Sniip ranked in the AFR Fast 100 for 2025

Sniip’s Ranks in AFR Fast 100, Cementing Its Status as One of Australia’s Fastest-Growing Fintechs

Sniip, Australia’s leading consumer and business bill-payment platform secures Australian Financial Review’s Fast 100 List for 2025 ranking, recognising the company’s rapid revenue growth and its push to change the way bills are managed and paid.

The AFR Fast 100 ranks the nation’s fastest-growing established companies based on compound annual revenue growth over the past three years. Sniip’s debut on the list reflects its surging customer adoption, expanding partner ecosystem, and relentless focus on creating a simple and rewarding bill-payment experience.

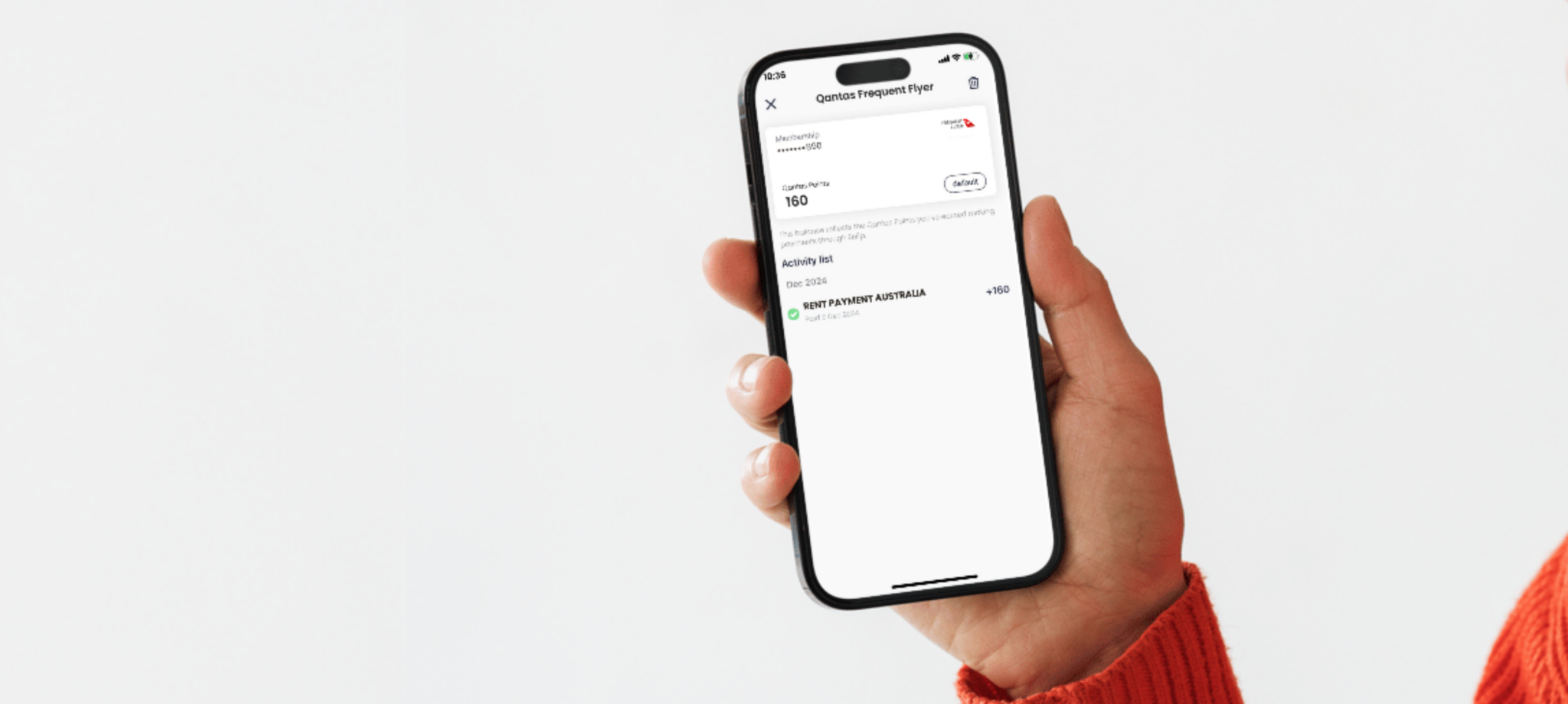

Founded in Brisbane in 2014 by Damien Vasta, Sniip has become a household name in bill payments. The Australian-built software company offers email bill-sync technology, bill-scanning and the ability for customers to earn full rewards points on payments traditionally excluded from loyalty programs, including council rates, utilities, ATO payments, rent, business suppliers and more.

Sniip’s momentum has been fuelled by major partnerships with BPAY, American Express, Qantas Frequent Flyer, Virgin Australia Business Flyer and WEX Motorpass, widening its reach and unlocking more value for consumers and businesses. Combined with bank-grade fraud detection and full PCI DSS compliance, Sniip has built a reputation as one of Australia’s most trusted and innovative fintech players.

“This recognition proves what our customers already know: Australians want a faster, easier and more rewarding way to pay their bills. Sniip has reimagined the bill-payment vertical – redefining what Australians should expect from what was formerly considered an unrewarding and complicated payment experience. And we’re only just getting started,” Sniip Founder and CEO Damien Vasta said.

It comes on the back of Sniip being crowned Best in Business – Best Innovation in Payments by peak industry body Fintech Australia at the Finnies in June.

The milestones come amid a period of strong expansion for Sniip, as the company aggressively pursues its mission to help individuals and business customers to streamline all areas of bill management, while earning rewards on payments that previously delivered no benefits.

About Sniip

Sniip is an Brisbane-based, Australian-made bill-payment platform with over 170,000 business and personal customers.

Founded in 2014 by Damien Vasta, the company boasts a lengthy list of big-name partnerships including BPAY, American Express, Qantas Frequent Flyer, Virgin Australia Business Flyer and WEX Motorpass.

Customers are able to pay every type of bill or invoice in Australia, with popular billers including ATO payments, as well as recurring expenses such as office or home rent.

Credit card users have especially appreciated Sniip, as they have the ability to earn full reward points on all their essential bill payments, including payments to the ATO, land tax and council rates.

About the ARF Fast 100

The ARF Fast 100 – hosted by the Australian Financial Review honours the fastest-growing, large, established companies in Australia.

The ranking considers compound annual revenue growth over the past three years.

To be eligible for the List, a company must have recorded revenue of minimum $10,000 in FY23, minimum $5m in FY25 and have started trading prior to July 1, 2020.