Our ten most popular recurring payments

Our ten most popular recurring payments

- How can I earn more Qantas Frequent Flyer Points or Velocity Points?

- Use Sniip to pay all of your business and personal bills while earning full credit card points!

Introducing: Recurring bills! Today we’re revealing our ten most popular recurring payments set-up in the Sniip bill payment app. Wondering what bill you could make a recurring payment?

To give you some inspiration, here’s our Top 10 recurring bills our users love paying with Sniip:

1. Water, waste and sewerage (Urban Utilities, Victorian Water Corp, etc)

2. Council rates

3. Tax bills (Australian Taxation Office, Land Tax)

4. Rent (DEFT, RentPay, Meriton Property Services, PayWay rental and strata)

5. Phone, mobile and internet (Optus, Telstra, Vodafone, iiNet)

6. Energy (Origin, Momentum Energy, AGL)

7. Health insurance (Medibank, Bupa, AHM, HCF)

8. Real estate fees (Rich & Oliva, Abel Property)

9. Superannuation (AustralianSuper, Rest Super)

10. Child care and school fees

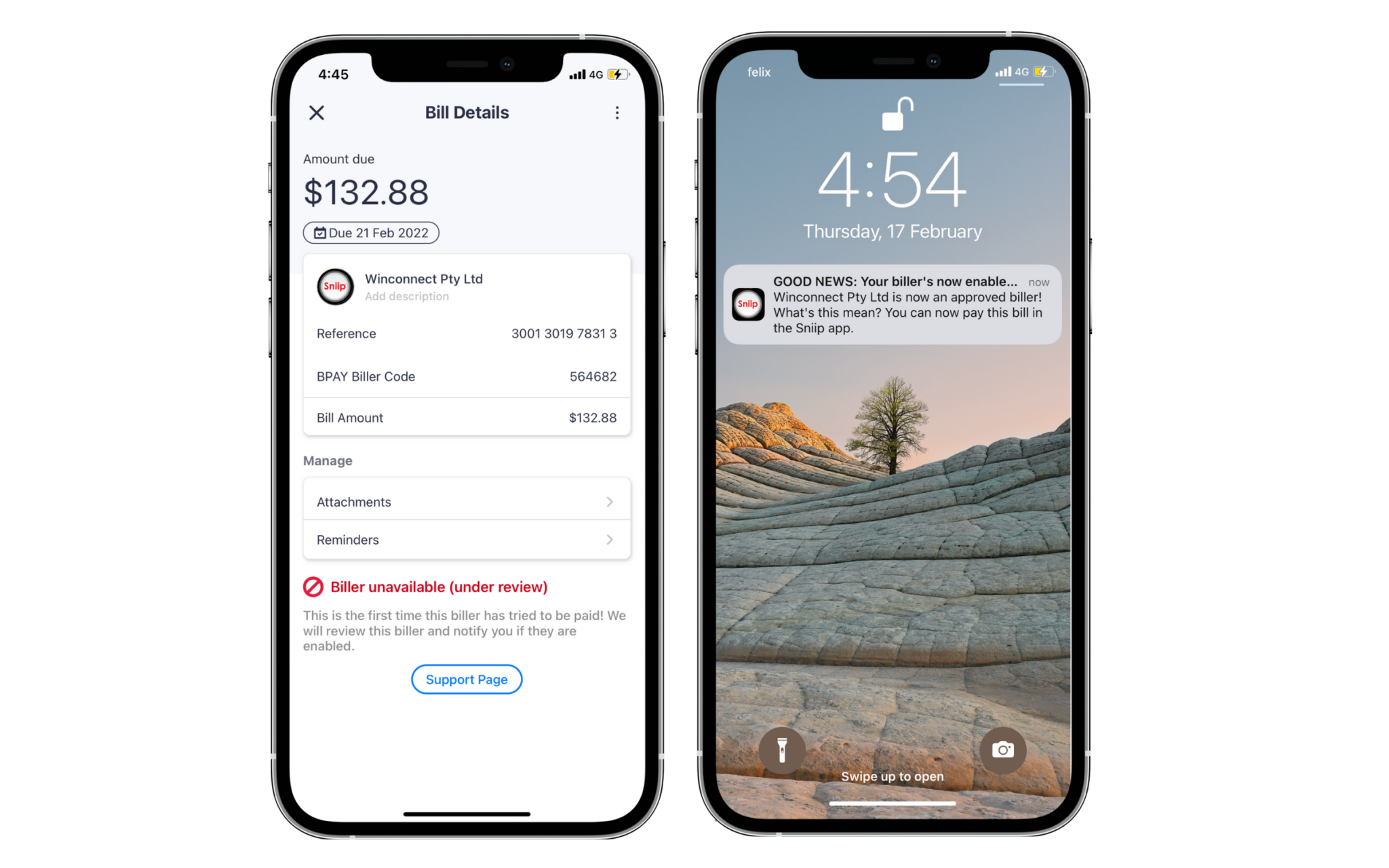

How to set up a recurring bill payment

- Scan or import the bill to Sniip

- In the bill details, tap on ‘Schedule’

- Select ‘Recurring Payments’

- Select the frequency and end date for the payments

- Confirm

- Done!