Common Bills Paid Through Sniip

NOW LIVE: Results are in, here's April's top bills.

User Exclusive: You Need To Know These Top Billers

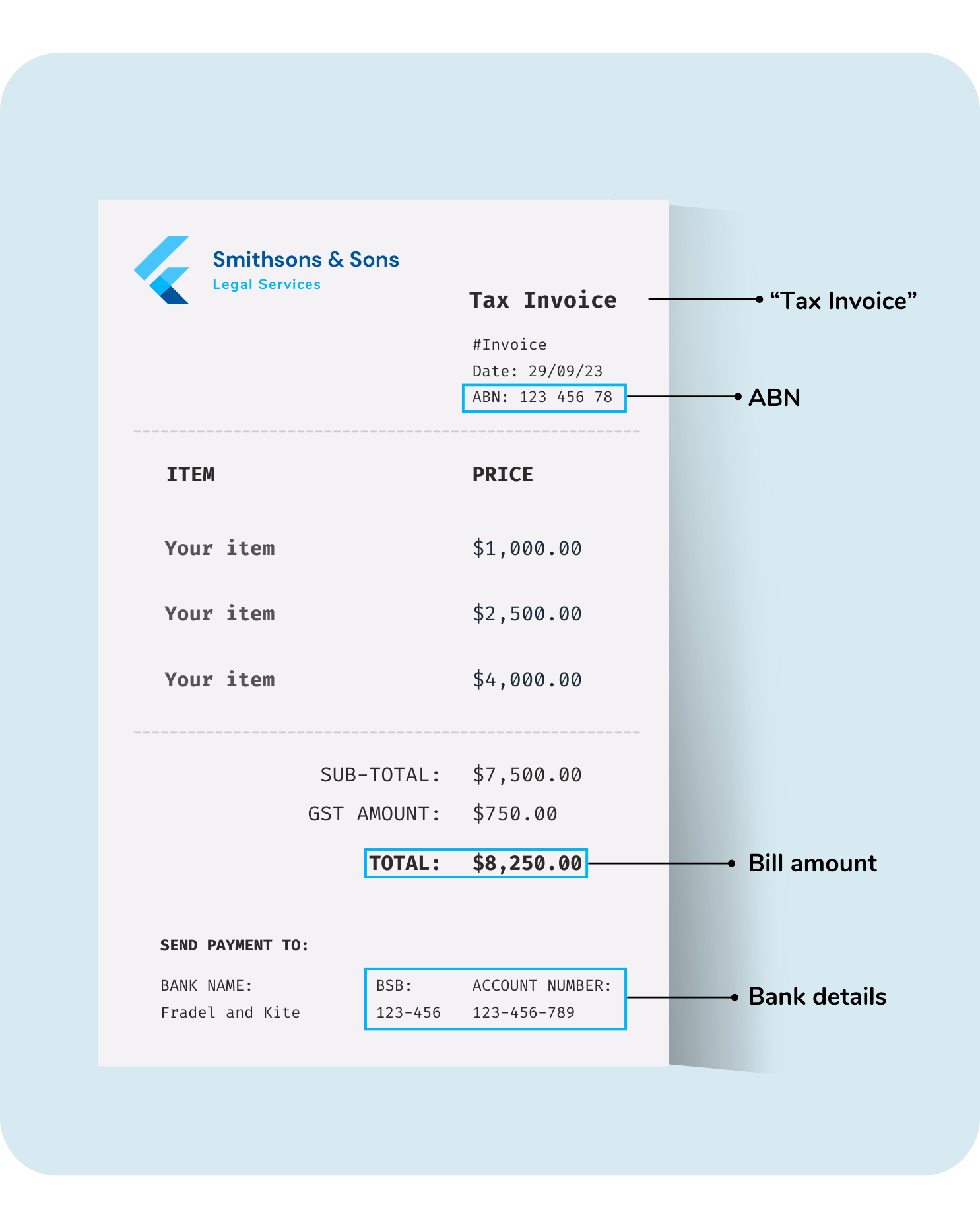

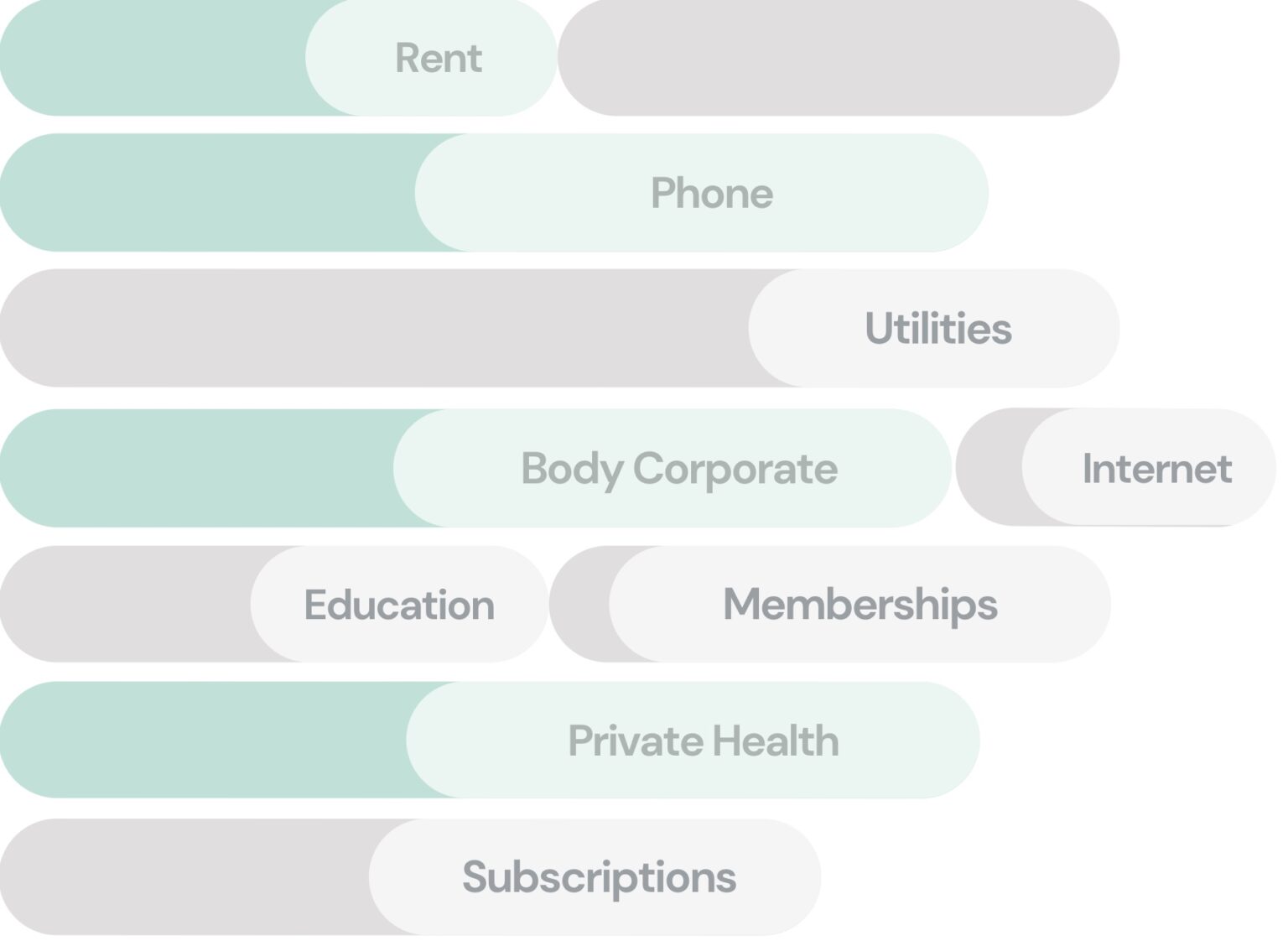

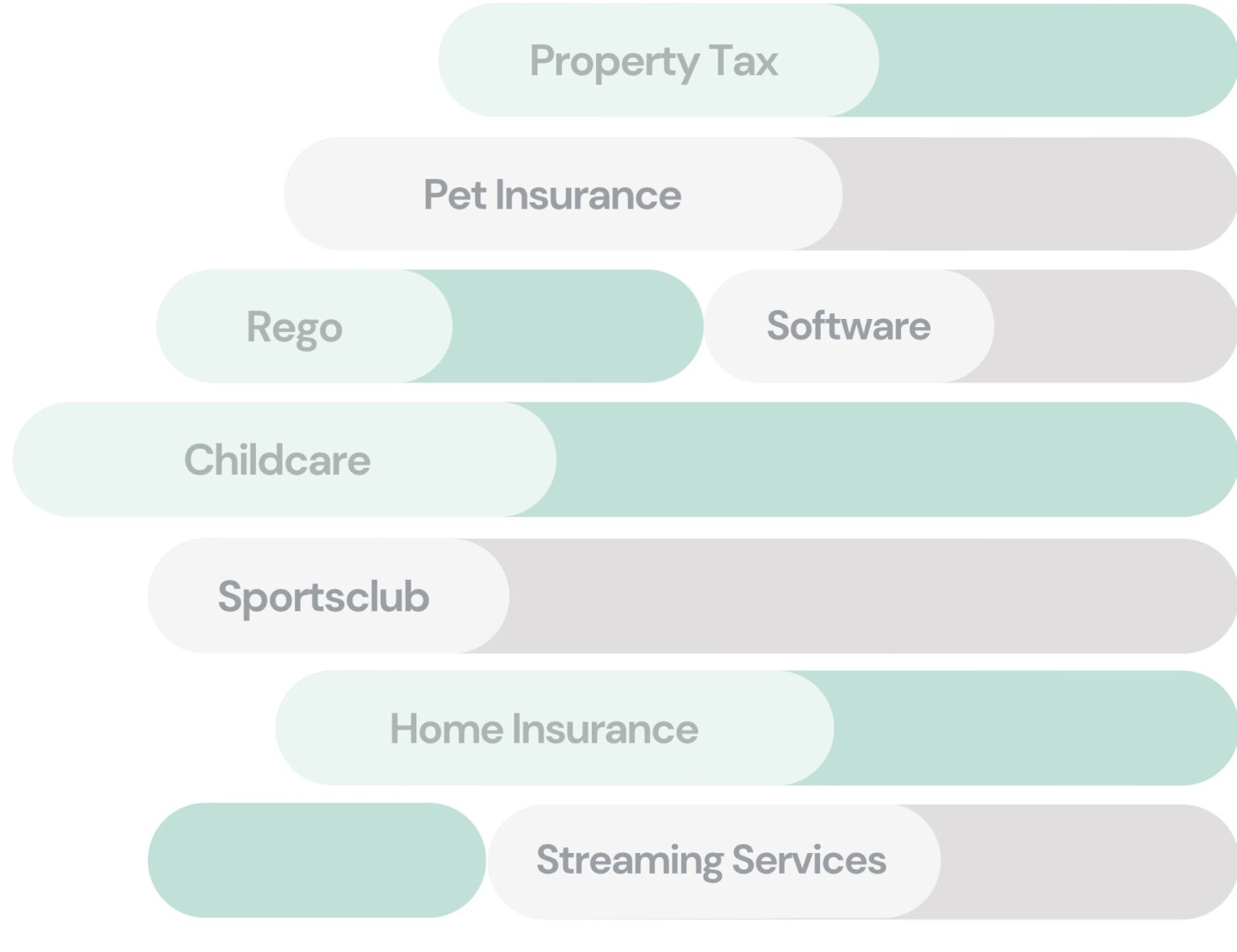

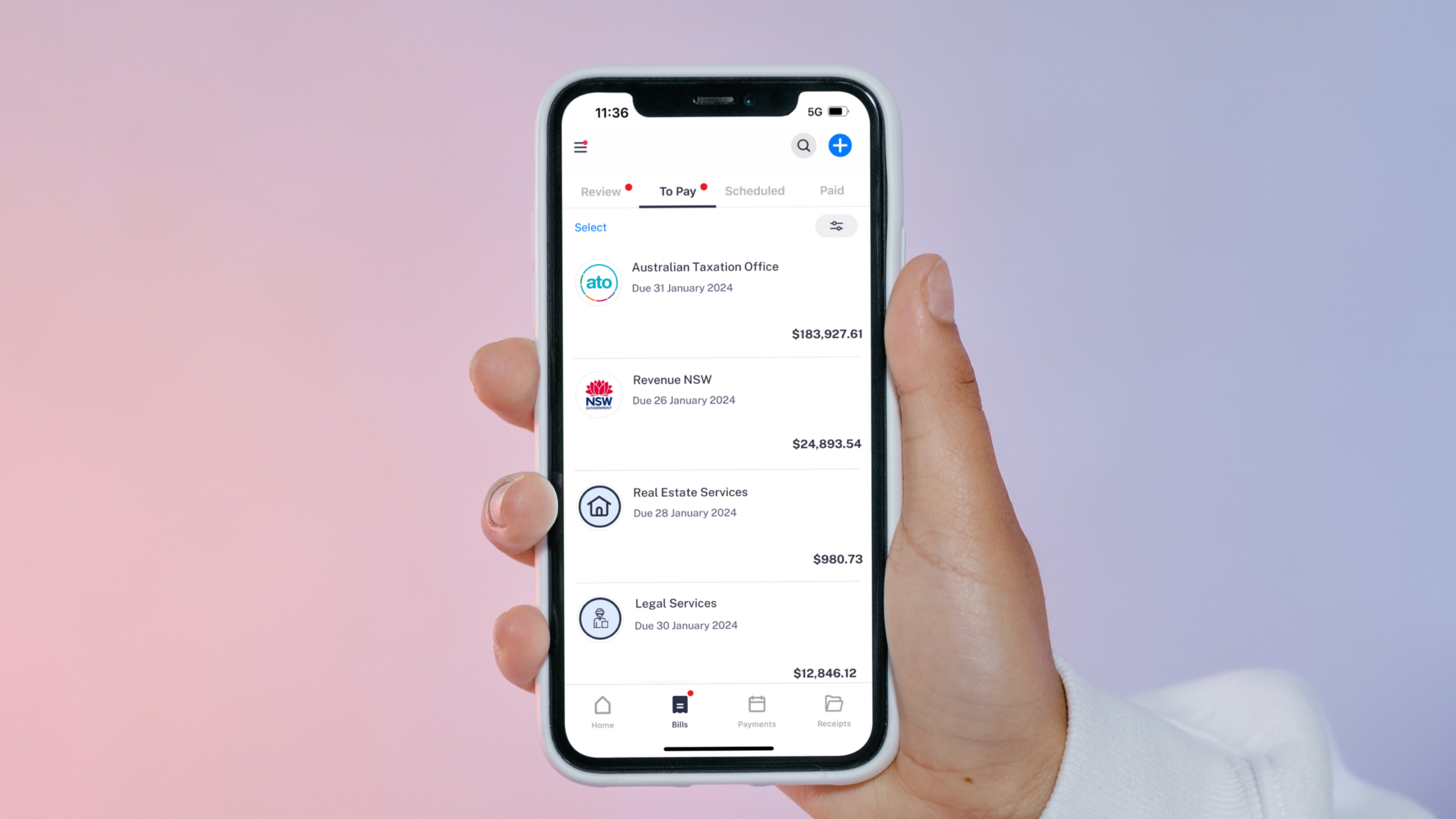

