Ben Fraser

Are you embarrassed by your late payment charges?

How to stop paying your bills late

Are you embarrassed by your late payment charges?

You’re not alone. Late fees are costing Australians around $286m a year according to research from one of the big four banks.

Some energy bills can have late fees of up to 40 percent.

But despite this, 27 percent of Australians pay at least one bill late each year.

In times like these, with unemployment up to 7.5 percent, we simply cannot afford to throw money away.

So what’s the answer?

Lining up at your local post office to pay your utilities bills is not only time consuming, with COVID-19, it’s less appealing than ever before.

Then there’s paying bills via internet banking. What should be easy enough tends to be a real chore. You start off your regular bill paying session with a coffee and a biscuit but after getting through a stack of bills and data-entry, you’re ready to drink something a little harder.

And let’s not forget to mention the bills you never even saw. Maybe the paper bill that never arrived, or got accidentally thrown into the bin with the latest wad of junkmail.

Electronic bills sent by email definitely help. But why is it that most important bills end up in junk mail or spam? Or if you’re like us, you need someone to remind you to check your email regularly – both junk and spam too.

Surely there’s a better way!? Well there is.

There’s Sniip.

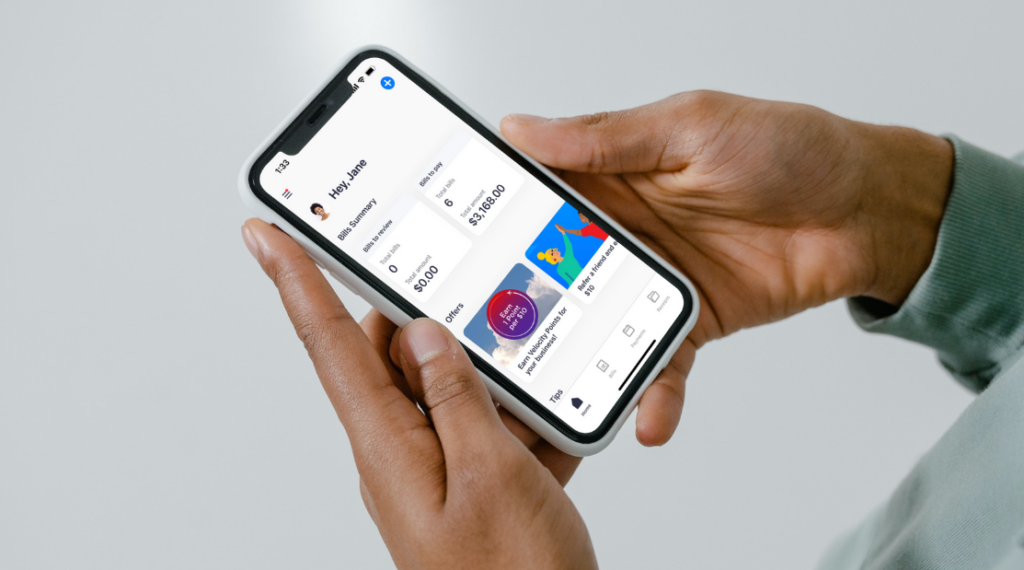

Sniip is a Brisbane-based, Australian owned bill paying mobile app that makes bill payments super easy.

Better yet, Sniip’s bill scheduling feature helps you say goodbye to those late payments fees.

Sniip’s m-billing (mobile billing) subscriptions means your regular bills can be sent straight to the app with push notification alerts for you when they arrive. This is in addition to any paper or electronic version you may wish to receive.

