Leah Kidd

For the ultimate Amex reward pay your bills with Sniip

A new financial year is upon us, and for the savvy points earner, it’s the perfect time to take a look at how to make the most of your personal expenses with your Amex on your everyday outgoings.

What’s the best way to do this? Use Sniip! Pay all your personal expenses using your Amex, even if your biller doesn’t accept American Express directly.

If you’re on your search for the ultimate Amex reward pay experience, Sniip offers the best rate in the market. Your ATO bills, superannuation payments, school fees, body corporate etc.

Essentially, all BPAY payments can be made using Sniip! You earn more reward points and use Apple Pay/Google Pay wallet for seamless payment.

What is Sniip?

Sniip, as a Bill Payment Service Provider, allows you to pay approximately 60,000+ BPAY Biller Codes with the payment method of your choice*.

How do Sniip payments work?

Put simply, Sniip aggregates all payment and bank networks into one central place, making it easy to pay your bills.

It’s the ultimate in payment logic! This means that with Sniip, you can pay with whatever card or bank you like, for whatever bill* you have.

For example, Jane has a $50k personal tax bill to pay. She uses her American Express Velocity Platinum Card and pays $375 p.a. In fees. She gets 1.25 Velocity points per $1 spent on purchases.

When she pays the ATO with Sniip, she still earns 1.25 points per $1 spent, unlike paying the ATO directly where she would earn 0.5 points per $1 spent.

How does Sniip benefit me using my Amex card?

Sniip is a Bill Payment Service Provider (BPSP), meaning you make your everyday bill payments to Sniip, and Sniip pays the biller or supplier on your behalf – it’s a two-legged transaction.

When you make a payment through Sniip with your American Express, you earn FULL POINTS on the first leg of the transaction at 1.29% (incl GST). As of 1 March, all payments to the ATO/superannuation with any Amex card are required to be processed at our business rates. Unfortunately this change in the processing fee has been imposed on Sniip. This fee change doesn’t reflect a margin increase for Sniip – rather, it is simply the cost we are being charged to process these payments.

With Sniip, you only pay the processing fee of 1.29% (incl GST). There are no other biller surcharges, monthly account keeping fees or subscription-based fees.

Paying a $30,000 bill could mean a Brisbane to Sydney return trip in Business Class, all paid for with points!*

Every point counts! Maybe you’re saving your points for a one way ticket to London? Accumulating American Express Membership Rewards Points throughout the year by paying your rates, insurance or ATO bill means that the sky’s the limit with Sniip.

Point Hacks recommends Sniip, saying ‘The true value of Sniip lies in its new 2021 partnership with American Express that sees it offer a reduced 1.5% (processing) fee, (now 1.29% as of 1 March, 2023), for Amex transactions. … it makes sense to funnel some of your bigger bills through a service like Sniip to maximise rewards and boost your cash flow.’

Drew at the Points Brotherhood, outlined in his article how he used Sniip to pay the ATO and boost his points balance.

For example, on a $50,000 ATO bill, you can earn 63,868 points on your Amex Velocity Platinum Card. You can calculate the points you would earn on different payments with your American Express here!

When you pay your bills with Sniip, you unlock the full earning potential of your Amex Membership Rewards Points. For the ultimate Amex reward pay your bills with Sniip.

Summing up

Sniip is the best way to pay all your personal and household bills and earn FULL POINTS on your American Express card. Maximise your cash flow and unlock your full points earned by downloading the app for free today. Getting started only takes a few minutes, and you can check out our guide, here.

*Restricted/ prohibited industries apply.

How to pay personal ATO bills and earn credit card rewards points

Ultimate Guide:

Pay personal ATO tax bills and earn credit card rewards points

Tax time can be busy enough without having to worry about making sure you’re getting the full benefits from your points-earning credit card. This easy to ready article will explain how to pay personal tax bills to the ATO and earn credit card rewards points at unbeatable rates.

More frequently, banks and other credit card providers are restricting the rewards points for payments made directly to billers, including the Australian Taxation Office (ATO).

With Sniip, you can use any type of card you choose and will always earn full points on payments to the ATO! Please note that payments with any American Express card (personal/business/corporate) are required to be processed at our business rates.

The Sniip app is free to download on your phone and simple to use, making tax time a breeze.

How can I pay personal ATO bills with a credit card?

Paying your tax bill with a points-earning credit card is an easy way to get that little bit closer to your next holiday destination or business class upgrade.

However you need to be savvy, and research whether you will earn full or reduced points for your payment. When you pay the ATO directly, you pay a 1.45% fee and earn a reduced amount of rewards points.

When you pay with Sniip, you only pay a 1.5% processing fee using a personal Visa/Mastercard, and you earn full points on your transaction! Personal payments to the ATO using an American Express are processed at our business rates.