Here’s the top bills users like yourself will pay with Sniip this month. We’ve broken the list down by payment method to ensure it’s super specific to your individual circumstances.

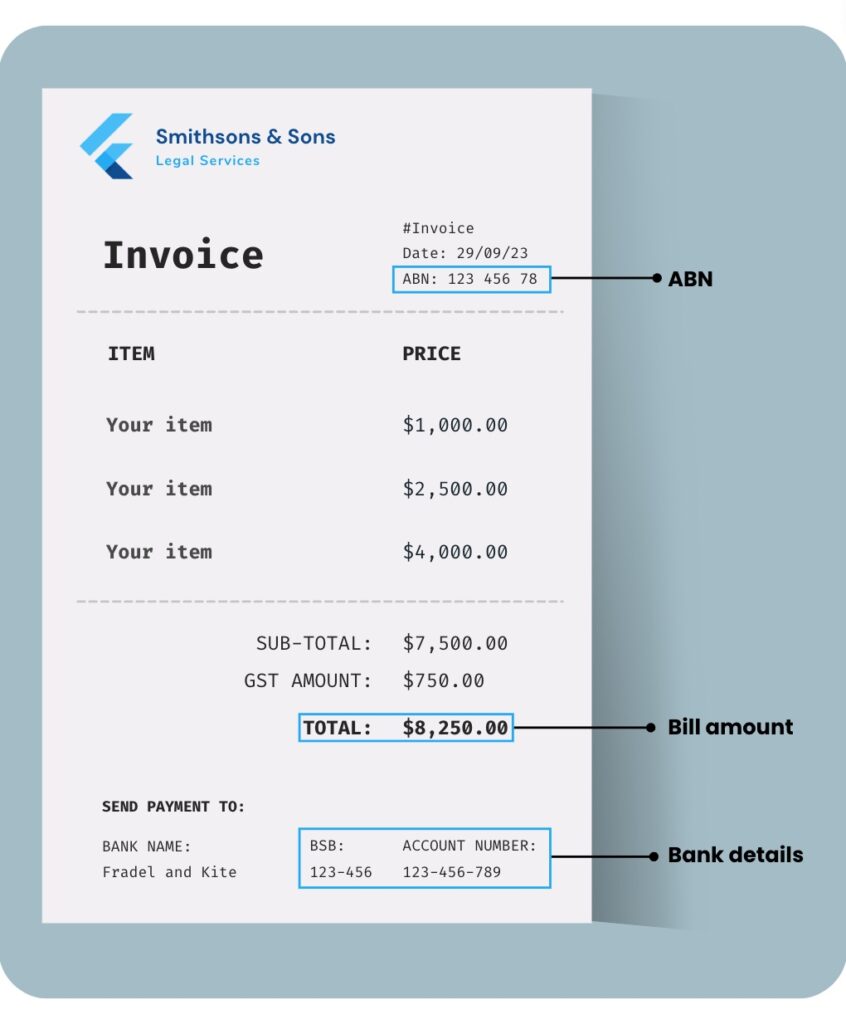

We’ve included both BPAY and non-BPAY (payments to a billers BSB & Account Number) billers too!

