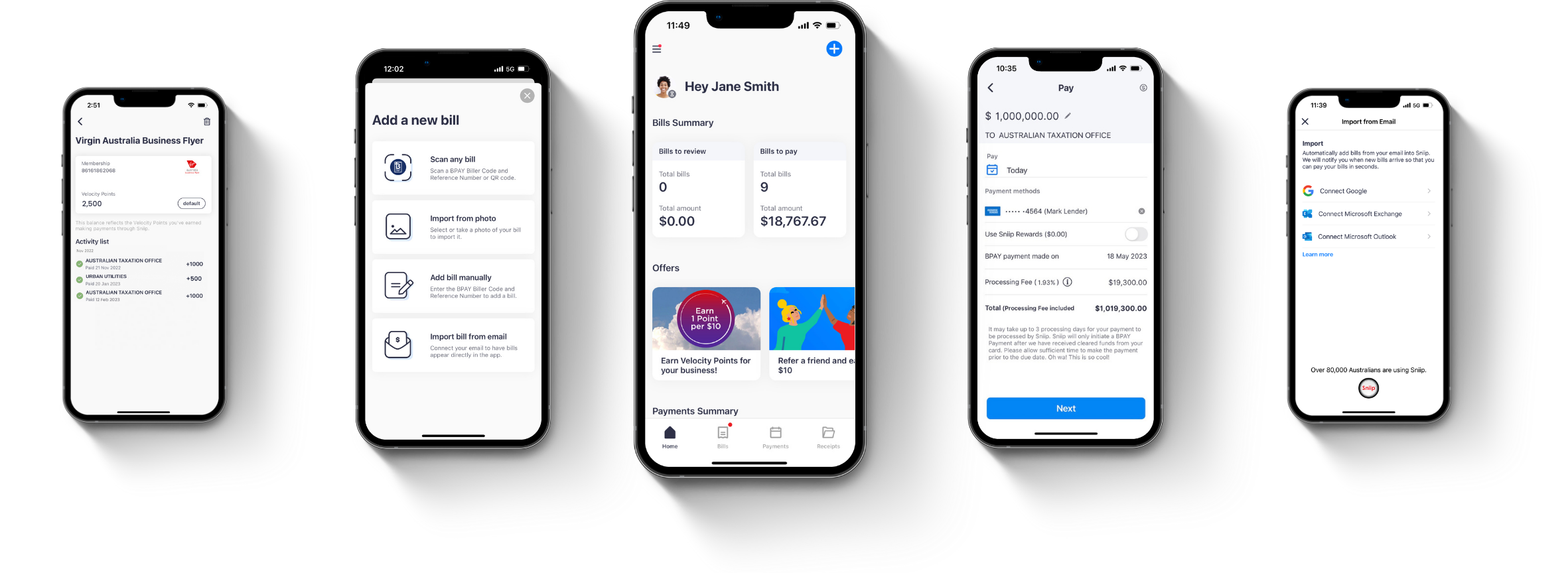

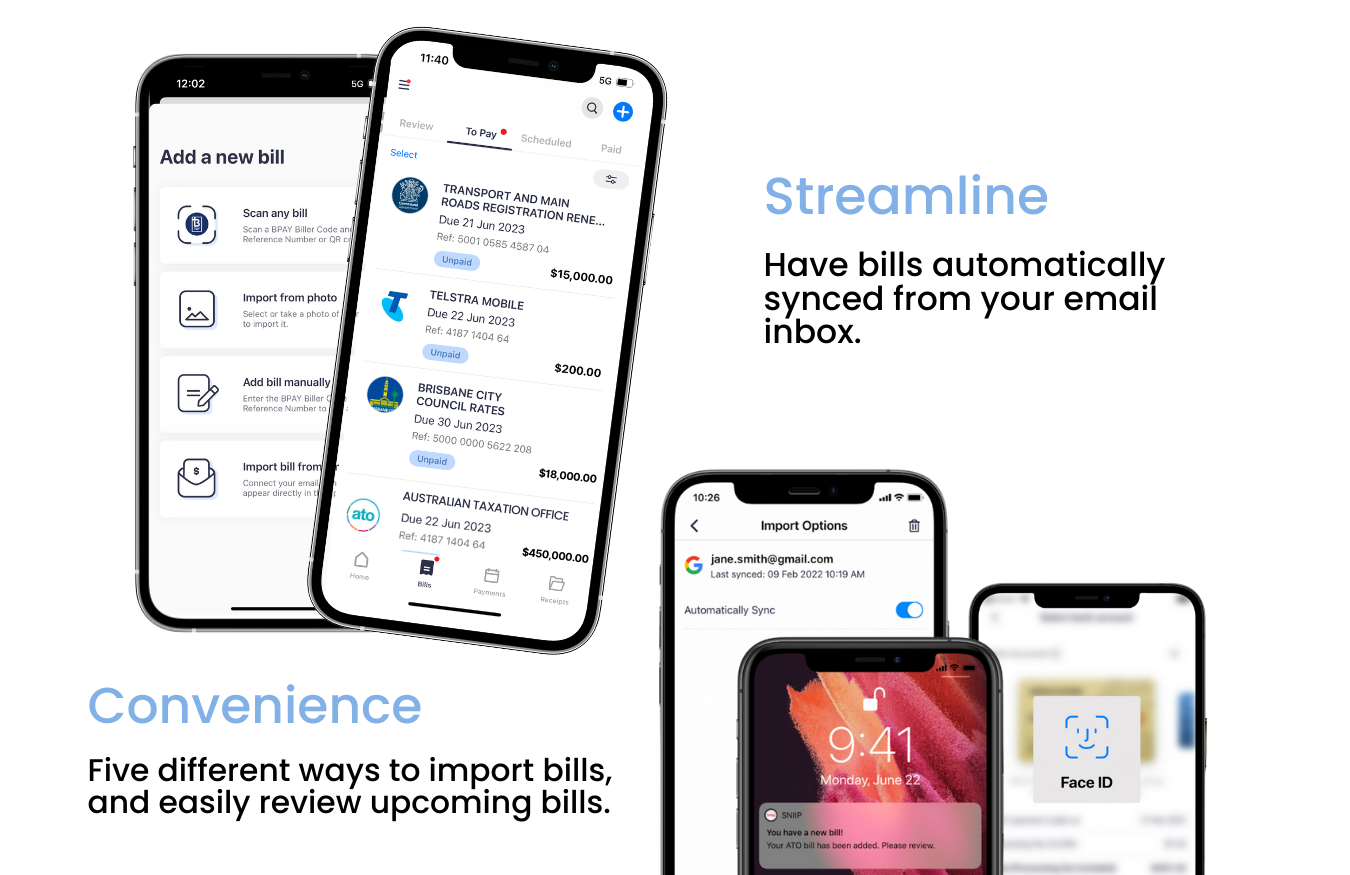

Sniip is a trusted partner of American Express, enabling you to pay all your business bills and earn full points.

Sniip is a trusted partner of

Get the best credit card points, always. Plus, unbeatable rates!

- Earn full points when paying all billers

- Best rates in market

- Uncapped points

Earn points for less! Pay your ATO, BAS, Superannuation and Land Tax payments through Sniip and earn full points. That’s right, full points on government billers with Sniip.

$0/month subscription

Personal + Business payments

Apple Pay + Google Pay

Live support when you need it

Pay business bills, earn full points.

- ATO

- Superannuation

- BAS

- Land tax

- Insurance

- Rent

- Vehicle registration

- Legal fees

- Utilities

- Suppliers

- Contractors

- Private health

Points Calculator

Bill amount

1

Select your payment method

Amex Velocity Business Card

Amex Velocity Business Card

Amex Platnium Business Card

Amex Qantas Business Rewards Card

Amex Business Explorer Credit Card

Amex Gold Business Card

Amex Qantas Corporate Platinum Card

Amex Corporate Card

Amex Qantas Corporate Gold Card

Amex Qantas Corporate Card

Amex Corporate Platnium Card

Amex Corporate Gold Card

Amex Centurion Card

Diners Club Business Card

NAB rewards signature

NAB Qantas Business Signature Card

.png)

Mastercard Business Awards

Mastercard Business Platinum Awards

Citi Prestige Mastercard

Amex Velocity Business Card

Amex Velocity Business Card

Amex Platnium Business Card

Amex Qantas Business Rewards Card

Amex Business Explorer Credit Card

Amex Gold Business Card

Amex Qantas Corporate Platinum Card

Amex Corporate Card

Amex Qantas Corporate Gold Card

Amex Qantas Corporate Card

Amex Corporate Platnium Card

Amex Corporate Gold Card

Amex Centurion Card

Diners Club Business Card

NAB rewards signature

NAB Qantas Business Signature Card

.png)

Mastercard Business Awards

Mastercard Business Platinum Awards

Citi Prestige Mastercard

Total points earned*

10,219

Velocity Points

Bill amount

$10,000

Processing fee (excl GST)

(Tier 1: $0 - $99,999)

$199.09

GST

$19.91

Total

$10,219.00

Assumes points earn based on 1 point/s per dollar spent.