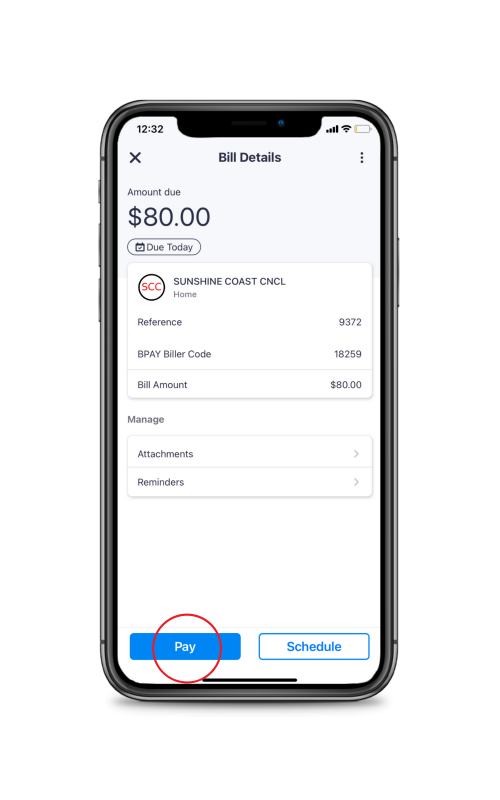

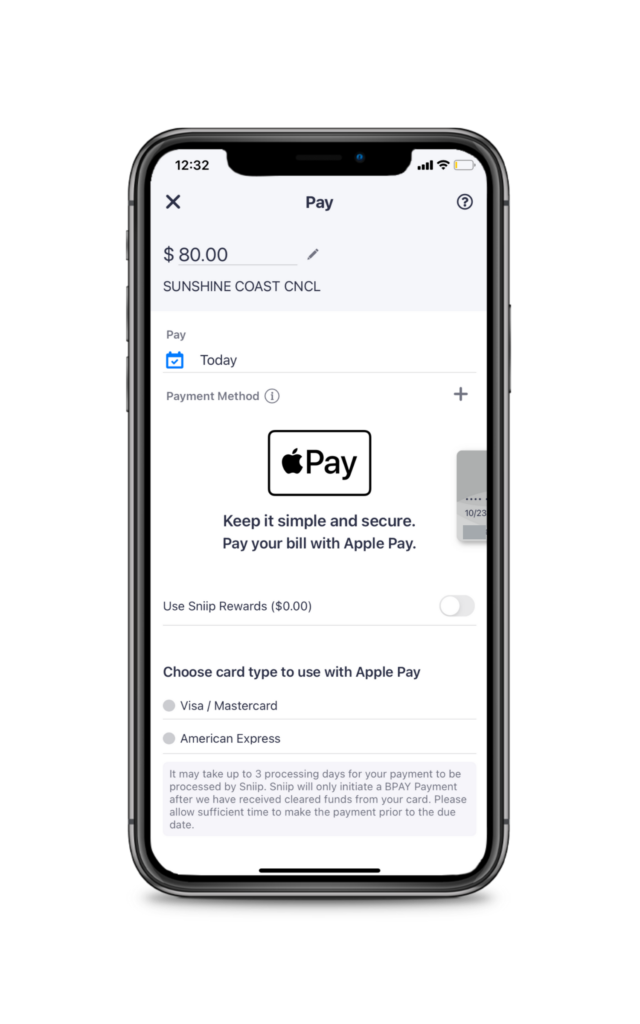

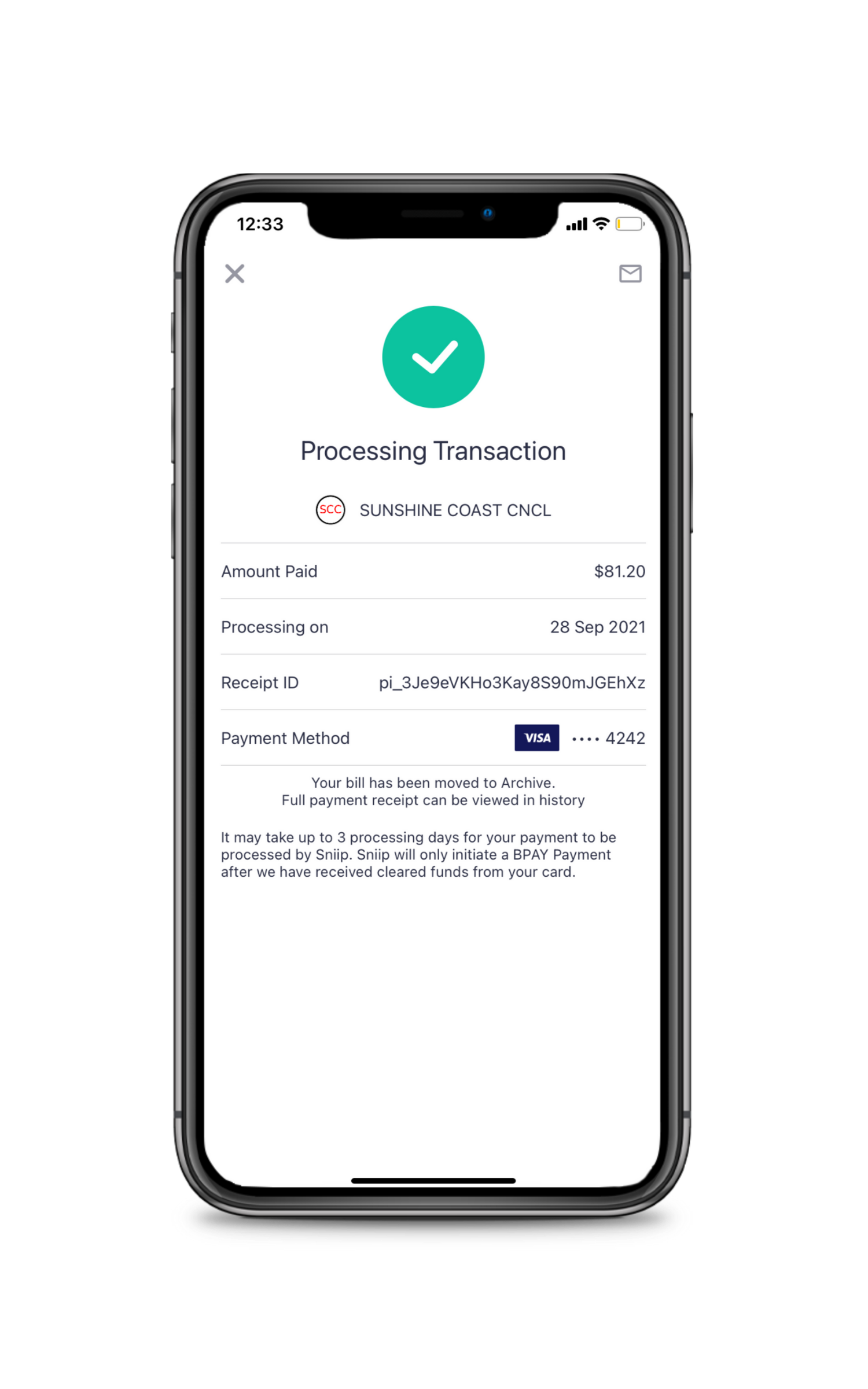

You can then pay your m-bill directly in the app with just a few clicks. Goodbye manual data entry and wrong digits!

With Sniip, you can pay any BPAY bill. That’s right. Simply take a picture of the BPAY or Sniip code with your phone and let the Sniip app do the rest.

But our favourite feature? Bill scheduling of course!

We’ve all paid a bill late because we’re waiting for our pay to come in, or wanted to push the bill into the next credit card cycle. There’s usually a good reason for not paying straight away, but then we often get distracted and completely forget about it.

With Sniip, you can schedule payment for when it best suits you. As soon as you get the bill, simply schedule the bill, and then forget about it. No worries!

But don’t just take our word for it. The results speak for themselves: 90 percent of bills paid using Sniip get paid before the due date.

That’s compared to our 63 percent national average.

It’s time for you to start getting back those late fees? You deserve to spend your money on what you want to spend it on, and we bet it’s not late fees.

Sign up for Sniip today and together, we’ll make your life easier and less stressful.

Tech Solutions: QLD Fintech Enables Easy BPAY Payments

A Queensland fintech startup that’s joined BPAY is about to make paying bills easier

Sniip, a free mobile app that lets you scan bills and pay them quickly using its mobile wallet, has signed a partnership with BPAY.

Sniip’s move into BPAY is being sponsored by the Indue, the Australian-owned e-payments bank.

As a result of joining the payments platform, Sniip is increasing the number of billers accessible through its app to 45,000, and gaining access to 1.5 million more payments daily.

It’s also the first mobile payments solution outside the banking sector to join BPAY.

Sniip CEO Damien Vasta said that because BPAY aggregates every biller in Australia and Sniip aggregates every financial institution used to pay these bills, the partnership will also be “the first real change to the national bill payment landscape since the advent of BPAY itself”.

“When BPAY was introduced in 1997, its centralised online bill payment capabilities revolutionised bill payment for Australian consumers practically overnight,” he said.

“This new partnership and its bank and card-agnostic solution is designed to enhance this capability by providing Australians with a fast, simple, and seamless means to pay any bill through any bank and using any type of mobile.”

Sniip’s inclusion on BPAY puts an end to having to manually enter the biller code and reference number when paying a bill. with the app scanning it instead.

Indue CEO Derek Weatherley said several of Sniip’s enhanced features such as payment scheduling, reminders, and receipt storage for tax and record-keeping, attracted the bank to the fintech startup.

“Sniip’s customer-centric approach to innovation is a key reason we are proud to sponsor them into the BPAY scheme, and we look forward to working together to transform Australia’s payments landscape for the good of all Australian bill-payers,” he said.

Sniip launched in Queensland in 2016 with several major billers in the state. Last year it went national when Australia Post began to offer its customers the app as a payment option.

Exclusive: Australia Post Pilots Sniip To Save You Time

The best

way to pay Australia Post

Use any payment method and earn full credit card reward points.

$0 fees for bank accounts

0.65% fees for debit cards

1.29% fees for American Express

1.50% fees for VISA, Mastercard and Diners

Sniip offers a flexible and rewarding way to pay your Australia Post bills. Choose any payment method, and earn uncapped membership points when you pay with rewards based credit cards.