What’s more is that Sniip is an extremely secure payment option. Sniip is proud to have achieved and maintained Tier 1 Payment Card Industry Data Security Standard (PCI DSS) compliance.This means you can rest assured that you are protected by the highest standard of secure payment processing.

Everyday Sniip processes hundreds of payments on behalf of its users to the ATO via their rewards credit card. The only fee you will pay is the Sniip 1.5% fee for processing Visa and Mastercard credit card payments.

How many points can I earn by paying personal ATO tax bills with a credit card?

When you process your payments through Sniip, you’re eligible to earn full rewards points on your credit card.

If you’re an avid points chaser with the right credit card, by using Sniip you can potentially earn 1.25 points per dollar paid to the ATO.

Sniip charges a 1.5% credit card processing fee for Visa and Mastercard. American Express payments to the ATO (including superannuation) are processed at our business rates.

The cherry on top is that you are also eligible to earn points on the processing fee!

Check out our Points Calculator to find out an estimate of your potential points earned on your next personal or household bill.

American Express Points Calculator

Please note: the above calculator is not an exhaustive list of the Amex cards you can use with Sniip. Sniip accepts American Express cards.

This information is provided as a guide only, please refer to the Amex website for the most accurate information or contact Amex directly.

What other bills can I pay with Sniip?

With Sniip, you can pay more than just the ATO!

We have many customers who process all their personal and household bills through Sniip, to make sure they are maximising their points earning!

With Sniip, you can pay your superannuation, rates, school fees, water and every other household bill with a credit card, while only paying the 1.5% processing fee for Visa and Mastercard. Personal bills (excluding ATO and superannuation) receive a lower processing rate of 1.29%!

If it has a BPAY Biller code and reference number on the bill, you can pay it with Sniip and earn your full points!

How do I sign up?

Signing up is easy! Simply download the Sniip app from either the Apple App Store or the Google Play Store and follow the prompts to sign up!

Join the 70,000+ Australians using Sniip to pay their personal and household bills to maximise their rewards points.

Enter your mobile number and we’ll send you a link to download the app!

How do I pay?

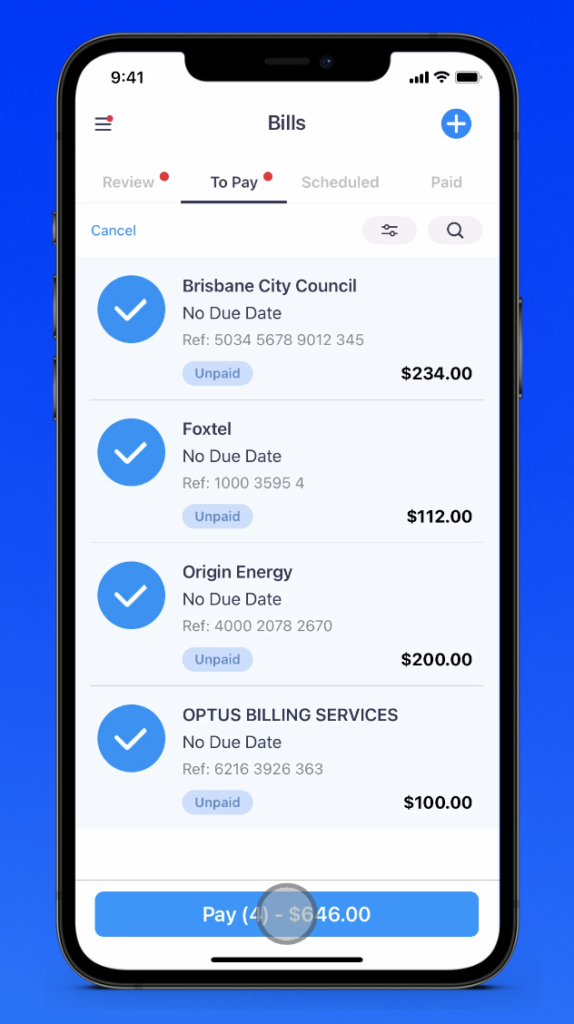

Making payments through Sniip is seamless and super fast. Once you have signed up and downloaded the app, you can upload and pay your bills within seconds.

Scan your bill or import it from your emails, then add your payment method or pay directly with your card from your ApplePay or GooglePay digital wallet.

Fast Five FAQ: Our most frequently asked questions in August

Fast Five FAQ: Our most frequently asked questions

1. Can I switch my existing direct debit/auto-debit bill payments over to Sniip?

Absolutely! If you have a direct debit/ auto-debit set-up through your bank or with a biller for the same amount every period, you can use Sniip’s recurring payment feature.

Many Sniip users have switched to recurring payments for bills such as rent, internet, monthly insurance instalments etc. In doing so, users earn full points on each payment if they choose to pay with a points earning card.

