How to pay BPAY with a credit card 2023

How to pay BPAY with a credit card 2023

Updated March 2023

What is BPAY?

Are you looking to pay BPAY with credit card? If you’re based in Australia and you’re paying bills, it is likely you’re familiar with BPAY.

Short for Bill Payments, BPAY is the most prominent payment service in Australia that allows you to pay your bills through online banking.

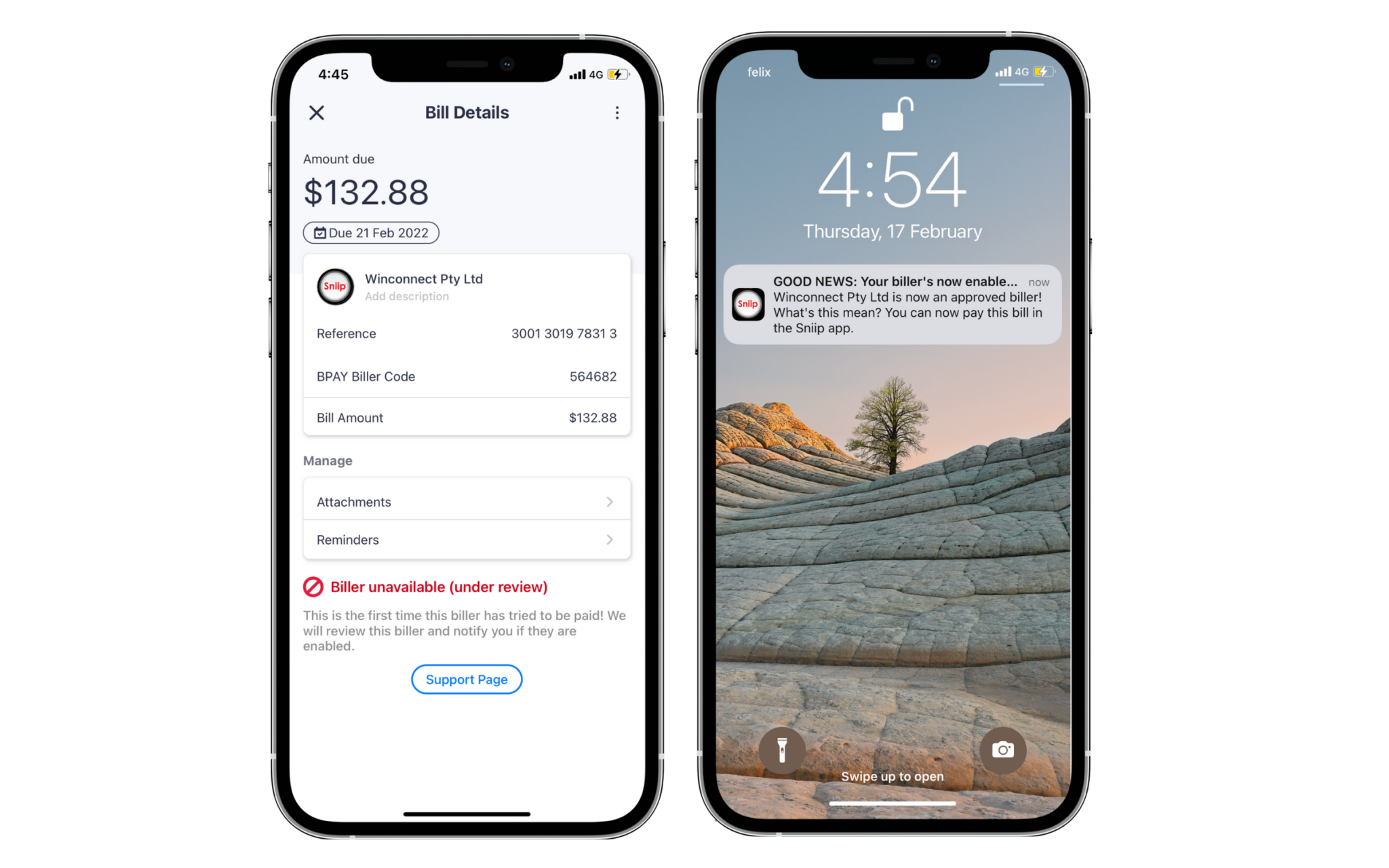

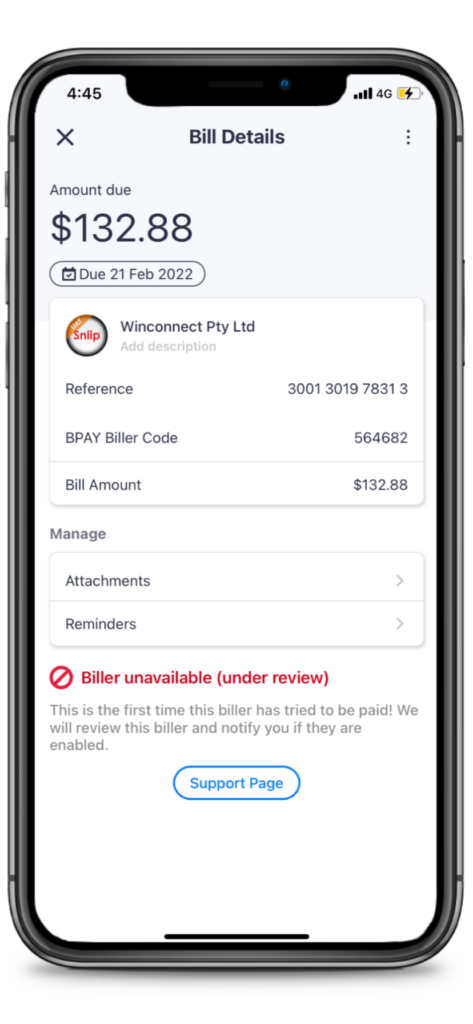

To pay a BPAY bill traditionally, you would enter the BPAY Biller Code, Customer Reference Number, and payment amount manually into your personal online banking platform.

Can I use BPAY with my credit card directly?

Short answer – yes, you can. Some BPAY Billers permit direct credit card payments.

However, you need to ensure that your final Biller does not consider the payment as a cash advance, which would result in an additional cash advance fee.