How to pay Aus Post Bills

Paying your Australia Post bill has never been easier (or more rewarding).

Simply scan the BPAY Code and Reference Number on your paper-copy bill; share your bill PDF from your email to the Sniip app; manually enter your bill details; or have your bills automatically imported into the Sniip app from your inbox.

1. Scan the BPAY Code & Reference Number

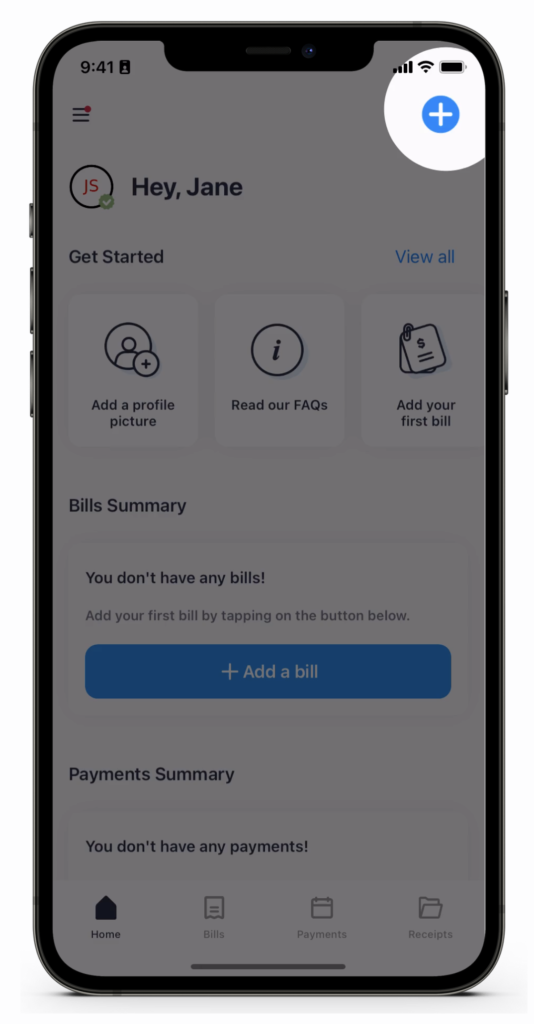

- Open the Sniip app and tap the ‘+’ button in the top right corner

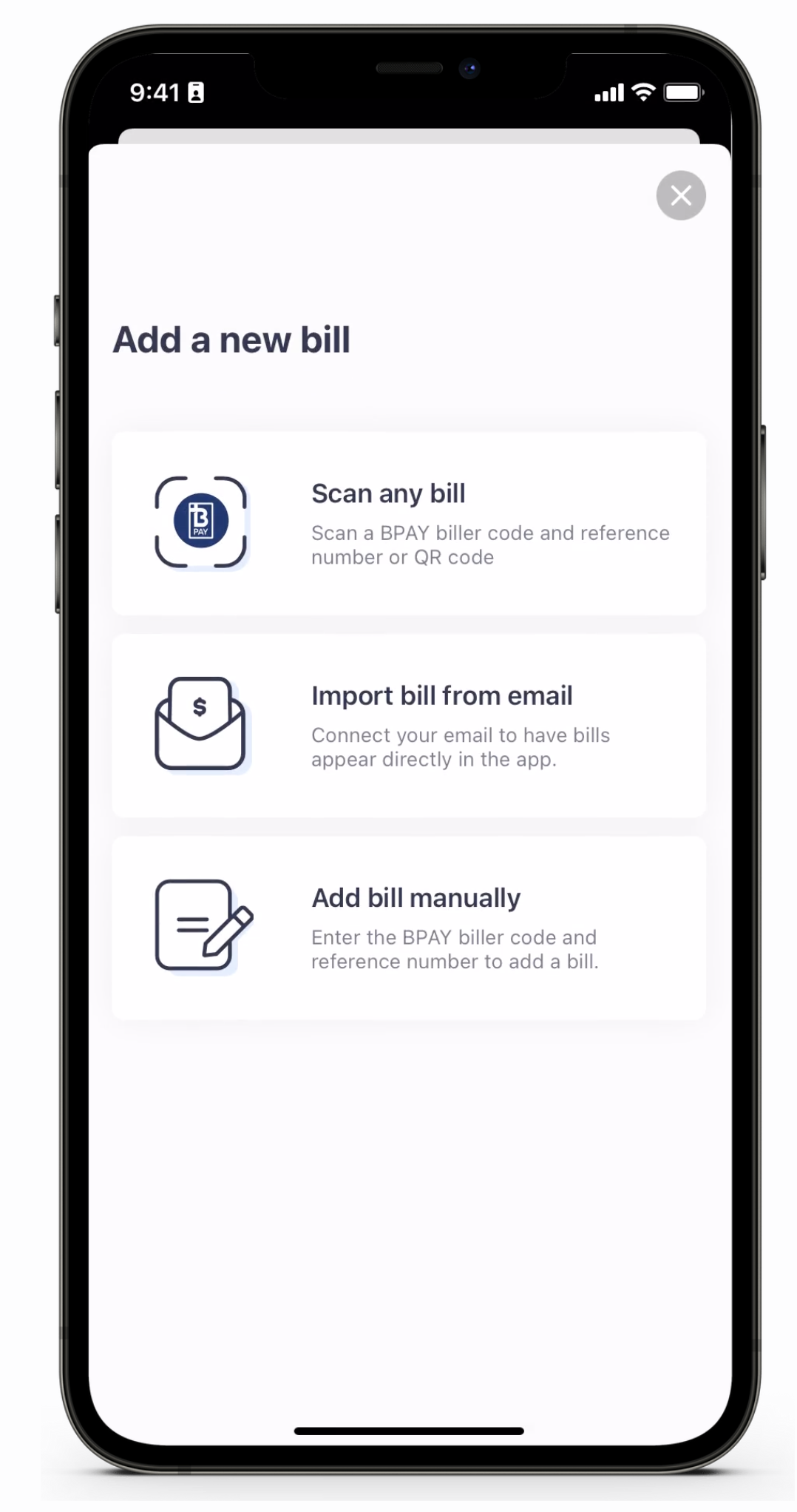

- Tap ‘Scan any bill’

