Leah Kidd

Financially savvy New Years resolutions – PART 2

Financially savvy New Year's resolutions – Part Two

Last week we shared part one of our Financially Savvy New Year’s Resolutions.

We covered everything from asking for a better rate on your home loan to starting a side hustle.

Up next is Part Two of our financially savvy New Year’s Resolutions:

- Explore investing in shares

No-one’s money is working hard for them in a savings account or fixed term deposit right now. A recent article showed 40 per cent of Millennials and Gen Z invested in shares.

There’s so many different ways to invest but if you’re new to the game, micro investing platforms like Spaceship, Raiz or CommSec Pocket are a good place to start.

- Don’t worry about the Jones’ – Put a 24 hr hold on all purchases

Let’s be honest, keeping up with the Jones’ is a costly and fruitless expedition. The reality is, no matter how much you have, you will likely always want more.

With Instagram and Facebook shopping, you can check-out in a few taps and while $40 might not seem like much – all these little purchases quickly add up. The solution? Try to put at least 24 hours between an item piquing your interest and you making a purchase.

- Make a budget (and stick to it)

There’s so many different ways to work out your budget and they don’t have to be painful. If you’re lost as to where to start, the Barefoot Investor provides a step-by-step guide on budgeting and the exact percentages recommended to spend, save and splurge.

Budgets might not sound sexy but they sure are helpful to take the guilt out of spending and set a clear vision for your financial goals. The idea is less about restriction and more about creating buckets of spending, saving and splurge money (or whatever you want to call that frivolous spending cash!).

Otherwise you may find yourself spending recklessly and feeling bad about it later. When you know what you’re allowed to spend, you won’t feel guilty about treating yourself.

- Review subscriptions

Did you sign up for a three-day trial of an app and forget to cancel? All the subscriptions you don’t use are still costing you money.

Take an inventory of all your subscriptions and you might be surprised by just how much you’re spending and what you could cut down on.

Not sure of what other subscriptions you have? Here’s how you can see mobile subscriptions on iOS and Android. You might be surprised to see what sneaky subscriptions you’re still forking out for.

- Declutter your home

Clearing out your space can do wonders for your mind and the bonus is, if you pop some of what you clear out on Gumtree, Ebay or Facebook Marketplace, you could earn money on what you no longer use.

Maybe you’ve got an old vacuum cleaner or washing machine under the house, old sunglasses, a watch or shoes you no longer wear or an assortment of unused kitchen appliances you could turn into cash.

If you’re lost as to where to start, check out Slow by Brooke McAlary or follow The Organising Platform over on Instagram.

Financially savvy New Years resolutions – PART 1

Financially savvy New Year's resolutions – Part One

As we head into the New Year, here at Sniip we have put together our best financially savvy New Year’s resolutions for you all.

1.Round up for the wrap-up

As we can all attest, Christmas and the festive season can be expensive. Maybe you can consider rounding up your purchases to the nearest dollar? (Banks such as ING, Up and others offer this service). You can roll those round-ups into a Christmas Club/Festive Fun savings account and take the sting out of the 2021 festive season.

2. Dry January?

Alcohol can be expensive and after the festive season, we could probably all do with a bit of a breather. Maybe you could try a dry January or February (or maybe Dry July) and skip the beverages for the month. Take the money you would have spent and invest that into your savings to kick-start the year.

If alcohol isn’t for you, pick another recurring expense you could cut back on. Maybe it’s coffee, an energy drink, a bliss ball, or lunch out each day. Whatever it is, see if you can take a break for a few weeks.

You’ll be surprised by how much money you can save and the sense of achievement when you reach your resistance goal is a great perk too.

3. Stop paying late fees

A bill comes in, you see the due date and pop that to the back of your mind for later. The days roll over quickly and before you know it, the bill is overdue and you’re hit with a late fee.