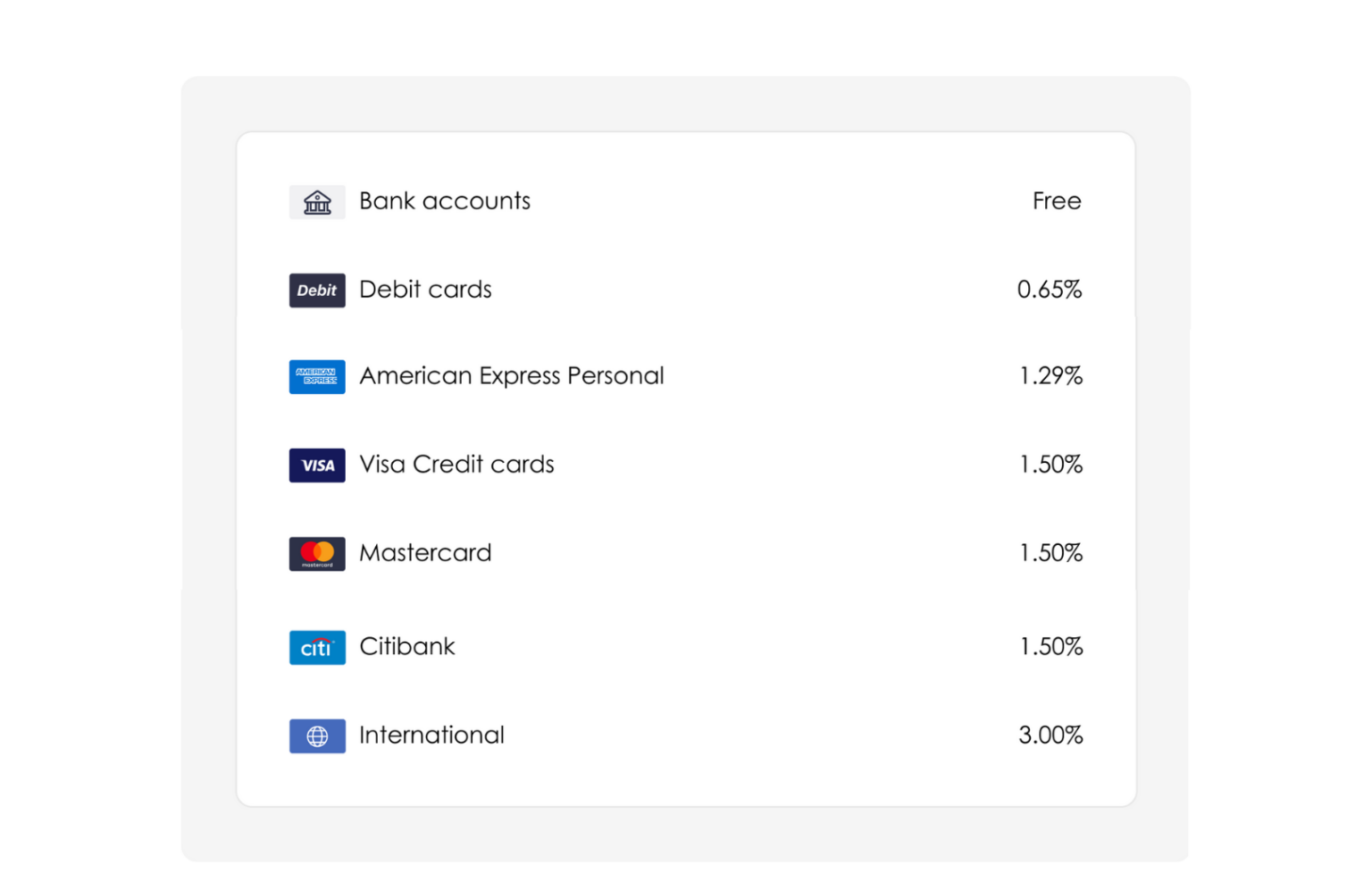

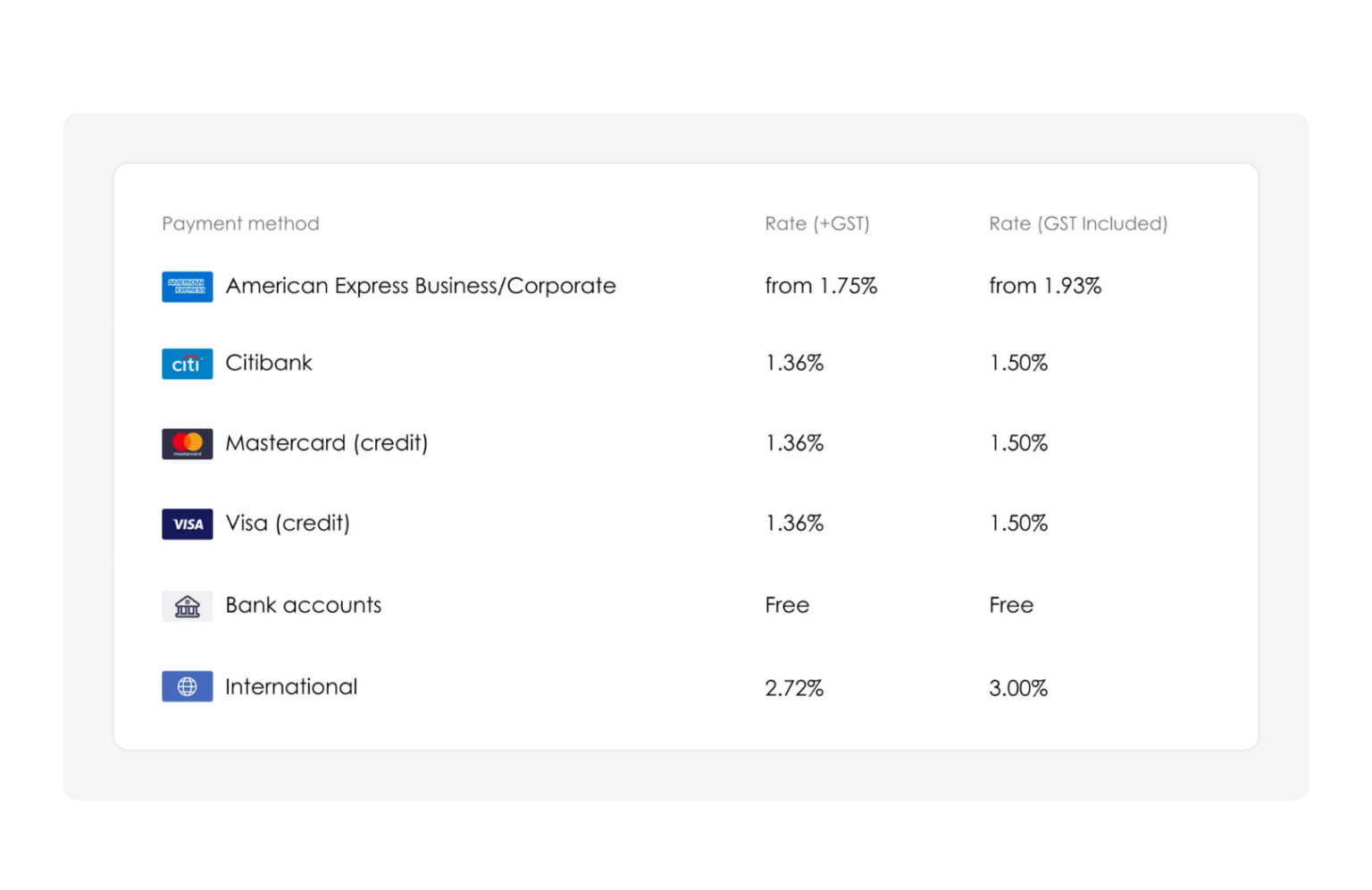

What payment method do you use?

land tax NSW, qld land tax, land tax calculator, land tax victoria, land tax qld, nsw land tax, queensland land tax, sto land tax, land tax calculation nsw, land tax queensland, land tax threshold nsw, victoria land tax, nsw land tax calculator, victorian land tax, qld land tax changes