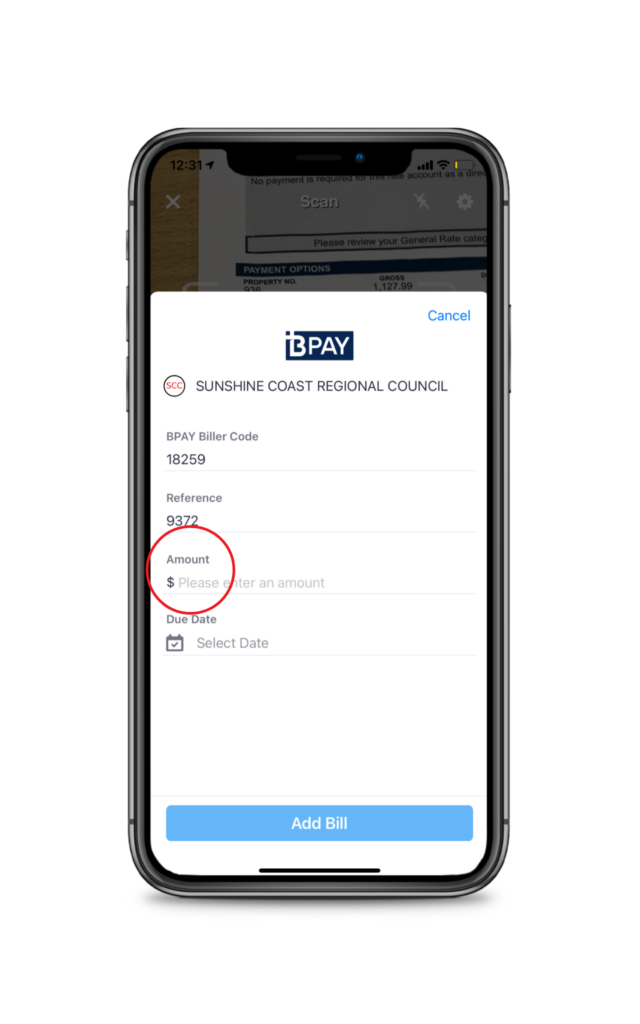

- Scan the BPAY Code and Reference Number on your bill

- Tap the ‘Add bill’ button

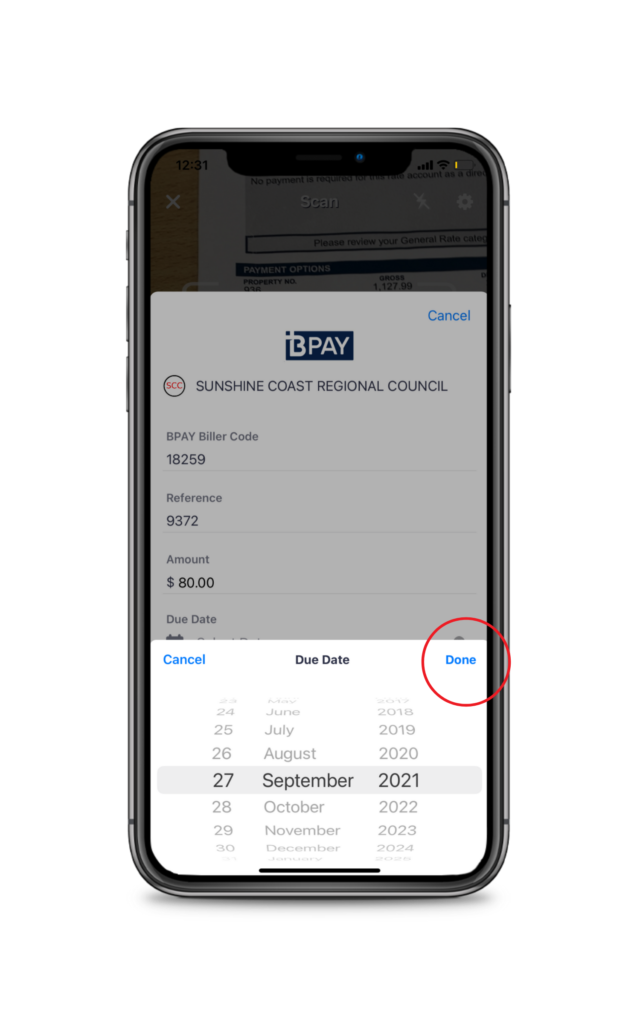

- Choose to pay your bill now, or schedule it to be paid at a future date

- Select your payment method and confirm the payment

- All done!

2. Upload your bill (PDF) from your email

- Open your email and select the PDF bill attachment

- Tap the upload icon (box with arrow) at the top of the screen

- Select the ‘Sniip’ app

If you cannot locate this in your apps option, scroll across left until you see the ‘More’ button. Select this, and scroll down until you can see the Sniip app. - Tap ‘Import bill’, and allow a few minutes for the bill to be read within the app

- You’ll receive a notification when your bill has uploaded and is ready to be paid or scheduled.

3. Manually enter your bill details

- Open the Sniip app and tap the ‘+’ button in the top right corner

- Tap ‘Add bill manually’

- Enter the BPAY Code on your bill, then select your bill

- Enter your reference number, bill amount, and due date that’s written on the bill

- Tap ‘Add bill’

- Choose to pay your bill now, or schedule it to be paid at a future date

- Select your payment method and confirm the payment

- All done!

4. Set up ‘Auto Import from Email’

- Open the Sniip app

- Tap the menu in the top left corner.

- Select ‘Import from email’.

- From here, choose your email provider and enter the email address you’d like your bills imported from.

- Tap ‘Continue’ and follow the prompts to connect your email address.

- All done! The next time you receive a bill attachment in your emails, it’ll be automatically uploaded to the Sniip app, ready for you to pay or schedule. You’ll receive a notification when a new bill arrives 😊

Read about Sniip’s partnership with Australia Post below

Blog article published August, 2019

Australia Post pilots Sniip bill-paying app to save customers time

Australia Post is pleased to be offering its customers a new choice for paying bills by piloting state-of-the-art mobile payments app, Sniip.

General Manager Payments and Financial Services at Australia Post, Deanne Keetelaar, said Sniip’s mobile payment technology means customers can pay their bills from their smartphones within seconds.

“Australia Post is very excited to be working with Sniip on this pilot project, which supports our commitment to continually improving the bill payment experience for customers,’’ Ms Keetelaar said.

“We will initially be offering our customers the ability to pay bills from selected billers using Sniip and seeing how they respond. Sniip has proven through its current billing partners that bill payers see the need for a simple user experience that is both secure and fast,” she said.

Founder and Chief Executive Officer of Sniip, Damien Vasta, said the company was excited to be working in partnership with Australia Post, introducing the new payment option via a simple scan of ‘Post Billpay’ barcodes, which currently appear on many bills.

“We see it as a great vote of confidence that Australia Post is working with us to offer Sniip as a bill payment option to its vast customer base,’’ Mr Vasta said.

Sniip offers substantial benefits to billers including cost savings compared to other payment methods, quicker payments and conversion to paperless bills via in-app push notification of bills to users.

“With Sniip now available as a payment tool, users can scan the “Post Billpay” barcodes and pay their bills within seconds, eliminating the need to enter a long account number, reference number or bank account details.

“The Sniip integration makes payments easier and safer on a mobile, allowing customers to manage their bills more efficiently in-app and reducing instances of misplaced bills, forgotten emails and late payment fees,’’ Mr Vasta said.