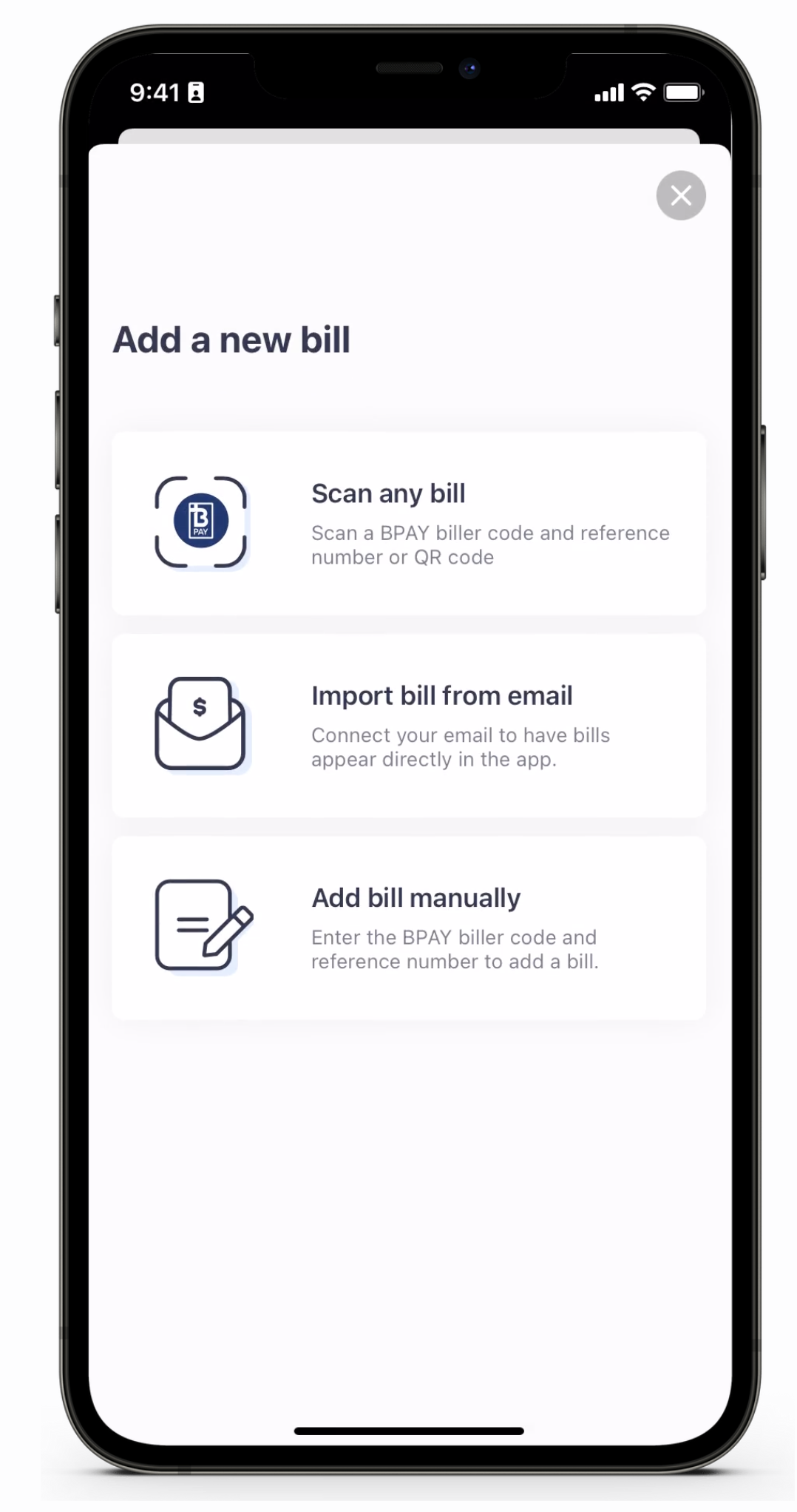

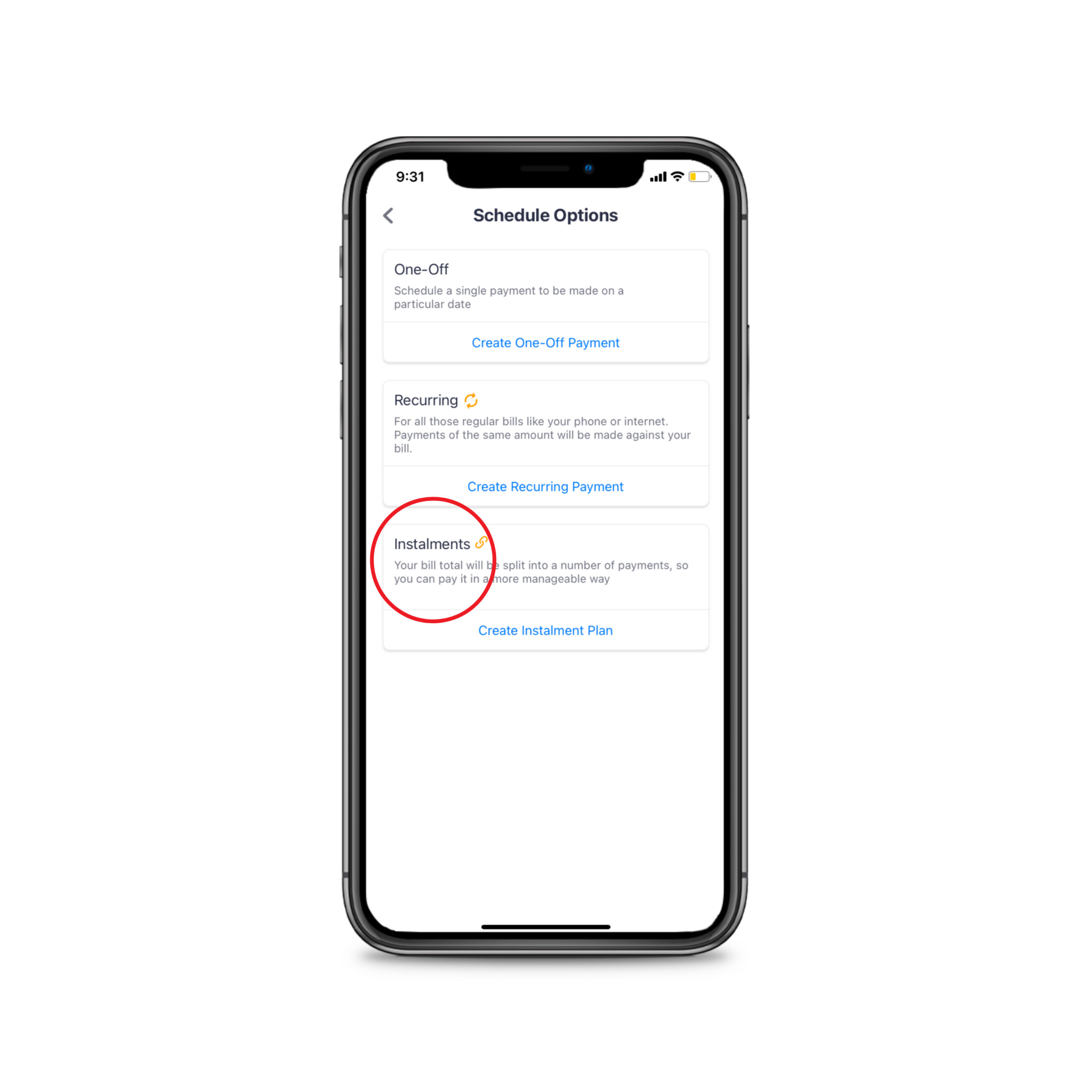

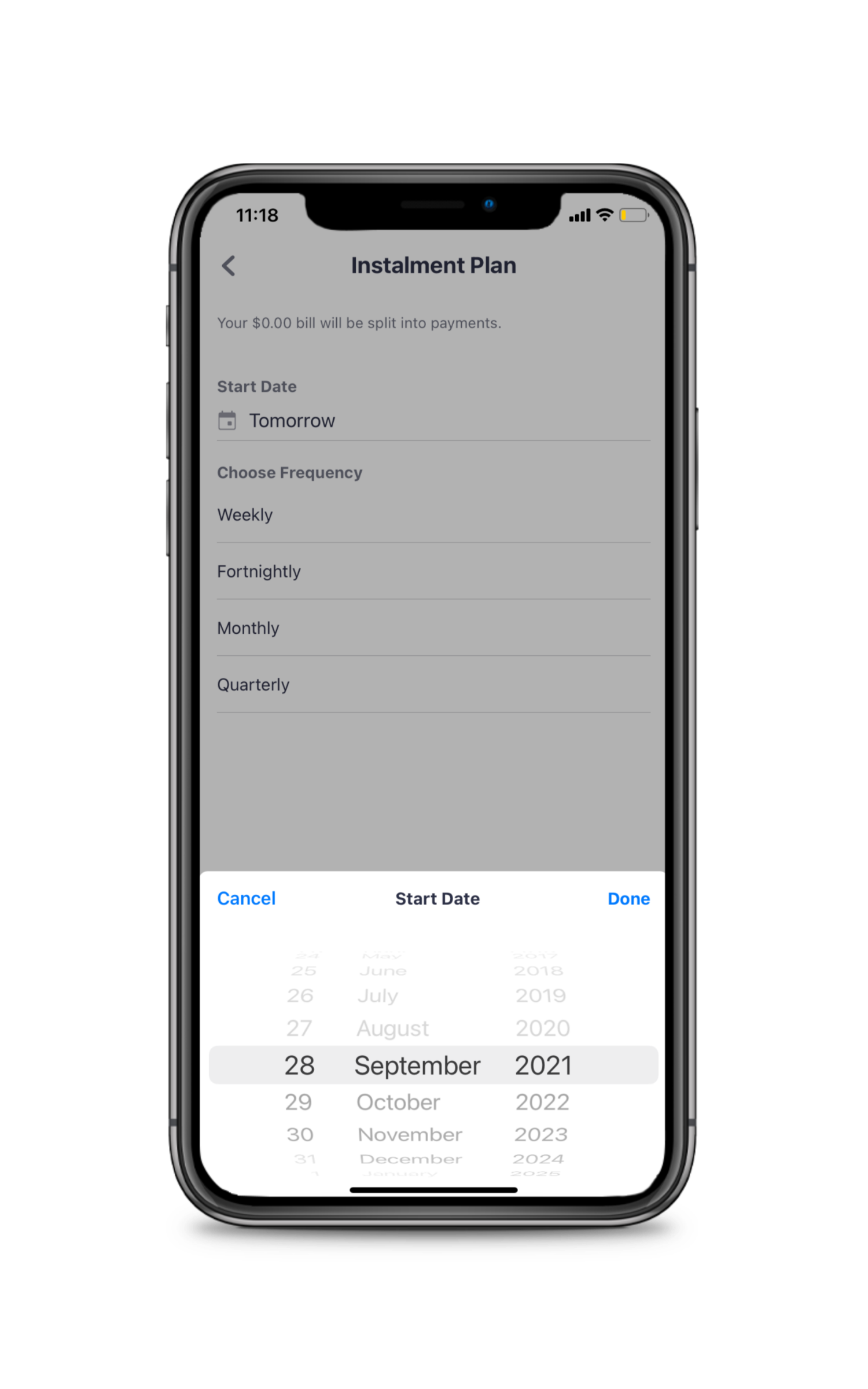

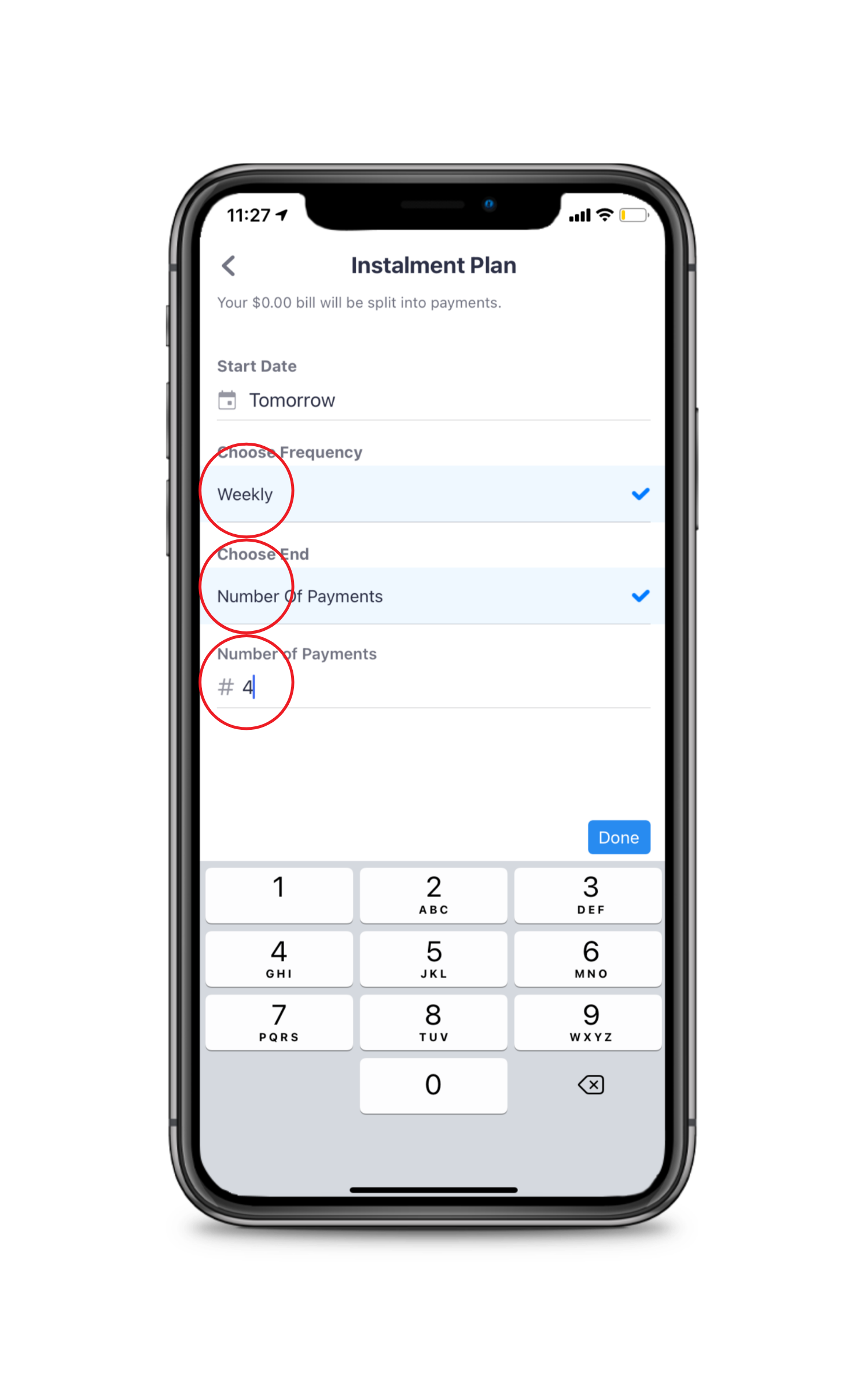

Late fees are dead money and your hard-earned dollars deserve a better future. But there’s good news. Using the Sniip app, you can schedule your bill payments as soon as they drop into your mailbox and set and forget, knowing that your bills are sorted. The results speak for themselves as 90% of all the bills ever paid using the Sniip app have been paid before the due date!

4. Consider a side ‘hustle’

Are you always baking for your friends? Do you love sewing, mending or perhaps woodwork? Or, are you a secret maths whiz who could offer some tutoring on the side?

Think about what you love doing in your downtime and how that hobby might be able to make you some spare change. The reality is, earning $500 a month equates to $6,000 a year – yes please!

