Uncategorized

Christmas Gifting List 2024

Christmas Gifting List

🎄 In true Sniip Christmas tradition, we’re here to help make your gifting stress-free and budget-friendly!

Introducing our Christmas Gifting Wishlist—your go-to tool to keep holiday shopping under control. Print it out, stick it on the fridge, and start jotting down all your brilliant gift ideas. 📝

Because a little planning goes a long way (especially when it comes to your wallet 😉).

More on the Sniip blog

- Date: February 18, 2026

February’s Top Bills 2026

- 7 min read

- Date: January 14, 2026

Fast Five FAQ January 2026

- 4 min read

Easter Competition T&C 2025

COMPETITION TERMS

EASTER COLOURING-IN 2025 COMPETITION, TERMS AND CONDITIONS

Competition Terms and Conditions

The promoter is Sniip Ltd, Level 1, 14 Edmondstone Street, South Brisbane QLD 4101. The promotion is subject to Terms and Conditions. Information on how to enter this competition forms part of the terms and conditions of entry. Entry into this competition is deemed to be an acceptance of these conditions.

Eligibility to enter competition

Entry is open to anyone aged 12 years or younger, who is linked to a registered user of Sniip. The entrant must be linked to a registered user of Sniip and submit a valid entry between Wednesday 19 March, 2025 at 6pm (AEST) and 11.59pm (AEST) Thursday, 10 April, 2025.

Employees and immediate family members of the Promoter and suppliers, providers and agencies associated with this promotion are eligible to enter, but ineligible to win a prize. A participation certificate will be awarded to all eligible entrants who meet the competition terms.

Competition period

The promotion commences Wednesday 19 March 2025 at 7pm (AEST, Australian Eastern Standard Time) and closes 11.59pm (AEST) Thursday, 10 April, 2025.

Entering the competition

By entering this competition, you give the promoter, Sniip Ltd permission to use entrant submission for the purpose of promoting the competition and winning entries.

The promoter is not responsible for entries that are not received, or are received late. All entries will be the property of the Promoter and will not be returned to the entrants.

Entries will be judged by Darren Lockyer on Thursday, 10 April, 2025. The judges decision is final and no correspondence will be entered into concerning granting of prizes. In the event the assigned judge is unable to judge the competition, an alternate judge will be allocated by the Promoter.

Judging will be on the merit of the entry and all valid entries will receive a participation certificate.

The Promoter’s decision to disqualify an entry is final and no correspondence will be entered into the competition.

Entrants may enter as many times as they like for the duration of the competition.

The prizes are not transferable and cannot be taken as cash.

The prize winners first name, age and state of residence (for example ‘Pete, 6-years-old, Queensland’) will be published on the Sniip website and associated social media pages.

The parent/guardian/associated user of the prize winner/s will also be notified by telephone or email on Thursday, 10 April, 2025.

Prizes will be sent to the address provided by the entrant, unless otherwise advised.

Any unclaimed prizes remain the property of Sniip Ltd.

Entries may be published on the Sniip website and associated social media channels.

Obtaining an entry form

Download and print the entry artwork, or collect an entry form in person from Sniip Headquarters, Level 1, 14 Edmondstone St, South Brisbane 4101 between 8:30am – 5pm (AEST) Monday – Friday.

Submitting an entry

Completed entries are to be submitted at https://sniip.com/easter-competition/, emailed to competition@sniip.com or delivered in person to Sniip Headquarters, Level 1, 14 Edmondstone St, South Brisbane 4101.

Your entry may be submitted as a photo of the entry, scan, or a picture of the entrant with their entry.

Please note, winning entries will be published on Sniip.com, promoted on our social media channels and shared via this email forum to announce the winner.

Entries close 11.59pm AEST Thursday, 10 April, 2025. The winners will be drawn by football legend Darren Lockyer at Sniip HQ on Friday, 11 April, 2025 and announced on Wednesday, 16 April, 2025.

Eligibility of entry

The competition is open to anyone aged 12 years or younger, who is linked to a registered user of Sniip.

Prize

There is one (1) prize and one (1) bill voucher for first, second and third prize winners along with one (1) prize and one (1) bill voucher for the three runner up winners of the competition.