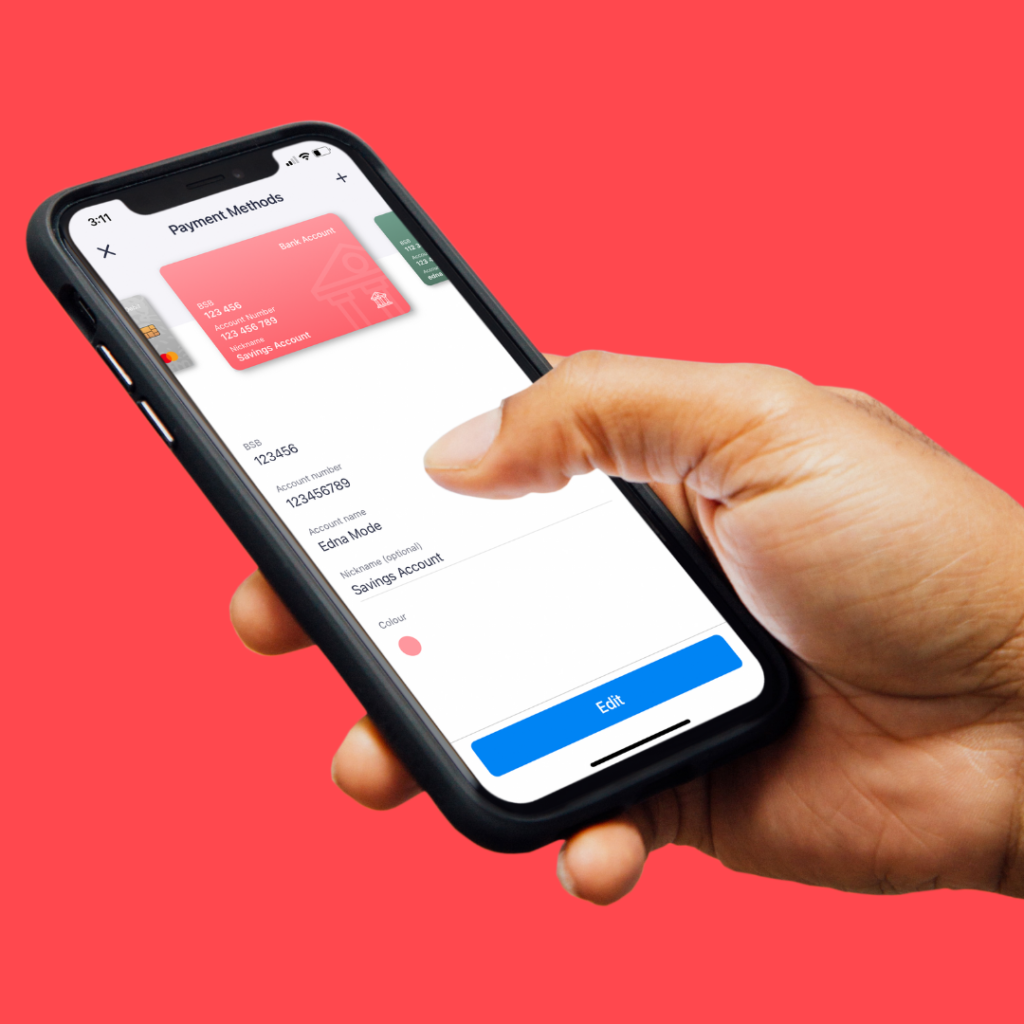

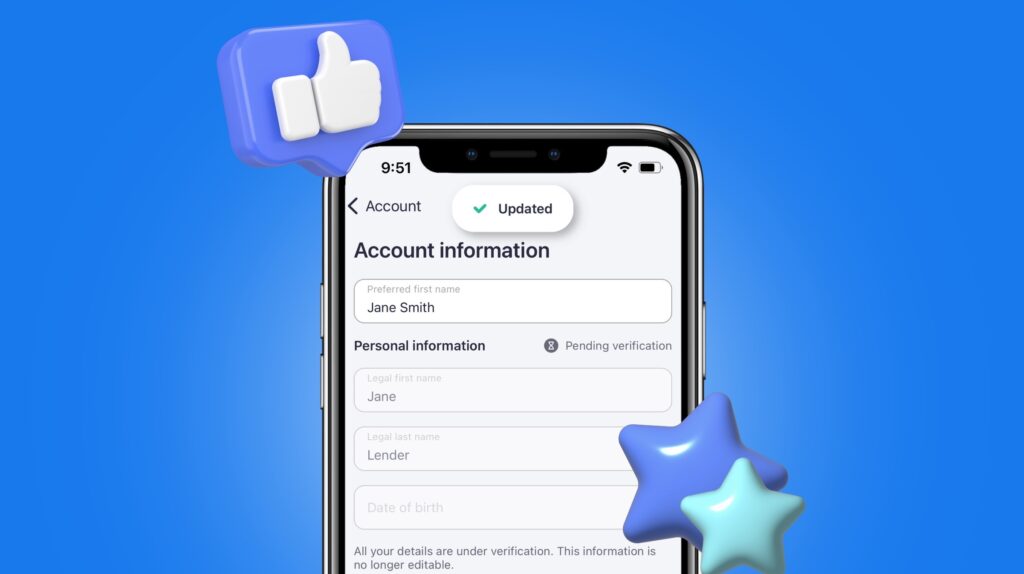

If you want a convenient and reliable method to pay a BPAY Biller with a credit card, you can simply use the mobile bill payments app, Sniip. The app is available for IOS and Android.

In 2019, Sniip became a Payer Institution Member (PIM) of BPAY, opening up the 60,000+ BPAY biller network able to be paid with Sniip.