“We’ve already helped customers including Brisbane City Council and Queensland Urban Utilities to improve the bill payment experience for their customers and we look forward to extending this to Australia Post.”

Mr Vasta said that with an estimated 80% of Australians owning a smartphone, and people using them for almost everything they once did on a desktop, offering customers the ability to both receive and pay a bill on a mobile is simply responding to a market need.

“There is a consumer expectation that everything can be accessed on a mobile, and everything should be easy to use. Paying a bill is never pleasant, but Sniip has tried to offer customers the ability to make it happen quickly and easily,’’ Mr Vasta said.

Mr Vasta said that 88% of current Sniip users paid their bills before the due date, which is considerably higher than the national average for billers. The Australian-developed mobile payment app has been well received by the market, growing transaction volumes by 15% quarter-on-quarter since 2016.

How to pay Toowoomba Regional Council Easier

Toowoomba Regional Council first in Australia to launch digital bill delivery using push notifications, via Sniip

Toowoomba Regional Council is leading Australia in digital billing, by partnering with Australia’s first bank-agnostic payments and billing app, Sniip, to launch a patented “m-billing” function that will alert ratepayers of Council rates and water bills via push notifications directly on their smartphones.

Ratepayers can opt into the function by registering for m-billing in the Sniip app, from which point they will receive future bills directly into the app via push notifications and can pay in a few simple clicks, without inputting any extra data or leaving the app.

The end-to-end paperless solution is expected to drastically reduce the Council’s overheads and carbon footprint by helping them transition seamlessly to paperless billing, shorten bill payment times across the region, and simplify bill payments for ratepayers.

“Toowoomba Council is addressing the long-standing issue of late payments, which has been an ongoing and very expensive concern for billers across Australia,” said Damien Vasta, CEO of Sniip.

“The fact that there have been so many attempts to address Australia’s billing and payments problem is testament to how much of an issue it really is. Unfortunately, many of these attempts have been incomplete and can even compound the issue.

“The confusion for customers mistaking email bills for junk mail or spam has actually increased numbers of late payments, while payers typically still need to open a PDF, go to a different website to pay, and repeatedly input large amounts of information.

“M-billing, eliminates every one of these issues. Push notifications are seen instantly and can be actioned in seconds. There’s no need to input further information after the app is set up, data is stored with bank grade security that can’t be hacked, and all payment history is stored for future reference. The key is to seamlessly integrate the bill-receiving and bill-payment functions.

“We applaud Toowoomba Regional Council for being a pioneer of this technology on behalf of their constituents ahead of every other council in Australia,” concluded Damien Vasta.

The move towards completely digital payments by the Council comes shortly after calls by Treasury to stop banks, telcos, and energy providers from negatively coercing consumers away from paper billing through punitive fees. It also comes after decades of research that highlights cash flow as a key indicator of long-term business viability and success, including the Federal Government’s Prompt Payment Protocol Paper which highlighted that 90 per cent of SME failures result from poor cash flow.

Sniip’s “scan to pay” functionality – where payers scan a QR code and pay via the app, but continue to receive paper bills – has already been rolled out for Toowoomba, Gympie Regional Council, Brisbane City Council and Queensland Urban Utilities.

However, Toowoomba Regional Council was also first to pioneer Snip’s “scan to pay” functionality in 2015, and is proud of being consistently first in Australia to break new ground in the important area of payments innovation and progression, according to General Manager Finance and Business Strategy, Arun Pratap.

“Like any Australian council, we are dedicated to serving the needs of our residents, and are constantly seeking out new ways to improve their lives, including using innovation to create more options for making payments,” said Arun Pratap.

“We understand that keeping on top of bill payments can be stressful for many Australians, who want to pay on time, but who often have so much else going on in their lives that sometimes things slip through the cracks.”

“We fully believe we’re making their lives easier by offering m-billing, while also helping the environment and reducing ratepayer-funded council overheads” concluded Arun Pratap.

‘Fintech Business of the Year’ Finalist in Optus Business Awards!

Sniip revealed as finalist ‘Fintech Business of the Year’ in Optus My Business Awards 2017!

A record number of finalists have been revealed for this year’s Optus My Business Awards, ensuring the SME community’s night of nights will be bigger than ever this year!

Hundreds of businesses across Australia have submitted their nominations for 27 categories. Judges were blown away by the calibre of many of the entries, demonstrating exceptional business leadership, impressive innovations and unwavering commitment to their respective industries and customers.

Of course not everyone can make it through to the next stage – check out who is in the running in our full list of finalists below.

Judging will now commence straight away with a select group of leaders in business and industry, taking on the difficult task of selecting winners for each category. These winners will then automatically be included as finalists for the coveted My Business – Business of the Year award.

Winners will be announced at a black-tie dinner on Friday, 10 November 2017, at the luxurious The Westin Sydney, with major sponsors including Optus, Kwik Kopy, Qantas Business Rewards and Momentum Intelligence.

Congratulations to all of our 2017 finalists and thank you to everyone who sent in their submission!

Fintech Business of the Year

Curve Securities

ezyCollect

Maestrano

MAUS Business Systems

MoneyMe Financial Group

NowInfinity

Practice Ignition

SelfWealth

Sniip

zipMoney

How To Pay Brisbane City Council Bills Easily

Pay Brisbane City Council Rates

Use any payment method and pay $0 processing fees when you scan the Sniip QR Code.

Earn full credit card reward points when you scan the BPAY Code and Reference Number on your Brisbane City Council Rates bill.

Fees for payments via BPAY

$0 fees for bank accounts

0.65% fees for debit cards

1.29% fees for American Express

1.50% fees for VISA, Mastercard and Diners

Enter your mobile number and we’ll text you a link to download the app.

Easy Council Payments

Pay your rates, fines, infringement notices and other Council bills through the Sniip app with any payment method.

Brisbane-based technology firm, Sniip, has partnered with Brisbane City Council and emerged as the preferred solution for Queenslanders seeking an easy way to pay their Brisbane City Council bills.

With the Sniip app, you enjoy the flexibility to use any payment method, while earning uncapped credit card points with each Brisbane City Council transaction. You can opt to scan the Sniip QR Code on your bill, or scan the BPAY Code and Reference Number.

Say goodbye to the hassle of entering lengthy numbers or worrying about errors during your Brisbane City Council payment process. Alternatively, if you receive your bills from Brisbane City Council via email, effortlessly share the PDF directly into the Sniip app, ready to pay within seconds.

There’s no better (and easier) way to settle your Brisbane City Council bill than with Sniip. Trusted by over 100,000 Australians and expanding daily.

What is Brisbane City Council?

Brisbane City Council, established in 1925, is the governing body overseeing the development and services in Brisbane, Queensland. Led by a Lord Mayor and elected councillors, the Council manages urban planning, waste, public transport, and cultural initiatives, working to enhance residents’ quality of life.