5. Ask for a better rate

Do you have a home loan at a rate over 3%? With most residential mortgage rates now starting with ‘2’ at the front of them, you may be able to ask your bank for a better rate or shop around for a better deal.

Ensure you do the research and arm yourself with information. Explore what’s available on the market, tell your bank what competitors are offering and what it will take for you to stay.

Note: Make sure the loan is over the same period as your current loan and doesn’t extend your repayment period another 5/10 years or you might end up paying more interest overall than at your current rate.

Last minute Christmas shopping? Sorted!

Last minute Christmas shopping? Sorted!

1.Buy an experience

You’re pressed for time and the person you’re buying for likely has enough stuff in their home already. Why not buy them an experience instead? Shop last minute from the comfort of your own couch with little more than a bank card and a printer (or just email the gift certificate to them instead). Sorted!

There’s a plethora of options online like RedBalloon for the adventure junkie or subscriptions like Magshop or Book a Buy for the avid reader. You can even get creative and organise your recipient a home cleaner/ ironing done for a week or two/a facial/a massage or home delivery meals (try HelloFresh 0r Soulara) too.

2. Make a donation in their name

Charities have done it tough this year and could do with all the support they can get. How about making a donation to a cause or charity that aligns with your recipient’s values. You can easily make a donation to one of the registered charities in the Sniip app too, simply open the app, tap the menu and select ‘support a charity’.

3. Stock up on their favourites

Your local supermarket might seem like the last place to go to buy presents, but if you’re time poor (and on the way to the party), it can be beyond helpful.

Does your friend/family member love a particular chocolate or an expensive brand of oat milk?

Why not stock up their favourite supplies or put together a quick hamper. Simply grab a mixing bowl, pop your items in the bowl then cover with an over bag and you’re done. There’s some great ideas of what you could fill your gift basket with, here. No-one is going to begrudge a gift of a few blocks of their favourite supermarket chocolate/ treat.

4. Same day and same evening delivery

There’s a selection of online retailers who offer expedited delivery for Christmas day. You get what you pay for and if you need speedy delivery, it will cost you but sometimes it’s worth the money to remove the stress you’re feeling for gifts not being sorted. It’s been a whirlwind of a year and December kind of snuck up on all of us.