This means you can pay your biller with a credit card and only be charged the Sniip processing fee of 1.5% for Visa and Mastercard. In addition, American Express personal cards incur a processing fee of 1.29%. There are no cash advance fees, hidden charges, or additional costs.

Certain industries may have restrictions imposed by Sniip and our banking and acquiring partners regarding credit card payments. You can find the details of these restrictions, here.

No one enjoys paying bills, however Sniip makes this process as painless as possible. We developed scan-to-pay technology as the first step, allowing you to scan the BPAY Biller Code and Reference Number instead of manually entering the digits. We verify these details with BPAY to ensure their accuracy before you make the payment.

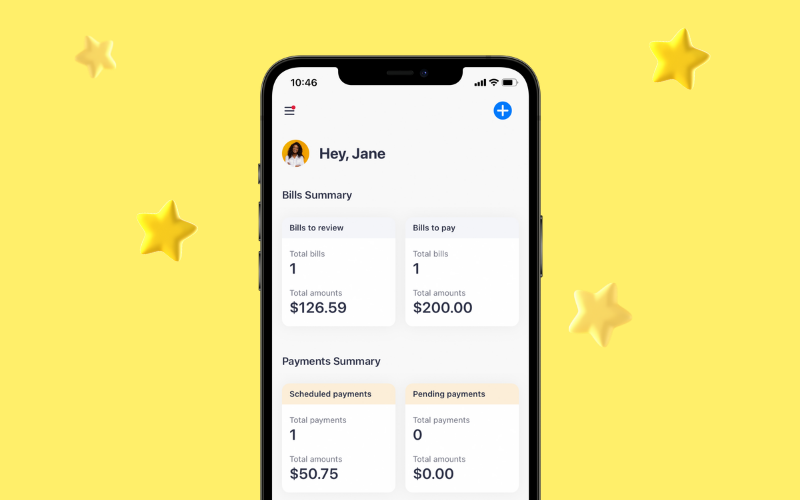

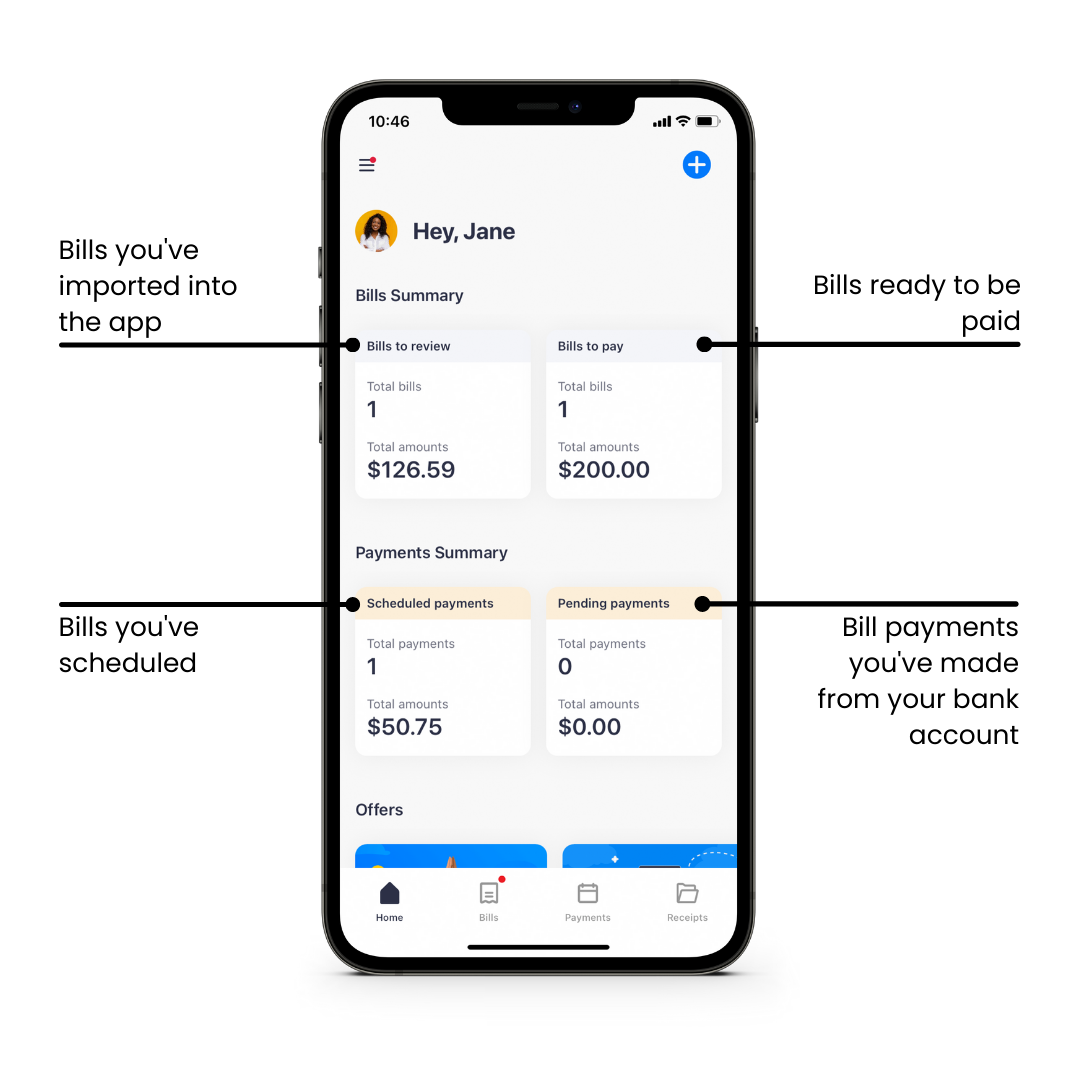

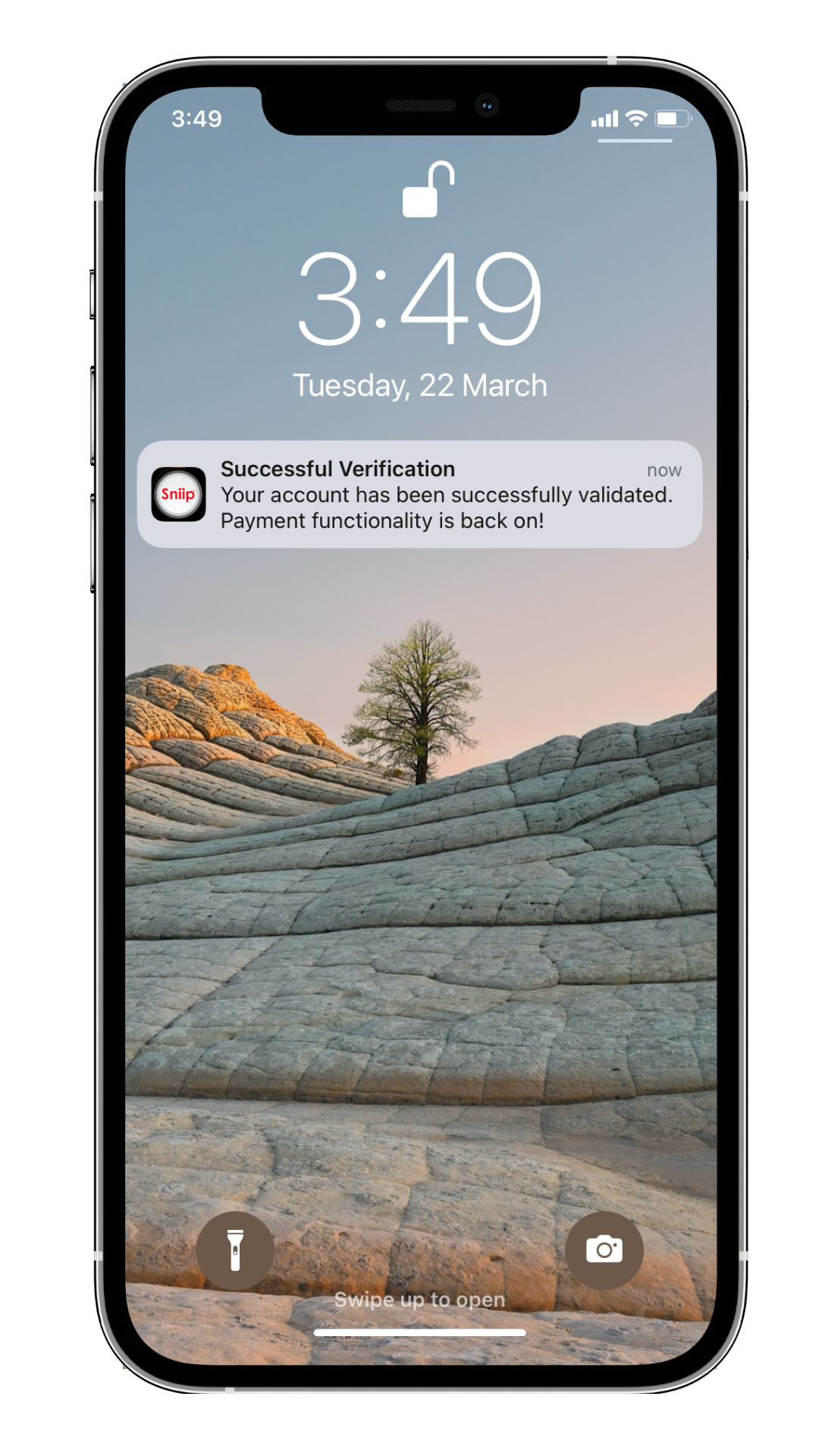

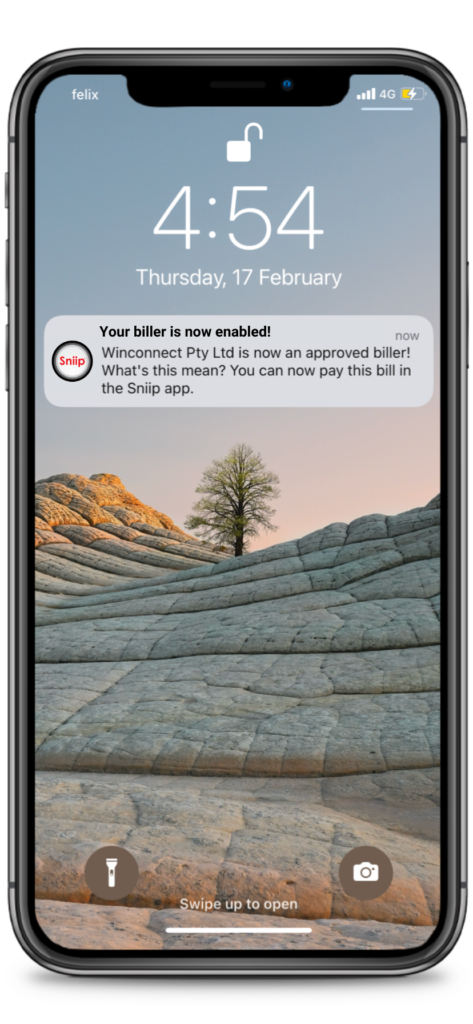

Sniip also enables you to import or share your bills in the app for seamless payment. Additionally, if you connect your email address to Sniip, we can retrieve all your bills from your email and digitise them within the app, ready for payment. You’ll receive a helpful push notification when they are ready to be paid, eliminating the risk of missing bills or forgetting to pay them by the due date.

How does Sniip work?

Sniip allows you to pay approximately 60,000+ BPAY Biller Codes with your payment method of choice. You take back control!

We process your funds through our partner payment gateways, into a bank account with our BPAY-sponsor banking partner.

Then, once these funds have cleared, we make the BPAY payment on your behalf.

At Sniip, we consider all payments made through our app as regular credit card purchases rather than cash advances.