Since 2015, Sniip has been a proud partner of Brisbane City Council, unlocking hassle-free bill payments for Queenslanders. This partnership signifies a commitment to enhancing the payment experience for Brisbane residents. With Sniip’s user-friendly app, individuals can easily settle their bills without the usual hassles associated with traditional bill-payment methods.

Sniip offers a flexible and rewarding way to pay your Brisbane City Council Bills. Choose any payment method, and earn uncapped membership points when you pay with rewards based credit cards by scanning the BPAY Code and Reference Number on your bill. Or, simply scan the Sniip QR Code to pay your bill*.

*Please note, when scanning the Sniip QR Code, your biller will be paid directly and you may not earn uncapped credit card points when paying with a rewards based credit card.

How to pay Brisbane City Council

Paying your Brisbane City Council bill has never been easier!

Simply download the Sniip app and scan the BPAY Code and Reference Number or the Sniip QR Code on your paper-copy bill; share your bill PDF from your email to the Sniip app; or have your bills automatically imported from your email inbox into the Sniip app, ready for you to pay!

1. Scan the BPAY Code & Reference Number

- Open the Sniip app and tap the ‘+’ button in the top right corner

- Tap ‘Scan any bill’

- Scan the BPAY Code and Reference Number on your bill

- Tap the ‘Add bill’ button

- Choose to pay your bill now, or schedule it to be paid at a future date

- Select your payment method and confirm the payment

- All done!

2. Scan the Sniip QR Code

- Open the Sniip app and tap the ‘+’ button in the top right corner

- Tap ‘Scan any bill’

- Scan the Sniip QR Code on your bill

*Please note, when scanning the Sniip QR Code, your biller will be paid directly and you may not earn uncapped credit card points when paying with a rewards based credit card.

- Tap the ‘Add bill’ button

- Choose to pay your bill now, or schedule it to be paid at a future date

- Select your payment method and confirm the payment

- All done!

3. Upload your bill (PDF) from your email

- Open your email and select the PDF bill attachment

- Tap the upload icon (box with arrow) at the top of the screen

- Select the ‘Sniip’ app

If you cannot locate this in your apps option, scroll across left until you see the ‘More’ button. Select this, and scroll down until you can see the Sniip app. - Tap ‘Import bill’, and allow a few minutes for the bill to be read within the app

- You’ll receive a notification when your bill has uploaded and is ready to be paid or scheduled.

4. Set up 'Auto Import from Email'

- Open the Sniip app

- Tap the menu in the top left corner.

- Select ‘Import from email’.

- From here, choose your email provider and enter the email address you’d like your bills imported from.

- Tap ‘Continue’ and follow the prompts to connect your email address.

- All done! The next time you receive a bill attachment in your emails, it’ll be automatically uploaded to the Sniip app, ready for you to pay or schedule. You’ll receive a notification when a new bill arrives 😊

Frequently Asked Questions

Contact Brisbane City Council

What is the Brisbane City Council phone number?

The Brisbane City Council's Contact Centre is open 24 hours a day, seven days a week at 07 3403 8888.

The council aims to answer calls within 60 seconds. This line is the preferred contact method for urgent issues, such as traffic light problems, lost animals, dangerous dogs, lost property, and public safety concerns.

How do I contact Brisbane City Council?

You can get in touch with the Brisbane City Council a number of ways.

- Phone call: The Brisbane City Council's Contact Centre is open 24 hours a day, seven days a week at 07 3403 8888. The council aims to answer calls within 60 seconds. This line is the preferred contact method for urgent issues, such as traffic light problems, lost animals, dangerous dogs, lost property, and public safety concerns.

- Email: For any general inquiries, general complaints, or feedback, you can email the Brisbane City Council, here. If you request a Council service, they will provide you with a reference number and request details within 3-5 days. In the case of complex requests or those requiring investigation, your email will be forwarded to the pertinent business area, and they will aim to provide you with a written response within 30 days.

- Visit in-person: The Customer Centres of the Brisbane City Council offer information and guidance on various topics, including licences, permits, rate inquiries, account payments, animal registrations, compliance, local laws, and development applications. Opening hours can be found, here.

- SMS/MMS: You can use your mobile device to report any issues that require attention in your street, local park, or neighbourhood to the Brisbane City Council. Capture a photo and send the problem details, including the location and your name, to 0429 2 FIX IT (0429 234 948). The council aims to acknowledge your message and provide a reference number within two working days.

- Email or post: You can mail your letter to:

Brisbane City Council

GPO Box 1434

Brisbane Qld 4001

The Brisbane City Council aim to provide a full response to your letter within 20 working days.

Pay Brisbane City Council

How do I pay the Brisbane City Council?

Great question! There are four easy ways you can pay rates to Brisbane City Council through the Sniip app. To learn how to complete your rates payment, click here.

The Sniip mobile app is a trusted partner of Brisbane City Council, and is the preferred bill-payment platform for over 100,000 Australians. Sniip is free to download and use. Use any payment method and simply pay one processing fee per transaction.

What’s the easiest way to process my rates payment?

You have multiple, convenient options for settling your rates with Brisbane City Council through the Sniip app.

To pay rates to Brisbane City Council:

- If you receive a physical copy of your rates, simply use the Sniip mobile app to effortlessly scan the Sniip QR Code or BPAY details. The app will then digitise your rate details, facilitating a quick and convenient payment using any preferred method.

- Alternatively, for those receiving BCC rates via email, simply share the bill PDF with the Sniip app for an easy payment process with your preferred method.

As a trusted partner of the Council, Sniip serves as the preferred bill-payment platform for over 100,000 Australians. The app is free to download and use, allowing you to utilise any payment method while incurring just one processing fee per transaction.

To process your rates payment, click here.

General

How do I access my rates notice?

You can receive your Brisbane City Council Rates via post, or via email. To sign up for email delivery, please complete the rates notice by email online registration form.

Are there any Council jobs in Brisbane?

To search for new job opportunities with the Brisbane City Council, you can access their Job Opportunities webpage here.

What are the Brisbane City Council fees and charges?

The Brisbane City Council has a range of fees and charges, including rates, permit renewals, fines, infringement notices, and other bills. Rates are issued on a quarterly basis.

You can find out how your Brisbane Council rates are calculated, here.

What suburbs are covered by Brisbane City Council?

The Brisbane City Council covers a wide range of suburbs in the region. You can search the list of suburbs covered by the Brisbane City Council, here.

Is there a Brisbane Council Rates Calculator?

There sure is! You can find out how your Brisbane Council rates are calculated, here.

What are the council rates in Brisbane?

“Brisbane’s lowest residential rate will be $847.12 in 2023-24”, highlighted in this article.

The calculation of general rates relies on land valuations and rating categories. Additional fees such as levies and waste utility charges may also be reflected on your rate account.