Velocity Points

Bill amount

$10,000

Processing fee (excl GST)

(Tier 1: $0 - $99,999)

$199.09

GST

$19.91

Total

$10,219.00

Assumes points earn based on 1 point/s per dollar spent.

$10,000

Processing fee (excl GST)

(Tier 1: $0 - $99,999)

$199.09

GST

$19.91

Total

$10,219.00

Assumes points earn based on 1 point/s per dollar spent.

(Tier 1: $0 - $99,999)

$199.09

GST

$19.91

Total

$10,219.00

Assumes points earn based on 1 point/s per dollar spent.

GST

$19.91

Total

$10,219.00

Assumes points earn based on 1 point/s per dollar spent.

Total

$10,219.00

Assumes points earn based on 1 point/s per dollar spent.

Assumes points earn based on 1 point/s per dollar spent.

* Please note: the above calculator is an estimate and not an exhaustive list of the Amex cards you can use with Sniip. Sniip accepts all American Express cards.

This information is provided as a guide only, please refer to the Amex website for the most accurate information or contact Amex directly.

You don't have to take our word for it.

We prioritise your payment security

Sniip is a trusted partner of Amex. Payment security is of the highest priority at Sniip.

We have never had a security breach in our 8+ years of operations and have quarterly vulnerability scans to try and penetrate our systems. Our systems have never been penetrated.

Sniip is proud to have achieved and maintains Tier 1 Payment Card Industry Data Security Standard (PCI DSS) compliance.

This mean you can rest assured that your payments are protected by the highest safety and encryption standards.