Ready to get set-up? All you have to do is add your bill to your Sniip account, tap ‘Schedule’ and setup a recurring payment.

2. What are the processing times for payments?

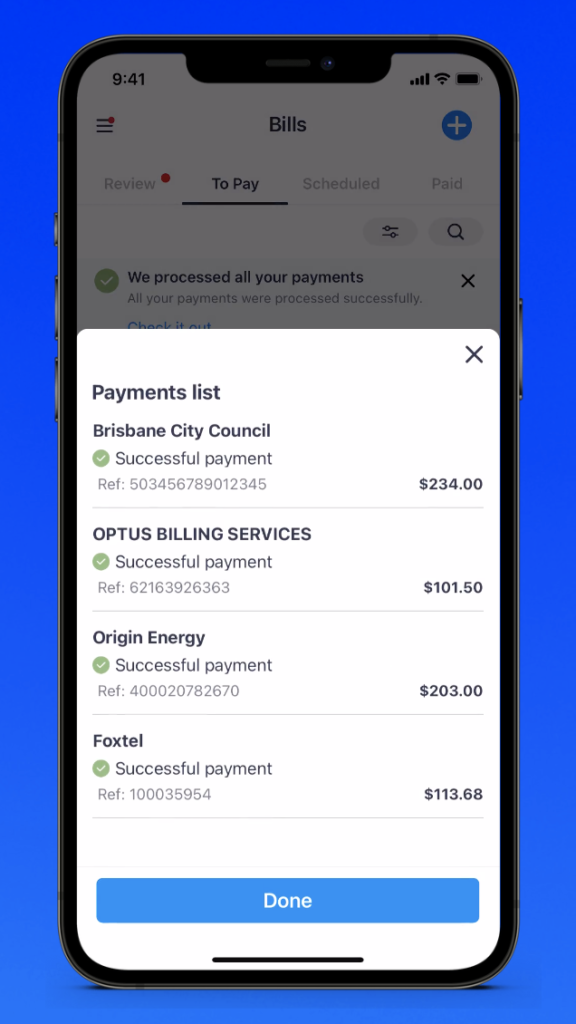

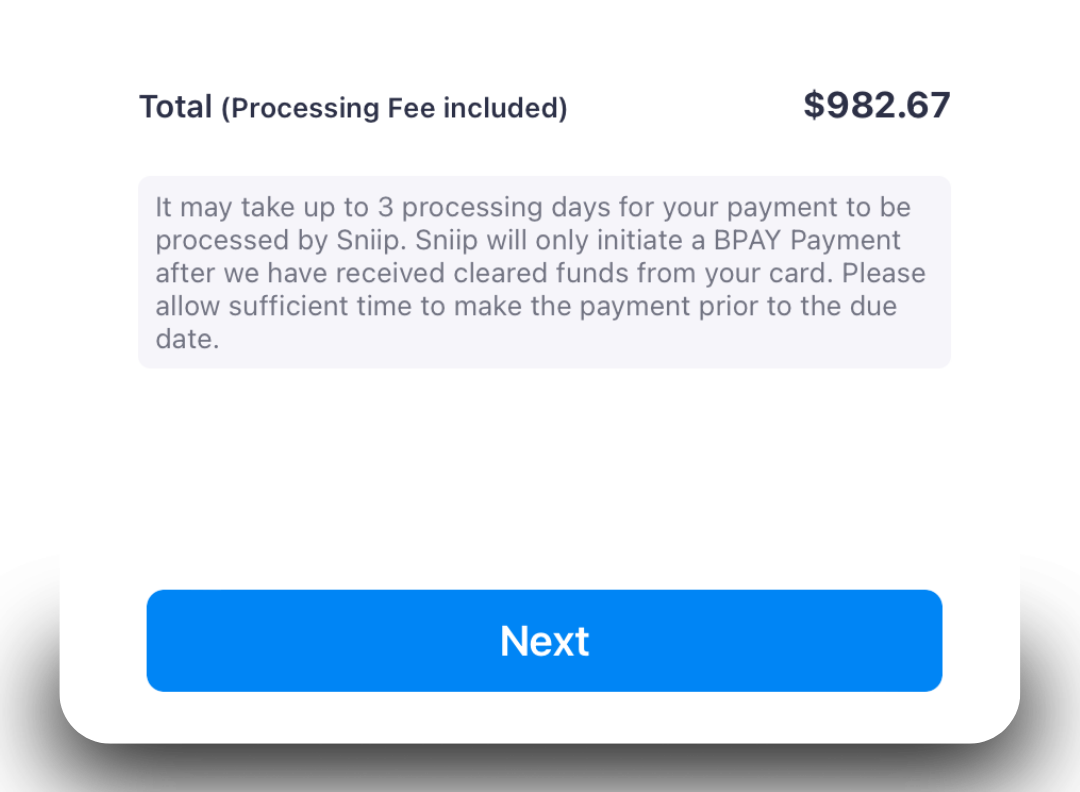

It can take between 24 and 48 hours for Sniip to receive your funds. We process your bill payment the same day as we receive your funds.

