Our Most Helpful Q&A in 2023: You ask, we answer!

Our Most Helpful Q&A in 2023: You ask, we answer!

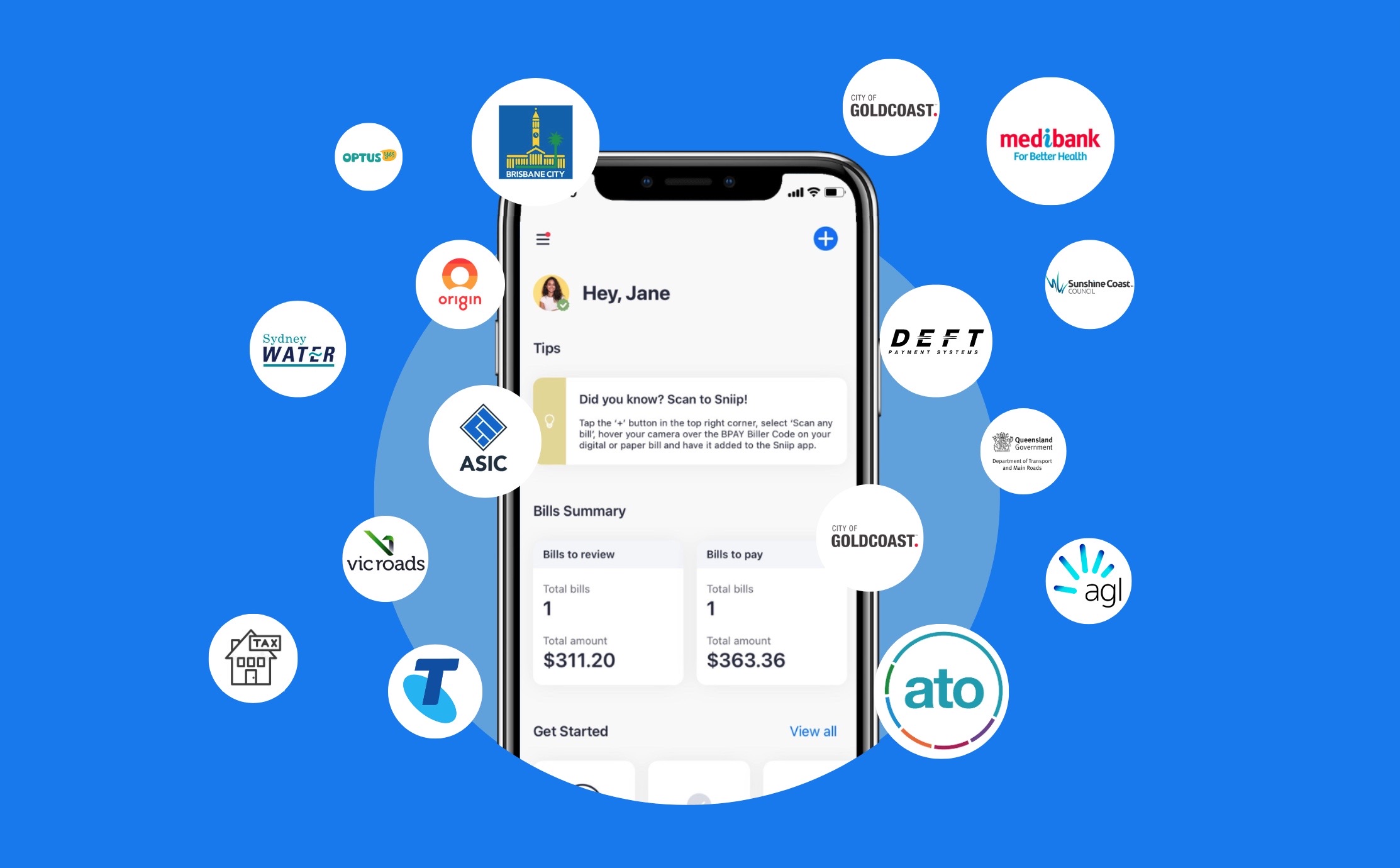

Can I pay more than rates and water with Sniip?

