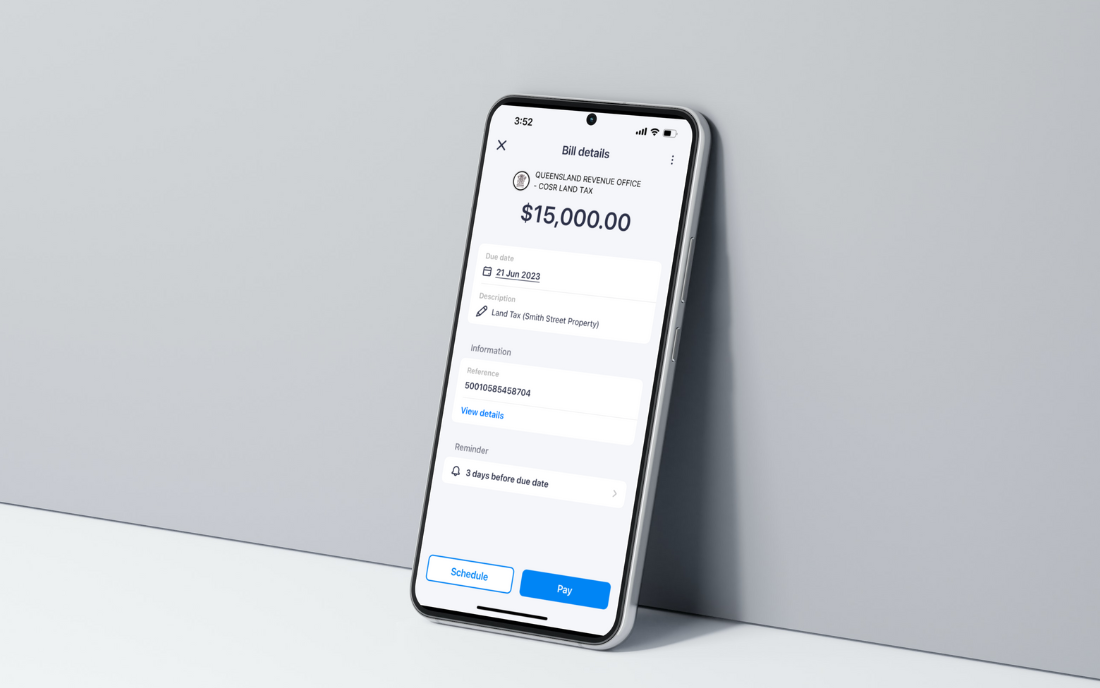

Top 10 Payments in June You Need to Know – Pay land tax, ATO, and more!

New Top 10 Bills Paid in June Always earn full credit card points on all of your bills you pay through Sniip! From land tax

New Top 10 Bills Paid in June Always earn full credit card points on all of your bills you pay through Sniip! From land tax

End of Financial Year Tips and Tools 2023 GUIDE “What can I claim on tax?” You’re not alone in wondering, “What can I claim on

How to pay Land Tax with American Express any card | earn full points | lowest processing fees Do you have one of these? land

The Account Section designed for YOU https://sniip.com/wp-content/uploads/2023/05/Customise-Notification-Settings.mp4 Customise Notifications Tell us how and when you want to hear from us. You can create notifications for

Making voluntary payments to HECS/HELP debt A little background… With the (slightly alarming) hikes in Australia’s inflation rate, everyone’s saying that you should consider making