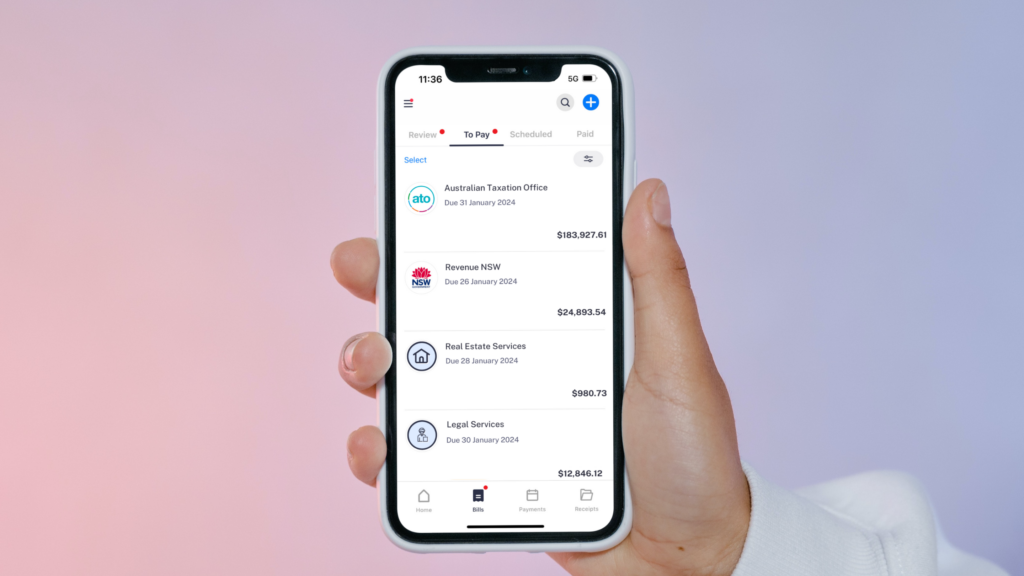

The most popular payments with an American Express (Business)

BPAY Bills

- Australian Taxation Office

- Insurance Advisernet Australia

- ACT Revenue Office

- Vicinity Centres

- iCare Workers Insurance

- Revenue NSW

- Precision Clearing House

- ASIC

- State Revenue Office VIC

- Star Track

Non-BPAY Bills

- Real Estate Services (inc commercial rent)

- Residential Building Construction

- Machinery and Equipment Manufacturing

- Electrical Services

- Management Advice and Related Consulting Services

- House Construction

- Hardware and Building Supplies Retailing

- Gardening Services

- Dental Services

- Building and Other Industrial Cleaning Services

The most popular payments with an American Express (Personal)

BPAY Bills

- Australian Taxation Office

- Revenue NSW

- AGL

- State Revenue Office Vic

- Colonial First State

- Melbourne Inner City Management

- Origin Energy

- iCare Workers Insurance

- Vic Roads

- Urban Utilities

Non-BPAY Bills

- Real Estate Services (inc household rent)