The prize is the value of the allocated bill voucher to be paid towards an additional bill/ bills paid in the Sniip app. This prize is a Sniip credit and is valid only for bills paid through Sniip. The prize is valid for twelve (12) months after the issue date.

First prize

$100 Sniip bill voucher

Jumbo Easter Hamper (valued at $200)

Second prize

$50 Sniip bill voucher

Large Easter Hamper (valued at $100)

Third prize

$25 Sniip bill voucher

Mini Easter Hamper (valued at $50)

3 x Runner-up

$10 Sniip bill voucher

Petite Easter Hamper (valued at $25)

The prizes are not transferable or exchangeable.

General

If for any reason this promotion is not capable of running as planned because of infection by computer virus, bugs, tampering, unauthorised intervention, technical failures or any other causes beyond the control of the Promoter which corrupt or affect the administration, security, fairness, integrity or proper conduct of this promotion, the Promoter reserves the right in its sole discretion to cancel, terminate, modify or suspend the promotion subject to any written directions under applicable legislation.

The Promoter also reserves the right in its sole discretion to disqualify any individual who the Promoter has reason to believe has breached any of these conditions, or engaged in any unlawful or other improper misconduct calculated to jeopardise the fair and proper conduct of the promotion. The Promoter’s legal rights to recover damages or other compensation from such an offender are reserved.

The Promoter is not responsible for any problems or technical malfunction of any telephone network or lines, computer on-line systems, servers, or providers, computer equipment, software, technical problems or traffic congestion on the Internet or at any website, or any combination thereof, including any injury or damage to participants or any other person’s computer related to or resulting from participation in or downloading any materials in this promotion.

All entries and any copyright subsisting in the entries become and remain the property of the Promoter. The Promoter collects contact information about entrants in order to contact them about the promotion and where appropriate award prizes and may also use the information to assist the Promoter in improving goods and services and to contact entrants in the future with special offers via any medium including mail and commercial electronic messages. If you do not provide the information, you cannot participate.

The laws of Australia apply to this promotion to the exclusion of any other law. Entrants submit to the exclusive jurisdiction of the courts of Australia.

The Promoter is Sniip Ltd of Level 1/14 Edmondstone Street, South Brisbane, Queensland 4101, Australia. ABN 86161862068.

FEATURE FOCUS: Scan and schedule any bill

Scan your BPAY Biller Code and Reference

- Tap the ‘+’ button in the top right corner

- Select ‘scan’

- Position the BPAY Biller Code within the scan frame

- Review the bill details

- Select your payment method and pay!

Sniip gives you the choice of payment methods to pay your bills. Watch the how-to video, here.

Schedule your bill!

Schedule your bills for when they’re due. That way, you can rest easy knowing that when the due date rolls around, your payment is scheduled and you are sorted!

This is a great time hack for rego, rates, or any bills that arrive early. You don’t want to pay them before they’re due, but don’t want to miss the due date either!

Now, you can relax knowing your bills are scheduled and you’re sorted! Nice work!

Christmas Gifting List 2022

Christmas Gifting List

In true Sniip Christmas tradition, we’re sharing our Christmas Gifting Wishlist to help you get your gift buying under control (and not breaking the bank). Print it out, stick it on the fridge and start scribbling!

More on the Sniip blog

- Date: March 19, 2023

Easter Competition T&C 2025

- 6 min read

- Date: October 25, 2023

Exclusive: Welcoming A New Board Member

- 4 min read

The Points Whisperer, Steve Hui of iFlyFlat endorses Sniip to earn full points on all your bills

The Points Whisperer, Steve Hui of iFlyFlat endorses Sniip to earn full points on all your bills.

Steve Hui of iFlyFlat endorses Sniip to earn full points on all your bills when paying with a credit card.