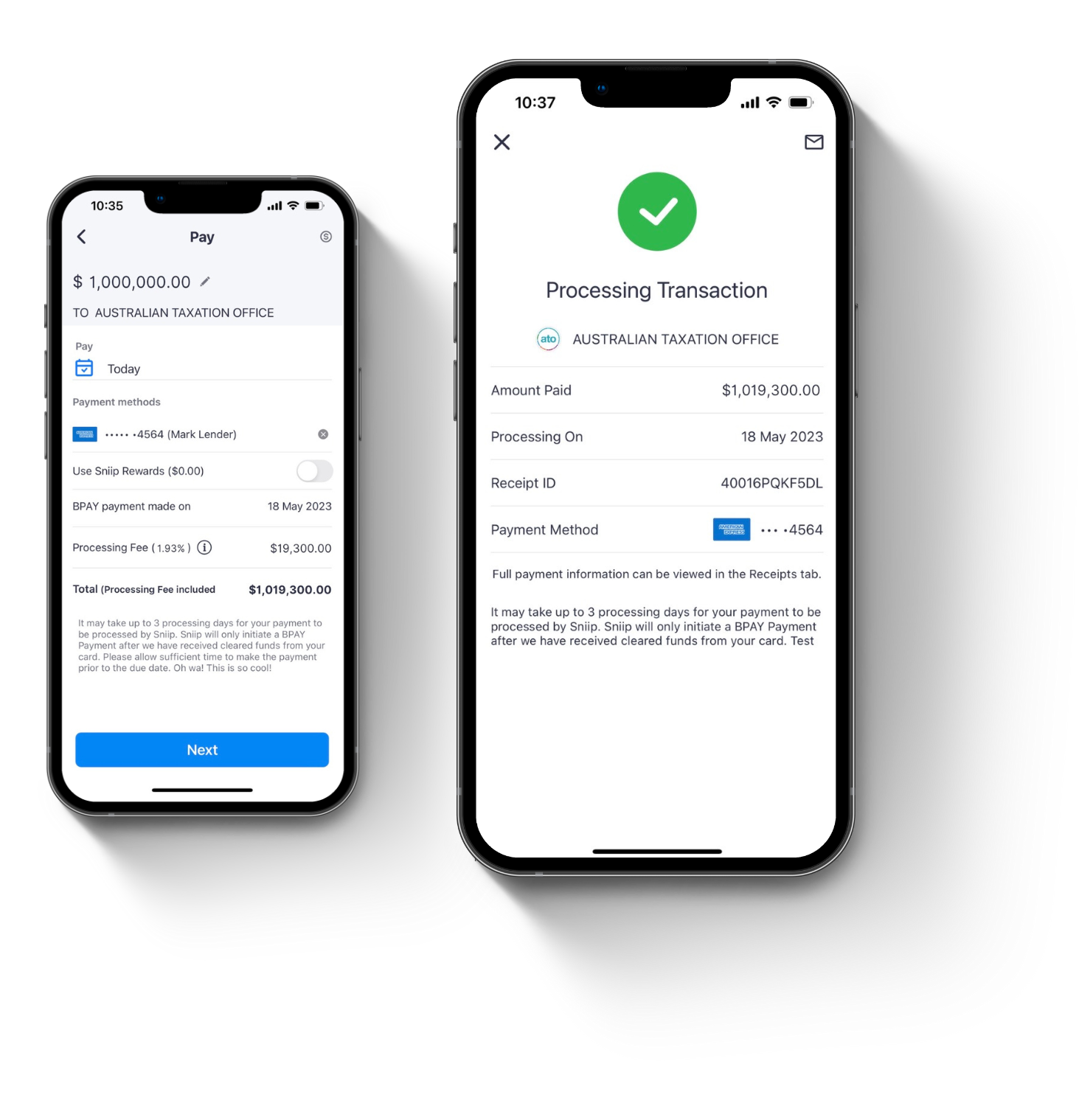

Sniip is an authorised Bill Payment Service Provider (BPSP). All BPAY payments made through Sniip happen via a two-legged transaction. All transactions are paid into a Sniip trust account and your bill payment is made the same day we receive your funds.

We do not hold onto your funds. The payment that you make to us will appear on your statement as ‘Sniip Ltd’.

We have processed over $500 million worth of bill payments to date.

For more detailed information, you can read our terms and conditions.

FAQ

How does my payment get processed?

When you pay a bill via Sniip, you authorise Sniip to receive funds from your nominated payment method. The bill amount will be held by us on trust for the specific purpose of paying your bill. Sniip will then process your bill payment to your biller on the day those funds are received.

Why can’t I make a payment to another credit facility using my credit card?

Unfortunately, we are restricted from allowing payments to certain billers using credit facilities, as determined by BPAY and our banking partners.

This means, you aren’t able to pay credit facilities with a credit card or a debit card, but you can pay from a bank account. Paying from a bank account is completely free in the Sniip app, and this way you are able to keep using Sniip to store and organise all your bills and invoices.

If you have any questions, please email Sniip Support Squad or call (07) 3268 7710 for more information.

Why would I use Sniip to pay my business bill?

Sniip users benefit from the best processing fees in market, you can read more about our tiered pricing, here.

Plus, it’s the easiest and quickest way to pay your bill (and earn full points).

You can explore our Amex x Sniip hub, here or speak with our Amex x Sniip representative Jennifer by calling (07) 3268 7710.

How do I know how many points I’ll earn on my transaction and what my processing fee (tier) will be?

Great question! We’ve built a points calculator just for you, superstar! You can explore the points calculator, here.

Do I earn points on the processing fee?

Absolutely! You earn full points (even at the ATO) on the transaction amount and the processing fee.

What if you determine my payment to be business, but it’s personal?

All rates are clearly displayed before you make a payment and you can always clarify with us before you process the payment.

The processing fee for personal payments using a personal card is 1.5%, excluding American Express personal cards. The rate for personal American Express cards is 1.29%.

