Just Arrived: Fast Five FAQ Exposed

Fast Five FAQ: Our most commonly asked questions

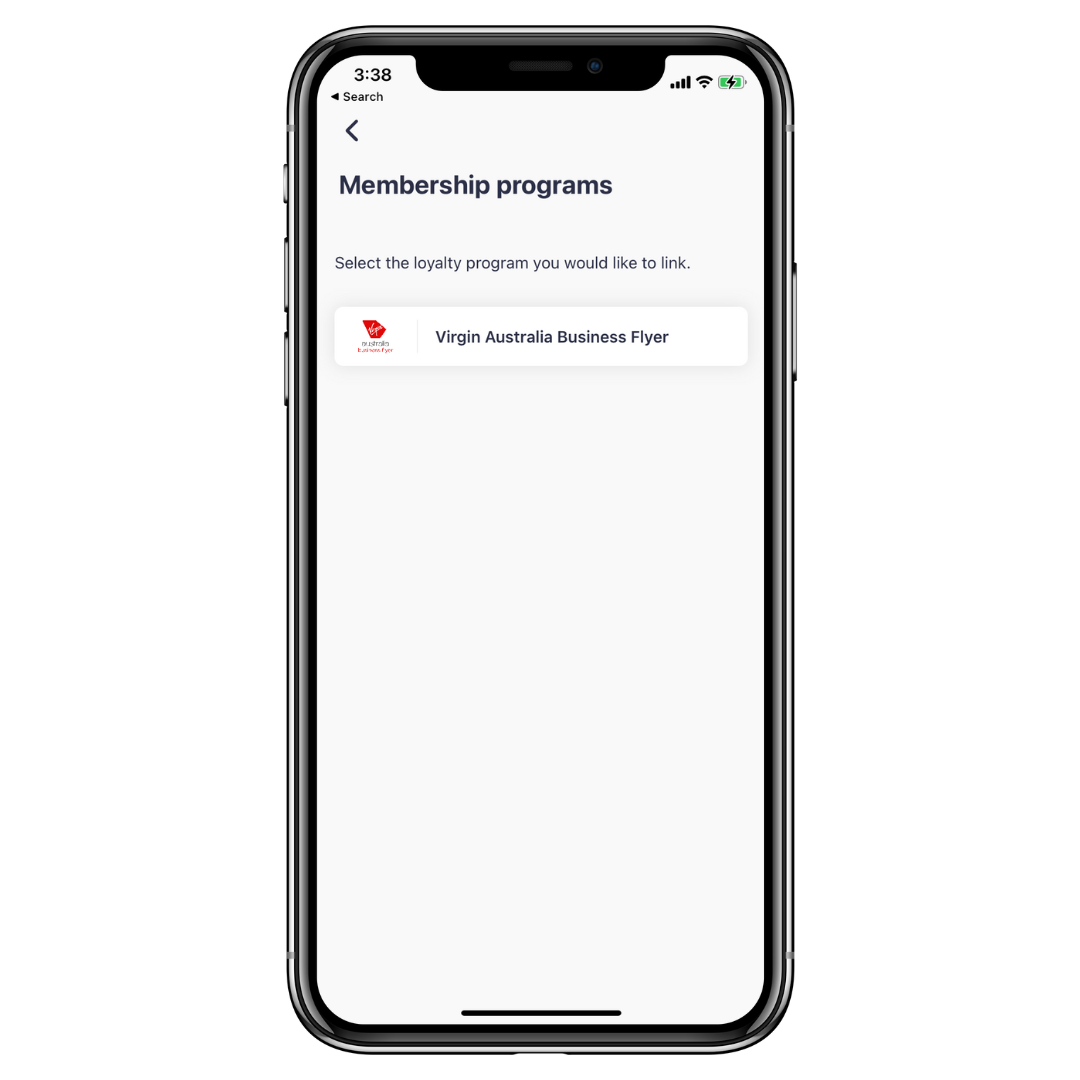

I saw you’re offering Velocity Points through Virgin Australia Business Flyer. What membership number do I use to link my account to Sniip?

Great question! Your Virgin Australia Business Flyer membership number is your ABN/ACN.

To add your Virgin Australia Business Flyer number to Sniip, do the following:

- Login to the Sniip app

- Tap the menu bar in the top left corner and select, ‘Loyalty’, then ‘Add membership’

- Select ‘Virgin Australia Business Flyer’ from the available options

- Enter in the ABN/ACN associated with your Virgin Australia Business Flyer account in the ‘Membership number’ field

If entering this number does not work, please contact businessflyer@virginaustralia.com.