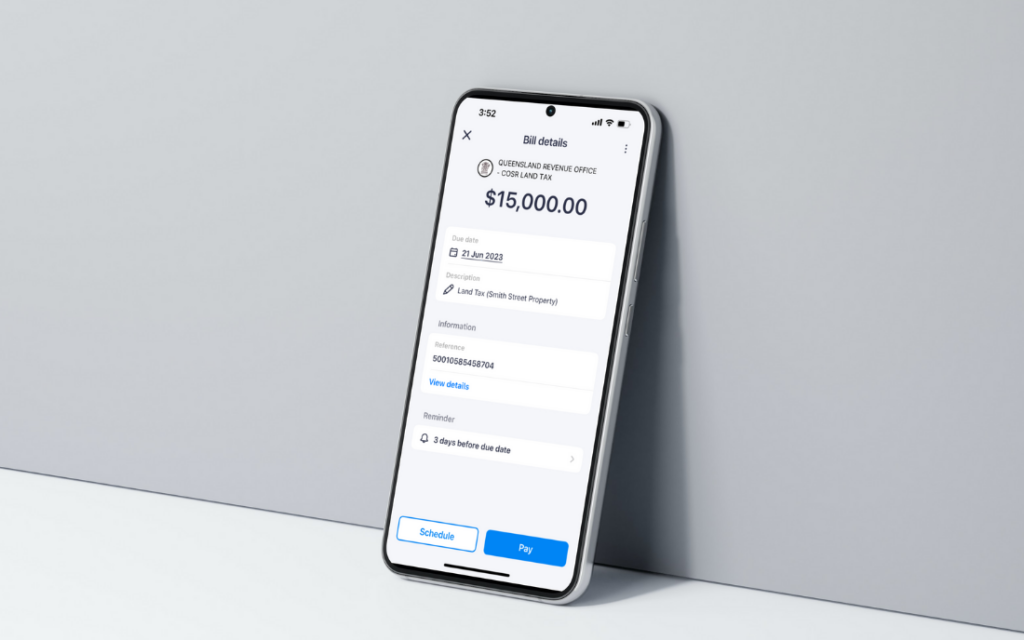

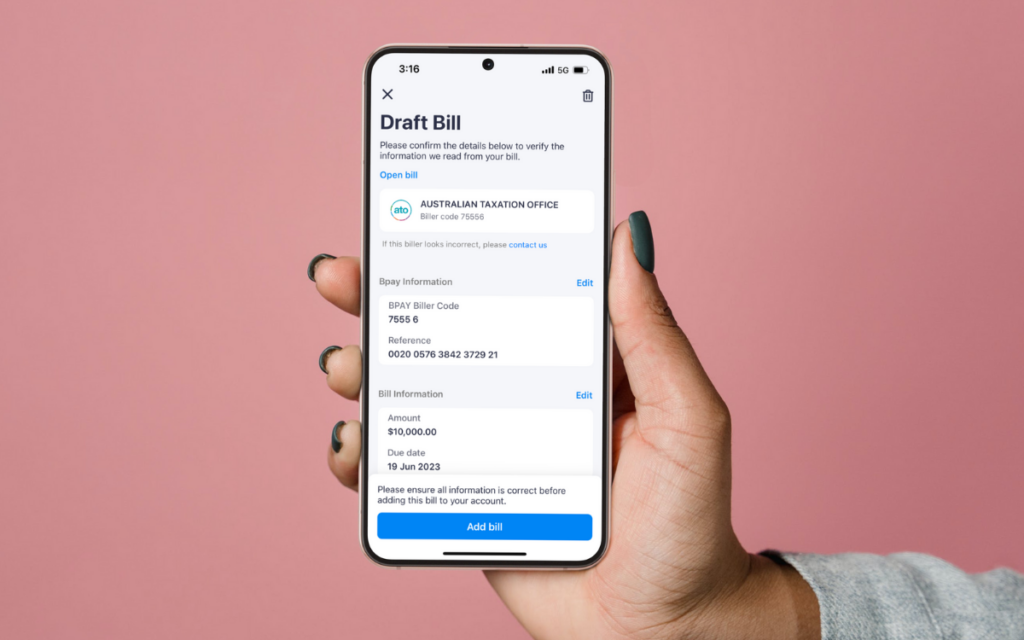

Absolutely superstar! You can pay any* bill with a BPAY Biller Code and Reference Number on it using Sniip.

The same way you scan the Sniip QR code, you can scan the BPAY Biller Code and Reference Number on any bill. You can explore scanning the BPAY Biller Code, here.

Some other bills you may need to pay include rent, school fees, ATO, land tax or a HELP (formerly HEX) debt.

*restricted industries and payment method groups apply

Why do I have to verify my account/card? I’ve already verified?

Great question! There’s a number of flags that will trigger a request to complete user verification. This might include adding a blocked biller (new or restricted industry), adding a payment method that’s different to your legal name, or transacting whilst overseas.

The good news is, you can verify yourself or your cards at any point to ensure your account gets the green tick from our compliance department.

If you add another payment card down the track and trigger a fraud rule, you may be asked to further verify that specific card. This is a swift process requested for the security of your account to ensure you’re in possession of the card.

This might include if the new card you’ve added is in a different name to the legal name on your account.

You can read more about the Sniip user Verification process, here.

