Save $700 on your electricity bill

EXPERTS warn household energy bills are set to soar, so here’s how to prepare now and save $700 off your energy bill.

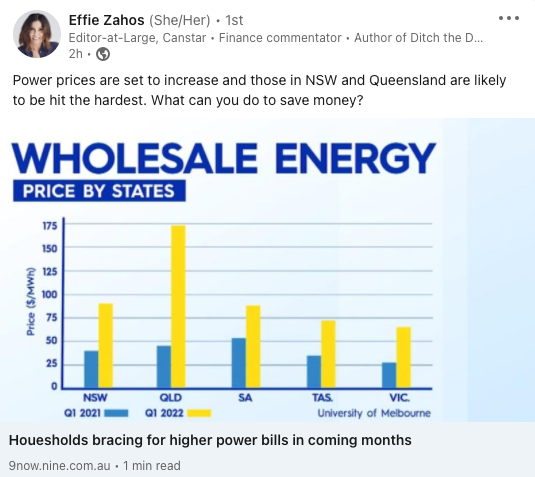

Finance guru Effie Zahos chatted to Nine News this morning forecasting rises around June/ July this year to layer on top on annual winter household heating costs.

The article reminded us of a piece we put together heading into summer last year on how to save $700 on your energy bill. So, we created a winter version for you too, here.

We’re 56 days out from winter and we see you reaching for that reverse cycle aircon as the morning mercury starts to mellow.

Here’s your friendly reminder that every extra degree of heating is adding a greater cost to your energy bill. There’s the obvious steps to layer on an extra jumper, slip on those fluffy bed socks or boots, grab a cup or tea, cozy up with a blanket on or simply do some star jumps. But sometimes, it’s just not enough? We hear you!

If you’re going to run the aircon, what’s the recommended reading? Good question! Set your thermostat between 22 to 24 degrees celsius and ensure your aircon filter is clean. Use your aircon sparingly and if you can, run it to warm your house when you get home, or your bedroom before you go to sleep rather than blasting it 24/7 (we see you, you cheeky devils).

According to a recent article by Nine news, ‘Households bracing for higher power bills in coming months’, wholesale energy prices, which make up to 32% of our bill, are soaring and your next energy bill will follow accordingly.

If you’re looking to prepare now to reduce the cost of your next energy bill, here’s some fast facts from the Department of Energy to save you in other areas of your home.

- Turning off, or ridding yourself of a second fridge could save you around $172 a year

- Switching off the game console when not in use could save you up to $193 a year (this goes for all appliances you’re not using, just remember to switch them off at the wall)

- Using the clothesline once a week instead of using the dryer could save around $79 a year

- Installing a water-efficient 4-star showerhead could save around $315 a year on water bills (you’ll also save on your energy bill as less water will need to be heated)

- Shop around for the best deal from energy suppliers, don’t assume you’re automatically on the best plan.

Effie’s top tips from the Nine News article this morning:

- If you’re eligible for rebates (e.g a low income earner or pensioner) “grab them” – there’s some great information, here.

- When you receive your energy bill, check the bottom of your bill to see if you could save on a cheaper plan with your current provider.

- Or, better yet, use receiving your bill as a reminder to “compare, compare, compare” with other energy providers to ensure you’re getting the best deal, check out the comparison tool by Compare the Market, here.