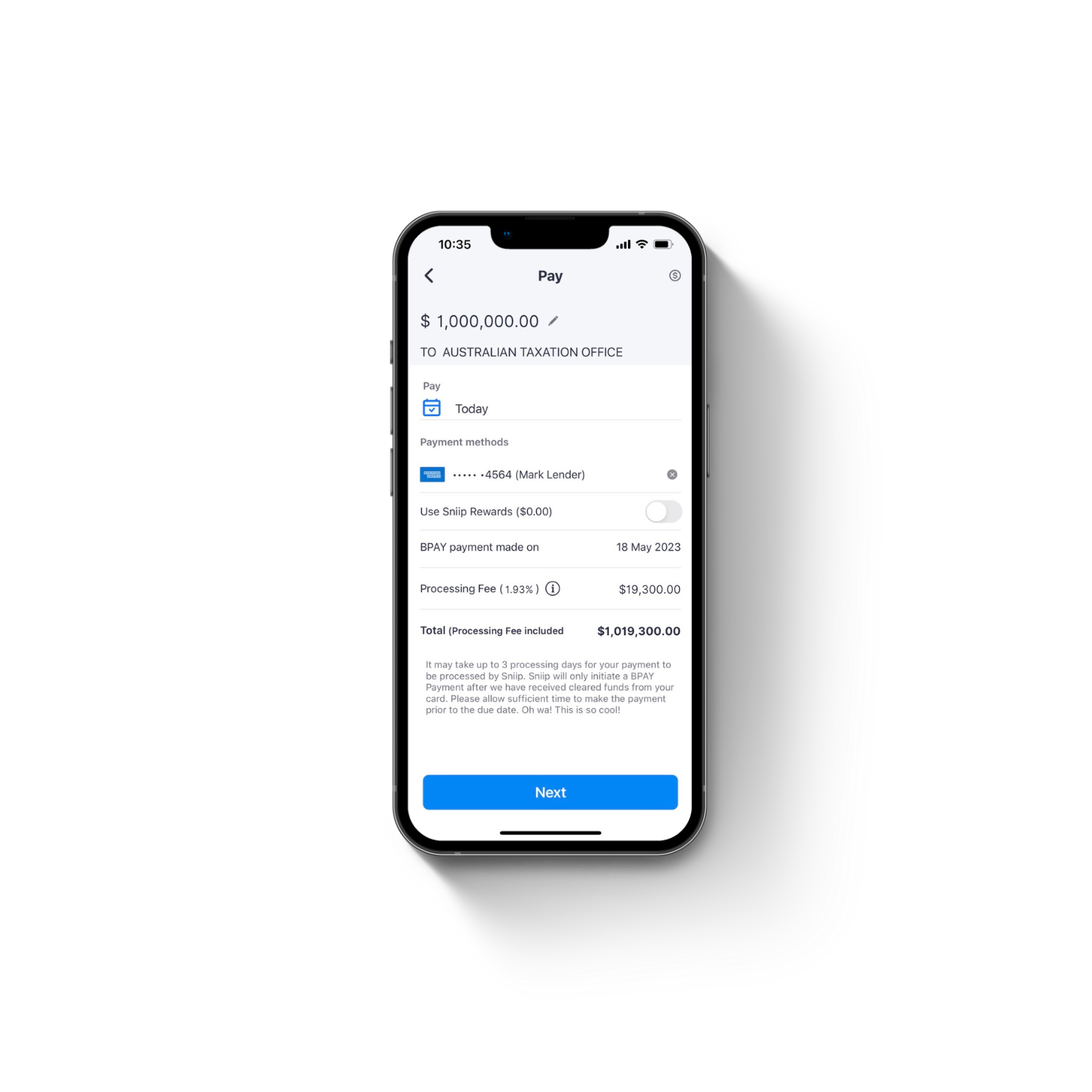

Does Sniip have a transaction limit?

Sniip has no transaction limit. There are however, minimum and maximum payment amounts determined by each biller.

If you are making a large payment and are getting a declined message even though you believe you have the funds available to make the payment, we would suggest contacting your financial institution.

If your financial institution identifies a large transaction that seems out of the ordinary, it may be stopped or flagged as fraudulent. Once you contact your bank and explain that you are making a transaction via Sniip they should enable the transaction. If you have any questions or wish to discuss your transaction, please contact the Sniip Support Squad or call (07) 3268 7710.