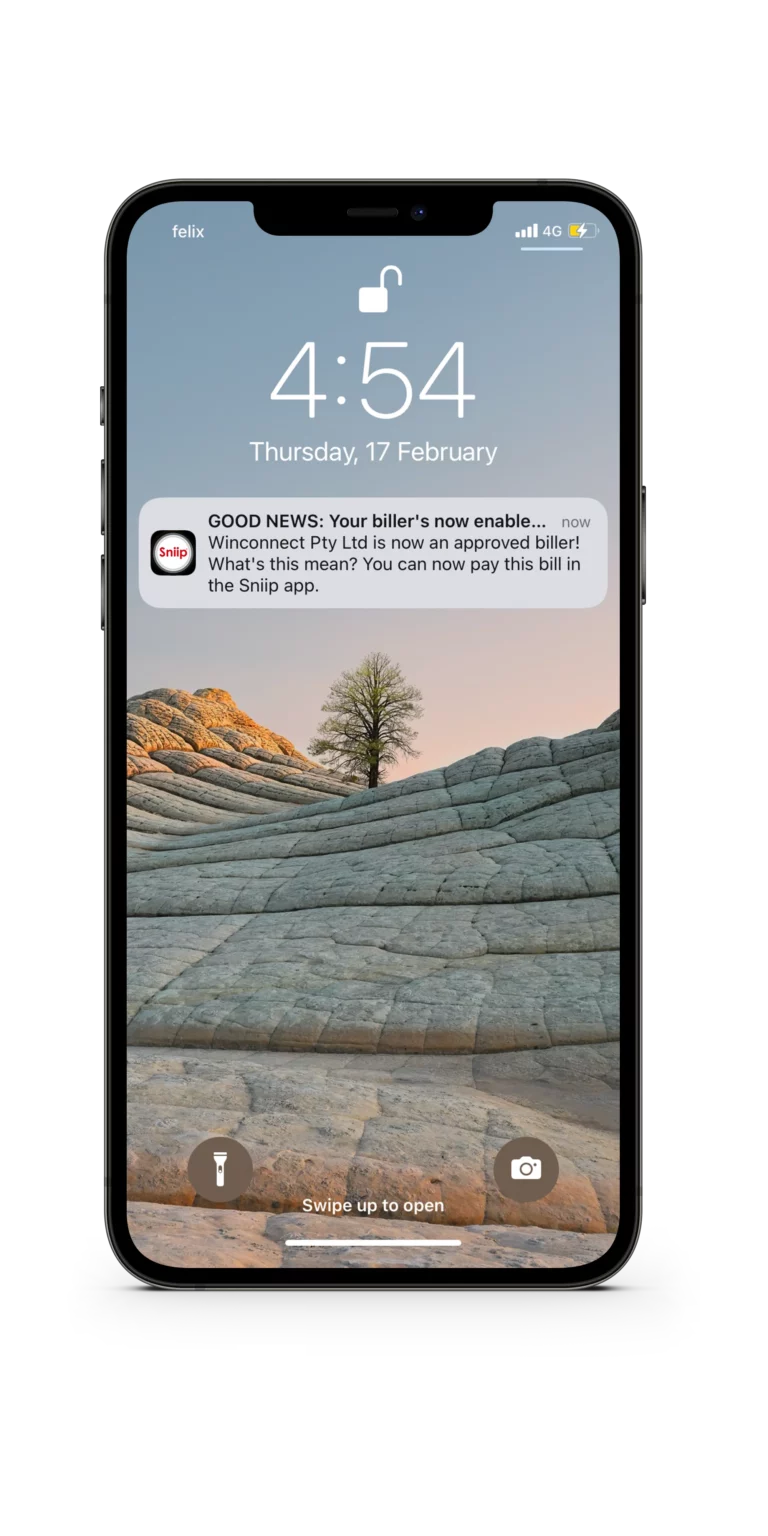

What does ‘Biller Under Review’ mean?

Here’s a little insight into an important task we do – each BPAY biller is manually reviewed by the Sniip Operations Team to ensure it falls under an approved industry!

If you’ve tried to add a BPAY Biller Code and it says ‘Biller Under Review’, it means that you are the first person to pay this BPAY Code. We are required to review each BPAY biller to ensure that it is in a permitted industry and not restricted by any of our banking or acquiring partners.

This process is usually completed within one (1) business day of you adding that biller for the first time in Sniip.

If a biller has been restricted by us, you will receive a ‘blocked biller’ message when you try to process the bill payment.

Due to the risk profile of certain billers, Sniip has been required by our banking partners to restrict payments that fall within the following sectors.

These categories include:

- Travel or holiday accommodation products

- Banking and financial institutions (incl car and home loans)

- Hiring and leasing

- Remittance service provider (i.e overseas payments)

- Charities and not-for-profit

- Intermediaries

- Pay-day lenders

- Gaming (incl Internet gambling and casinos)

- Goods dealers and foreign exchange currencies

- Securities and derivatives

- Managed investment schemes

- International business operations

If you believe you should be able to pay any of these billers, please email a copy of your invoice through to customercare@sniip.com and our team will evaluate your biller on a case-by-case basis.

When can I pay a payment to BSB and Account Number?

Our #1 requested feature from our valued users. We’re working on it right now and it’s currently looking to launch early in the new financial year. The good news is, by being a registered user of Sniip, you’ll be the first to know when it’s available!