If there’s a specific item you need/want to buy, check out sites offering same day/ evening delivery like The Iconic, Target and Myer (click + collect), The Hamper Emporium/ Hamptons Hampers.

5. Regift, regift, regift

Who says regifting has to be saved for next Christmas? By this point we’ve probably all been part of some form of Secret Santa/ present swap situation. Why not take the opportunity to regift it onto someone else who will really appreciate it?

Or, maybe you’ve got some almost expired gift cards collecting dust in your wallet from Christmas 2019 or birthday/celebrations been and gone. Save yourself some pennies and use up the gift cards when doing your Christmas shopping this year. That’s some savvy regifting!

Top items to buy after Christmas

Top items to buy after Christmas

So we’ve just made it past Black Friday and Cyber Monday! But before our bank accounts can catch up, Boxing Day is here and we’re bombarded with more deep discounts.

As overwhelming as it can seem, if we’re strategic in our purchases now, this can be a really financially beneficial period. By buying what you already need/will need to purchase in the not-so-distant future, you can be prepared before the rush and reduce expenses for the coming year.

INSIDER TIP: Keep the tabs open on your web browser and refresh them come Boxing Day. That way, you’ll see what discounts are available on the exact items you’re already looking for, rather than get overwhelmed by offers for stuff you don’t need.

- Christmas decorations, cards and bon bons

You know when the best time is to shop for Christmas paraphernalia? The day after Christmas. If you’ve got the storage space at home, the days and weeks that follow the festive season are the best time to pick yourself up a bargain on all things Christmas. Let’s be honest, those Christmas crackers can be expensive!

- Calendars and diaries

Are you still a stickler for the paper diaries and calendars? Now’s your time to shine! As we edge closer to the New Year, these calendars start being massively discounted. There’s some great digital options on the market too that you can print at home to save yourself some money.

- Valentines Day gifts

Golly, that’s organised we hear you say. Well, the reality is Valentine’s Day is just 51 days after Christmas and it will be here before you know it. If you’re looking to get your loved one a present that doesn’t weigh too heavily on the purse strings, you’ll likely be able to pick up a good discount in the Boxing Day/New Year sales. From perfume, magazine subscriptions to unique experiences, if you have the capacity, now’s the time to buy to avoid the price hikes in February.

- Gym membership and subscriptions

Now, no-one is saying you should follow the New Years Resolution crowd and get a gym membership subscription that you may not really use. However, if you currently have a gym membership that you could be happier with, or are looking to get your foot back in the door, now might be the time to shop around and see if you can get a better deal.

- Birthday presents

Similar to Valentines Day presents, why not create a list of everyone you need to buy for in the coming year and see if you can’t nab a deal on the gift you’d like to buy them.

Maybe you could pick up a few gender neutral presents too for those moments when there’s a birthday we forgot about (we’ve all been there) – sorted!

- Tech and homegoods

From kettles to laptops, a new washing machine or a couch, you can pretty much guarantee you’re going to be able to find yourself a saving on technology and home goods post-Christmas.

If you wouldn’t have purchased at full price, it’s probably not essential. But if your family has outgrown your 8kg washing machine or the kids need new tech for school, it’s not a bad idea to keep an eye out for a discount on what your family already needs.

- Wardrobe staples

Take an inventory of your wardrobe and see if there’s any key pieces you’re really on the hunt for. Do you need a new suit for work? A simple A-line skirt or some cotton/linen dresses to see you through the scorching summer ahead, you won’t have to look far to find retailers with unreal deals this season.

Hot tip #1: Take your personal measurements whether you’re shopping online or in person. Having your measurements when shopping in-store can assist in avoiding crowded change room situations.

Hot tip #2: On that note, check the returns policy on the store you’re shopping at. Sometimes super sales come with a ‘no returns’ policy. It pays to check the returns policy before purchasing.

- New car

Look, it’s not going to be on everyone’s boxing day list, but if you’re in the market already – it’s a good time to look. The adage of out with the old and in with the new sees dealerships offering some pretty attractive deals to move older (new car) stock.

- New house?

This is a big ticket item, but hear us out. December can be a really slow period for real estate and agents often pull houses for the market/sellers are too time poor with Christmas to prepare their homes for a new listing.

In January, there’s a glut of new homes that hit the market which can often make real estate more affordable.

If you’re on the hunt for a new house, you’re bound to find fresh inventory and you might find those houses that sat in the months prior listed for a more appealing price in the New Year. Who knows? Worth keeping an eye out.