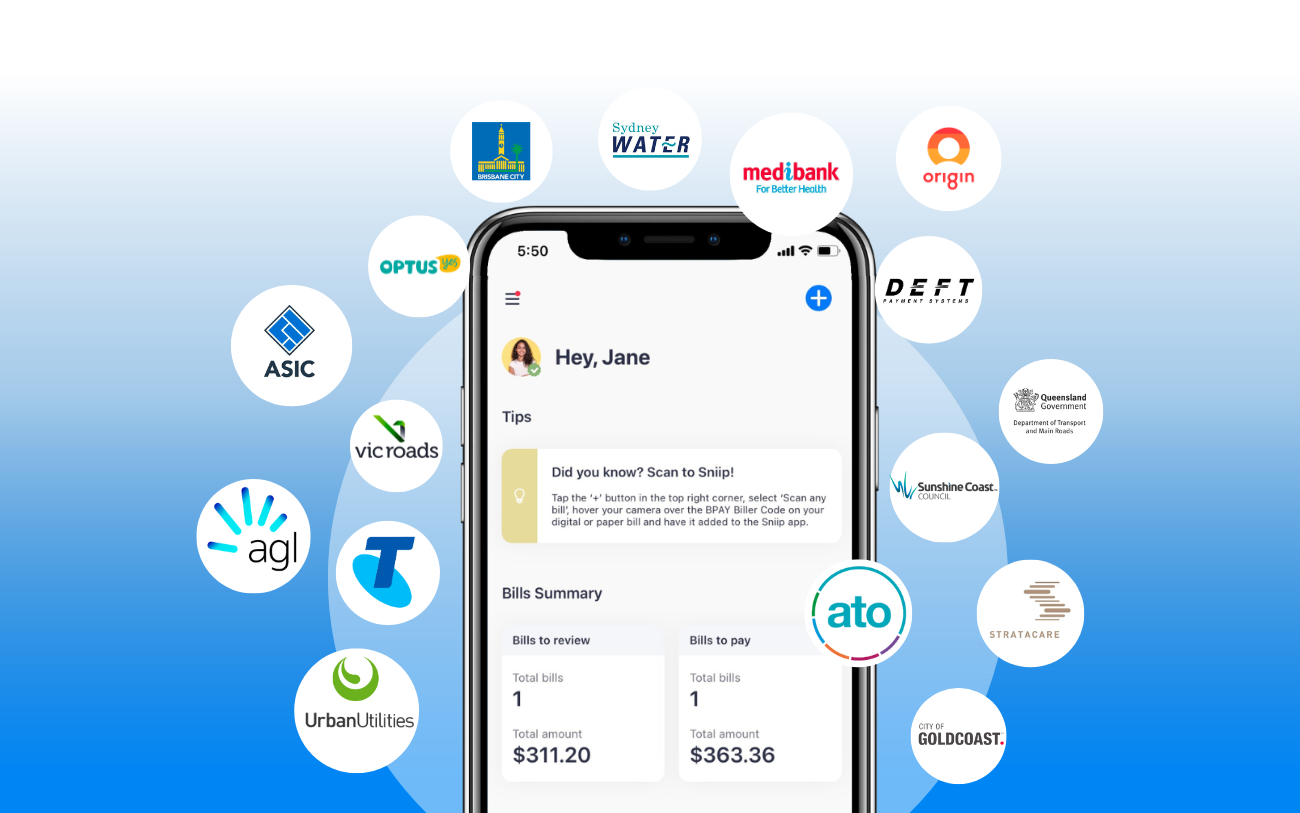

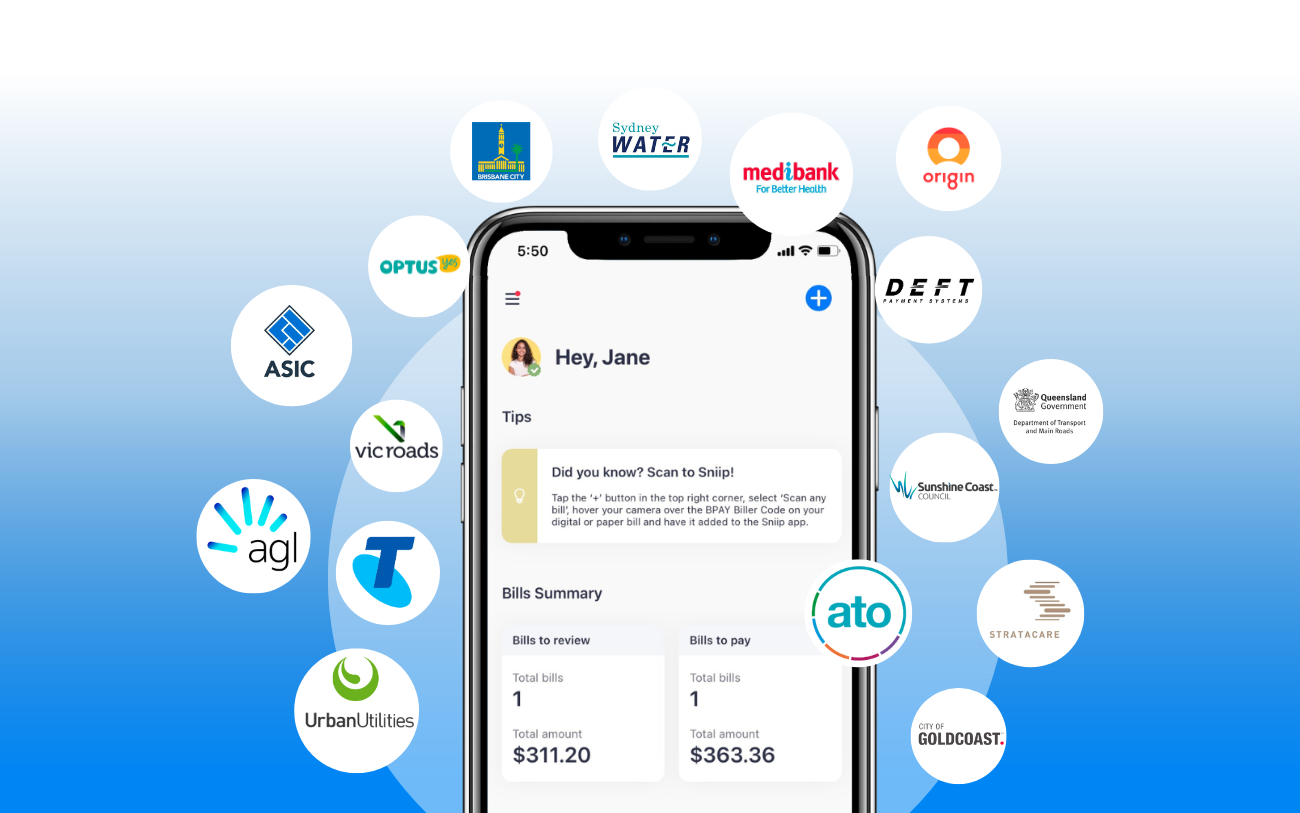

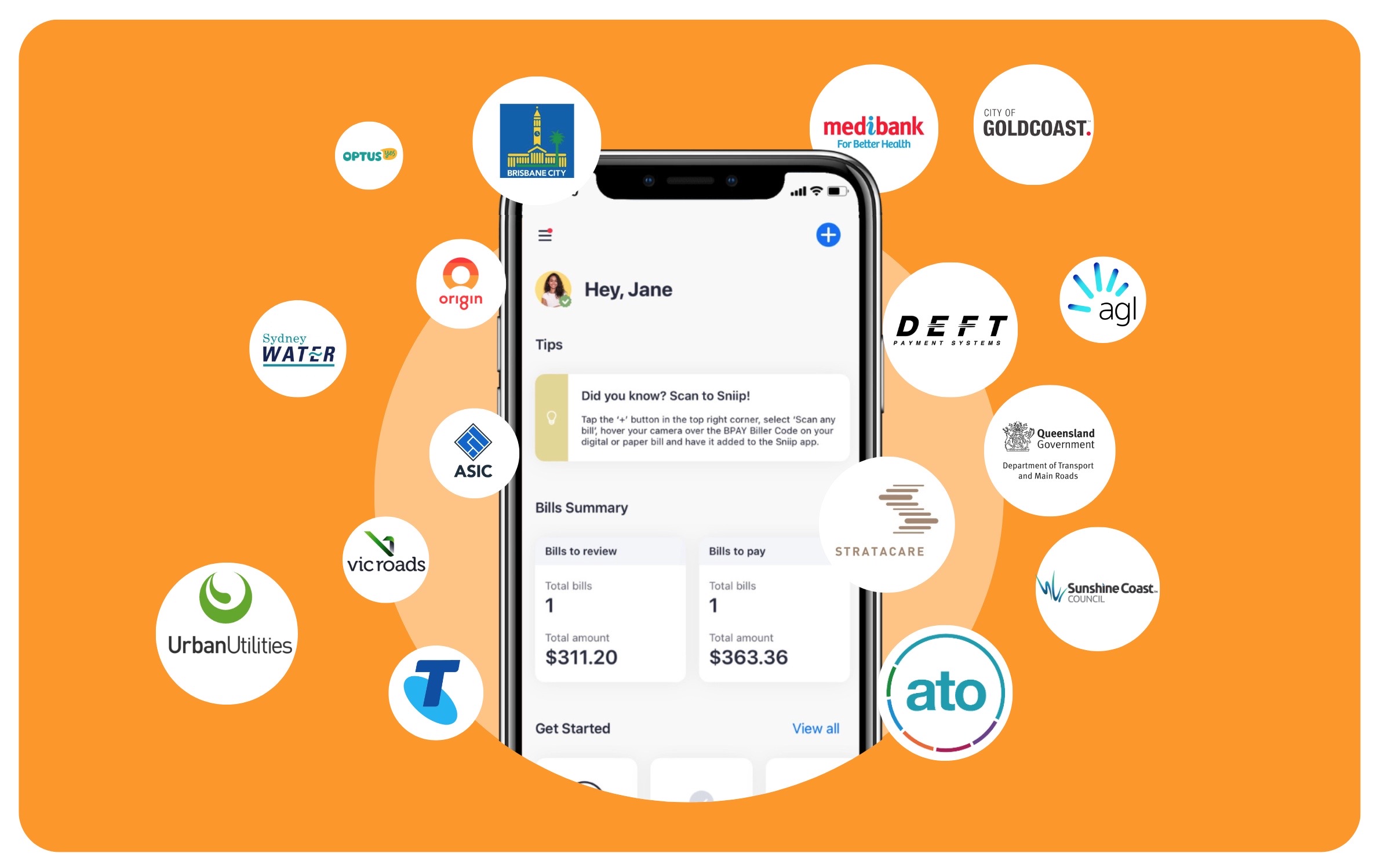

How To Get More Credit Card Points? Best Bills in 2023 Our most popular payments in May 2023 Sniip is the best Australian payment platform

Our Most Helpful Q&A in 2023: You ask, we answer! Can I pay more than rates and water with Sniip? Absolutely superstar! You can pay

High Tech: What happens when you turn on auto-import This is the ultimate way to streamline your bill payments We weren’t lying when we said

New Q&A: Your Most Common Questions Answered I added my bill and it says, ‘Under Review’, why? It’s likely you’re simply the first person to

We’ve got a new look for you! Meet our newest interface design for your ‘Bill Details’ screen! The interface displaying your bill details has gone