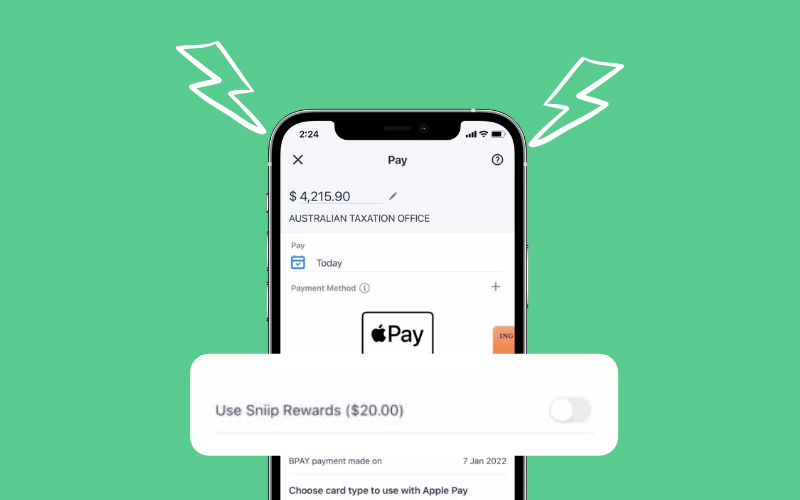

When using Visa and Mastercard credit cards, you only need to pay the Sniip processing fee, which is 1.5% of the transaction amount. For personal American Express cards (excluding payments to the ATO and superannuation), the processing fee is 1.29%. There are no additional fees associated with your transaction.

If you possess a reward-based credit card, you will earn points for every BPAY payment made through Sniip using that card.

Do BPAY transactions earn credit card rewards points? Can I pay BPAY with credit card?

A question we get asked fairly regularly is ‘How do I earn full points on BPAY bills, like paying the ATO and other government bills?’

We understand the confusion since many rewards-based credit cards earn reduced or no points when paying bills.

When you pay with Sniip, you will be eligible to earn full points on your rewards earning credit card!

How to make BPAY payments using Sniip?

Sniip allows you to make BPAY payments seamlessly from your mobile.

If you have a paper bill, you can easily scan the bill with the Sniip scanner and read the BPAY Biller Code and Reference Number.

Just enter the payment amount, and pay with your credit card or digital wallet (Apple Pay/Google Pay).

If you have a digital bill, you can share your bill to the Sniip app or import it from your email!

Other frequently asked BPAY questions

What’s a BPAY Biller Code?

A BPAY Biller Code is the unique 4-6 digit number that can be found on your bill or statement, we use it to process your BPAY transactions.

The Sniip scan-to-pay technology allows you to simply scan the BPAY Biller Code with the camera, and the scanner reads the BPAY Biller Code on your bill. In summary, there’s no more manually entering long codes when trying to pay your bills!

What is the BPAY processing time using Sniip?

We recommend paying your bill 2-3 days before the due date, to allow for usual BPAY processing times.

When you pay your bills with Sniip, we pay your bill as soon as we receive your payment.

The cut-off times for Sniip to receive your payments for processing the following business day are:

11.59pm AEDT Visa/Mastercard

6pm AEDT American Express

6pm AEDT Diners

For all BPAY payments, Sniip will let you know prior to confirming the payment when the bill will be processed via BPAY to your biller.

The biller must recognise the BPAY payment on the date when you paid the bill via Sniip. Sniip will provide you with a date-stamped receipt that can be found in the app under ‘Receipts’.

To pay a bill with a BPAY Biller Code using Sniip, make the following steps:

- Locate the BPAY logo on your digital bill (email or photo)/paper bill which will show the BPAY Biller Code (usually in the bottom right corner of your bill).

- Create/login to your Sniip app

- Select ‘+’ to ‘Add a new bill’.

- Scan or enter the BPAY Biller Code and Reference Number.

- Add your amount and due date, then select pay (use your digital wallet)

- Done! Your BPAY bill payment is processed.