The cut-off times for payments to be made the next business day are:

- 11.59pm AEDT Visa/Mastercard

- 6pm AEDT Amex

- 6pm AEDT Diners (+ 1 extra business day)

- 6pm AEDT Bank Accounts (+ 1 extra business day)

Payments made after this cut-off will not be processed next business day – they will be processed the business day after.

Payments made after this cut-off will not be processed next business day, they will be processed the business day after.

Please note any payments made over the weekend will be processed on Monday (or the next business day for instances of a public holiday). For payments made with a BSB and Account number, it can take 2-3 business days for your payment to be processed.

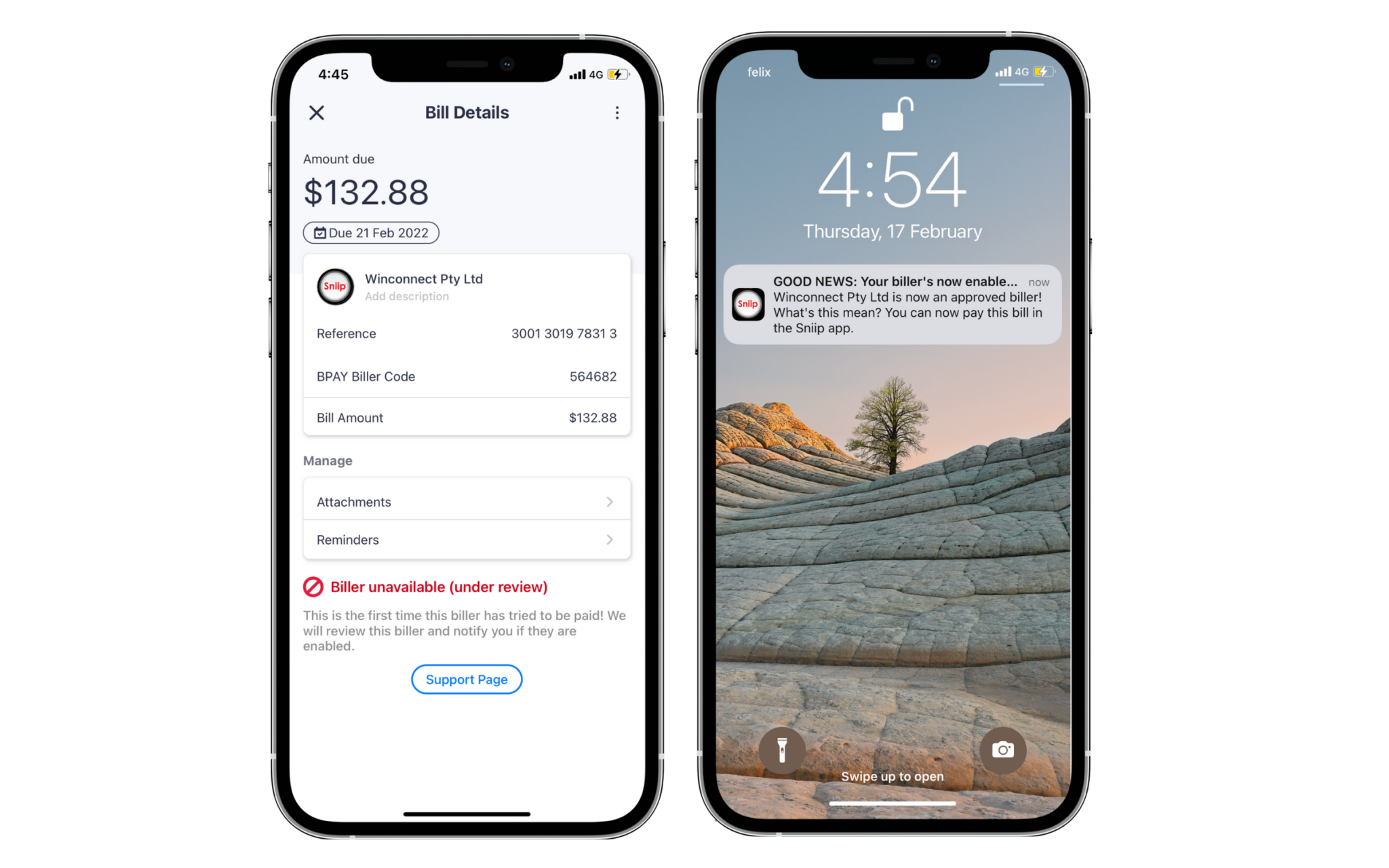

3. How long does it take to review a biller?

Great question! If you’ve tried to add a BPAY Biller Code and it says ‘Biller Under Review’, it means that you are the first person to pay this biller. We are required to review each BPAY biller to ensure that it is in a permitted industry and not restricted by any of our banking or acquiring partners.This process is usually completed within one (1) business day of you adding that biller for the first time in Sniip. If you require us to review your biller urgently, please email us a copy of the invoice/bill to pay to customercare@sniip.com.