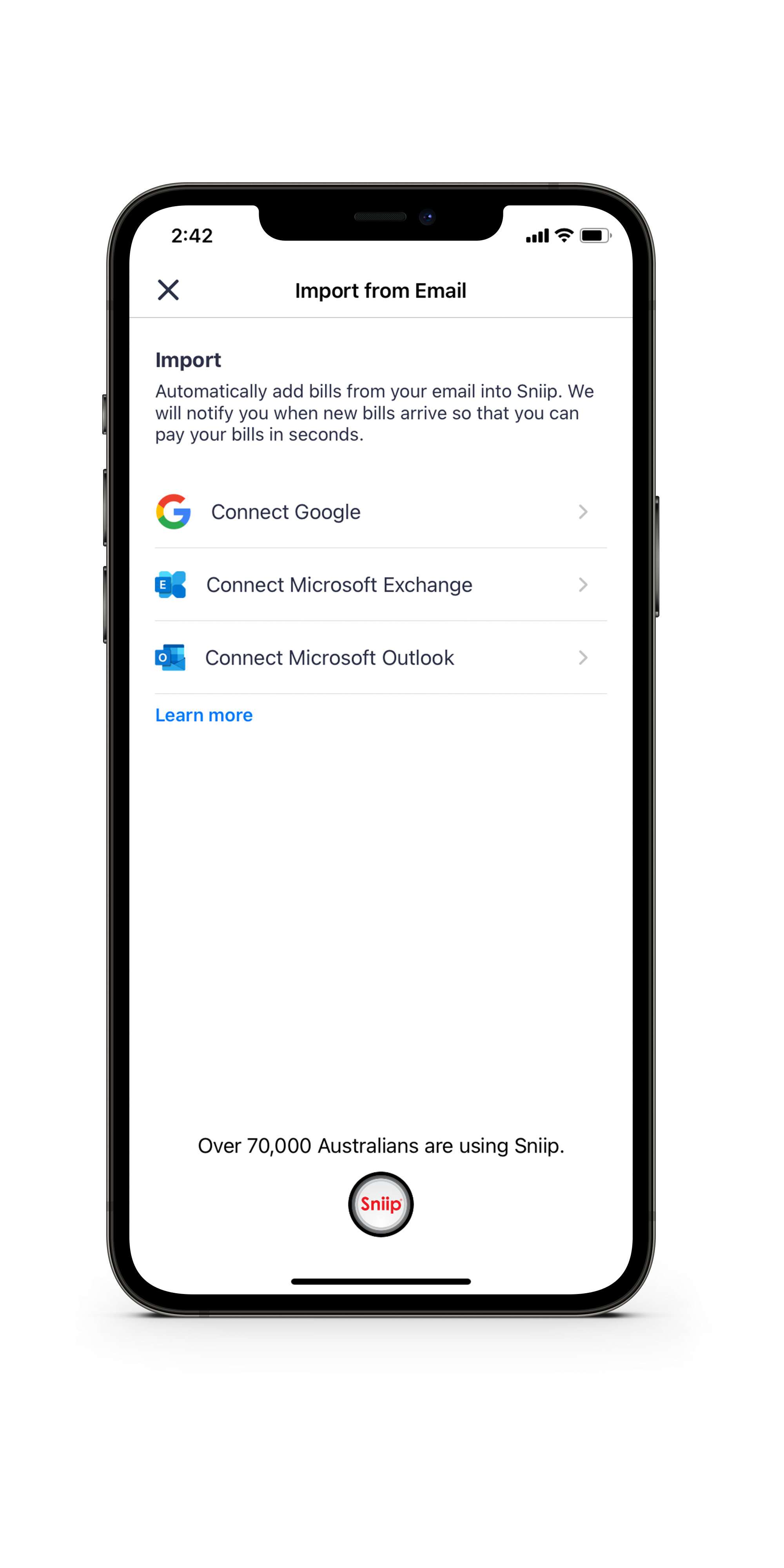

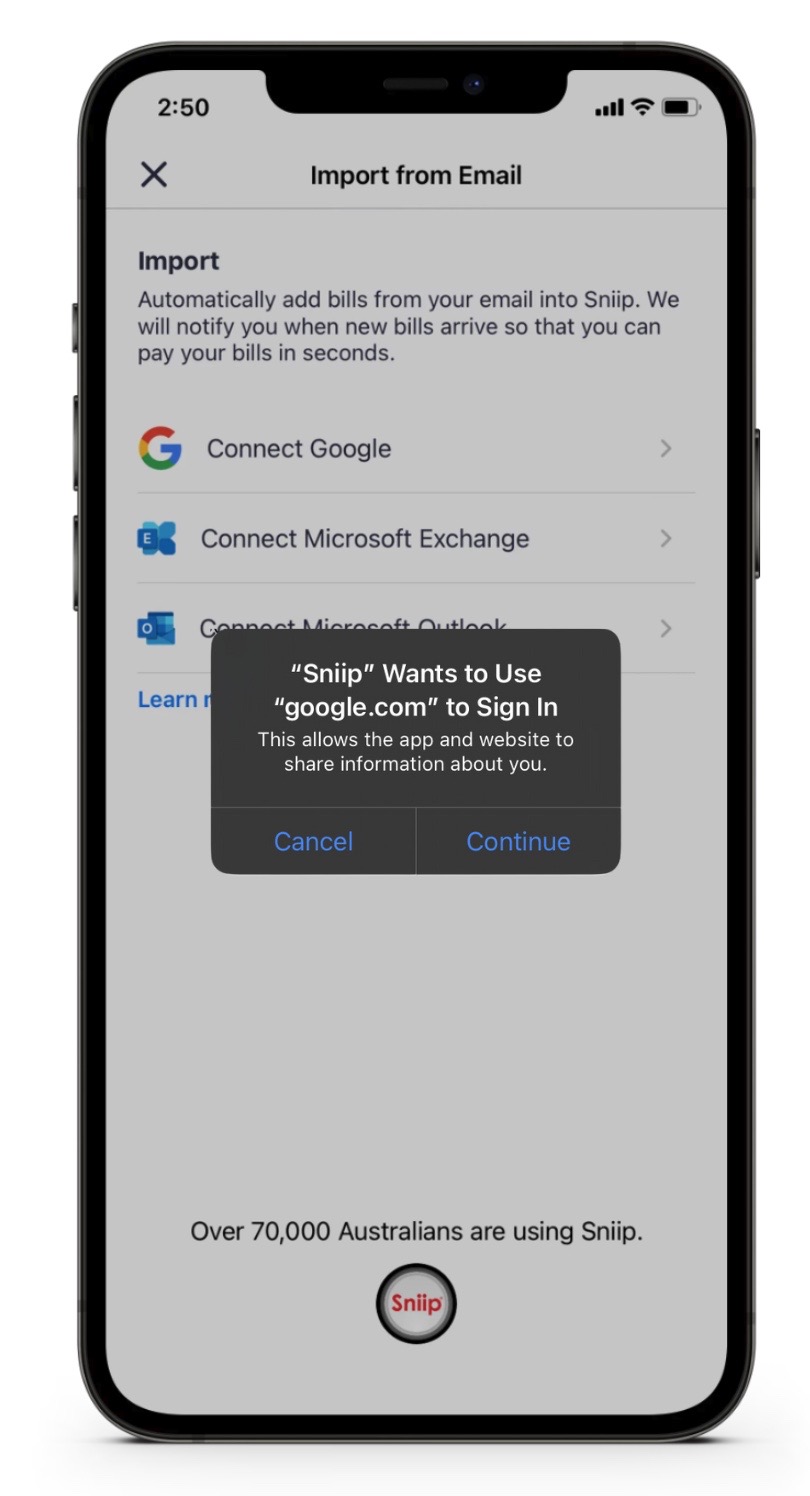

To prepare for this feature release, you can connect your eligible email account for auto bill import. When the feature is launched, we’ll be able to add your BPAY as well and any bills that need to be paid to a BSB + Account Number (bank account), the minute it’s launched!