Christmas travel guide – Australia edition

Leah Kidd

Looking for a Christmas holiday that won’t break the bank or, have a little more in the kitty to spend this year?

Whether your ideal holidays looks like the beach or the bush, there’s something for everyone in this roundup.

Plus, while you’re on holiday, why not consider putting your own house/ room or granny flat on Airbnb to save yourself a little extra on the trip.

Three steps to listing your home for short-term rentals:

(1) Take a few snaps of your home

(2) Add your listing price and minimum stay

(3) Welcome your first guest (yes to savings!).

Queensland

Rainforest cottage, Cooloolabin

New South Wales

Victoria

Western Australia

Heritage home in heart of city, Perth

Private & peaceful, Bandy Creek

South Australia

Northern Territory

Squeakywindmill Boutique Tent B&B, White Gums

Tasmania

Christmas gifting guide under $20

Christmas gifting guide under $20

Whether it’s for another secret santa, or you’re running out of stocking filler ideas, we’ve rounded up our top picks for gifting under $20.

Want to save $700 on your energy bills? Here’s how

Want to save $700 on your energy bills? Here's how

The mercury is soaring and we see you reaching for that aircon remote.

Here’s your friendly reminder that every extra degree of cooling is adding a greater cost to your energy bill.

What’s the recommended reading? Set your thermostat between 22 to 24 degrees celsius and ensure your aircon filter is clean. Use your aircon sparingly and if you can, run it to cool your house when you get home, or your bedroom before you go to sleep rather than blasting it 24/7.

According to a recent article by news.com.au, approximately 13 percent of Australians have already asked for, or were planning to ask for an extension on their energy bill.

If you’re looking to reduce the cost of your next energy bill, here’s some fast facts from the Department of Energy to save you in other areas of your home.

- Turning off, or ridding yourself of a second fridge could save you around $172 a year

- Switching off the game console when not in use could save you up to $193 a year (this goes for all appliances you’re not using)

- Using the clothesline once a week instead of using the dryer could save around $79 a year

- Installing a water-efficient 4-star showerhead could save around $315 a year on water bills (you’ll also save on your energy bill as less water will need to be heated)

- Shop around for the best deal from energy suppliers, don’t assume you’re automatically on the best plan.

Fast five: holiday hacks to save you serious $$

Fast five: holiday hacks to save you serious $$

1. Do a little (read: a lot) DIY

Last week we touched on the idea of DIY pot plants.

Now we’ve planted the seed, we wanted to build upon it. The reality is, you can DIY pretty much anything for Christmas and save yourself some serious dollars.

From your gift-wrap to your present tags, Christmas cards, the gift themselves and of course, who wouldn’t love a DIY baked good for Christmas.

2. Don’t buy presents for yourself

We see you adding that extra item to the cart. A little something for the list, a little something for yourself can spiral out of control quite quickly and blow the budget.

As tough as it is, resist the urge. It’s likely the item you’re chasing will be available in the New Year when your gift giving finances have had a little breather.

3. Unsubscribe from marketing emails

If you’re not in the market for something, you likely don’t need to be receiving marketing emails. If you are in the market for something, it’s easy enough to find a deal/ discount when you need it. It’s amazing how often you find you “need” something just because it’s on sale.

It might be time to do a quick little stocktake/cleanse of your inbox and determine which emails you need to be receiving and which ones are a little too tempting.