4. Is my payment treated as a cash advance?

When you make a payment through Sniip, it is not treated as a cash advance. The payment is treated as a standard purchase/payment on your credit card and does not incur any cash advance fees.

5. Why does it say this biller does not accept Amex?

If you scan the Sniip QR code on a bill (rather than the BPAY Biller Code), it may come up that the biller doesn’t accept American Express.

In this instance, you can scan or enter the BPAY Biller Code on that bill, which will allow you to make the payment with your American Express credit card (and earn full points).

This will also occur when you try to pay billers currently restricted by American express (e.g. DEFT). Billers that are classified as a ‘Payment Aggregator’ are currently restricted when paying via Sniip.

How do credit card points work?

So, you’ve just signed up for your first credit card, and it earns rewards points. Nice work! Or maybe you’re considering signing up for one because you’ve heard myths and legends about using points to fly business class. Either way, how do credit card rewards points work? How do you make the most of them? What purchases are eligible?

Getting started in the world of rewards points can be daunting, so we’re here to answer all your burning questions. For those on the outside looking in, you may be wondering how those savvy point earners make it look so easy. Not to worry – with a little knowledge and research, you’ll be earning points like a pro and flying business class in no time.

What are credit card points?

Credit card points are rewards that can be accumulated through purchases on your credit cards. The most typical types of rewards programs are points, frequent flier or airline miles, and cashbacks.

How do you earn credit card points?

There are a few ways you can earn credit card points; the main being using your credit card for daily purchases. However, if you want to maximise the potential of your credit card, there are some savvy ways to make sure you’re earning as many points as you can.

Applying for a credit card with a sign up bonus is a great way to kickstart your points balance, and earn a large number of points at once.

Paying your regular personal and household bills with a credit card is one of the best ways to boost your points.

What are the points worth?

Depending on the credit card you apply for and the way you redeem them, your points will have a different value. It’s important to note that different purchases will also have different potential points earn capacity. Any savvy points chaser will read the fine print of their credit card, because not all purchases are made equal.

For some purchases and payments, like paying government bills or the ATO, you might have capped or reduced points earned.

For instances like this, we recommend using a bill payment service like Sniip.

Sniip is a bill payment service that allows you to earn full points on your bills that would otherwise have reduced or no points earning potential.

How does Sniip work?

Sniip uses a two-legged transaction to pay your bill, where you earn full points on the first leg of the transaction. Sniip then pays your final biller on your behalf.

Sniip charges a 1.5% processing fee for credit card transactions using a Visa or Mastercard, these transactions are eligible for their full points earn using Sniip. Personal American Express payments (excluding to the ATO and superannuation) receive a 1.29% processing fee.

How to pay with Sniip

Sniip is a mobile app that allows you to pay any* bill with a BPAY Biller Code and Reference Number. It’s free to download from the app store, and the only fee you will pay is the 1.5% processing fee for Visa and Mastercard credit cards, and 1.29% for personal American Express credit cards (excluding ATO and superannuation payments).

To pay a BPAY bill with Sniip, make the following steps:

- Locate the BPAY logo on your digital bill (email or photo)/paper bill which will show the BPAY Biller Code (usually in the bottom right corner of your bill).

- Create/login to your Sniip app

- Select ‘+’ to ‘Add a new bill’.

- Scan or enter the BPAY Biller Code and Reference Number.

- Add your amount and due date, then select pay (use your digital wallet)

- Done! Your BPAY bill payment is processed.

*Restricted industries apply.

Get started with Sniip!

Enter your mobile number and we’ll send you a link to download the app! 🚀

New Feature Alert: Import bill from photo

New Feature Alert: Import bill from photo

Have you ever taken a photo of your bill as a way to safekeep the information, then completely forgotten about it?

Well now, instead of your bills idly sitting in your camera roll, you can upload photos of your bills to the Sniip app. Schedule the payment in the app so that you can set and forget.

This week we rolled out our newest feature: Import bill from photo!

Upload a picture of any bill with a BPAY Biller Code and Reference Number. We’ll read the important details and have it ready for you to pay.

Bills uploaded, no worries!

How to use Import bill from photo

It’s super simple to import a bill from your photos.