You can read more about how council rates in Brisbane are calculated, here.

although analogous to

altogether although this may be true

another another key point

basically as a matter of fact

because as a result

before as an illustration

besides as can be seen

but as has been noted

certainly as I have noted

chiefly as I have said

comparatively as I have shown

concurrently as long as

consequently as much as

contrarily as shown above

conversely as soon as

correspondingly as well as

despite at any rate

doubtedly at first

during at last

e.g. at least

earlier at length

emphatically at the present time

equally at the same time

especially at this instant

eventually at this point

evidently at this time

explicitly balanced against

finally being that

firstly by all means

following by and large

formerly by comparison

forthwith by the same token

fourthly by the time

further compared to

furthermore be that as it may

generally coupled with

hence different from

henceforth due to

however equally important

i.e. even if

identically even more

indeed even so

instead even though

last first thing to remember

lastly for example

later for fear that

lest for instance

likewise for one thing

markedly for that reason

meanwhile for the most part

moreover for the purpose of

nevertheless for the same reason

nonetheless for this purpose

nor for this reason

notwithstanding from time to time

obviously given that

occasionally given these points

otherwise important to realize

once once in a while

overall in a word

particularly in addition

presently in another case

previously in any case

rather in any event

regardless in brief

secondly in case

shortly in conclusion

significantly in contrast

similarly in detail

simultaneously in due time

since in effect

so in either case

soon in essence

specifically in fact

still in general

straightaway in light of

subsequently in like fashion

surely in like manner

surprisingly in order that

than in order to

then in other words

thereafter in particular

therefore in reality

thereupon in short

thirdly in similar fashion

though in spite of

thus in sum

till in summary

undeniably in that case

undoubtedly in the event that

unless in the final analysis

unlike in the first place

unquestionably in the fourth place

until in the hope that

when in the light of

whenever in the long run

whereas in the meantime

while in the same fashion

in the same way

in the second place

in the third place

in this case

in this situation

in time

in truth

in view of

most compelling evidence

most important

must be remembered

not to mention

now that

of course

on account of

on balance

on condition that

on one hand

on the condition that

on the contrary

on the negative side

on the other hand

on the positive side

on the whole

on this occasion

only if

owing to

point often overlooked

prior to

provided that

seeing that

so as to

so far

so long as

so that

sooner or later

such as

summing up

take the case of

that is

that is to say

then again

this time

to be sure

to begin with

to clarify

to conclude

to demonstrate

to emphasize

to enumerate

to explain

to illustrate

to list

to point out

to put it another way

to put it differently

to repeat

to rephrase it

to say nothing of

to sum up

to summarize

to that end

to the end that

to this end

together with

under those circumstances

until now

up against

up to the present time

vis a vis

what’s more

while it may be true

while this may be true

with attention to

with the result that

Read about Sniip’s long-term partnership with Brisbane City Council below

Brisbane City Council gets Sniip!

The Brisbane City Council (BCC) has entered into an agreement with mobile payment technology company Sniip to streamline its billing processes with rates notices about to be issued across the city.

Co-Founder and Chief Executive Officer of Sniip, Damien Vasta, said the company was excited about the new partnership with BCC which would provide a central, secure and organised way for customers to receive, view and pay bills in the mobile world.

“Brisbane City has over 450,000 homeowners and this technology allows for the best possible customer experience for its residents,’’ Mr Vasta said.

Mr Vasta said Sniip had developed a speedy and safe method for making a payment – either by scanning the circular QR code on the bill or by electing to receive a bill electronically into the Sniip app.

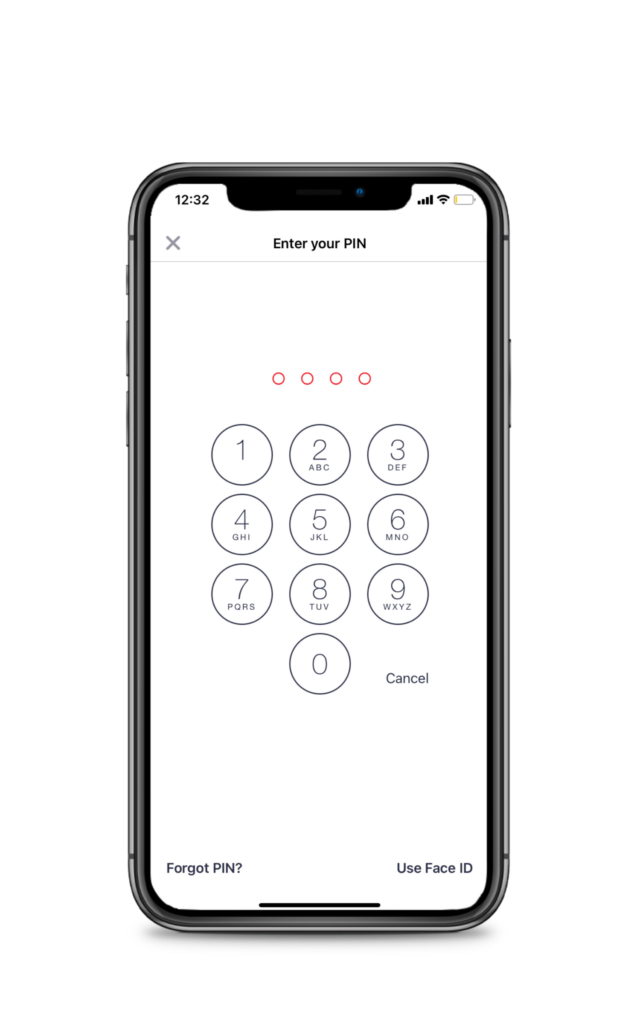

“Using the Sniip app on your smart phone is more secure than carrying your wallet – no-one can view your card details or make a purchase without entering your 4-digit pin.”

“Sniip provides instant payment methods as well as calendar reminders, which means people are less likely to be hit with late payment fees,’’ he said.

He said BCC welcomed Sniip for its innovation, convenience and because the world-class technology had been developed in Queensland.

“Brisbane City Council has shown its willingness to embrace innovative, home-grown proposals designed to make living in Brisbane a better experience,’’ Mr Vasta said.

“We are looking forward to working with BCC in streamlining the bill paying process for its customers.

Sniip is also working with other tiers of government and utilities companies to roll out the technology.

“We think that the BCC has cleared the path for other billers to offer Sniip as the most convenient payment option to their customers, especially those based in Queensland,” said Mr Vasta.

He said Sniip offered substantial benefits to billers including cost savings over incumbent payment methods, quicker payments and conversion to paperless bills.

“Consumers can scan and pay their bills within seconds using Sniip’s trademarked circular QR code, eliminating the need to enter a long account number or bank details or waste time paying over the phone.

“Mobile phone payments are becoming a hugely popular method of making payments to billing organisations.

“Once you’ve downloaded Sniip and created an account, you can pay a bill in seconds.”

The BCC agreement is the latest coup for Sniip which recently successfully raised $3 million in a private placement to roll out its mobile bill payment technology across Australia.