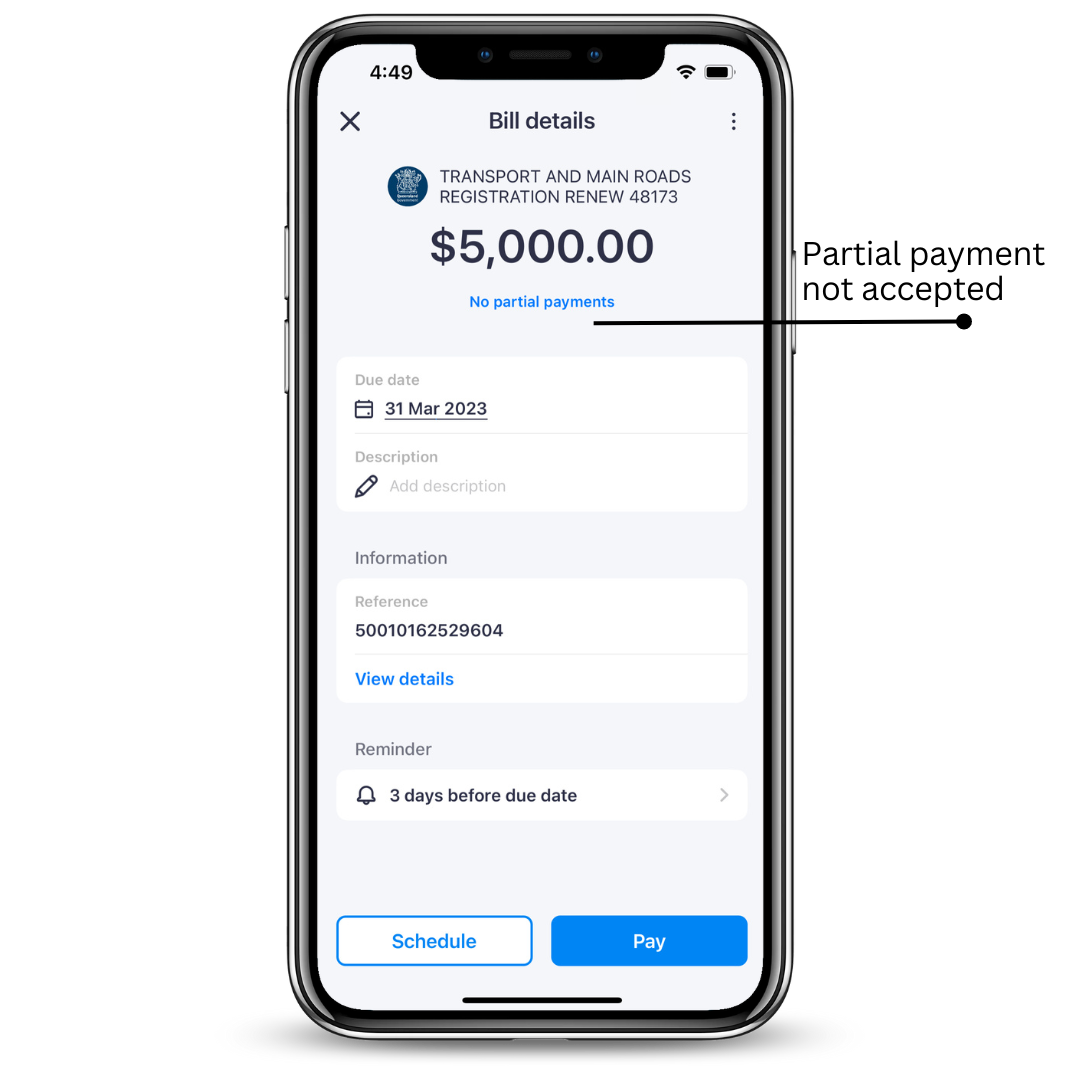

Do you have a daily limit for transactions?

There’s no limit at Sniip’s end. We’re able to process bill transactions for any amount.

What we do say is, if the transaction you’re making is unusual for your account, it may be blocked by your bank or card provider. This is more common with American Express. If this is the case, simply call the number on the back of your card and let them know it’s you making a large payment.