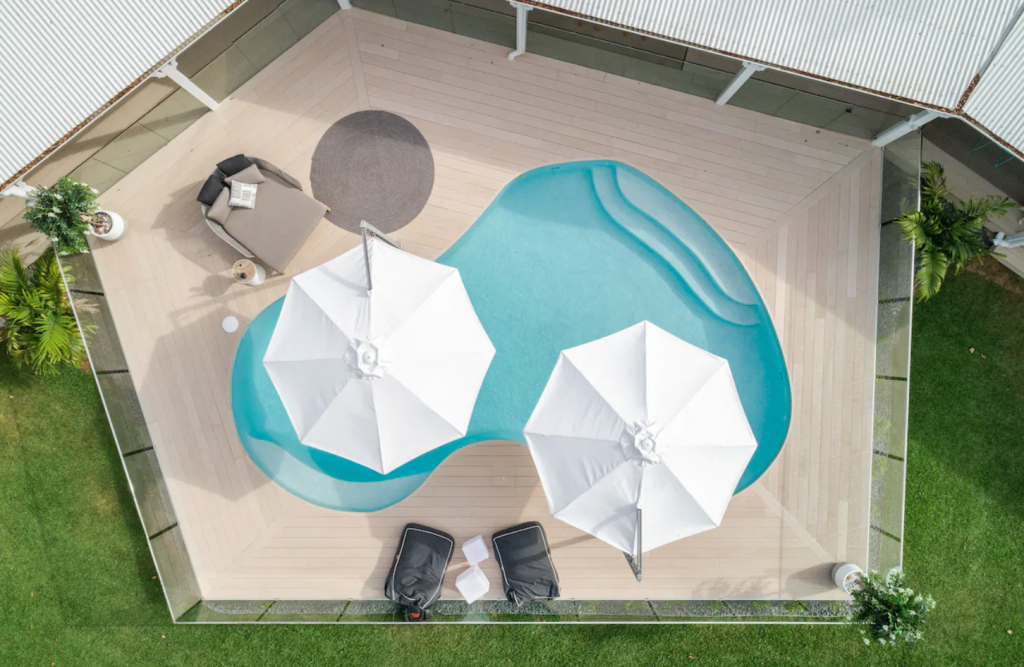

4. Think out of the box for a holiday

The international and potentially interstate borders where you live may not be open for Christmas and let’s be honest, there may be no room for travel in the budget this year.

A little staycation can be a fun way to switch it up and feel like you’re had a break. Sometimes a little distance from the house, away from chores and whatnot is a holiday in itself.

Perhaps go camping and explore a local National Park. Or, if you’re not up for roughing it, support a local business and book a few days at a nearby hotel or perhaps an Airbnb.

5. Bank the points

If you pay your bills with the Sniip app, you can earn full points on your points earning bank card.

While the international borders are closed right now, why not bank those precious loyalty points now. That way, when you’re ready to fly again, you can take off in style!

Five tips for a financially savvy festive season

Five tips for a financially savvy festive season

1. Get in early

Write a list of every person you have to buy for and add a rough idea of what you’d like to buy them. Now, it’s time to get in and start ticking each person (or pet) off.

Set aside time in your diary to shop in person, or online and smash it out. Most importantly, start now and cross each person off as you get their gift. You’ll get a little burst of achievement with every person you tick off and will be ready to move onto the next.

By getting in early, you’ll avoid the express shipping costs incurred when you’re scrambling to ensure the gift arrives in time for Christmas day. Plus, you’ll ensure your loved ones don’t end up in an episode of Friends with a gift from the local petrol station. We’ve all been there.

2. Set a budget (and stick to it)

Maybe you’ve got $10 to spend on Christmas, or maybe you’ve got $1,000. Perhaps there’s people you like to splurge on in your family/ friendship group and there’s others you want to give a token of your appreciation to. Divvy up your list with a budget for each person and challenge yourself to stick to it.

If $10/$20 seems unachievable, it might be time to get crafty. A terracotta pot from Bunnings can easily be jazzed up with some paint and a small plant.

And keep in mind, an experience often costs less than a gift and could be as simple as a voucher for the recipient’s local coffee shop. Supporting small business, and on-budget is a double win.

3. Trim the fat

Are there monthly or recurring subscriptions you could pop on hold over the festive season?

Maybe you’re planning to head away over Christmas and don’t intend on hitting up the gym. Perhaps you plan on doing some Christmas cooking and could probably put that weekly food subscription service on hold for a while to save some money.

Not sure of what other subscriptions you have? Here’s how you can see mobile subscriptions on iOS and Android. You might be surprised to see what sneaky subscriptions you’re still forking out for.

4. Group the gifting

Are you from a big family, friendship group or workplace?

Cut down on the cost of individual gifts and suggest a Secret Santa this year and save yourself some serious gift money. The budget might be as simple as $10 or $150, it’s really up to you!

There’s a bunch of online tools to make the process easier (we like Drawnames) and those in the group can make suggestions of what they’d like. Participants can add online links to make the process smooth, simple and cost effective for all involved.

5. Avoid late fees

Sometimes you might head away for Christmas and other times you’re just so focused on relaxing, spending time with family and having a bit of a digital detox that bills can creep up.

Add your upcoming bills to the Sniip app now, select when you’d like them to be paid then set and forget, enjoy your Christmas and know your bills are sorted without any painful late fees.

Stats show 90 percent of bills paid using the Sniip app are paid on or before the due date (probably because it’s so fast and easy!). That means more money for Christmas and less money burnt on late fees.