The $3 million raising managed by Integra Advisory Partners Pty Ltd has introduced a number of successful high net worth and family office investors to the register which already includes the founding CEO and CFO of Virgin Blue Brett Godfrey and Manny Gill as major shareholders along with Sniip CEO Mr Vasta.

Sniip is also pleased to announce rugby league legend Darren Lockyer as a Sniip brand ambassador and new shareholder.

Exclusive: Brisbane paves path to digital reform at APCS

Brisbane plans path to digital reform at APCS

Australia’s largest local government is using the Asia Pacific Cities Summit in Brisbane to harness the innovation of both local and international companies to make Brisbane the most liveable city in the world.

One of the four themes at the Summit is Digital Cities, and enabling people to make digital decisions. One such company that meets this challenge is Brisbane-based technology company Sniip, which has built a new app that allows residents to pay bills securely on their mobile phone by scanning a QR code.

Sniip is one of many companies trying to assist the way residents make payments. Sniip’s Head of Marketing Lisa Hardie said the app safely stores credit card details on the individual mobile phone with payments processed by a four digit security code after consumers scanned a trademarked circular QR code.

“It’s a credit to the Council that they are looking towards solutions to meet the surge in consumer trends that now sees 8 in 10 mobiles in Australia as smart phones and an increasing number of people wanting to pay on their mobile device,” Ms Hardie said.

“But consumers don’t want to download an app that’s been built around a bank or a credit card and they certainly don’t want to enter their credit card details into a mobile every time they make a payment”.

“The fact we now have over 90 retailers signed and we are working towards solutions for several local governments is evidence that there is benefit in combining multiple opportunities for a consumer to make a payment, easily and securely.”

Lord Mayor Graham Quirk said Sniip was another part in his journey to make Brisbane a new world city.

“Many people live increasingly busy lives and the thought of having to go to a customer service centre, make a phone call or try to enter credit card on a web page on their phone may not be everyone’s cup of tea,” he said.

“What’s important is that we offer choice and through working with technology companies like Sniip we are attempting to provide zero cost solutions to our ratepayers at a low cost to Council.”

“We have some exciting news on the horizon through further retail and government partnerships that will bring further benefit to local residents,” Ms Hardie said.

Sniip is a Queensland based company established in 2013.

Considering paperless billing? Our three must haves

Considering paperless billing? Our three must haves

So, you’ve decided to go paperless when it comes to your billing. This could mean a whole range of cost savings, environmental benefits, and added convenience for your customers.

But buyer beware – not all paperless billing solutions are created equal (email, we’re looking at you). And there’s no point ditching the paper just yet, if you haven’t worked out exactly what you’re looking for in a paperless solution.

Below are three must-haves for any paperless billing system, to make the switch worthwhile for you and your customers.

- Integrated solution

When thinking about billing, it can be easy to forget the other side of the equation – payments. You only bill so you can get paid, so why use two different vendors for the one transaction?

If we consider email billing as a digital strategy, the break in transaction from email presentment to website payment portals often results in increased late payments or mistyped reference numbers, which that leads to paper reminder notices and higher overheads. Email is only one part of an overall digital solution that still requires the missing piece of the puzzle; an easy way for people to make payments.

Find a billing solution that is integrated with your payments solution, preferably from the same provider. This should provide a far more seamless experience for both parties to the transaction.

- Bank card and phone agnostic

Basically everything happens from our mobile phone these days, so it makes sense that a paperless solution is designed accordingly. It’s probably also pretty safe to say that we are all still paying from a bank or credit card these days.

But on both of these fronts, there is still a wide variety of banks and phone types used by your different customers. So, your customers need to be able to pay you regardless of which bank, credit union, card provider, or mobile device they are using to do so. Go bank card and phone type agnostic, and no one will be left behind.

- Industry agnostic

This same “agnostic” principle applies to the industries of your industries your paperless billing solution services. Because even if your customers love paying your bill using your new paperless solution, they will love it even more if they can pay ALL their bills using this same solution!

So, find a billing solution that can be used across the board, not just for your specific industry or company. You will be helping your customers fight password fatigue, and giving them a true level of convenience and value.

Three ways fintech can help your business

Three ways fintech can help your business

When it comes to new technologies for SMEs, there are now a million new ways to streamline operations, and automate the delivery of offerings.

Many of these options may depend on your industry. Accounting firms are all about the cloud these days. Legal firms are increasingly embracing “e-discovery” technologies to simplify the time-consuming discovery stage of litigation. And even your local coffee shop may now have its very own app to help customers skip the coffee queue, and order in advance.

But regardless of your industry, there is one thing all SMEs have in common: the need to maintain a healthy cash flow that allows for growth. And this is where financial technology (fintech) truly shines.

Below are several areas where fintech is helping to streamline and shore up a healthy cash flow for Australian SMEs.

- Funding technologies

As you’re well aware, without proper funding for your business, your growth options can be pretty limited. This can affect you at various stages of your business: capital requirements when starting out, cash flow gaps during regular operations, and the need for extra capital to fund periods of high growth or seasonal demand.

But traditional lending to SMEs has a fairly dismal track record. Interest rates on SME loans are typically higher due to the challenge of pricing risk in this segment. After filling out lengthy paperwork and waiting for weeks, many SMEs often still receive a “no” from banks to their application.

But a whole host of fintech lenders have emerged in this segment, with high-tech lending platforms driven by advanced algorithms that can assess SME risk far faster and more accurately than traditional lenders. These lenders typically integrate with your accounting portal, and assess hundreds of online and social touch points to paint a clearer picture of your risk than any manual paperwork might. They also provide a decision in a matter of hours or minutes, not weeks, and can have money in your bank in a few days.

This means much more rapid funding and significantly reduced application processes – exactly what SMEs need.

- Payment and billing technologies

When it comes to cash flow gaps, sometimes prevention is better than cure. And a serious impediment to healthy cash flow for many Australian businesses comes from late paying clients.

According to a Federal Government Department of Industry, Innovation and Science payments report, Australian SMEs lose access to a staggering $19 billion each year because of overdue payments. So, it pays to check out some of the new technologies in this area.

When assessing which billing and payments solution is right for your business, the questions you ask yourself should be designed around the ease of use for your customer. Is it mobile-centric in this day of smartphone obsession? Can every one of my customers use it, i.e. is it device type-agnostic? Does it integrate with my existing payments portal? Is it easy for customers to make the switch in the first place?

When it comes to billing, you need a technology built specifically around the needs of the customer. Because after all, they are the ones you are trying to convince to pay!

- Budgeting technologies

There are so many different options when it comes to budgeting. In this case, it’s really a matter of finding what works best for you, your business, and your different objectives.

Many cloud accounting softwares, such as Xero and MYOB, come equipped with budgeting tools built into their systems. This is a great way to keep everything in the one spot, and potentially bring your accountant into the budgeting process.

For other business owners, individual accounting apps on their smartphones can allow them to integrate their own personal budgeting with their business budgeting. The key here is to select a technology that is going to work for you – and stick with it!