- House Construction

- Specialist Medical Services

- Landscape Construction Services

- Building Installation Services

- Architectural Services

- Accounting Services

- Corporate Head Office Management Services

- Building and Other Industrial Cleaning Services

- Professional Goods Wholesaling

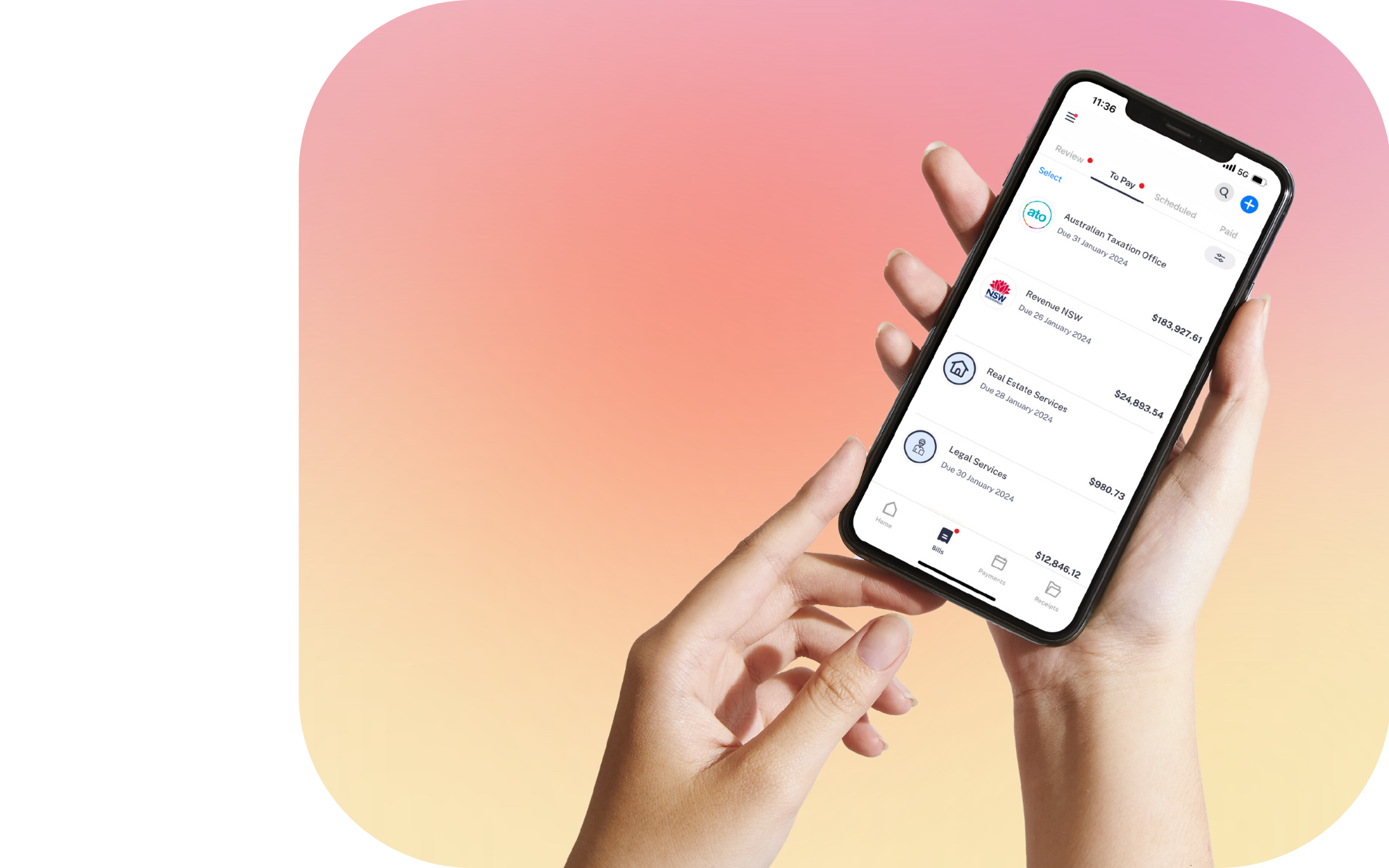

The most popular payments with a VISA

BPAY Bills

- Australian Taxation Office

- DEFT Payment Systems

- Urban Utilities

- Vic Roads

- Revenue NSW

- Payway Rent & Hire

- Strata Pay

- Brisbane City Council Rates

- Transport and Main Roads Registration Renewal

- Origin Energy

Non-BPAY Bills

- Real Estate Services

- Legal Services

- Corporate Head Office Management Services

- Aged Care Residential Services

- Accounting Services

- Gardening Services

- Specialist Medical Services

- Plumbing Services

- Electrical Services

- Veterinary Services

The most popular payments with a Mastercard

BPAY Bills

- Australian Taxation Office

- DEFT Payment Systems

- Urban Utilities

- Revenue NSW

- Strata Pay

- Brisbane City Council

- Origin Energy

- ASIC

- Rental Rewards

- Gold Coast City Council

Non-BPAY Bills

- Real Estate Services

- Accounting Services

- General Practice Medical Services

- Tiling and Carpeting Services

- Specialist Medical Services

- Water Supply

- Plumbing Services

- House Construction

- Specialist Medical Services

- Corporate Head Office Management Services

The most popular payments with a debit card

BPAY Bills

- DEFT Payment Systems

- Urban Utilities

- Brisbane City Council

- Sunshine Coast Council

- Transport and Main Roads Registration Renewal

- Origin Energy

- Strata Pay

- Telstra

- Unitywater

- AGL

Land tax nsw

The most popular payments with a prepaid card

BPAY Bills

- The University of Melbourne (tertiary fees)

- Australian Super

- State Revenue Office Vic

- Strata Pay

- QSuper

- Montgomery Real Estate

- Bright & Duggan

- L J Hooker

- Construction and Building Unions Superannuation

- Meriton Property Services

Land tax nsw

The most popular payments with a bank account

Land tax nsw

BPAY Bills

- Australian Taxation Office

- Insurance Australia

- DEFT Payment Systems

- Urban Utilities

- Transport and Main Roads Registration Renewal

- American Express Australia

- Strata Pay

- Westpac Banking Corporation Card Services

- Commonwealth Bank of Australia Card Services

- ASIC

Non-BPAY Bills

- Real Estate Services

- Education (inc private school fees)

- Gardening Services

- Plumbing Services

- Electrical Services

- Sports and Physical Recreation Venues

- House Construction

- Laundry and Dry-Cleaning Services

- Road Freight Transport

- Automotive Electrical Services