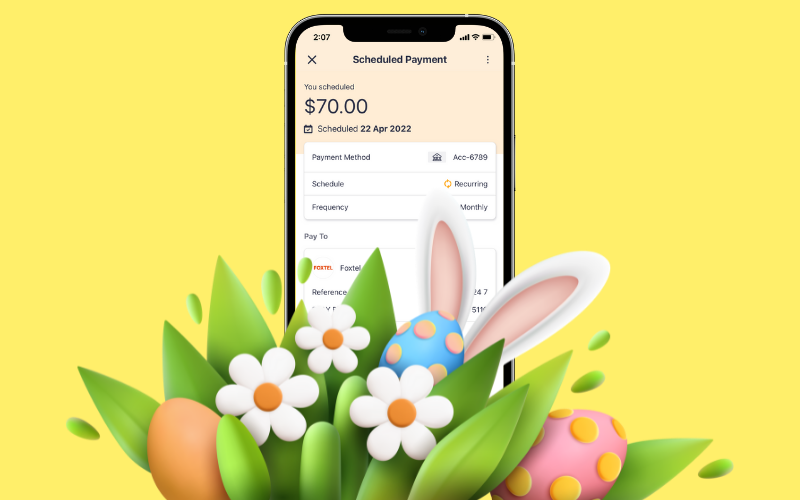

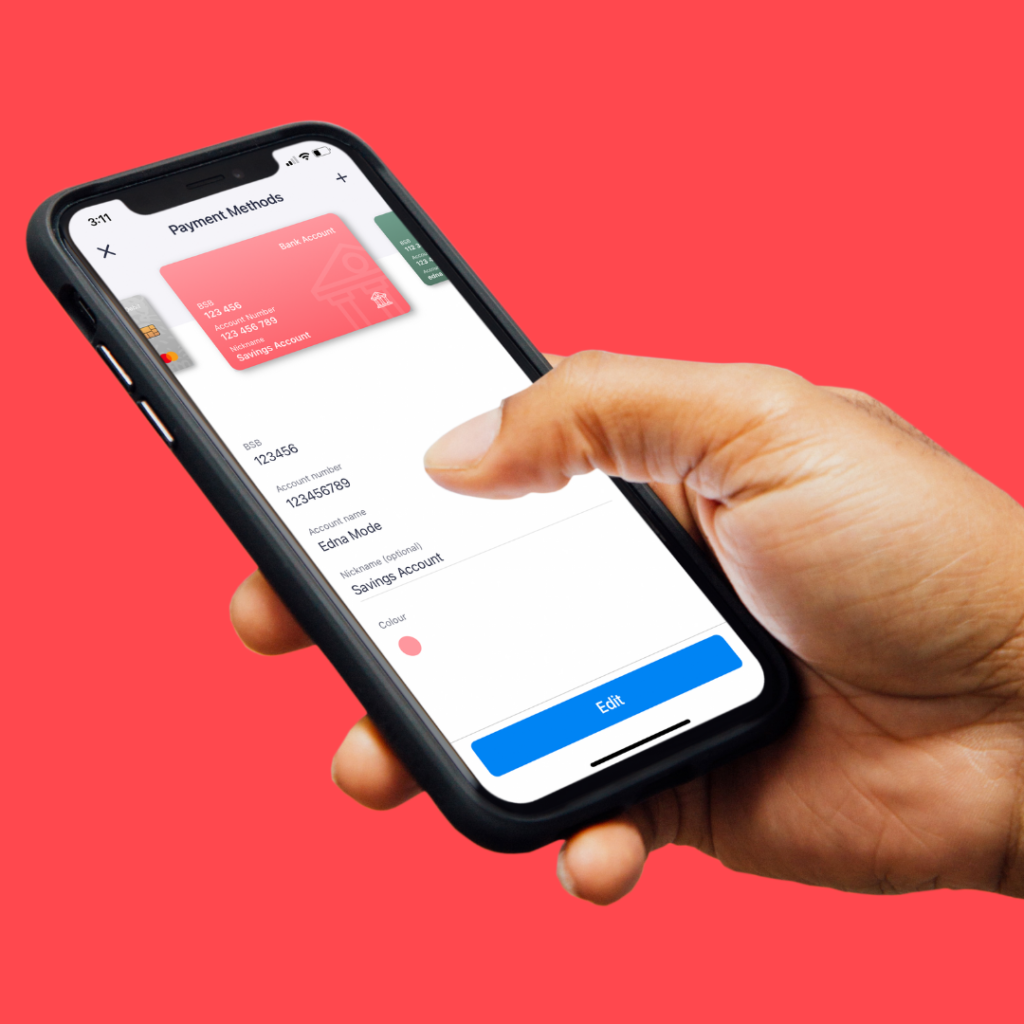

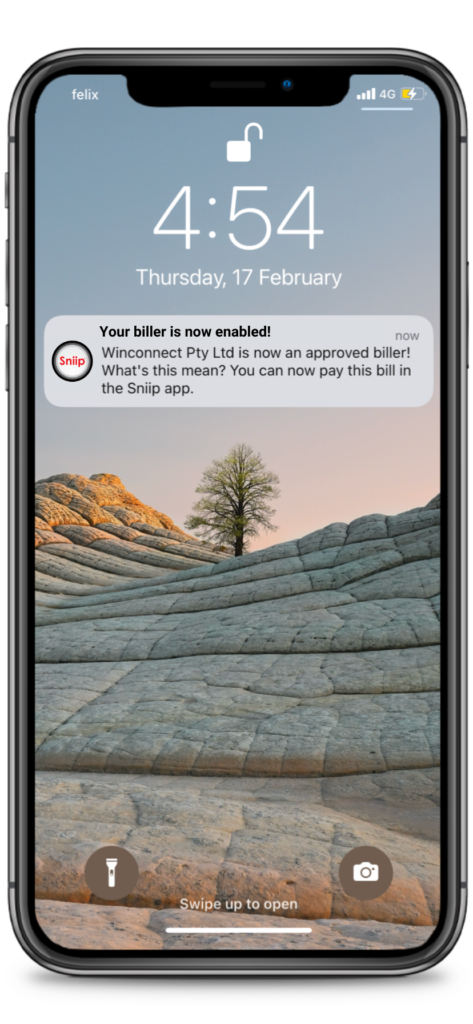

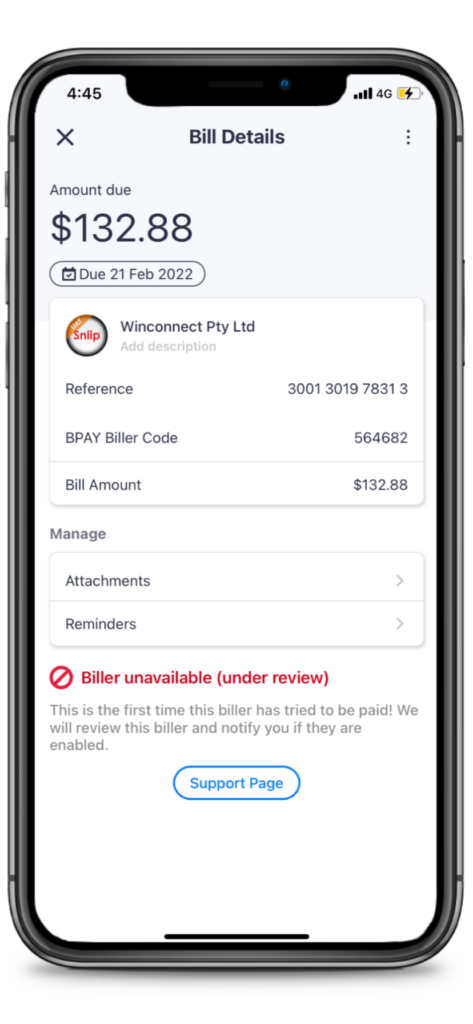

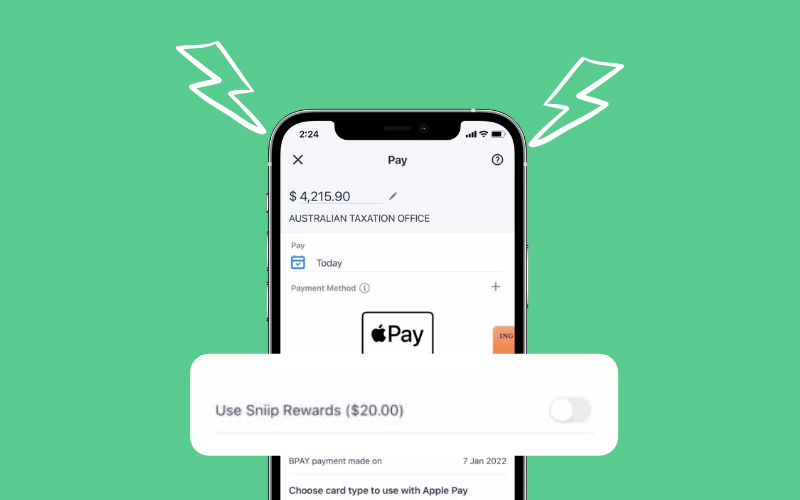

Plus, you can use Sniip instalments (not a BNPL) to save your own money in advance. That way, when your bill due date rolls around, there’s no nasty surprises and you’ve got the money ready to roll.