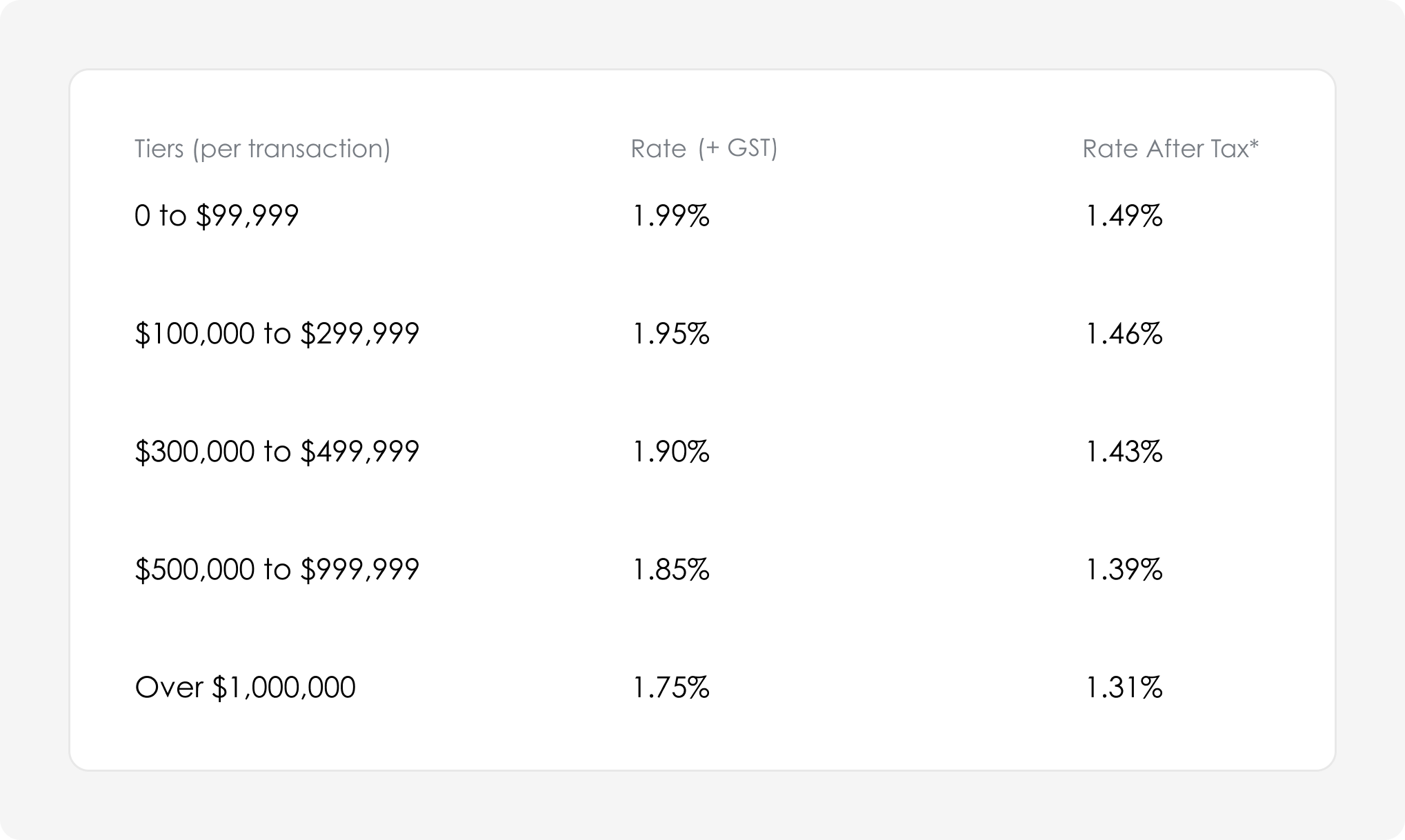

How do I know what tier my payment falls under?

Good question! Our business payment tiers are below.

You can explore more about tiered pricing, here.

Tier (single payment amount) | Rate (inc GST) | Rate % (+ GST) | **After Tax Rate |

$0 – $99,999 | 2.19% | 1.99% | 1.49% |

$100,000 – $299,999 | 2.15% | 1.95% | 1.46% |

$300,000 – $499,999 | 2.09% | 1.90% | 1.43% |

$500,000 – $999,999 | 2.04% | 1.85% | 1.39% |

$1,000,000+ | 1.93% | 1.75% | 1.31% |

If I’m a sole trader, will I be charged the business, or the personal rate if I pay the ATO?

If you’re making a personal payment to the ATO on a personal card, you’ll be charged at the personal rate. Payments to the ATO, including superannuation, are charged at the business rate when using any American Express card.

If you have an ABN, you may be classified as a business. If you’re making a business payment with a personal American Express card, you may be charged at the business rate.

The good news is, all rates are clearly shown before you make the payment and you can always clarify with us before you process the payment.

What is Sniip's criteria for determining what is business and personal payments?

Great question! It comes down to the payment you’re making and the card you’re using.

If you’re making a personal payment, on a personal card, you’ll be charged the personal rate.

If you’re making a business payment, on a business/corporate card, you’ll be charged the applicable business rate.

If you’re flagged as making a business payment on a personal card, you may be asked to supply a copy of your invoice and your transaction will be reviewed.

The good news is, all rates are clearly shown before you make the payment and you can always clarify with us before you process the payment.

If you have any questions, please call (07) 3268 7710 or email customercare@sniip.com.

I always use a personal Amex card for business expenses. Can I just use my business Mastercard instead now? What’s the fee?

Absolutely! The processing fee for all Visa/Mastercards is 1.5%.

Can I pay make SME payments now, pay to BSB + Account Number?

We’re working on it as you read this. Launch 2023! Promise.