Simply navigate to the ‘+’ on your dashboard of the Sniip app where you would normally add a bill, and select ‘Import bill from photos’ from the menu.

From here, you can choose whether you want to take a photo of your bill or select one from your camera roll.

Just make sure your photo clearly shows the bill details including the ABN, BPAY Biller Code and Reference Number!

Click import and we’ll do the rest! We’ll read all the important information on your bill and let you know with a push that it’s ready for you to review and pay.

Check out our video on how to import a bill from your photo.

Our ten most popular recurring payments

Our ten most popular recurring payments

- How can I earn more Qantas Frequent Flyer Points or Velocity Points?

- Use Sniip to pay all of your business and personal bills while earning full credit card points!

Introducing: Recurring bills! Today we’re revealing our ten most popular recurring payments set-up in the Sniip bill payment app. Wondering what bill you could make a recurring payment?

To give you some inspiration, here’s our Top 10 recurring bills our users love paying with Sniip:

1. Water, waste and sewerage (Urban Utilities, Victorian Water Corp, etc)

2. Council rates

3. Tax bills (Australian Taxation Office, Land Tax)

4. Rent (DEFT, RentPay, Meriton Property Services, PayWay rental and strata)

5. Phone, mobile and internet (Optus, Telstra, Vodafone, iiNet)

6. Energy (Origin, Momentum Energy, AGL)

7. Health insurance (Medibank, Bupa, AHM, HCF)

8. Real estate fees (Rich & Oliva, Abel Property)

9. Superannuation (AustralianSuper, Rest Super)

10. Child care and school fees

How to set up a recurring bill payment

- Scan or import the bill to Sniip

- In the bill details, tap on ‘Schedule’

- Select ‘Recurring Payments’

- Select the frequency and end date for the payments

- Confirm

- Done!

Fast Five: Our most frequently asked questions

1. How do I redeem my rewards? I can’t work out how to apply the credit to my bill.

Great question! To redeem your Sniip rewards, simply navigate to the top left menu in the app. Tap on ‘Rewards’ and type in your rewards code.

Then, next time you’re paying a bill*, make sure you move the toggle to ‘Use Sniip Rewards’ to redeem your rewards balance!

*Please note: you need to make a payment of at least $50 to use Sniip Rewards.

2. Where is Sniip customer service based?

Our customer service team is based in Brisbane, Australia and works from our head office.

If you’re ever in the area, pop in and say hi! We love visits from our users.

3. My friend recommended me to use Sniip, but I’m based overseas, can I use the app?

Thanks for your interest in Sniip! We plan to expand our operations abroad, however, right now we’re an Australian-based company and only Australian bills can be paid using the app.

Usage of the app is limited to those living in Australia or traveling overseas temporarily. This is in place for a couple of reasons:

We facilitate payments made through BPAY, which is a uniquely Australian bill-payment scheme. As part of our onboarding, you need an Australian mobile number and need to be able to be called by Sniip on that number in the case of verification, refunds from billers or errors with payments.

If you do not register with a legitimate phone number, Sniip has the right to withhold or quarantine your bill payments, until you have verified your mobile number (boring we know, but needed for the security of all our users).

4. Am I eligible to earn frequent flyer/ loyalty points with a credit card program when paying the ATO/ another biller?

Hey there points chaser! You sure can! With Sniip, you earn full points on your bill payment (including the processing fee). You are eligible to earn full points even if your biller doesn’t accept that payment method directly*.

*Restricted/prohibited industries are ineligible for payments using Sniip.

5. My biller says 'Blocked', what does this mean and how do I get this reviewed?

All this means is that you simply need to upload the bill to Sniip to find out if it can be paid with Sniip.

When you upload a bill to the app, it will let you know whether you are able to pay that specific bill.

If you are unable to pay that bill it will either show ‘Biller unavailable (under review)’ or ‘Biller not currently available’.

Your bill will be in the ‘To Pay’ tab, however it is unable to be paid until it has been reviewed by Sniip.

We aim to review all billers within 24 hours. However, if you need them to be approved quicker, feel free to give us a call (details below) and we will try and review it as soon as possible.

If your biller is approved, you’ll receive a push notification to your mobile (pictured above) as well as an email. If your biller is unable to be paid, it will remain as a ‘Blocked Biller’ (picture above).

Unfortunately, as determined by our banking partners, there are certain restrictions regarding payments to certain billers, due to their risk profile. These include:

- Remittance service provider

- Charities and Not-for-Profit

- Intermediaries

- Pay-day lenders

- Internet gambling

- Casinos

- Goods dealers

- Foreign exchange currencies

- Securities and derivatives

- Managed investment schemes

- International business operations

- International students or travel products

- Hiring and leasing

- Banking and financial institutions

If there’s any urgency to your bill payment, we completely understand! Please email a copy of your invoice to customercare@sniip.com. Alternatively, call our Sniip Support Squad on (07) 3268 7710 and we’ll be happy to assist you and expedite the review process, where possible.