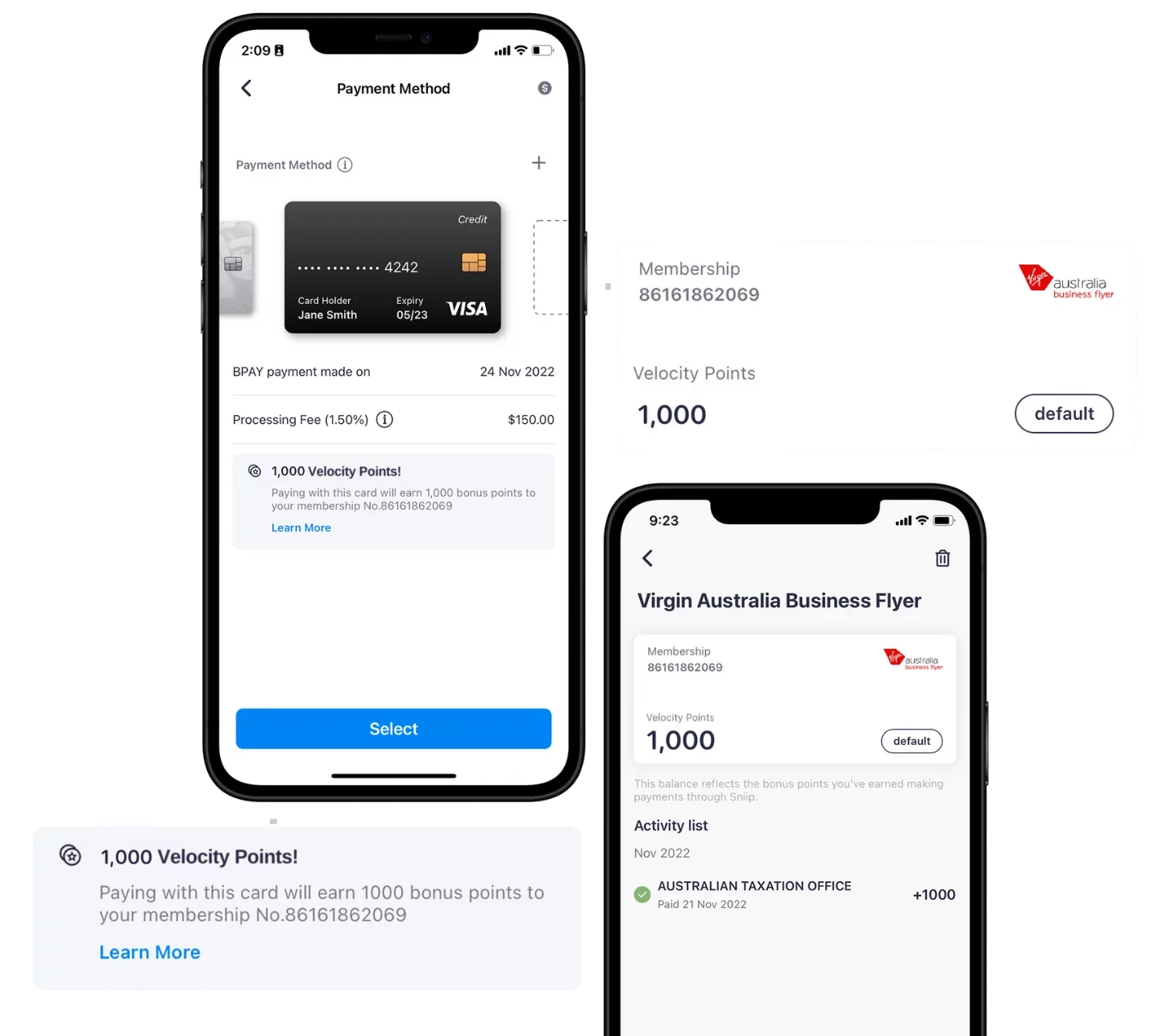

Then you’re able to process the transaction with Sniip and earn those full reward points that we all love.