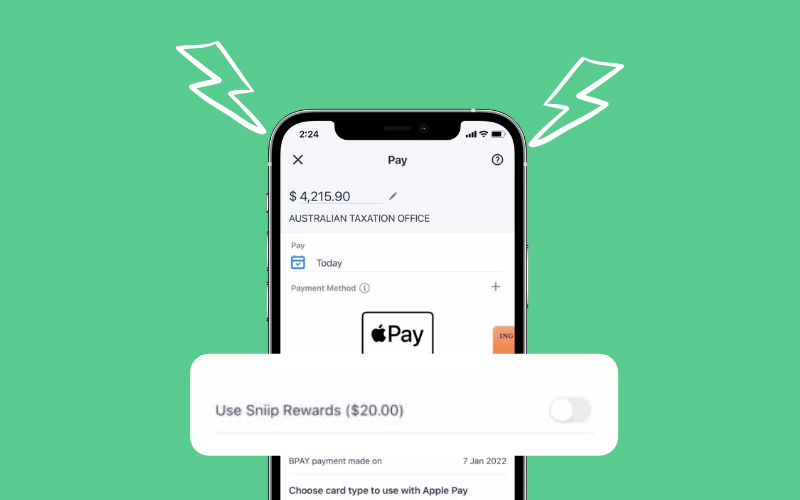

Redeeming your Sniip Rewards

Redeeming your Sniip Rewards

We have been getting a few questions from you recently on how to redeem your Sniip Rewards.

Maybe you’ve been busy referring your friends, or came in through one of our partners? Regardless, we’re so happy that you have been busy earning rewards!

We know that when it comes to budgeting and bill payments, there’s some times where we all need a little more help! That’s why Sniip gives you full control over how and when you redeem your Sniip Rewards.

Watch below to see how to Redeem Your Sniip Rewards Balance when making a bill payment.

It is important you ensure that the toggle in the payment screen is switched ON.

This will enable your Rewards balance for that bill, and you will see the final payment amount with your Rewards balance deducted.

Please note Sniip Rewards are unable to be used for scheduled payments, or when making payments via the Sniip QR or Australia Post ‘Post Billpay’ code. Rewards can only be redeemed for a bill with a minimum payment of $50.

Let us know if we can help in any other way by contacting our Sniip Support Squad at customercare@sniip.com or at (07) 3268 7710.

5 Under $5

5 Gifts under $5

As the purse strings tighten and you race to cross those last few gifts off your Christmas list, we’ve wrapped up 5 gifts under $5.

1. For your green thumb friend –

2. For your home decor obsessed friend

3. The one who always asks if anyone wants to play chess

4. The cook

5. For that friend who always smells good

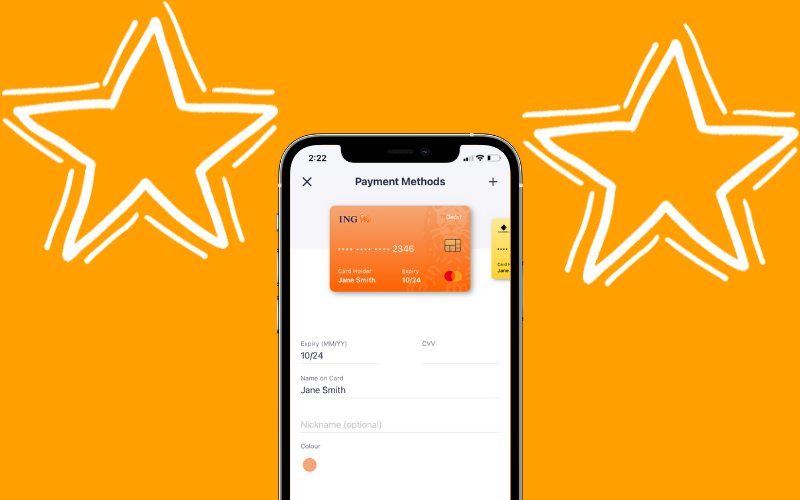

New Feature Alert: Sniip Wallet Designs

NEW LOOK: Fresh feel for your bank cards

We’ve been busy little bees here at the Sniip office and we’ve got 14 fresh and fancy new designs for your credit/debit cards in your Sniip wallet.

Check out the new designs for these 14 bank cards:

- ANZ

- Westpac

- BOQ

- NAB

- Suncorp

- Macquarie

- Bendigo

- Bankwest

- St George

- Up

Before!

After!

2021 Christmas Printable

Printable Christmas Gift Checklist

Click on the Christmas Gifting List to download your printable – from us to you!