Introduction to Sniip and how it could benefit you

The payment app, Sniip, has disrupted the Australian digital payments world by providing a new way for people to pay and manage their personal bills.

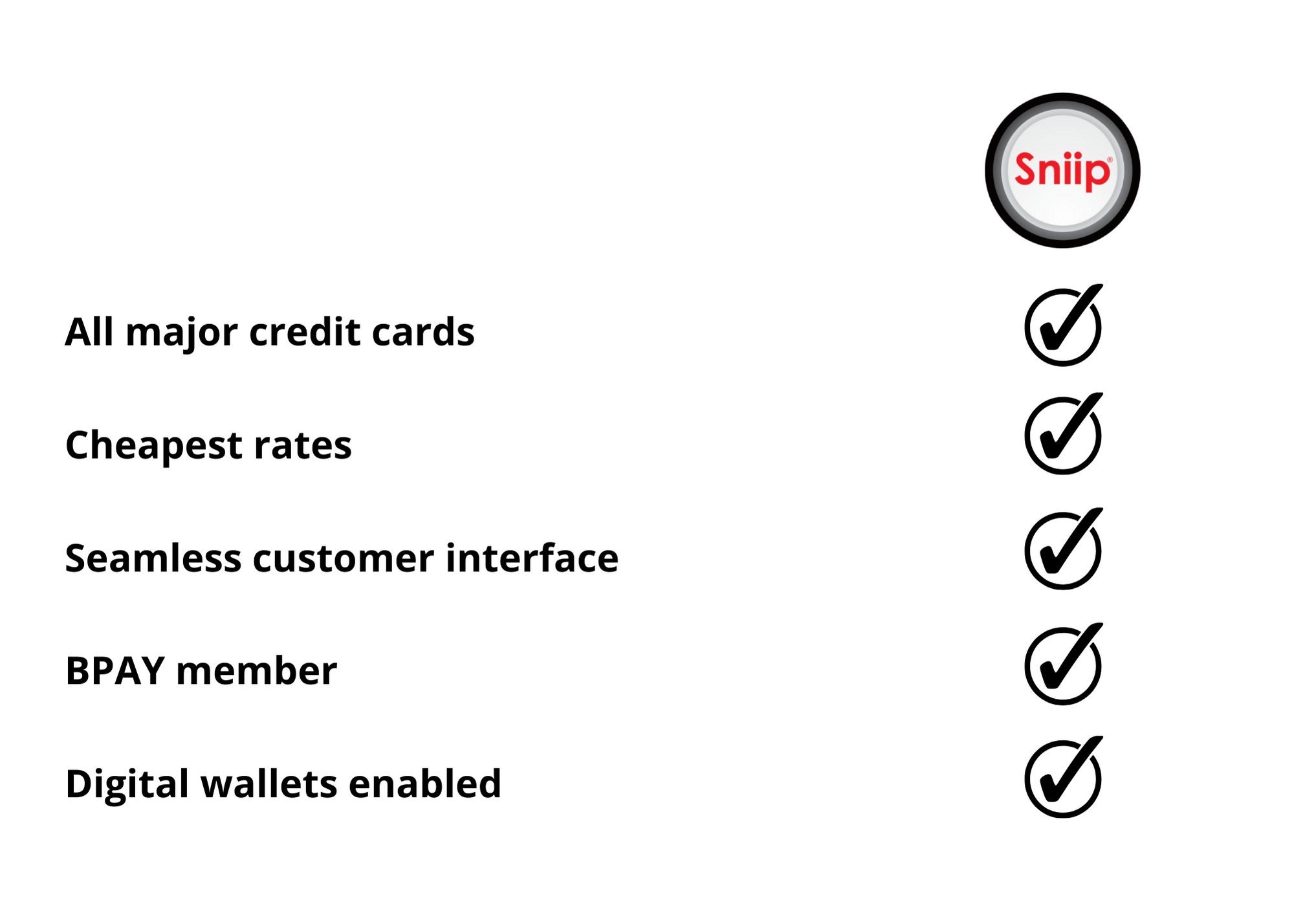

Since its inception, Sniip has continued to expand its offering, partnering with the likes of BPAY, American Express, Apple Pay and Google Pay to create a seamless bill payment experience.

Keep reading to find out all you need to know about Sniip.

What is Sniip?

Sniip is a payment platform that allows you to pay personal and household expenses with any debit card, credit card or bank account, all through one easy app.