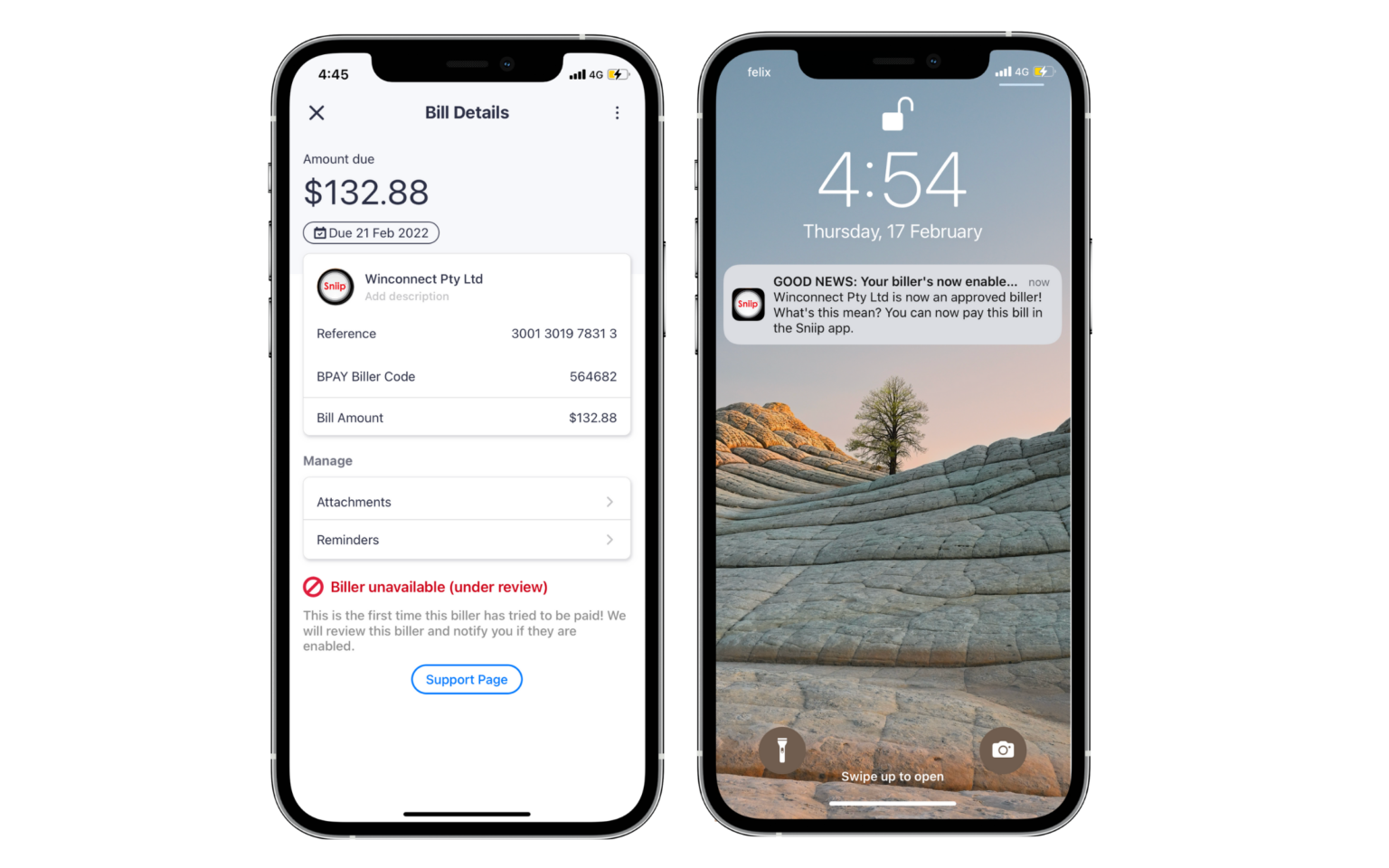

Is there a way I can send my bills directly to Sniip?

Absolutely! We’re really proud of this feature, it’s called, ‘Import from Email’. Simply connect your Gmail or Microsoft email account to Sniip, we’ll automatically add the bill to your Sniip app when it arrives in your inbox and send you a handy push notification when it’s ready for payment.

Here’s how to connect, ‘Import from Email’:

- Tap the menu bar in the top left corner and select, ‘Import from Email’

- Connect your email (we support these emails)

- Done! We’ll import your bill directly into the Sniip app when it arrives in your inbox.

What type of bills can I pay with Sniip?

You can pay personal and business bills with Sniip. If your bill is one of the 60,000+ billers with a BPAY Biller Code and Reference Number, chances are you can pay it with Sniip!

Here’s some of the top bills paid using Sniip:

- ATO, payroll tax

- DEFT

- School feels (incl higher education) and childcare

- Superannuation

- Rent, rates and body corporate (STRATA)

- Energy and water providers

- Phone and internet providers

- Insurance (health, car home and contents)

- Energy, gas and water

- Vehicle registration, fines and vehicle club membership fees (e.g. RACQ, RACV)

- Accounting services

When does Sniip process my bill payment? How long does it take? I’ve left it a bit late and I’m worried it won’t be paid on time.

It takes approximately 24 to 48 hours for Sniip to receive your funds. We process your bill payment as soon as we receive your funds.

The cut-off times for payments to be made the next business day are:

- 11.59pm AEDT Visa/Mastercard

- 6pm AEDT Amex

- 6pm AEDT Diners (+ 1 extra business day)

- 6pm AEDT Bank Accounts (+ 1 extra business day)

Payments made after this cut-off will not be processed on the next business day – they will be processed the following business day.

As the funds take roughly 24 hours to finalise and be deposited into the billers account, we suggest always paying your bill two (2) days in advance. The biller must recognise the BPAY payment as the date that the bill was paid. You may refer to the time-stamped Sniip receipt under the “Receipt” tab in the app for record/reconciliation purposes.

Can I pay to a BSB and Account Number (bank account) using Sniip?

This is a hot question and we’re working on it right now. Pay to a BSB and Account Number will be launched in 2023.

As a subscriber to Sniip, you’ll be the first to know when the feature launches.