Sniip has created the easiest and fastest way to pay bills. As an accredited BPAY Payment Institution Member (PIM), Sniip has reinvented the way Australians pay and manage bills, completely transforming the bill-payment landscape.

How does Sniip work?

As a payment platform

Sniip, is a Bill Payment Service Provider, and as a BPAY Payer Institution Member (PIM), it allows you to pay approximately 60,000+ BPAY billers with any payment method.

Using a two-legged transaction process, Sniip allows you to pay your personal bills with any credit or debit card. The process is simple: Sniip receives the payment for the bill from a user and once these funds have cleared, Sniip processes that payment on your behalf via BPAY.

In other words, Sniip aggregates all of your payment credentials into one central platform and allows you to choose the way you pay, irrespective of what the biller allows.

For example, Jane has a $50k personal tax bill to pay. She uses her American Express Velocity Platinum Card and pays $375 per annum for the card fee. She gets 1.25 Velocity points per $1 spent on purchases.

When she pays the ATO with Sniip, she still earns 1.25 points per $1 spent, unlike paying the ATO directly where she would earn 0.5 points per $1 spent. When Jane pays with Sniip, she earns 63,437 Velocity points, which is enough to take her and her husband to Melbourne flying business class return!

As a bill management system

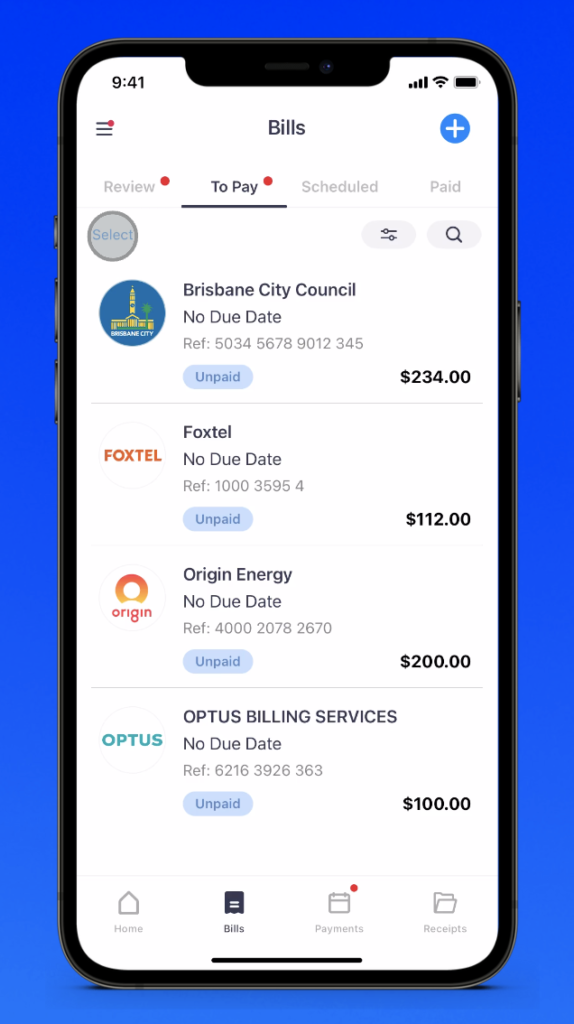

Sniip can help you to manage and organise all your bill payments.

At a glance, the app dashboard allows you to see a summary of your bills and payments, allowing you to quickly keep track of upcoming bills and payments.

You can set up auto-pay direct debit for your recurring bills, and have a summary of all your upcoming payments.

Plus, you can set up auto-bill import, which allows any bills sent to your email account to automatically be received into the app, ready for payment.

How much does Sniip cost?

Sniip is free to download from the Apple App Store or the Google Play store and there are no subscription fees! Personal and business transactions made with a credit card will incur a processing fee of 1.5% for Visa and Mastercard, with all payments earning full points. Business payments with an American Express receive our tiered rates, which can be viewed here. Personal American Express payments (excluding to the ATO and superannuation) receive a processing fee of 1.29%. You can learn more about payments to the ATO using an Amex here. Check out the complete list of processing fees, here.

Sniip currently offers the best credit card rate for personal bill payments when compared to other bill-payment platforms.

Summary of key benefits:

Sniip is transforming the way you pay your personal, household and business bills. By paying your bills through Sniip, you can maximise your cash flow and unlock your full points-earning potential.

Even better, Sniip provides a seamless payment experience, even allowing you to pay with Apple Pay or Google Pay, giving you back your valuable time to spend on more pleasant things in life than paying bills!

The Points Whisperer, Steve Hui of iFlyFlat endorses Sniip to earn full points on all your bills

The Points Whisperer, Steve Hui of iFlyFlat endorses Sniip to earn full points on all your bills.

Steve Hui of iFlyFlat endorses Sniip to earn full points on all your bills when paying with a credit card.